Present Value Calculations (Bonds)

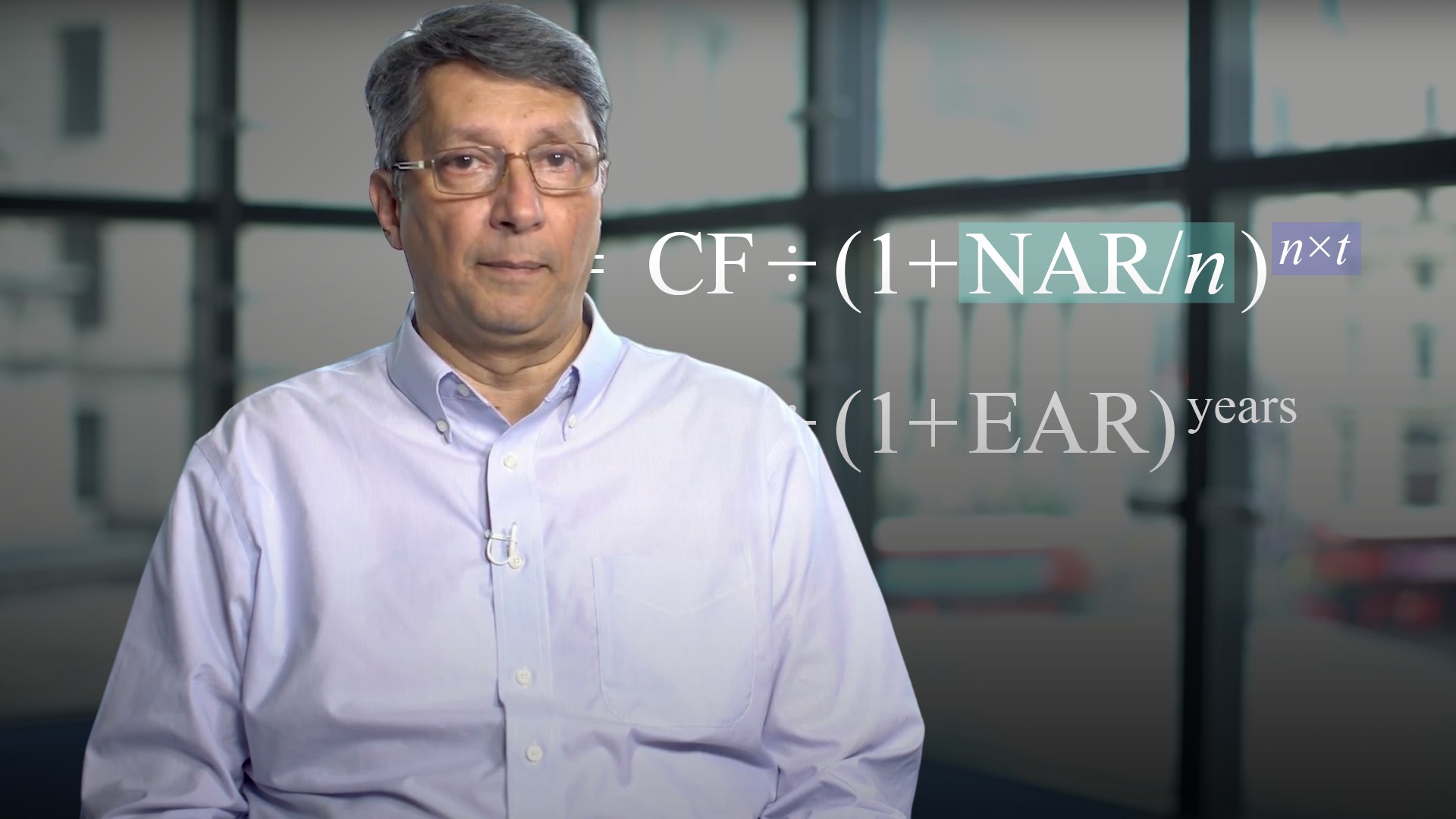

Abdulla Javeri

30 years: Financial markets trader

In this video, Abdulla outlines the formula used in bond markets discounted for multiple periods.

In this video, Abdulla outlines the formula used in bond markets discounted for multiple periods.

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

Present Value Calculations (Bonds)

4 mins 4 secs

Key learning objectives:

Understand how different rates affect the present value calculations of cash flows

Overview:

The value of the formulae used in bond markets to discount for multiple periods relies on the appropriate inputs. And there are many. Incorrect inputs will result in an incorrect PV and valuation.

