EU Support in the Irish Financial Crisis

Michael Torpey

30 years: Treasury & banking

In this video, Michael provides details of the Programme of Financial Assistance to Ireland, including the commitments to bank restructuring and recapitalisations. He also considers the effects of the Prudential Capital Adequacy Assessment which was required as part of the programme.

In this video, Michael provides details of the Programme of Financial Assistance to Ireland, including the commitments to bank restructuring and recapitalisations. He also considers the effects of the Prudential Capital Adequacy Assessment which was required as part of the programme.

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

EU Support in the Irish Financial Crisis

10 mins 32 secs

Key learning objectives:

Explain the background to Ireland’s Financial Crisis and the need for international assistance

Identify the motives behind the ECB actions

Discuss the role of the Troika Programme and its liquidation of IBRC which secured recovery.

Overview:

Ireland’s financial system had hit rock bottom and the need for international assistance loomed. This support arrived through the ‘Troika Programme.’ The result was capital injections into the BOI as well as the IBRC in promissory notes, leading to their liquidation. Ireland’s financial system was on the road to recovery.

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

Why was International Assistance needed?

- The expiry of the original government guarantee of bank debts

- The banking system could not finance itself

- The Government was finding market access increasingly difficult

- Retail banks exhausted all available collateral for their Euro-system borrowings

Private sector lenders to the Government similarly experienced losses on their holdings, hence, the dark atmosphere was brewing. It seemed as though the problem could not be solved domestically and thus an alternative option was necessary.

What were the motives behind the European Central Bank?

