The Weighted Average Cost of Capital (WACC)

Sarah Martin

30 years: Corporate Valuations

In this video, Sarah introduces the concept of the Weighted Average Cost of Capital (WACC), which plays a critical role in discounted cash flow (DCF) valuations. She explains how to calculate WACC using the costs of debt and equity, how to apply market-based weights, and how to handle key complexities such as sovereign spreads and funding in different currencies.

In this video, Sarah introduces the concept of the Weighted Average Cost of Capital (WACC), which plays a critical role in discounted cash flow (DCF) valuations. She explains how to calculate WACC using the costs of debt and equity, how to apply market-based weights, and how to handle key complexities such as sovereign spreads and funding in different currencies.

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

The Weighted Average Cost of Capital (WACC)

11 mins 38 secs

Key learning objectives:

Understand the concept and role of WACC in enterprise valuations

Identify how to calculate WACC using debt and equity components

Understand how market values and tax effects influence WACC

Learn how to adjust for sovereign spreads and hybrid instruments

Overview:

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

WACC represents the average return that all capital providers debt and equity expect for investing in a firm. It is the discount rate used in enterprise-level DCF valuations to convert future cashflows into a present value.

The formula weights the cost of debt and cost of equity by their share in the capital structure (based on market values, not book values). The after-tax cost of debt reflects the deductibility of interest in most tax systems.

- Cost of debt: Usually taken as the long-run cost (e.g. 5–10-year bonds), adjusted for tax

- Cost of equity: Often estimated using the CAPM

- Weightings: Based on market value of debt and equity, not book values

Investors base valuations on what they pay in the market. Book values may under- or overstate reality especially for equity, which is often materially different from its market capitalisation.

- Use the firm’s target capital structure for the weights

- Use a multiple-based valuation to approximate EV and then derive weights

Since interest payments are typically tax-deductible, the cost of debt is adjusted by (1 – tax rate). If the firm has tax loss carry-forwards, you still use the normal effective tax rate in the WACC.

What if the capital structure includes other instruments?

In addition to debt and equity, firms may issue preferred shares or hybrid instruments like convertible bonds. These must be factored in, each with their own cost and weighting.

How does sovereign risk impact the risk-free rate?