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

Understand how different rates affect the present value calculations of cash flows

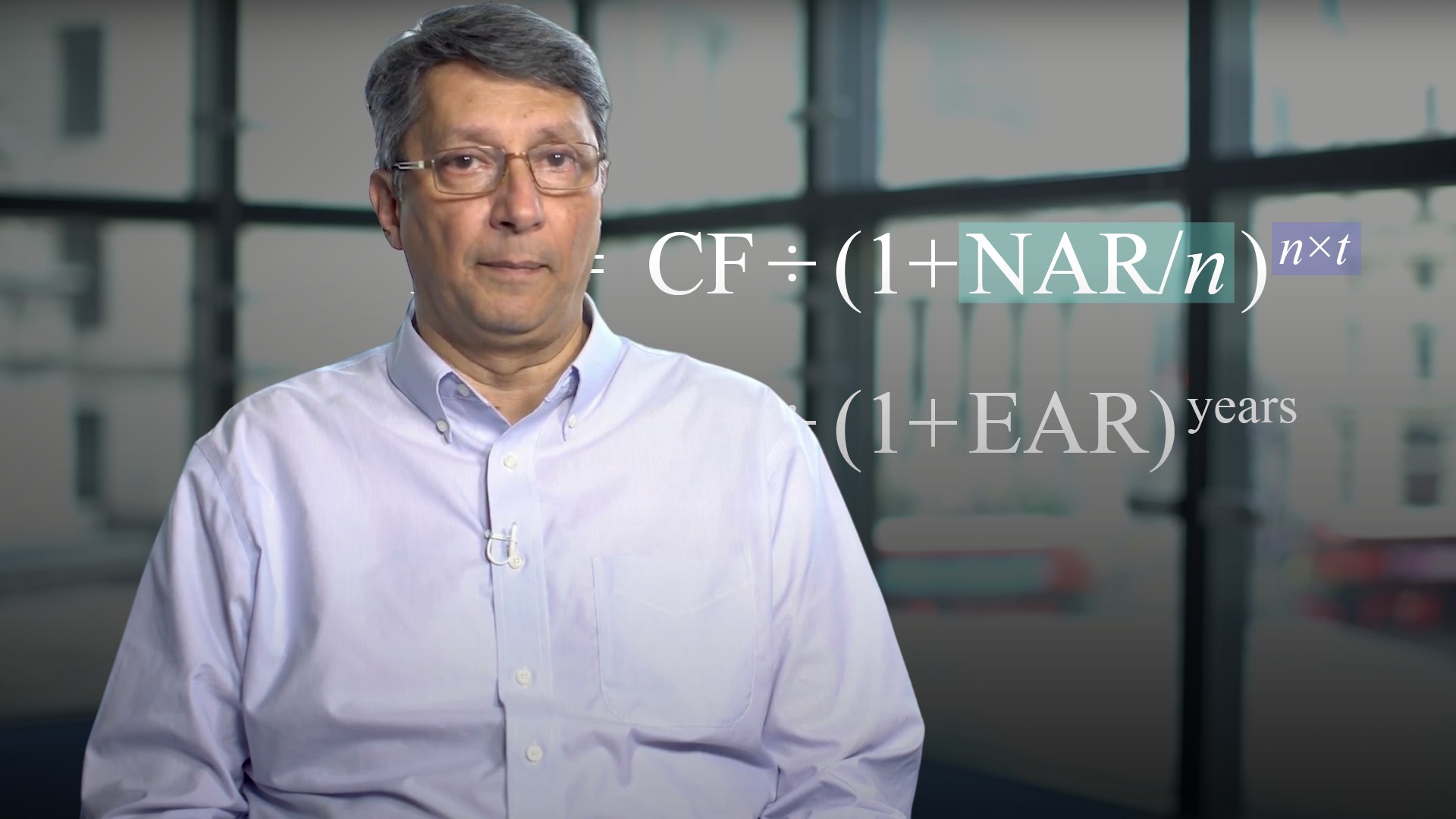

The value of the formula used in bond markets to discount for multiple periods relies on the appropriate inputs. And there are many. A simplified version of the formula is as follows:

PV = CF/(1+rp)periods

To find the present value of a given cash flow, use the term on the right of the division sign to discount it. Investors need to make decisions in respect of the interest or discount rate and the time in the power (or exponent). Incorrect inputs will result in an incorrect PV and valuation.

The choices in terms of the interest rate are between nominal annual rates, periodic rates and effective annual rates. If we apply a periodic rate, is it a nominal annual rate divided by frequency of compounding periods in a year, or an effective annual rate divided by frequency? For the power or exponent, the choice is between time in periods or in years.

Correct inputs will yield correct numbers. Any other combination will potentially result in valuation errors and therefore losses.

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

Abdulla Javeri

There are no available Videos from "Abdulla Javeri"