Working in Venture Capital

Harry Davies

Early stage business funding specialist

In the last video to this series on Venture Capital, Harry delves into the different roles and responsibilities of those within a venture capital firm. This includes partners, analysts, associates and so on before briefly introducing the VC ecosystem within the UK. In 2019, £10.1bn was invested by VCs into UK companies.

In the last video to this series on Venture Capital, Harry delves into the different roles and responsibilities of those within a venture capital firm. This includes partners, analysts, associates and so on before briefly introducing the VC ecosystem within the UK. In 2019, £10.1bn was invested by VCs into UK companies.

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

Working in Venture Capital

7 mins 16 secs

Key learning objectives:

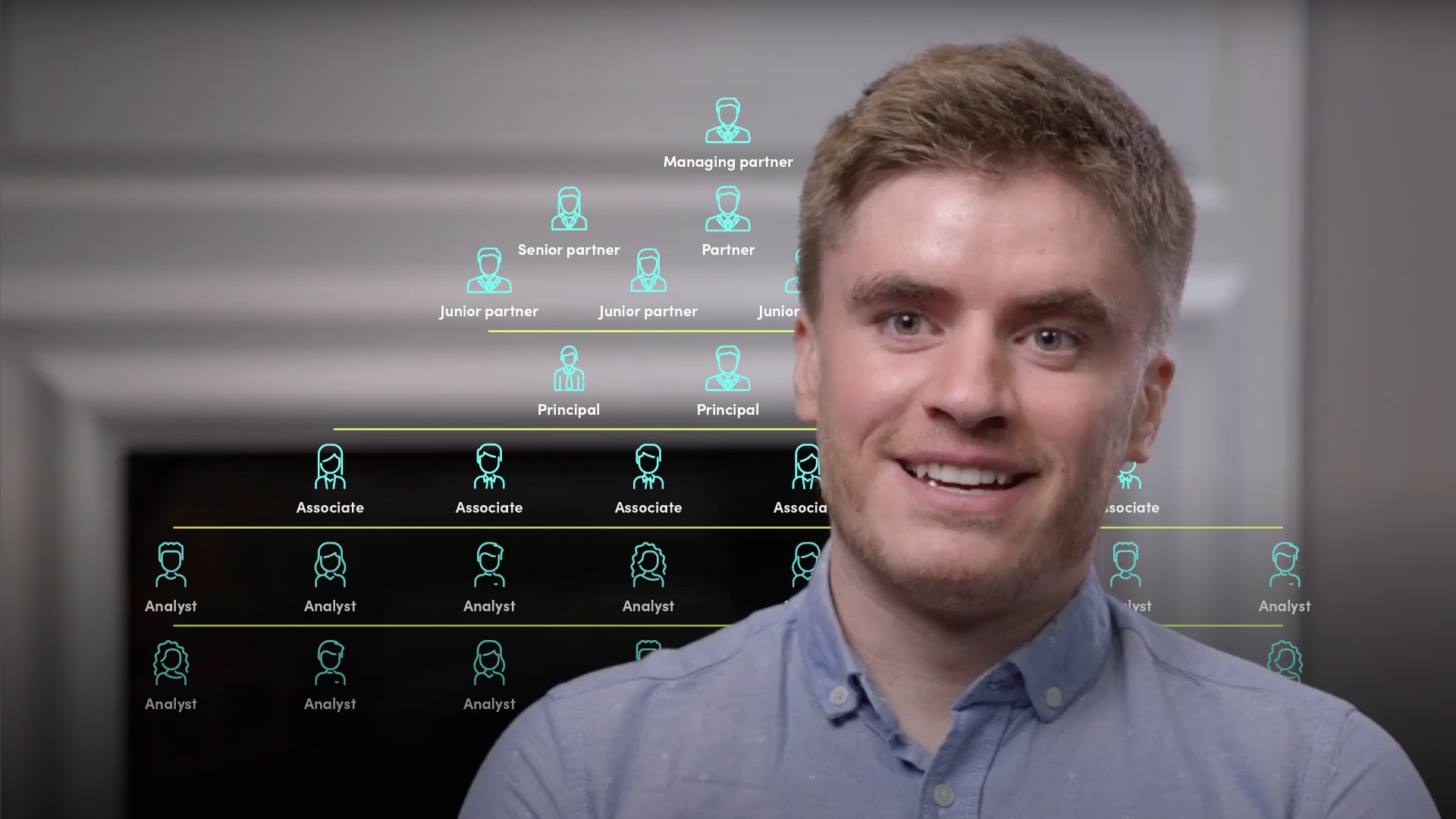

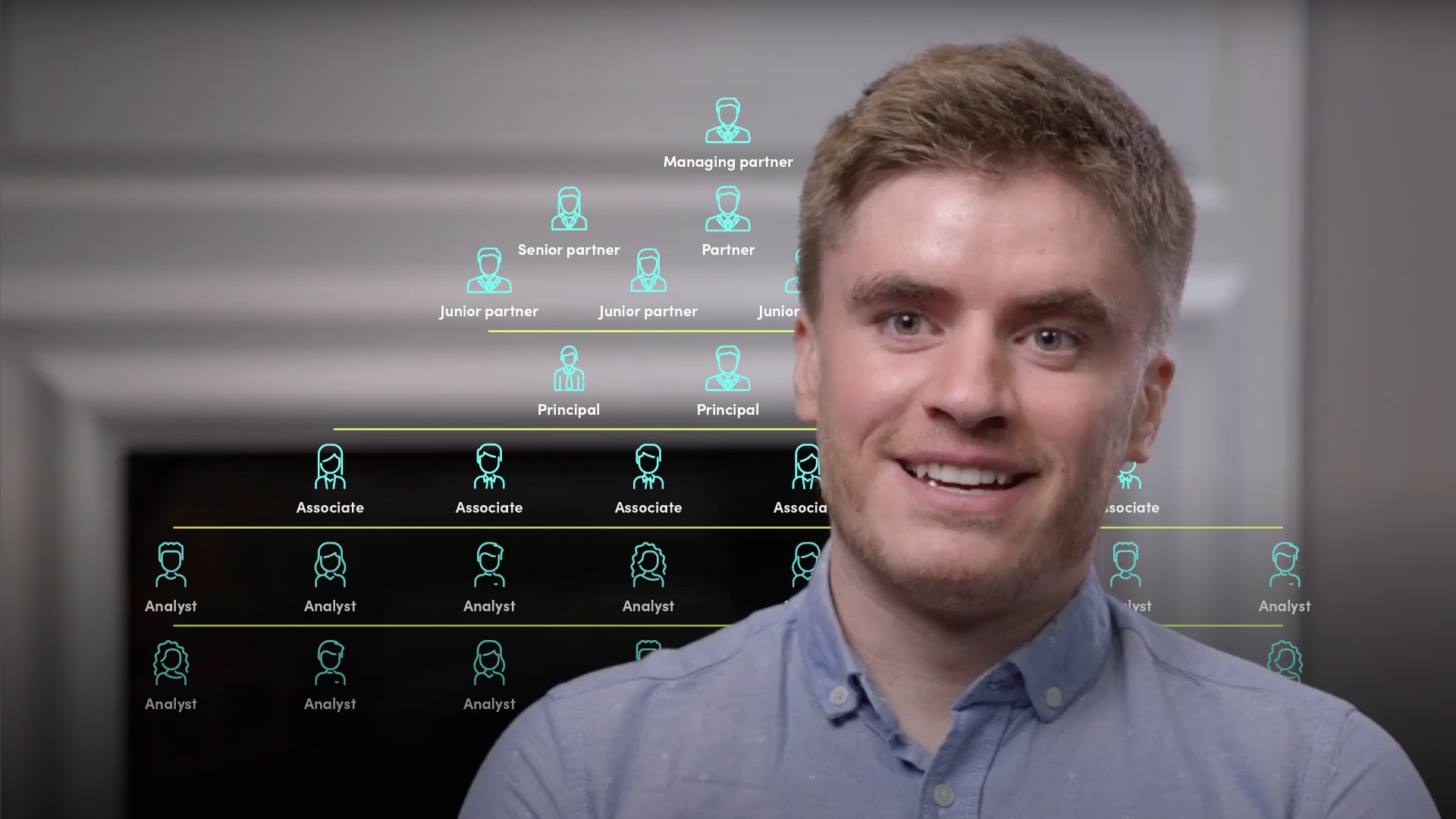

Outline the key roles within a venture capital fund

Identify whether venture capital firms network with each other

Understand what the venture capital ecosystem looks like in the UK

Identify where early-stage companies should go for funding

Overview:

In order for entrepreneurs to connect with the right people within a Venture Capital firm it’s valuable to know who does what. Partners play a large role, Principals bring influence, and Associates can champion your business within the fund. The VC ecosystem is in rude health in the UK and there are a wide range of options for early stage companies to take advantage of.

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

What are the key roles within a venture capital fund?

- Partners are in essence the owners of a venture capital firm, and are usually made up of investment veterans, formerly successful entrepreneurs, or senior operators. They will set the thesis of the fund, lead on its strategy, and coordinate fundraising. As the most senior members of a VC fund, the partners of a fund are therefore decision makers as to how best to deploy that capital

- Associates are more junior members of a VC firm - associates can be useful champions and internal evangelists

