What is a Bank?

Robert Ellison

20 years: Capital markets & banking

Rob describes the fundamental activities of a bank, builds a theoretical bank balance sheet and shows how liquidity and capital perform their vital functions.

Rob describes the fundamental activities of a bank, builds a theoretical bank balance sheet and shows how liquidity and capital perform their vital functions.

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

What is a Bank?

1 hour 11 mins

Key learning objectives:

Define assets and liabilities and the golden rule of balance sheets

What sits on a bank balance sheet?

What is equity and what is its purpose?

Why do investors invest in bank equity?

How do banks boost returns on equity?

What are the differences between equity and liabilities?

How do banks maintain balance-sheet balance when customers withdraw deposits?

Define asset liquidity and its link to maturity transformation

Overview:

The fundamental activities banks carry out are borrowing and lending money. Banks release financial statements at least once a year. At the heart of these highly detailed financial statements lie two key disclosures: the income statement and the balance sheet. The golden rule of balance sheets is they must balance at all times. The principal balancing components are assets and liabilities.

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

Define assets and liabilities and the golden rule of balance sheets

Listed banks release financial statements a.k.a. reports and accounts at least once a year. At the heart of these highly detailed financial statements lie two key disclosures:

- The income statement: a cash flow commentary on the money a bank has collected and spent in a given year

- The balance sheet: a statement of what a bank owns and owes at the given point in time

The golden rule of balance sheets is they must balance at all times, which is to say its two principal components must be in equilibrium at all times. The principal balancing components are:

- Assets, the things a bank owns or is owed

- Liabilities, the money a bank owes i.e. is liable to pay back to investors or customers

Equity, the money shareholders have invested in the bank, sits on the liabilities side of the balance sheet and acts as a shock absorber at times of stress and is first in line to suffer losses.

What sits on a bank balance sheet?