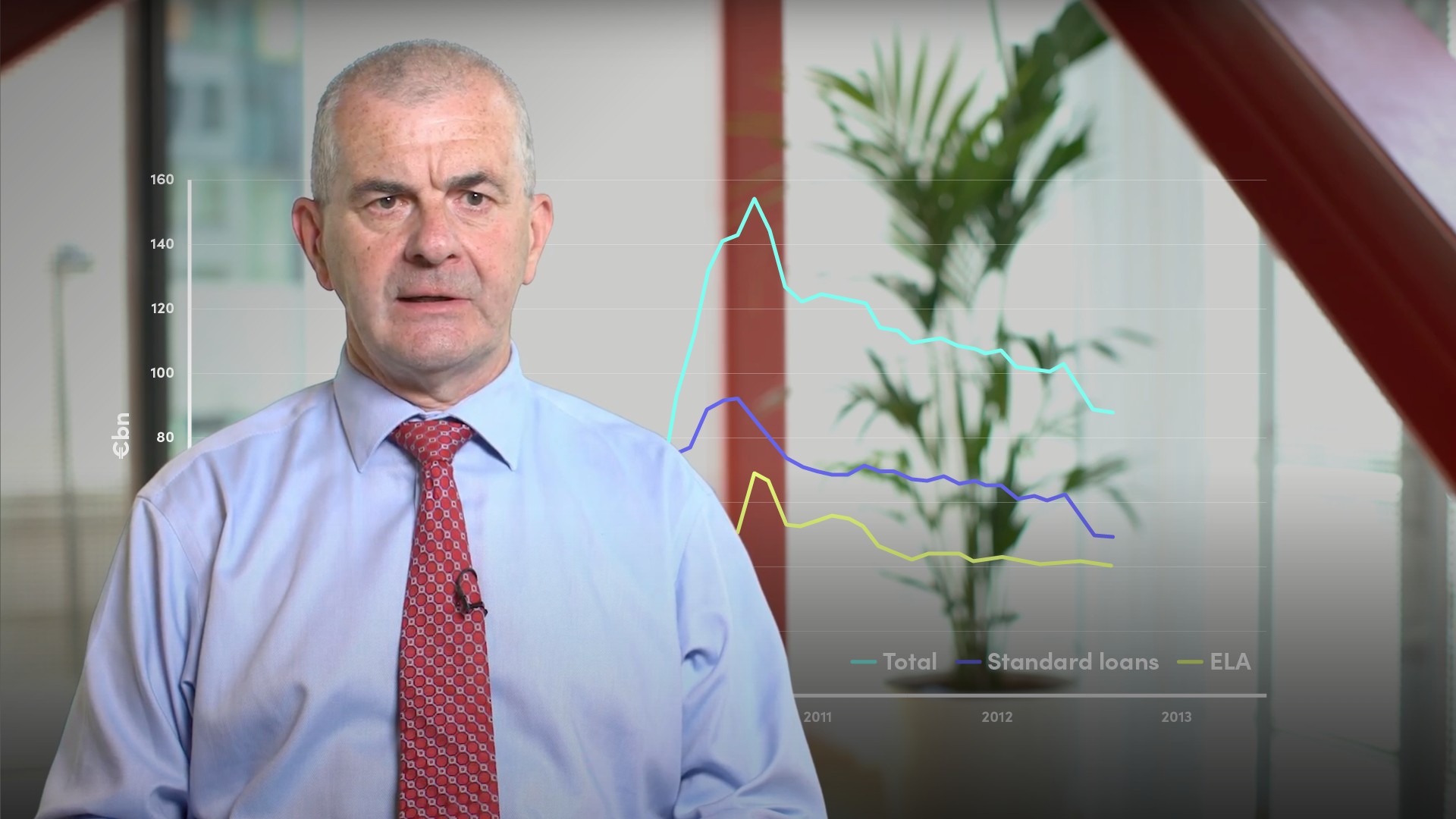

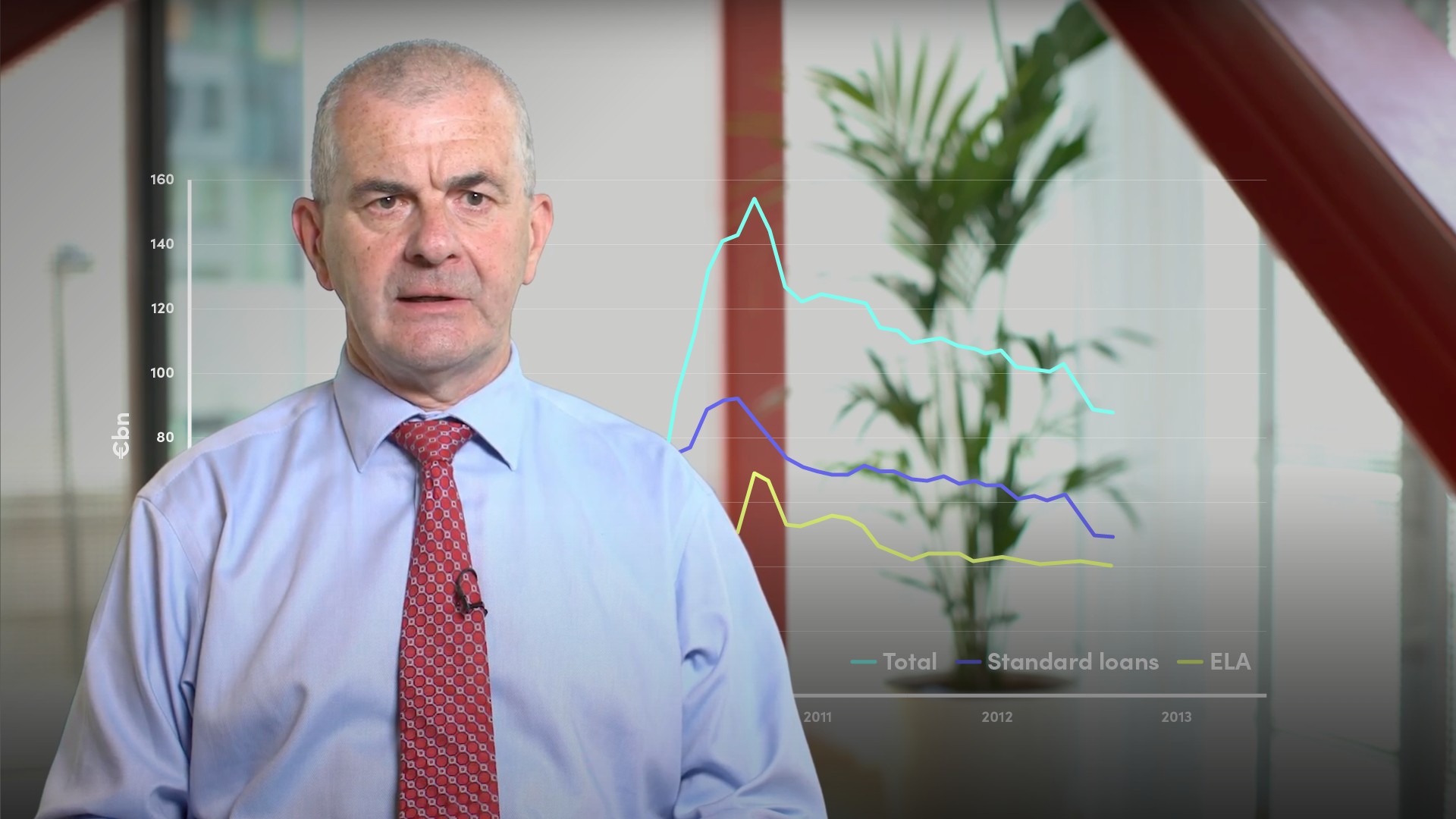

The ECB was becoming particularly uncomfortable with the scale of its support for the Irish Banking system, and thus, put pressure on Ireland to seek international help.

The ECB was accused of acting more like a large creditor seeking to secure recovery of their loans rather than a Central Bank trying to maintain financial stability throughout its currency bloc.

Further to this, the ECB put protection of its own balance sheet before the cost incurred to the Irish taxpayer. Hence, acting selfishly. Its aim was to re-open debt markets, recover loans and rather allow the state, IMF and EU to finance retail banks.

What was the Troika Programme?

An international programme of assistance that was formed in an agreement between the EU, IMF and the ECB. The programme included commitments to bank restructuring and further capitalisation.

What were the key milestones that led to the recovery?

A four-month window to raise capital was negotiated that enabled the Bank of Ireland to secure enough private investor support to keep it out of majority state ownership.

£30.6bn was provided to Anglo Irish Bank and IBRC in the form of Promissory Notes or government IOUs. These were available to pledge to the Central Bank as collateral for Emergency Liquidity Assistance. Notes proved lucrative for the ECB as they swapped them for FRNs that were high yielding.

Although the ECB criticism is needed, they did facilitate these Promissory notes and thus deserve some recognition. Under the terms of the notes, each year on 31 March, £3bn was to be paid to IBRC as part of their scheduled redemption. This proved instrumental in triggering the liquidation of IBRC.

Prudential Capital Adequacy Assessment (PCAR) 2011 - This required a further £24bn for banks driven by:

- Increased percentage of capital ratios

- An increase in projected 3-year loan losses for the banks

- A buffer against further future losses

- Deleveraging costs

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

Michael Torpey

There are no available Videos from "Michael Torpey"