What are Corporate Bonds?

Tim Skeet

35 years: Debt capital markets

Just like sovereigns, corporations raise debt to supplement operational revenues. In this video, Tim covers what a corporate bond is and how it is issued, the importance of credit ratings, and capital structure.

Just like sovereigns, corporations raise debt to supplement operational revenues. In this video, Tim covers what a corporate bond is and how it is issued, the importance of credit ratings, and capital structure.

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

What are Corporate Bonds?

9 mins 56 secs

Key learning objectives:

Define a corporate bond

Explain the different uses of bond proceeds and their benefits

Discuss the different assessments investors use before financing

Overview:

A corporate bond is a bond issued by a corporation in the debt capital market to supplement operational revenues and finance company activities.

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

How are the non-financial companies categorised?

- Investment-grade corporate debt

- High-yield debt

- Emerging market corporate debt

What are the proceeds used for?

- To pre-finance or refinance outstanding debt

- Pay for takeovers

- Operational expansion

- Finance research and development

- General corporate purposes

What is the benefit for issuers?

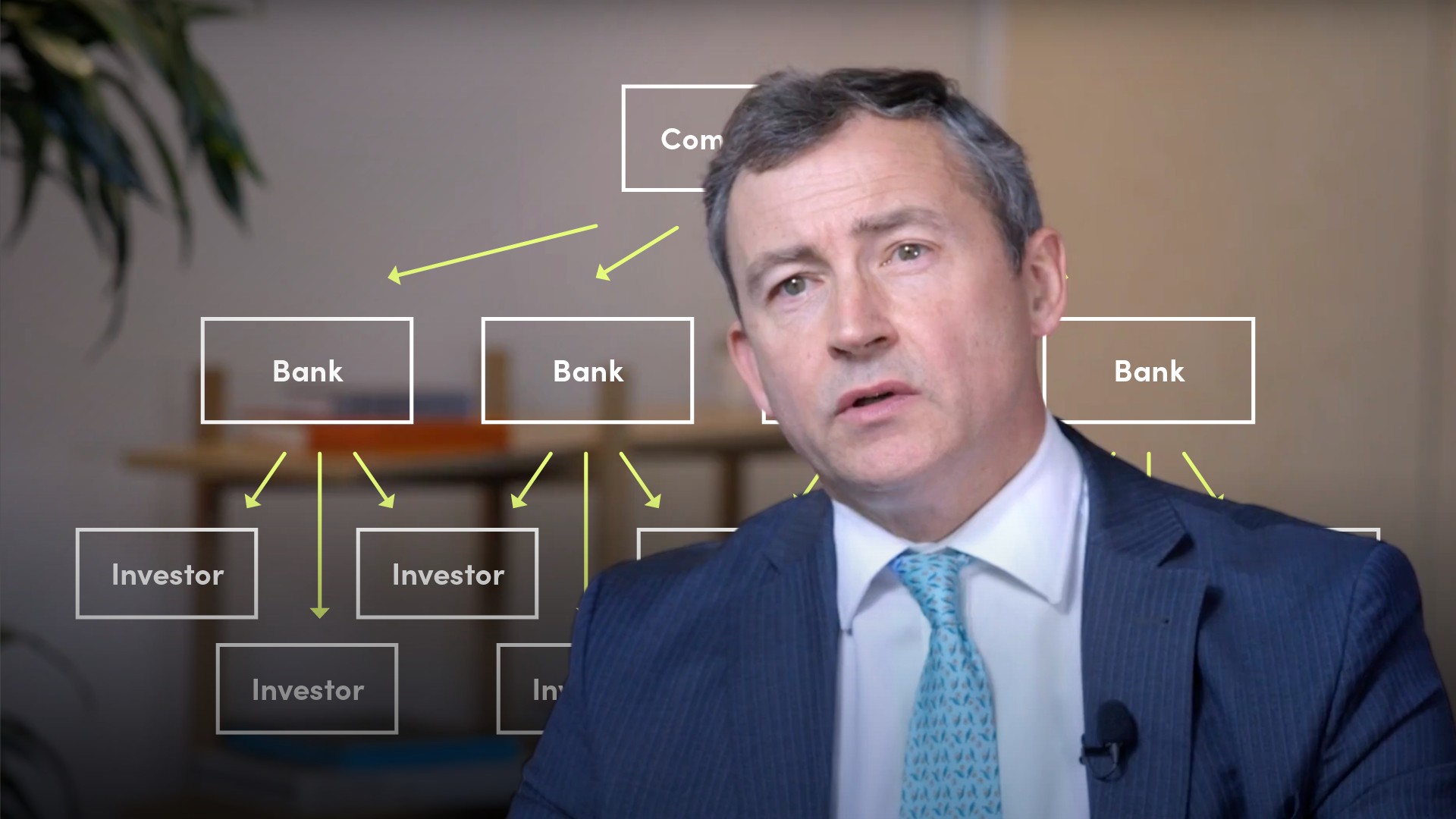

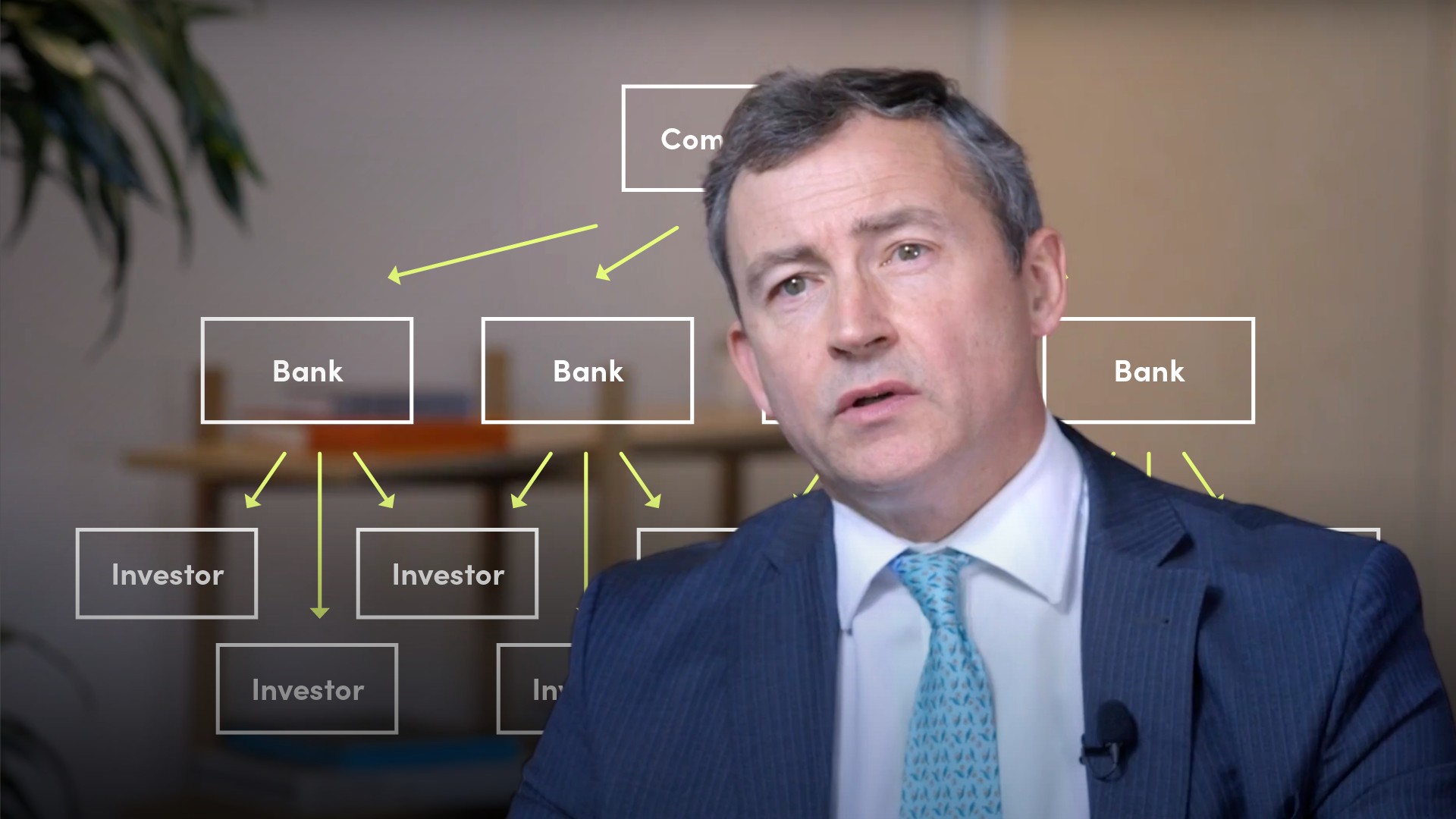

The Bond Market offers a diversified source of capital. For example, it comes from investors rather than borrowing from banks

Also, it’s a longer-term source of capital (some corporate bonds have long maturity dates).

What are the corporate debt sub-sections?

Investment-grade corporate DCM – This is short-hand for companies issuing bonds that are based in developing economies and have investment-grade credit ratings.

High-yield debt – This is for companies issuing bonds from developed countries that have non-investment-grade credit ratings.

Emerging market debt – This captures companies based in developing/emerging economies. It is used as a ‘catch-all’.

What are credit rating agencies, and how are bonds rated?

Credit Rating Agencies:

These are private-sector companies that provide extensive credit analysis of countries and companies. They offer professional opinions/ratings that describe the level of risk investors face if they buy the debt of a specific issuer. For example, the probability of default.

How are the bonds rated?

- Investment grade – Triple A to low Triple B

- Non-investment grade – Double B and below

- Default – securities rated in the C/D category

What other things do investors consider?

Prior to lending, investors assess the seniority of debt. This refers to the legal and contractual order in which debt is repaid if the borrower becomes insolvent or forced to declare default on its debt and is liquidated through the courts.

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

Tim Skeet

There are no available Videos from "Tim Skeet"