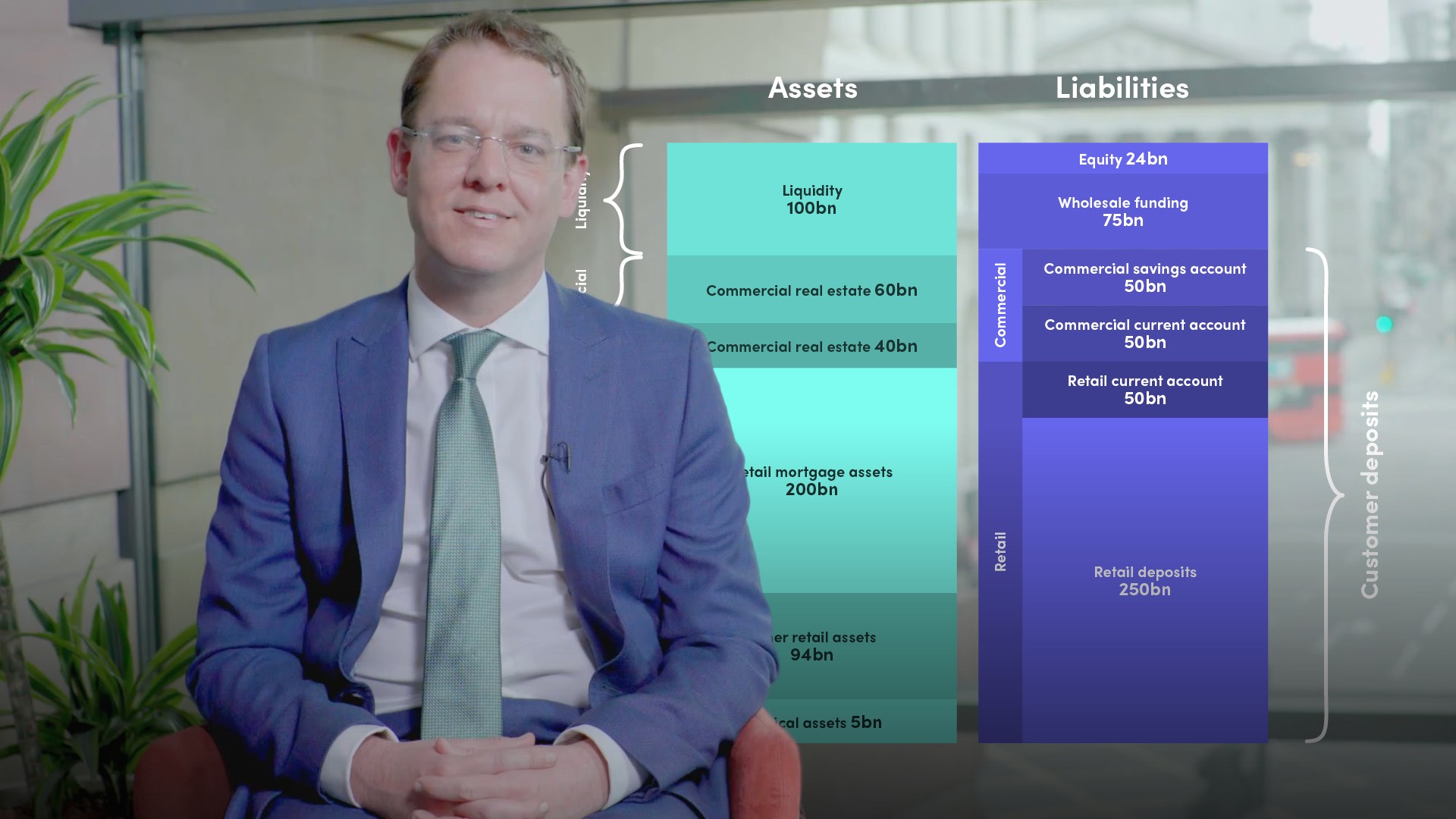

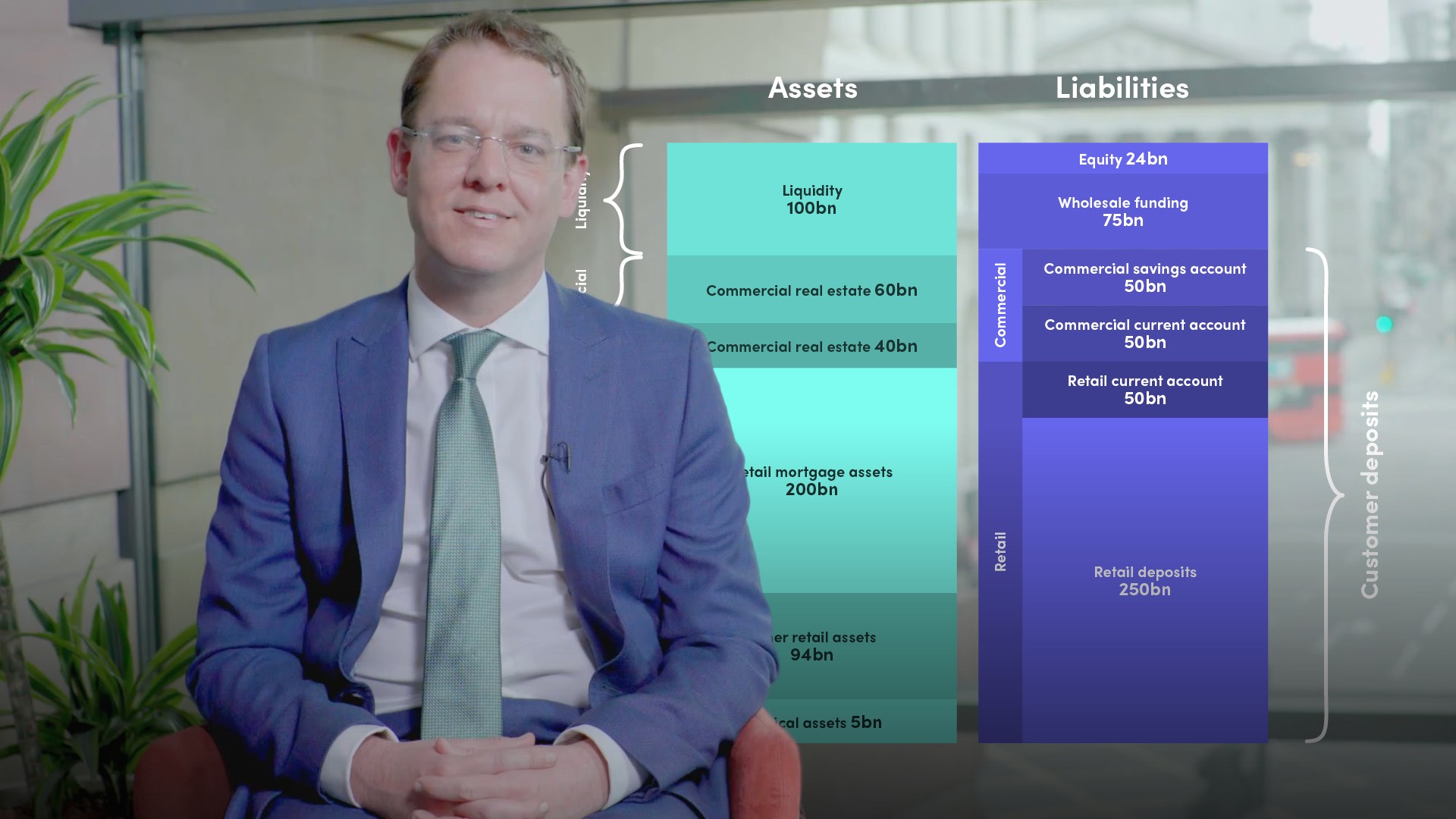

A bank’s balance sheet is typically made up as follows:Assets side

- Physical assets (customer branches, call centres, furniture, computers, telephones, other equipment)

- Financial assets:

- Liquidity

- Cash

- Central bank deposits

- Highly-liquid assets

- Loans to retail customers:

- Mortgages

- Credit cards

- Personal loans

- Auto loans

- Overdrafts

- Loans to commercial customers (typically more complex, especially for commercial customers operating in complex supply chains, in multiple currencies or jurisdictions):

- Mortgages (commercial real estate)

- Company overdrafts

- Company credit cards

- Loans to finance company auto fleets

- Commercial loans (in dozens of formats)

- Liquidity

Liabilities side

- Retail and commercial customer deposits:

- Current accounts (repayable on demand: cash withdrawals, payment instructions to third parties, standing orders, use of debit cards)

- Fixed-term deposits

- Notice accounts

- Wholesale funding:

- Borrowing from institutional investors in the bond market (lending for investment purposes); less reliable in times of crisis

- Equity

- The money shareholders have invested in the bank

The loan:deposit ratio is important when analysing a bank. It is derived by dividing customer lending by customer deposits. If the ratio is higher than 100%, the bank’s loan book is bigger than its deposit base. If the ratio is lower than 100%, the loan book is smaller than the customer deposit base. Banks with high ratios are more reliant on riskier wholesale funding.

What is equity and what is its purpose?

If a corporate borrower defaults on a loan, the bank will revalue the loan in line with recovery expectations. This is referred to as ‘recognising an impairment’ or ‘taking a write down’. The bank’s assets will fall in line with the size of the impairment. As the balance sheet must balance, the liabilities side has to fall by an equal amount.

But banks can’t reduce the value of customer deposits. Enter equity: the money shareholders have invested in the bank. While this is not strictly speaking a liability, equity sits on the liability side of the balance sheet. If a bank could liquidate all its assets and use the proceeds to repay all of its liabilities, the equity is what remains.