- Principals are somewhere in between associates and partners; closer to, but not as senior as the latter, they tend to have more experience over the former.

What is the difference between a partner and a principal?

- There can be a hierarchy of partners at a firm. They are an ideal point-of-contact for entrepreneurs looking for fundraising where they are able to champion a deal and accelerate to a decision quickly

- Principals are useful contacts for founders with influence in the fund and a trusted track record with the partnership

Do venture capital firms network with each other?

VC is a highly network industry with many of the highest quality investment opportunities originating from other VC funds, who may be very familiar with the context of what a particular fund is likely to deem a fit and provide a trusted filter.

In all of the above roles, much time is spent networking with other funds as well as entrepreneurs.

What does the venture capital ecosystem look like in the UK?

The venture capital ecosystem in the UK is in rude health. According to Tech Nation’s annual report, £10.1bn was invested by VCs into UK companies in 2019, up 44% on the year previous. That is double the next European market, Germany, which saw just over £5bn invested.

The terminology - ‘ecosystem’ - has stuck as a way to describe the environment that VCs and founders operate in. The dynamic interplay of, government, law firms, accelerators, accountants, angel investors, corporate innovation leaders, and others makes for ‘ecosystem’ being an apt metaphor.

Where should early stage companies go for funding?

- The earliest-form of support to budding entrepreneurs comes through venture builders such as Entrepreneur First, ConceptionX and Antler. These organisations support potential founders through an idea, help them meet their co-founder, and support their company formation

- The first port-of-call for very early-stage, formed companies looking for funding are angels or pre-seed funds. The recent UK ecosystem has benefited from an increasing number of angel investors who have themselves been successful founders

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

Harry Davies

There are no available Videos from "Harry Davies"