Present Value (PV) Calculation (Multiple Cash Flows)

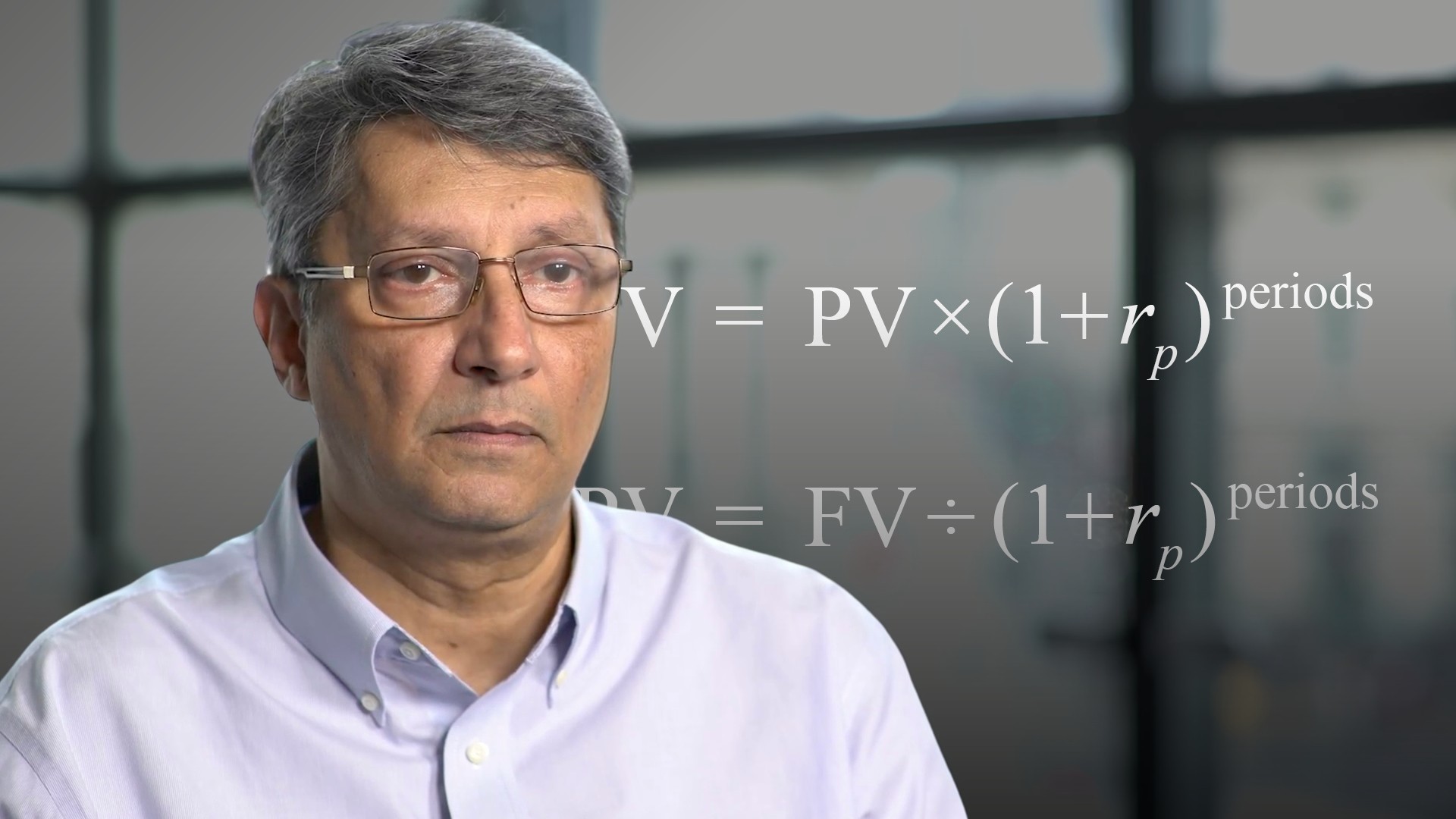

Abdulla Javeri

30 years: Financial markets trader

This video expands on Abdulla's previous video, What is Time Value of Money?, by introducing multiple cash flows occurring over different periods of time.

This video expands on Abdulla's previous video, What is Time Value of Money?, by introducing multiple cash flows occurring over different periods of time.