Shareholders’ equity is a shock absorber standing first in line to take losses when the bank suffers losses on the assets side of its balance sheet. It is called the capital buffer. The size of this capital buffer relative to the size of the asset book is dictated by regulations co-ordinated at a global level by an organisation called the Basel Committee on Banking Supervision, which has laid out standards, which are applied at a local level by national regulators. These regulations have evolved over time: the most recent iteration is referred to as Basel 4.

A complete representation of the balance principle is:

Assets = liabilities + equity

or

Assets - liabilities = equity

When a bank suffers loan losses, reductions on the assets side are counter-balanced by reductions in the equity cushion on the liabilities side. If a bank experiences losses to the point where equity is eaten up, the balance sheet would still have to balance but the onus to cover future losses to balance the balance sheet would fall on depositors. At that point, though, the bank will be at the point of non-viability.

Why do investors invest in bank equity?

Because returns on equity are typically significantly higher than what the bank pays on its liabilities.

Banks don’t pay interest to shareholders but shareholders benefit from a bank’s Net Interest Margin (NIM). This is the difference between the higher interest rate banks generate on their financial assets and the lower interest rate they pay on their liabilities. The NIM (minus the costs associated with running a bank) is paid out to shareholders in the form of dividends, or retained to generate more capital to support more customer business to generate more NIM to be paid out to shareholders in the future.

How can banks boost returns on equity?

Regulators prefer a bank’s equity to be as big as possible to provide as much protection to the bank’s depositors against asset-side losses in the event of an economic downturn, and maximise confidence in the banking system. Shareholders, by contrast, have a natural preference for equity to be as small as possible because a bank deploying half the equity capital compared to another bank generating the same NIM mathematically doubles the return on equity for its shareholders.

