Types of Funds and Asset Managers

Mark Doran

40 years: Fund management

Building on what we learnt about the role of the Asset Manager in the previous video, Mark delves deeper into Asset Management as a whole, by looking at the team surrounding the managers doing this work, before also exploring some of the external administration roles and structures that exist outside of Asset Management companies.

Building on what we learnt about the role of the Asset Manager in the previous video, Mark delves deeper into Asset Management as a whole, by looking at the team surrounding the managers doing this work, before also exploring some of the external administration roles and structures that exist outside of Asset Management companies.

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

Types of Funds and Asset Managers

8 mins 11 secs

Key learning objectives:

Understand the role of an asset manager

Outline the types of funds

Overview:

There are several different fund types, each with similarities, but they work in different ways and have different objectives and features. These fund types include the likes of mutual funds, pension funds, insurance companies, hedge funds, investment trusts, open-ended funds and closed-ended funds.

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

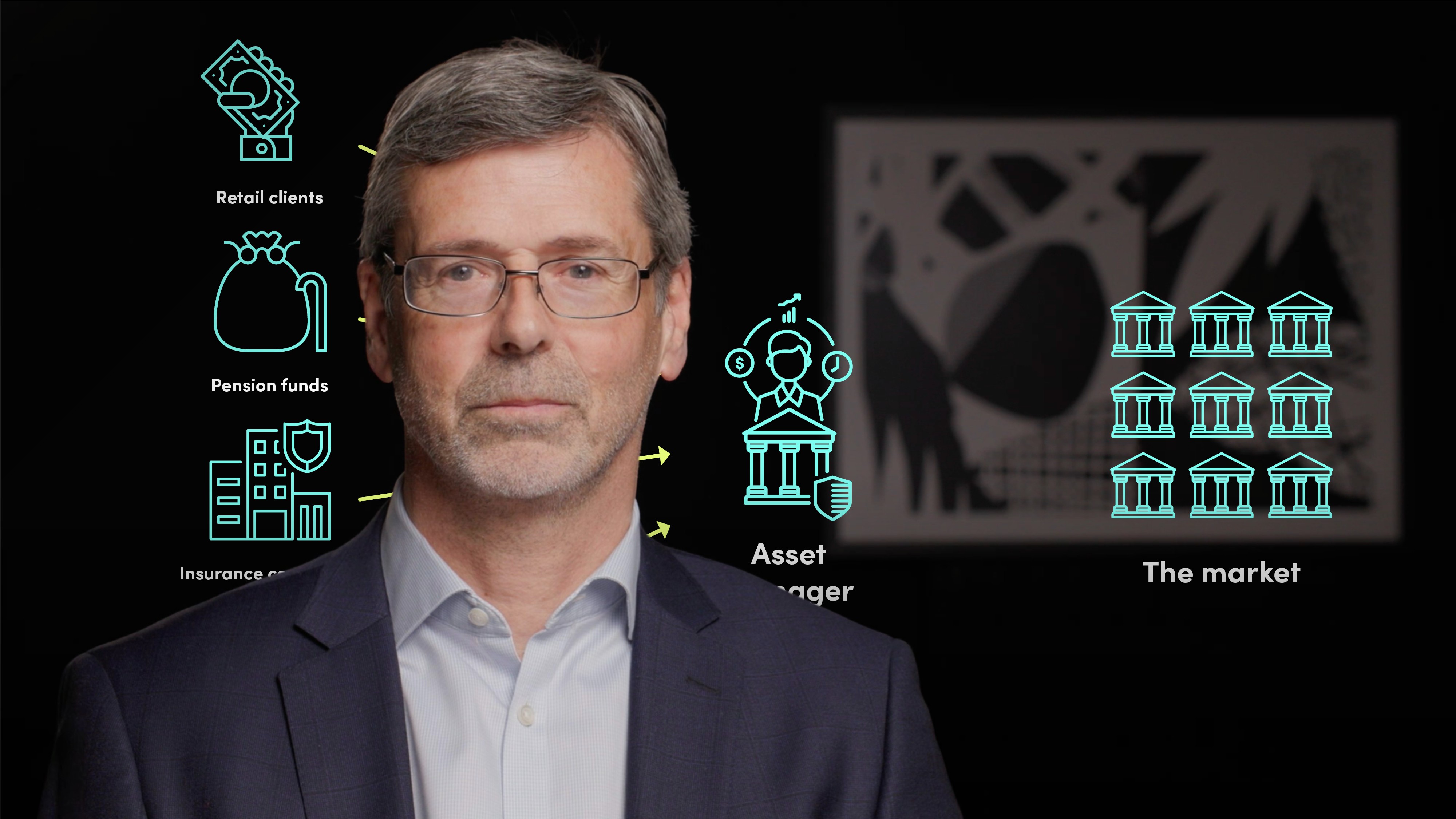

What is the role of asset managers?

Asset managers invest on the behalf of others, such as retail clients, pension funds, insurance companies or high net worth individuals to name a few. They earn money by charging a management fee, which could range from 0.08-2% of the fund value. Asset managers also charge other fees such as custody and dealing fees. Therefore they need to illustrate their total annual fees (total expense ratio), which is the total cost of fees divided by the fund’s assets.

What are mutual funds?

Mutual funds are professionally managed investment funds that pool money from multiple investors. Shares in these funds can only be bought or sold at a specific time of day, usually the afternoon.

Retail clients who want access to the financial markets often use Mutual Funds as they are a cheap way of accessing the markets on a diversified basis.

These funds are highly regulated, with the intention of protecting individual investors and the funds have to be diversified and are limited to 10% cash borrowing.

Why do pension funds and insurance companies invest?

These types of funds are the largest part of the investment market.

Pension funds receive payments for 20-40 years from pension holders, pension funds need to invest these assets so that it has enough to pay out in the future. Pension funds will work with asset managers in order to make decisions on how to invest these assets.

Insurance companies also receive premiums from policyholders and insurance companies also have to invest these premiums to ensure it has enough cash to pay out claims in the future.

What are hedge funds and investment trusts?

Hedge funds account for less than 5% globally, but they are looking to achieve higher than average returns and are deemed too risky to be sold to the public.

Investment trusts are companies that invest in other companies. Investors in this type of fund are not buying shares in the fund, but instead are buying shares in the company itself (the trust).

What are open-ended and closed-ended funds?

Open-ended funds are funds which have no limit on investment. The fund manager will buy or sell assets as the fund grows or shrinks. This way, it can alter its size based on its popularity.

Closed-ended funds have a maximum investment limit at which point they cannot accept any further capital. They often come with rules about when you can withdraw your money.

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

Mark Doran

There are no available Videos from "Mark Doran"