What is a SPAC?

Rupert Walford

25 years: Capital markets

This video by Rupert is a brief introduction to SPAC, he begins with introducing SPAC along with the key participants and further takes us through the purpose of a SPAC - and the process of setting one up and executing its strategy.

This video by Rupert is a brief introduction to SPAC, he begins with introducing SPAC along with the key participants and further takes us through the purpose of a SPAC - and the process of setting one up and executing its strategy.

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

What is a SPAC?

16 mins 16 secs

Key learning objectives:

Identify and explain the life of a SPAC from beginning to end

Explain the features of a SPAC and the benefits to all parties involved

Define SPAC

Overview:

A SPAC is an attractive additional funding mechanism for investment teams and entities to pursue acquisition opportunities, where such opportunities are not immediately apparent or in process. A SPAC can also provide a compelling route to the public markets for private companies, when market conditions allow. Additionally, SPACs can be an attractive downside protected investment for investors, particularly in a low interest rate environment.

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

What is a SPAC?

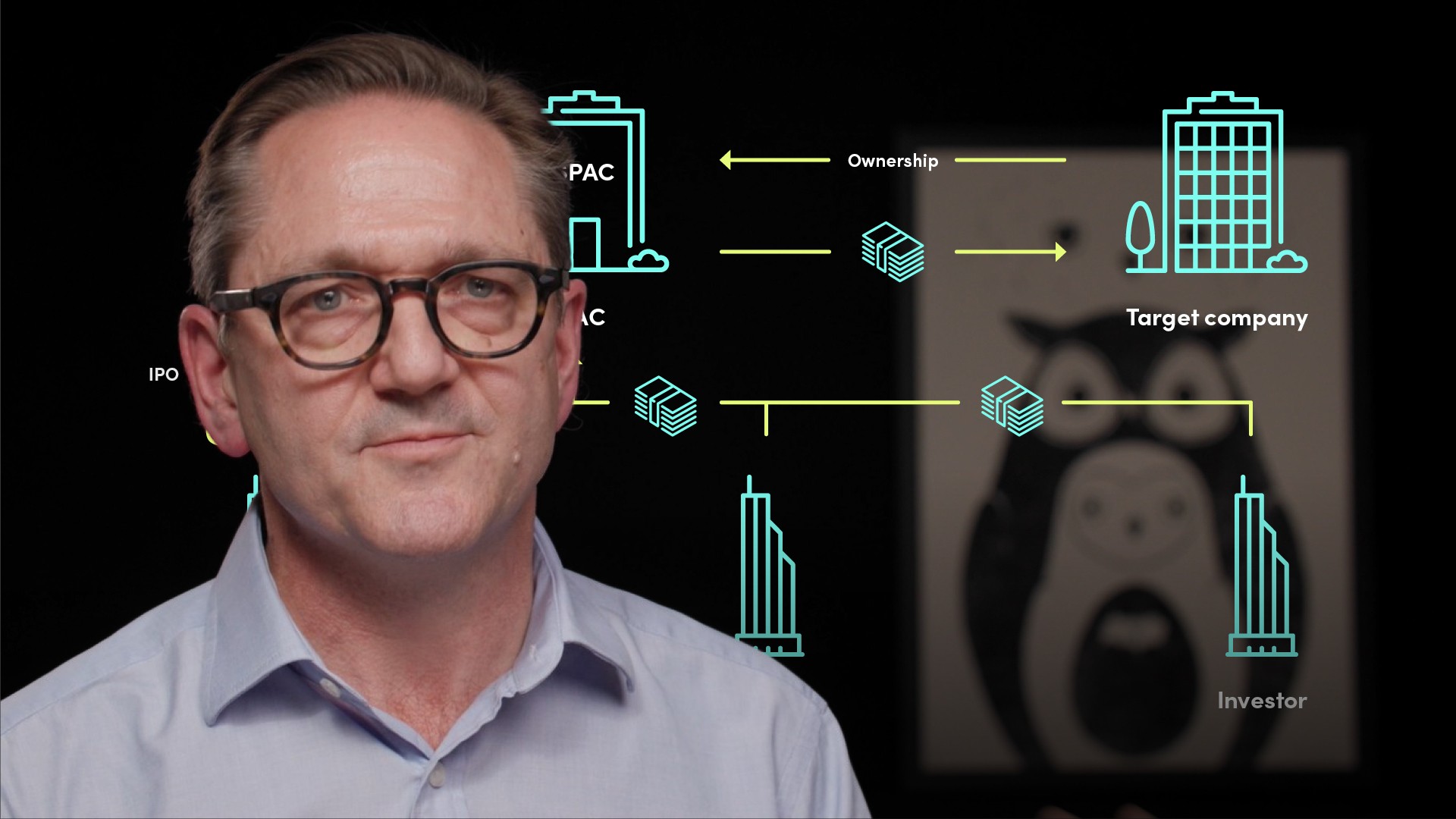

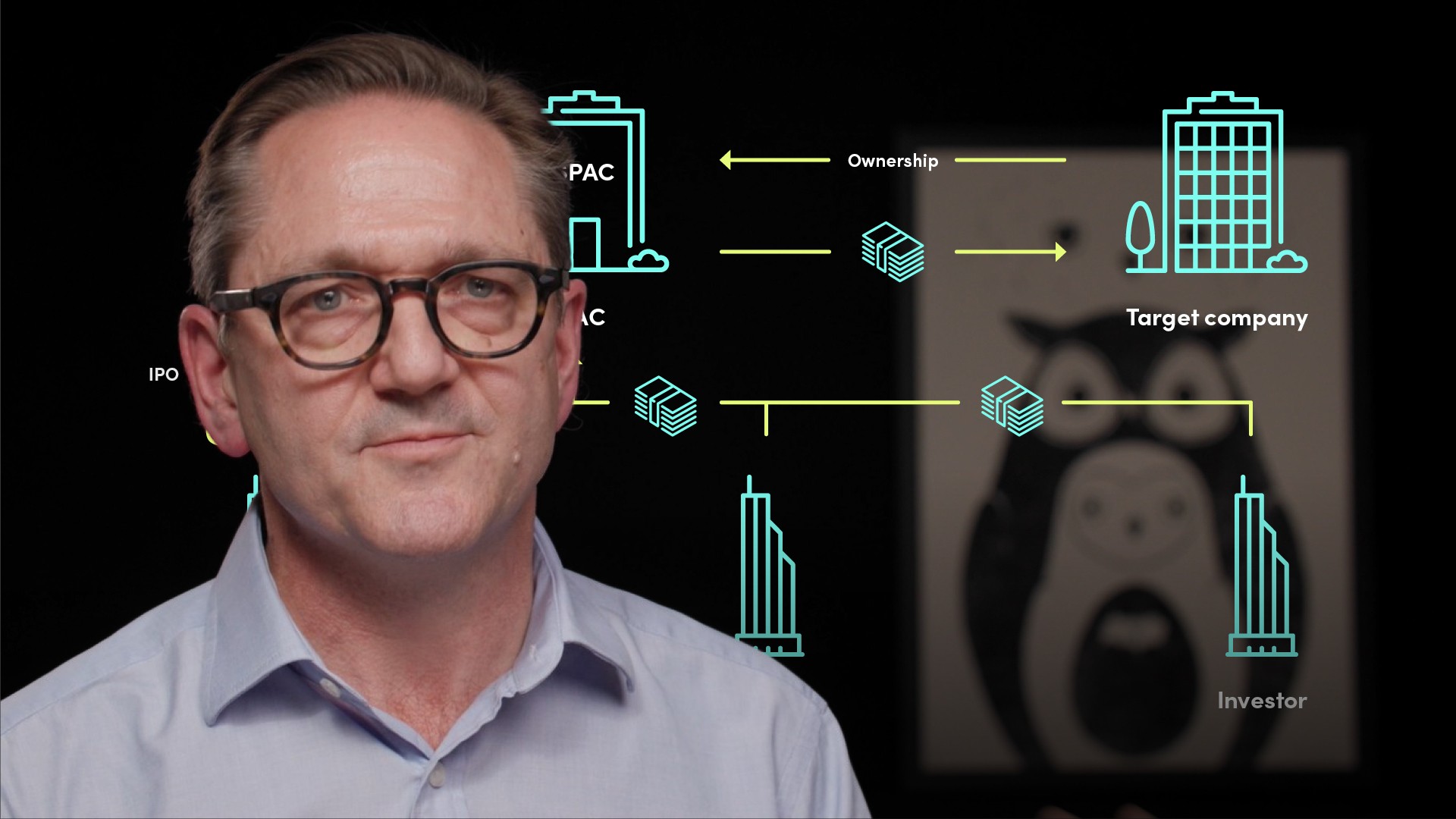

A SPAC - or Special Purpose Acquisition Company - is a company (often referred to as a vehicle or shell company - or blank cheque company) which raises money via an initial public offering and then acquires - or combines or merges with - a private company - with the aim of creating a publicly listed operating company. A SPAC typically has 2 years from its IPO to complete this process.

