What is Banking Resolution?

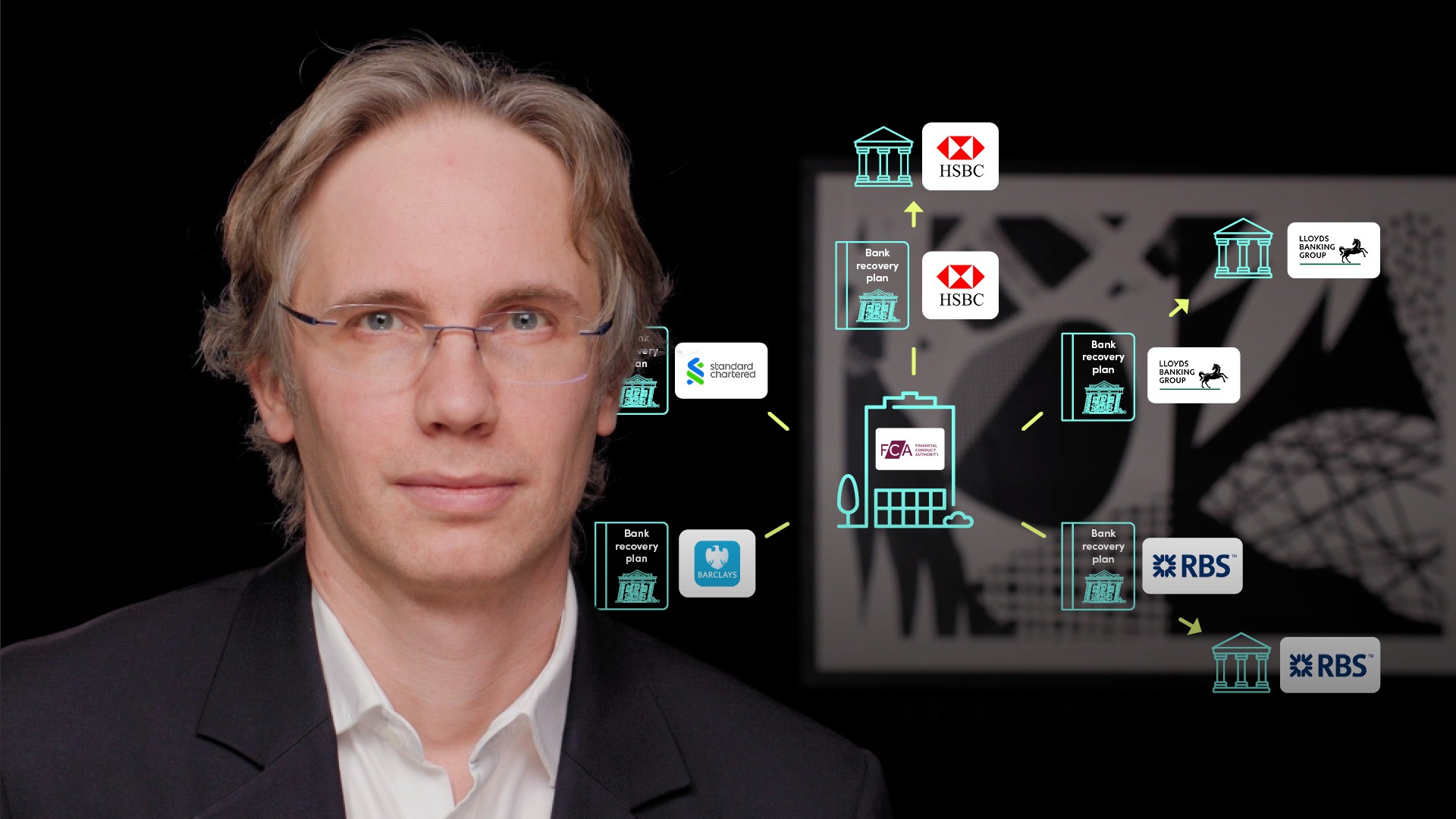

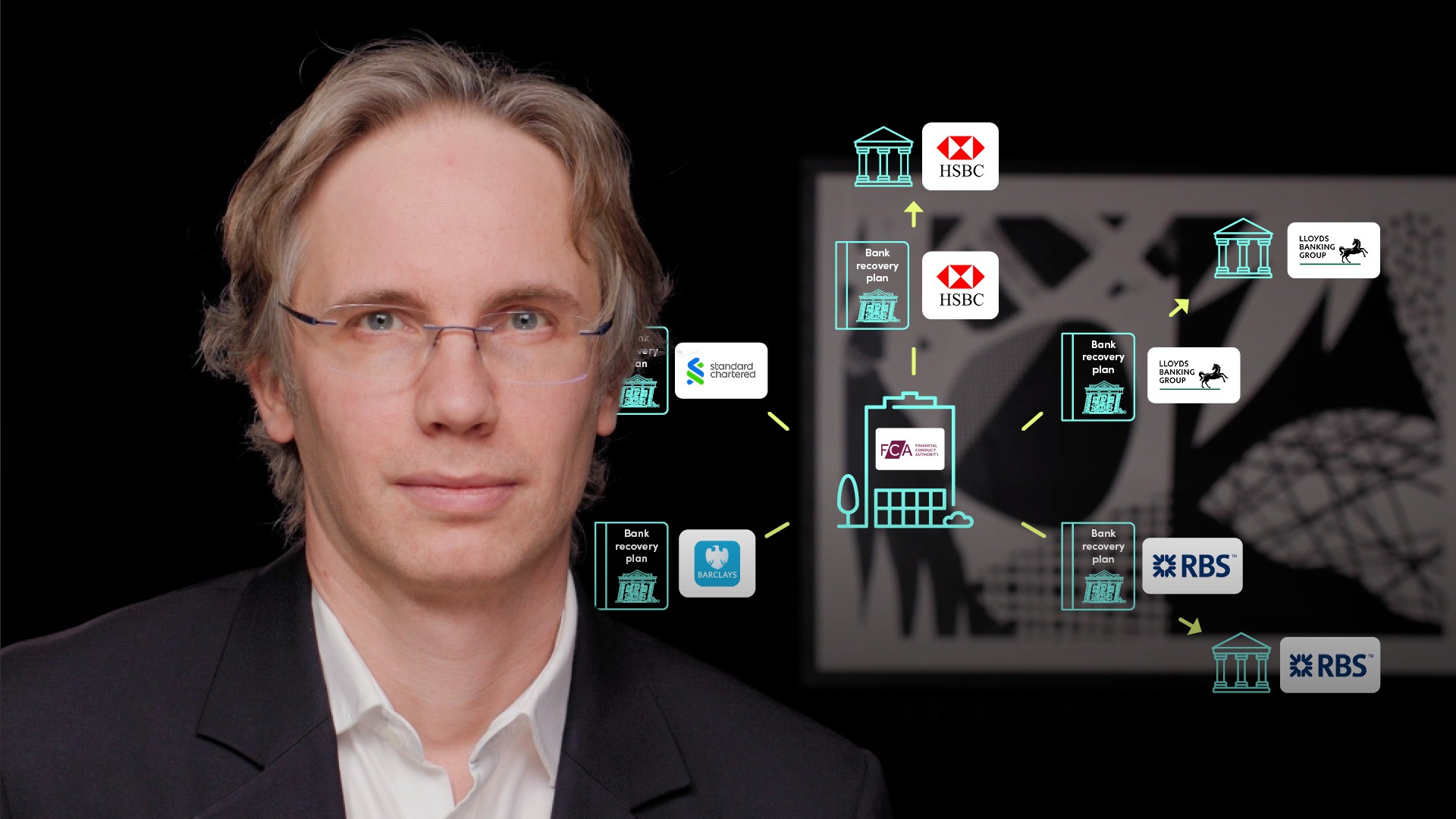

Gilles Renaudiere

Corporate Advisor: BNP Paribas

In the previous video, Gilles outlined recovery, i.e. the stage where a bank is still a going concern and attempts to bring itself back to health. In this video he explains the next stage if recovery fails, resolution.

In the previous video, Gilles outlined recovery, i.e. the stage where a bank is still a going concern and attempts to bring itself back to health. In this video he explains the next stage if recovery fails, resolution.

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

What is Banking Resolution?

6 mins 24 secs

Key learning objectives:

Understand the Resolution stage of Recovery and Resolution

Identify some real-world examples of Recovery and Resolution being implemented

Overview:

New rules implemented following the financial crisis of 2008 laid out standardised tools and powers for national authorities to deal with failing banks, with the intention of minimising the negative impact of bank failures on taxpayers, without jeopardising the financial system as a whole. The first stage is Recovery, with the intention of bringing a failing bank back to health, if this doesn’t work, the next stage is Resolution. Resolution is where a bank is failing or likely to fail and there is no prospect of recovery. In this scenario, the resolution authority will, if it is in the public interest, step in and take control of the bank in a safe and controlled manner with the intention of protecting financial stability.

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

What is bank Resolution?

If a bank has taken all possible actions to bring it back to health and still finds itself in distress the national authority will step in and take control of the bank in a way that protects consumers and the financial markets. A systemic bank cannot be put into administration, as too many market participants rely on them, they require an orderly wind-down or restructuring. This is known as resolution.

