What is a Greenshoe Option?

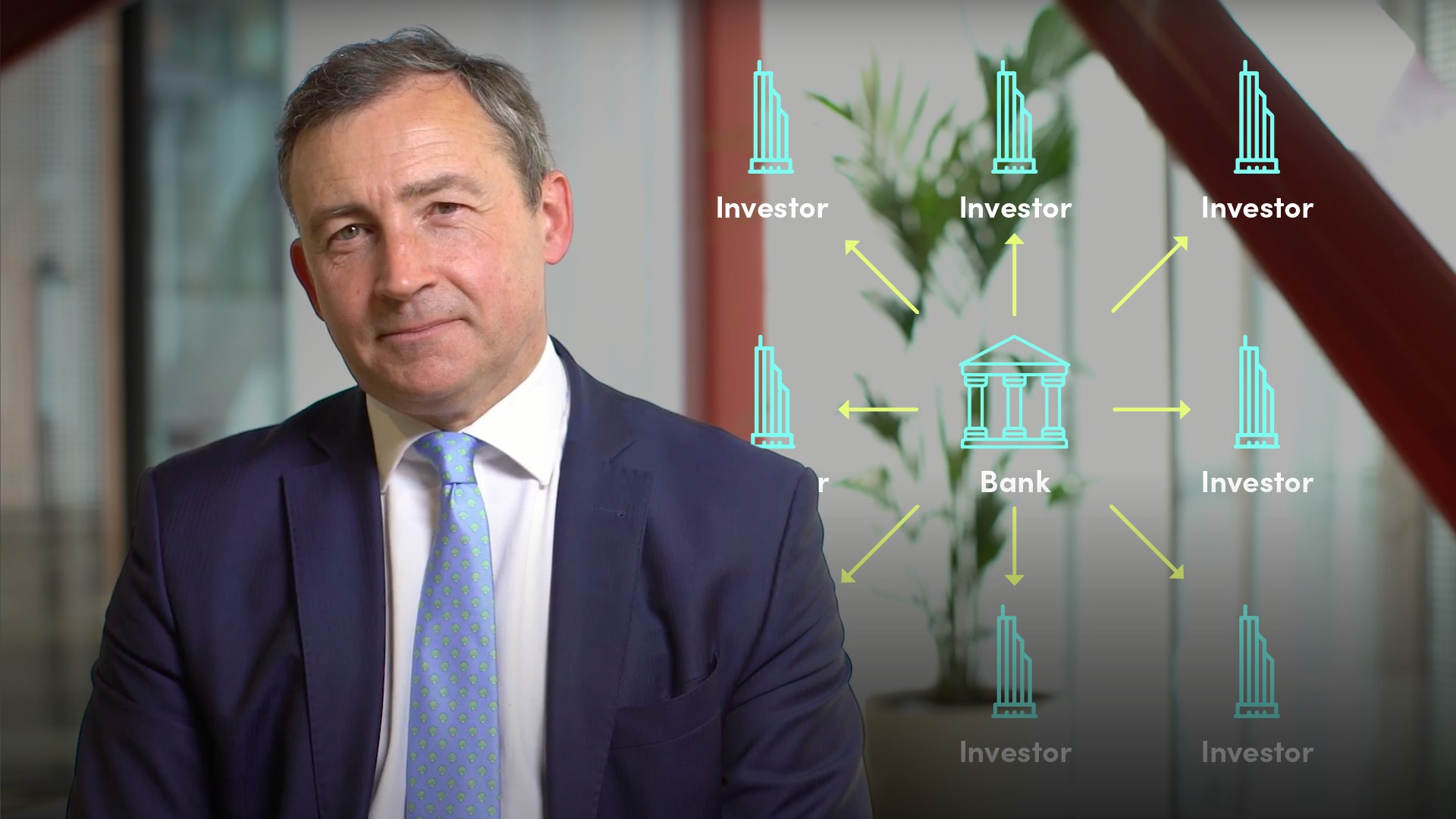

Tim Skeet

35 years: Debt capital markets

During an IPO, greenshoe options give underwriters the facility to acquire more shares to try and stabilise the stock price after initial trading. Tim explains the details around how these work and why they are necessary.

During an IPO, greenshoe options give underwriters the facility to acquire more shares to try and stabilise the stock price after initial trading. Tim explains the details around how these work and why they are necessary.

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

What is a Greenshoe Option?

4 mins 28 secs

Key learning objectives:

Define a greenshoe option

Explain how a greenshoe option works

Describe an event when a greenshoe option is necessary

Overview:

A greenshoe option is a mechanism specified in a prospectus or offering document during an initial public offering. The purpose is to ensure that a broker-dealer can stabilise the stock price by purchasing additional shares from the issuer in the event the price of over-alloted shares go up.

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

What is a Greenshoe Option?

A greenshoe option is a mechanism used in initial public offerings (IPOs), and other equity capital raisings, that enables a broker-dealer to try and stabilise the stock price after a deal starts trading. It is, in effect, an over-allotment option. In other words, it gives underwriters the facility to acquire more shares from the issuing company or from a shareholder if needed.

Why is it called a Greenshoe Option?