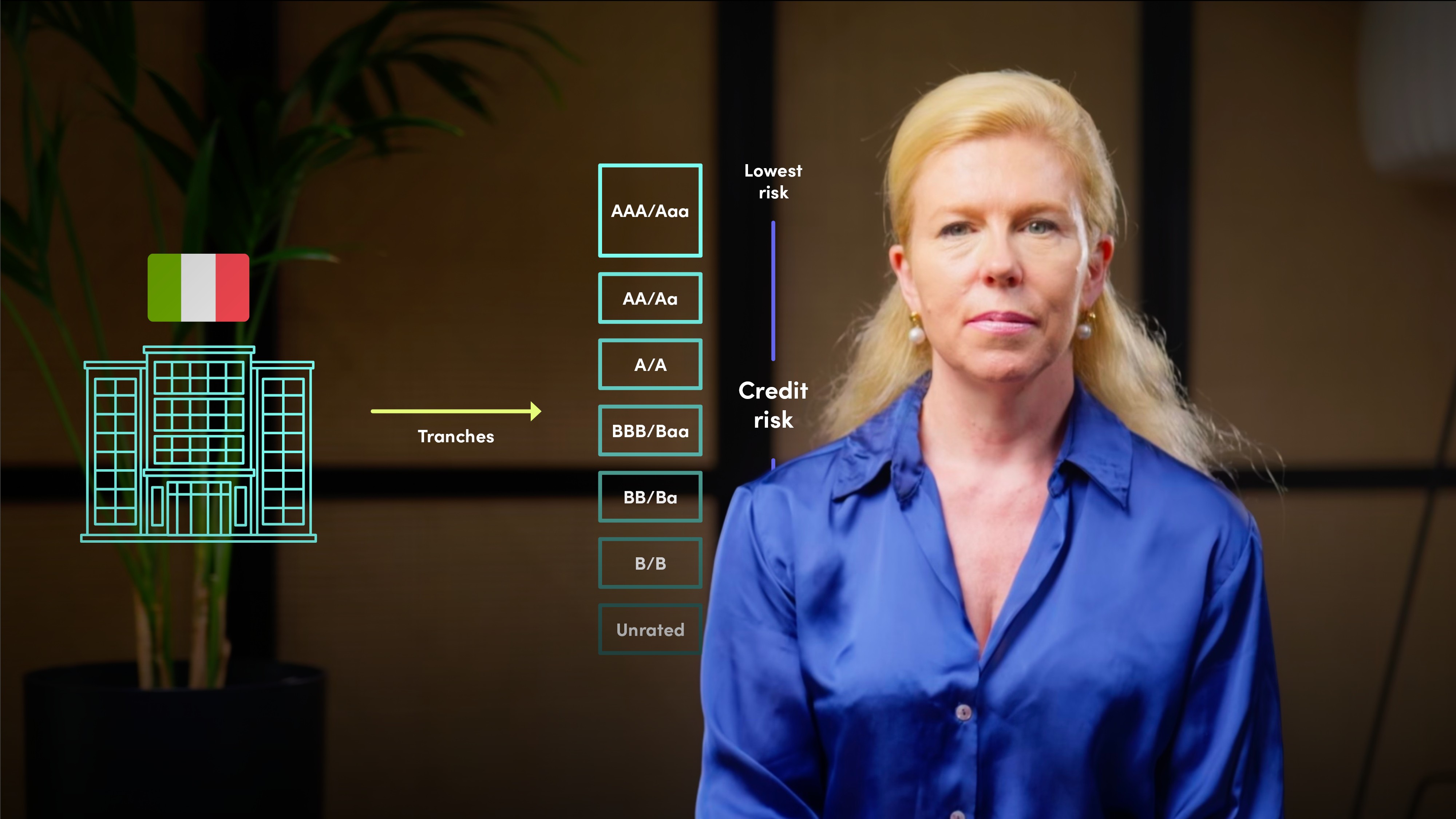

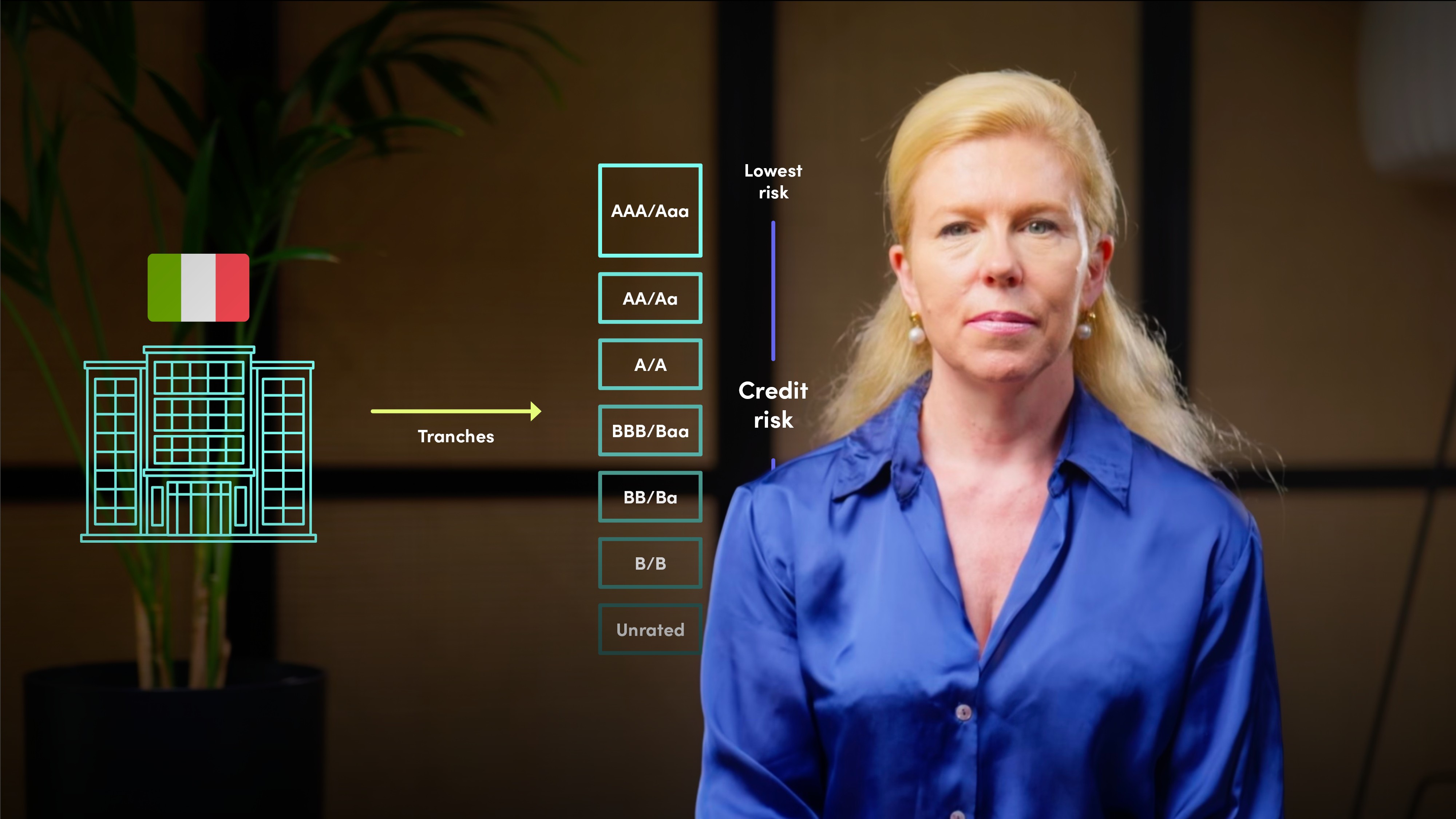

In countries with sub-AAA sovereign ratings, you must add a sovereign spread to the risk-free rate. For example, valuing an Italian firm in euros involves adding the spread of Italian government bonds over German Bunds.

Always base the cost of debt on the currency used for the valuation. If the valuation is in US dollars, use the USD cost of debt, even if the firm borrows in other currencies the FX impact will be reflected in market values.

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

Sarah Martin

There are no available Videos from "Sarah Martin"