Other ways of increasing returns on equity include:

- Growing the balance sheet while keeping the equity base the same (i.e. creating more assets funded by more liabilities and driving a bigger NIM for a static amount of equity)

- Using advanced modelling to recalculate credit risk-weighting on the assets side of the balance sheet. A lower level of risk-weighted assets means a bank has to hold less equity

- Replacing equity capital with hybrid instruments (a mix of equity and debt). The interest costs of so-called Tier 1 and Tier 2 instruments that banks raise from investors in the wholesale debt markets are far lower than the cost of equity

What are the differences between equity and liabilities?

- Equity absorbs losses. A bank’s liabilities (under normal circumstances) absorb no losses

- Return profiles. A bank might generate a return on equity of 15% for its shareholders. The rate paid on deposits and wholesale funding might average 3%

- Shareholders own the bank. They appoint the board and set the strategy through Annual General Meetings. A bank’s chairman is accountable to shareholders; shareholders influence a bank’s management

- Repayment. Equity capital is permanent capital. A bank may choose to repay shareholders’ via share buybacks or dividends but it is never liable to repay equity. If shareholders want to end their investment, they have to sell their shares at the market price. All customer deposits and wholesale liabilities are repayable

How do banks maintain balance-sheet balance when customers withdraw deposits?

On the retail side:

- Cash is handed to the customer

- The current account balance is reduced by the amount of cash handed out

- The deposit is removed from the liabilities side of the bank’s balance sheet

- Physical cash holdings, which are recorded as an asset in the bank’s so-called liquidity reserve, are reduced by an equal amount

On the commercial side (for a large deposit of, say 1bn):

- Bank A instructs Bank B (with which the corporate customer also has an account) to credit 1bn to the customer’s account

- The customer account balance with Bank A is reduced by 1bn

- The 1bn liability is removed from Bank A’s balance sheet

- Bank A’s treasury department asks the central bank to debit its account by 1bn, and for that 1bn to be credited to Bank B’s account. Bank B’s balance sheet is automatically balanced: a new 1bn financial asset is recorded (an increase in its credit balance at the central bank) while a new liability has also been recorded (the 1bn credited to the customer’s bank account)

Define asset liquidity and its link to maturity transformation

Cash, central bank deposits and government bond holdings form a core part of a bank’s liquidity buffer. Banks hold a range of other assets such as gold, and equities and bonds issued by banks and corporates, which are also deemed to be liquid. Banks maintain liquidity buffers to see them through periods of profound stress. If, in a stress scenario, a substantial cohort of current account holders removes their balances, a bank liquidates its liquidity portfolio to meet withdrawals (i.e. reduces the asset side of the balance sheet to keep the balance sheet balanced).

If withdrawals exceed liquidity buffers, banks then have to liquidate customer assets to continue to balance the balance sheet. But customer assets (such as mortgages) are not liquid. The typical legal maturity of mortgages is 25 years. Most customer assets on a bank’s balance sheet are illiquid. Illiquidity stems from what is known as maturity transformation: banks borrowing money from customers in a format that is repayable on demand but lending the money to customers where they can only demand payment in the future.

Maturity transformation is critical. If a bank is unable to carry out maturity transformation, no customer would want to borrow money from it, so rather than generating customer assets by lending into the real economy, that bank would be restricted to buying highly-liquid market securities such as government bonds, which have a much lower yield than customer assets. A deposit at the central bank yields even less, and cash held in the tills yields absolutely nothing. So a bank that only owns liquid assets generates no NIM for shareholders.

Returns on the liquidity buffer are lower than a bank’s average borrowing cost, so having a large liquidity buffer depletes the NIM. By extension, a large liquidity buffer drives a lower return on equity for shareholders. Shareholders want to minimise the size of the unprofitable liquidity buffer and deploy their funds to gather profitable customer assets via maturity transformation instead.

Bank regulators, on the other hand, are focused on maximising the size of liquidity buffers, or at least making sure these are big enough to cover those extreme stress scenarios. No bank has a liquidity buffer big enough to cover the most extreme and enduring stress possible; liquidity buffers buy time for a bank’s management and regulators to take the actions necessary to stem deposit flight or create new sources of funding support to replace fleeing depositors.

Bank regulation has historically focused on the adequacy of a bank’s equity capital base to meet the potential for losses arising from the bank’s customer asset book. The Basel 3 regulatory standard contained a substantial book of directives around liquidity and funding risk, introducing a Liquidity Coverage Ratio (LCR) and a Net Stable Funding Ratio (NSFR). The LCR makes sure banks have enough high-quality assets in their liquidity buffer to get them through an extreme stress event for 30 days. The NSFR limits the amount of maturity transformation banks can conduct.

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

Robert Ellison

There are no available Videos from "Robert Ellison"