It is named after the Green Shoe Manufacturing Co, which completed its IPO and became a public company in the US in 1960. Green Shoe Manufacturing, so the story goes, was the first company to go public using an over-allotment option.

How does a Greenshoe Option work?

In equity capital market offerings, the size of the greenshoe is capped at 15% of the overall deal size and is available to underwriters for 30 days from the day an offering is priced.

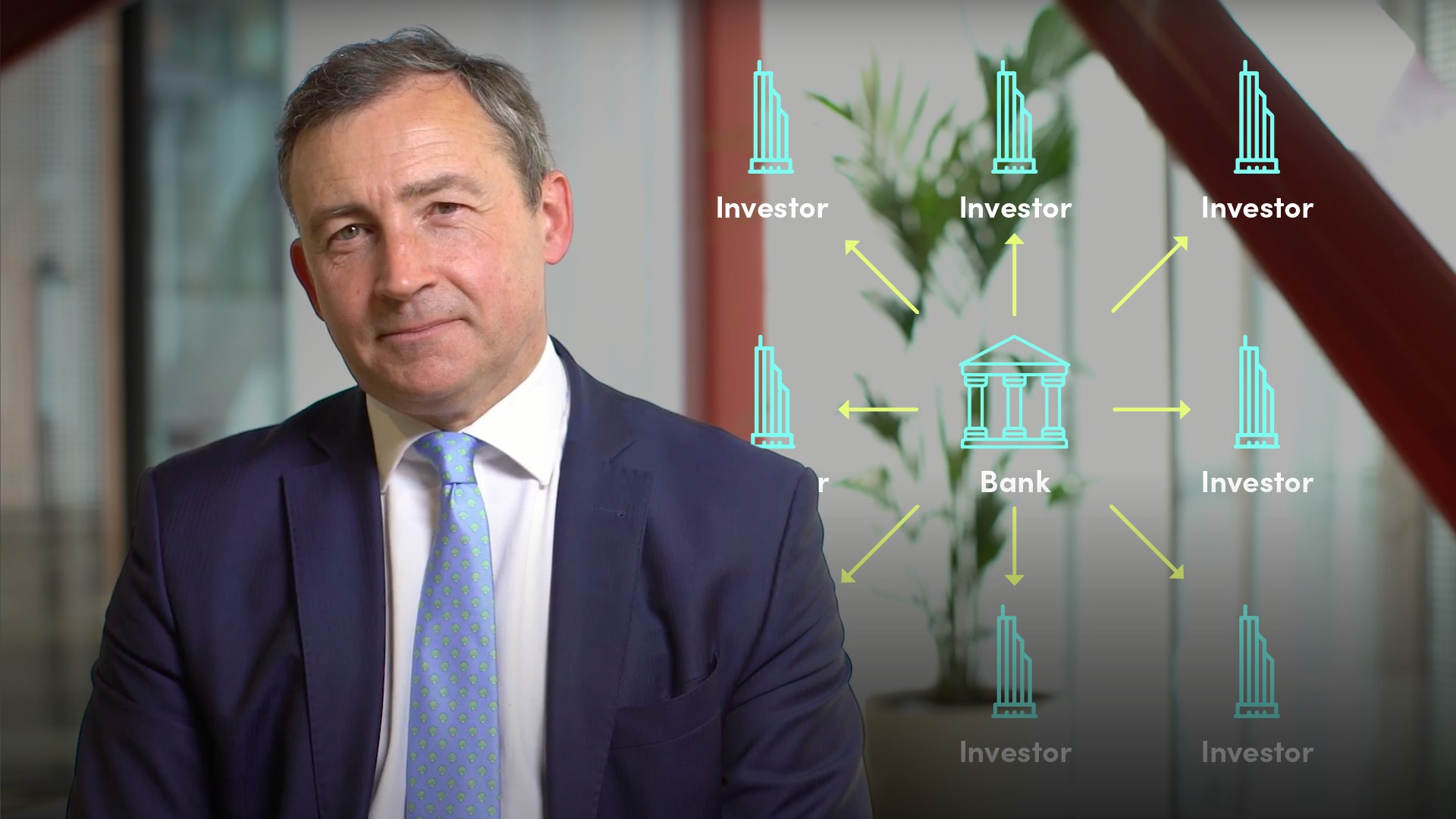

In an equity capital markets transaction, one of the broker-dealers in an underwriting syndicate will be pre-appointed to the role of stabilisation agent, operating on behalf of the entire syndicate. As standard practice, underwriters will over-allot shares as a deal management tactic. This means they allocate to investors more shares than are actually available in the transaction. By doing so, they are setting up a short position in the stock.

When is a Greenshoe Option necessary?

If the price of an offering declines in the aftermarket, the stabilisation agent can buy shares back from the market, thereby creating demand and helping bring supply and demand back into balance. This purchasing operation will be capped at the number of shares that have been over-allotted.

If however, the price goes up, the broker will exercise the greenshoe option with the company or selling shareholders in order to cover its short position, again in an attempt to bring supply and demand back into balance and provide price stability. At the point at which the greenshoe option is formally exercised, the additional shares allocated will be added to the initially-advertised number of shares, and that will be reflected in the total size of the offering.

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

Tim Skeet

There are no available Videos from "Tim Skeet"