What is the first stage of a SPACs life?

The SPAC IPO. For the IPO, the SPAC will issue an offering document (also known as a prospectus) which will be reviewed by the relevant regulator and will set out various details, including:

- Who is running the SPAC - the team of individuals or financial entity - and their track record

- The details of the offering - the number and type of securities being offered (usually shares or common equity and warrants) and the price at which they are being offered (usually 10 dollars)

- The aims of the SPAC and use of proceeds - principally the industry sectors, the geographies and the rough size of the assets that the SPAC is targeting

What is the money used for, and what happens if an acquisition is not completed within 2 years?

The money raised in the IPO is kept in a trust or escrow account where it is legally protected, invested in risk free investments such as US treasuries - and can only be used to make an acquisition or return funds to shareholders. If the SPAC fails to successfully complete an acquisition within the prescribed period, it is liquidated and the money raised in the IPO must be returned to investors.

What is de-SPACing?

The exercise of the SPAC acquiring or merging with another company is known as de-SPACing and is usually accompanied by a further fund raising - called a PIPE - which stands for Private Investment into Public Equity. The purpose of the PIPE is to replace the capital returned to SPAC shareholders who have exercised redemption rights and to provide additional funding for the merged business.

What else occurs before it becomes a publicly listed company?

- In the UK, the regulator will need to approve the merged company’s eligibility for listing, whilst in the US, this is not required - the regulator’s role is merely to review the disclosure for compliance with regulatory requirements

- The SPAC will also need to convene a shareholders meeting to seek approval for the merger and investors will, at this stage, have the ability to redeem their shares, even if they vote in favour of the merger. The end result is a publicly listed operating company

Who sets up SPACs?

SPACs are set up by sponsors - or promoters. They fund the set up and running costs of the SPAC. These comprise the underwriting commissions of the banks organising the SPAC IPO, the other advisors fees and the working capital the SPAC needs in order to operate until it completes an acquisition. There are two types:

- Individuals or groups of individuals who form a team

- Financial entities such as private equity groups or investment banks

What are founder warrants, and how do they work?

The sponsor’s funding of the SPAC’s working capital is done via subscribing for warrants - known as founder warrants, at a subscription price dependent on the size of IPO and the number of warrants offered to IPO investors. These founder warrants provide a right to purchase shares in the ultimately listed company at a price (known as the strike price) above the IPO issue price.

What is “sponsor promote”?

The sponsor also subscribes - for nominal consideration - for an amount of shares in the ultimately listed company typically equal to 25% of the amount raised in the SPAC IPO. This is known as the “sponsor promote”. The sponsor promote only crystallises if an acquisition or merger is completed - and the shares received by the sponsor are restricted from being sold by the sponsor - known as a lock-up - for between 6 and 12 months from completion of the de-SPAC.

What’s in it for investors in the SPAC IPO?

The SPAC IPO “unit” - Subscribers in the SPAC IPO receive what are referred to as “units” - comprising a share and a warrant component - a fraction of a warrant per share subscribed. The strike price of these warrants will be the same as the strike price of the founder warrants.

What are two more important features of SPACs?

- The shareholder redemption right - Upon announcement of the merger, every shareholder in the SPAC has the right to redeem its shares and get back the face value of their shares plus interest accrued. This provides a form of downside protection for investors in the IPO

- The shareholder vote - In addition, for the merger to go ahead, the SPAC’s shareholders must approve it. The SPAC’s shareholders can therefore choose to vote either in favour or against the merger whilst having the downside protection of the redemption right - and retaining potential upside via their warrants. A shareholder who was not in favour of the merger might still vote in favour of it and redeem its shares in order to hedge itself against any eventuality.

What’s different in the UK?

Currently SPACs listed in the UK do not have the shareholder redemption and shareholder vote features. Also, under UK listing rules, trading in a SPAC’s shares is required to be suspended upon announcement of the de-SPAC. For these reasons, the UK is currently seen as a less attractive place to list a SPAC.

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

Rupert Walford

There are no available Videos from "Rupert Walford"