What are Syndicated Government Bonds?

Tim Skeet

35 years: Debt capital markets

In 2018, sovereigns, supranationals and agencies around the globe issued a total of $1.4tn worth of new debt in the public syndicated debt capital markets. Tim explains the process in which these syndicated bonds are issued.

In 2018, sovereigns, supranationals and agencies around the globe issued a total of $1.4tn worth of new debt in the public syndicated debt capital markets. Tim explains the process in which these syndicated bonds are issued.

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

What are Syndicated Government Bonds?

3 mins 24 secs

Key learning objectives:

Identify all the parties that are involved in a syndicated bond issuance process

Understand what a syndicated bond is

Overview:

Syndicated bonds are underwritten by a syndicate, or a group of underwriters. Governments will then set up meetings to gauge the appetite for the offering in order to set a price and terms for the syndicate.

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

What is the process for issuing a Syndicated Government Bond?

The role of underwriters:

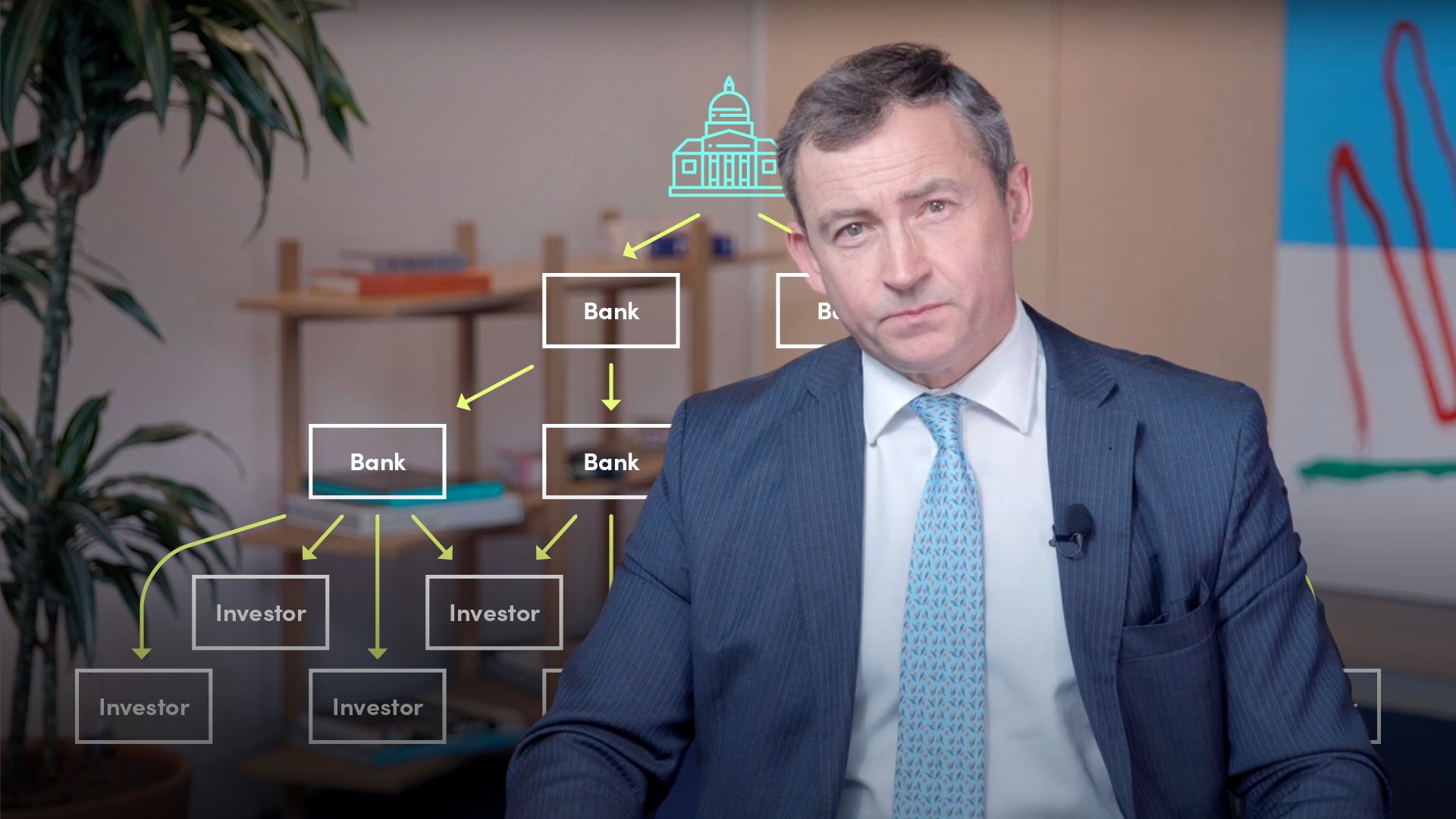

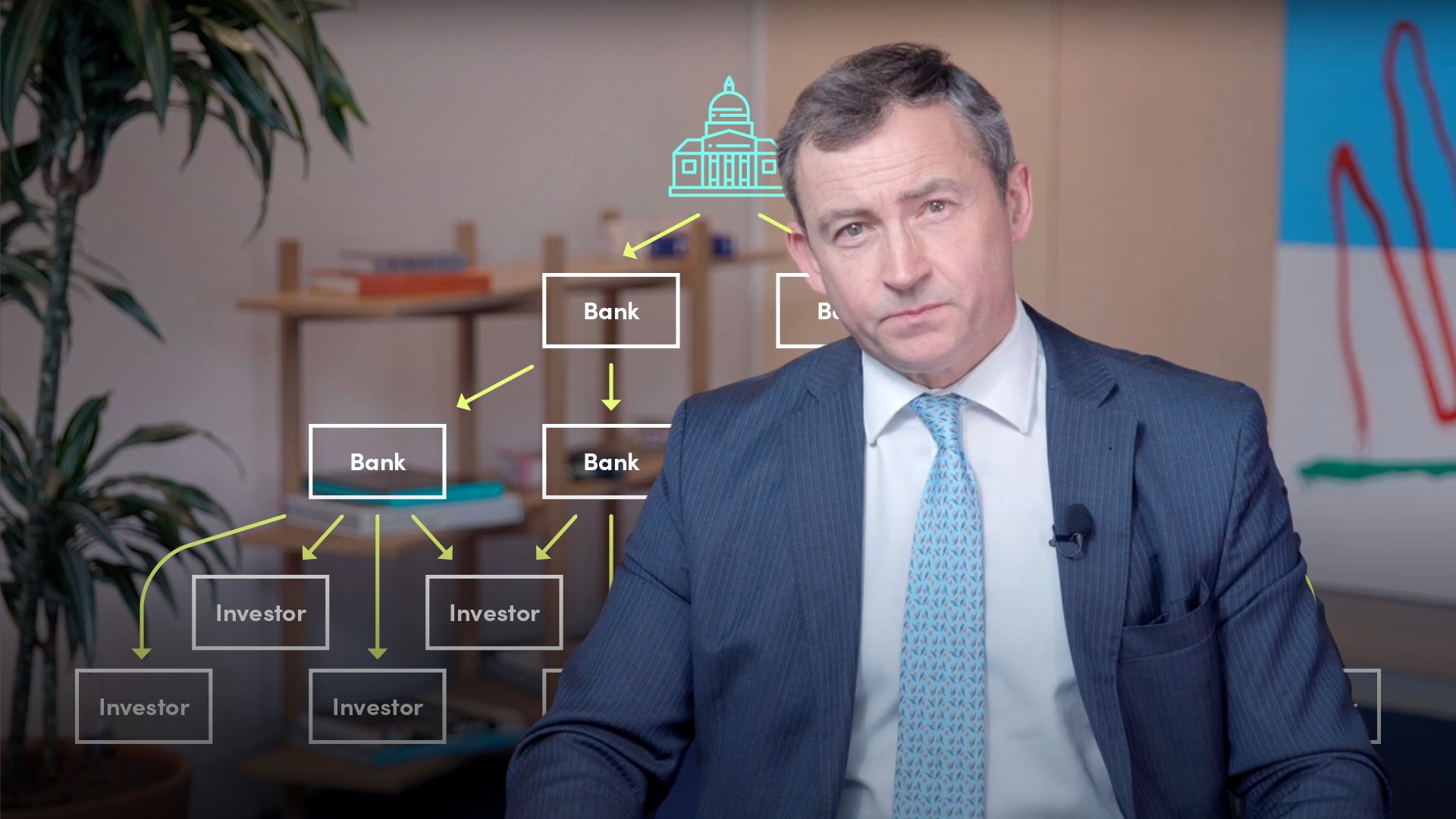

In syndicated bond offerings, a government debt office will appoint a panel of underwriters, banks and broker-dealers. They’re called syndicated transactions because the banks will form a debt syndicate, a group of underwriters, usually investment banks, who will manage the debt offering.

Once they have been appointed the panel of underwriters will provide feedback to the government issuer on market conditions, investor sentiment, and anything material that is happening in the market. The syndicate of banks is led by a small number of banks that take most of the responsibility for ensuring the bonds are sold and put in the hands of high-quality investors. The banks in charge are known as lead managers or bookrunners.

The role of bookrunners:

Bookrunners and other banks in the syndicate engage directly with institutional investors to gauge their appetite for the government bonds that are being sold. The banks will ask investors for their feedback in terms of price, maturity and other key issuing metrics.

Investor roadshows are arranged for sovereigns that haven’t issued in the syndicated part of the market before, or haven’t issued for some time, and feel the need to update investors on their numbers or material changes that have occurred.

The role of broker-dealers:

Banks and broker-dealers in this context are often called underwriters, but they are acting as intermediaries between government issuers and investors and operate on an agency basis. They no longer take underwriting risk by formally agreeing to buy unsold bonds or to buy the bonds up-front to sell-on later to investors.

Once they ‘close’ the books, syndicate members will fix the price they believe will enable the bonds to trade well in the secondary market. They then determine which investors have been selected to receive bonds and check that their demand is still good at the final price.

In what order are they distributed?

They will allocate bonds to high-quality investors first including large asset managers, insurance companies, pension funds, banks, central banks and sovereign debt offices. They will minimise allocations to low-quality accounts. These are accounts that will sell the bonds on to make a small profit in the immediate aftermarket or behave in a way as to create an uncertain or volatile aftermarket.

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

Tim Skeet

There are no available Videos from "Tim Skeet"