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

Present Value (PV) Calculation (Multiple Cash Flows)

3 mins 10 secs

Key learning objectives:

Learn how investors use the cash discounting formula to compare investments

Identify its limitations

Overview:

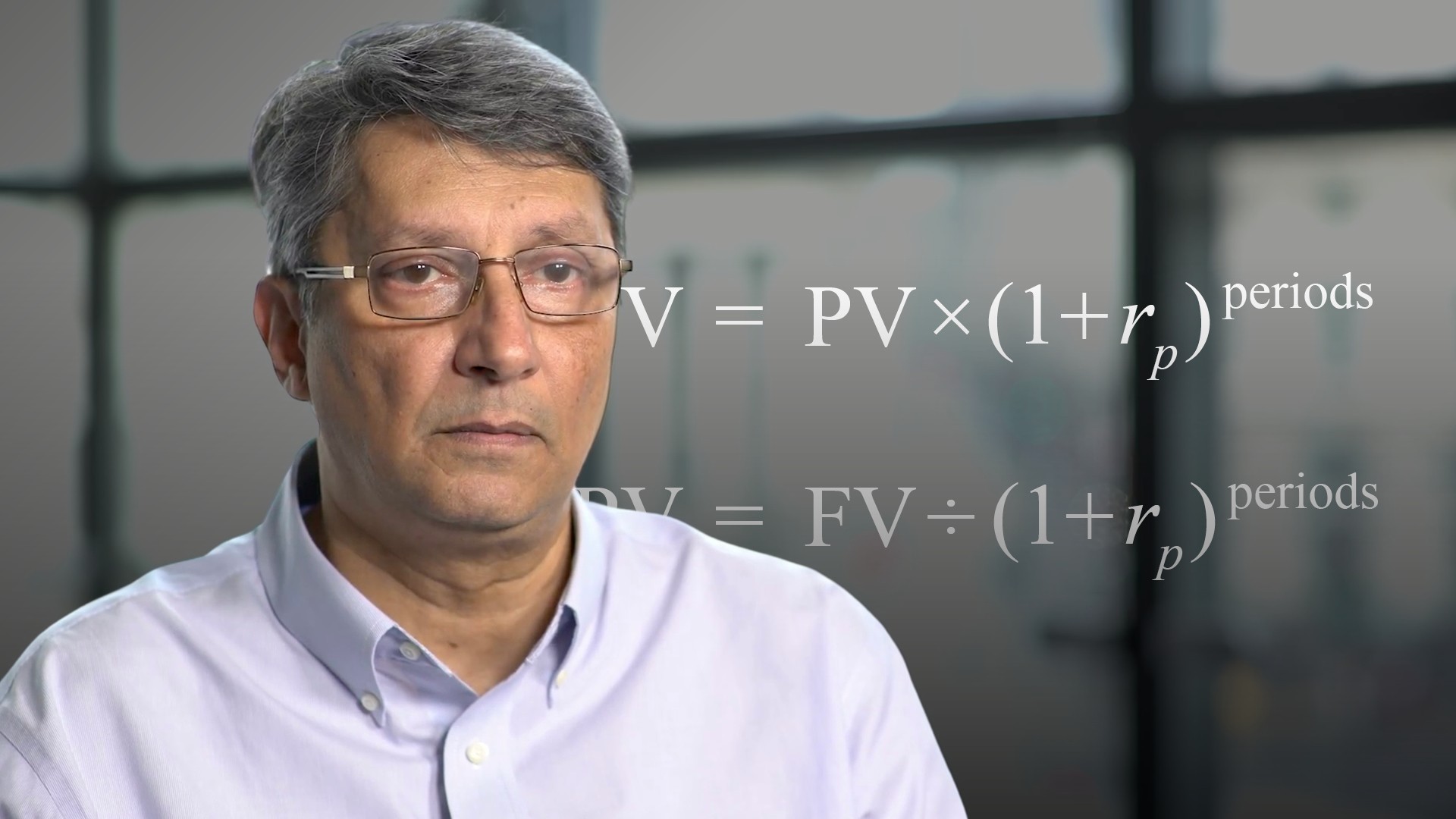

Investors can use the cash discounting/compounding formula to compare two or more investment opportunities with cash flows occurring over the same time period.

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

How can investors use the cash discounting formula to compare investments? What are its limitations?

Investors can use the classic cash discounting/compounding formula to analyse two or more investment opportunities with cash flows occurring over the same time period using a discount rate equivalent to their required rate of return. Investment opportunities offer various rates of return and various levels of risk. Any new opportunity has to be compared with the returns on another investment with equivalent risk. The PV is a function of the discount rate and the timing of cash flows. Different rates result in different PVs. Similarly for time periods. But PV cannot be used as a comparator for the relative desirability of different investments i.e. investment A is not necessarily superior to investment B simply because it has a higher PV.Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

Abdulla Javeri

There are no available Videos from "Abdulla Javeri"