Resolution plans are designed by the national resolution authority for each individual financial institution and are reviewed and updated frequently. The goal of a resolution plan is to outline key functions at a bank, identify and address any impediments to a bank's resolvability and to prepare for resolution. The plan will outline the preferred resolution strategy for a bank and the resolution tools that should be used in the event of its failure.

Resolution authorities can only take resolution action if the following conditions are met:

- The determination that the bank is failing or is likely to fail has been made by the competent authority, after consulting the resolution authority

- There is no reasonable prospect that any alternative private sector measures would prevent the failure of the bank within a reasonable timeframe

- A resolution action is necessary in the public interest

Resolution authorities have several ‘resolution tools’ at their disposal, those being:

- The sale of business tool: Assets of the failing bank are sold to another bank.

- The bridge institution tool: Assets of the failing bank are transferred to a bridge bank until a new buyer is found

- The asset separation tool: Assets of the failing bank are transferred to a purpose built asset management vehicle owned by public authorities, with the intention of not flooding the market with those assets

- The bail-in tool: Allows the authorities to write-down or convert certain liabilities into equity, forcing losses on creditors.

The resolution method undertaken will depend on the individual bank, i.e. its size and complexity, and the resolution plan that has been prepared for it.

Where has Recovery and Resolution been used in the real world?

Banco Popular Español (2017): All existing stocks, AT1 and T2 instruments written down, and the bank was sold to Banco Santander for €1.

Banca Popolare di Vicenza and Veneto Banca (2017): Declared likely to fail by the ECB. Single Resolution Board concluded that resolution was not in the public interest, so authorities wound up the banks. Certain assets and liabilities of the banks were sold to Banca Intesa for €1.

Banco Espirito Santo (2014): Went through the resolution process and resulted in the creation of a ‘good bank’, Novo Banco, to which all of the good assets were transferred.

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

Gilles Renaudiere

There are no available Videos from "Gilles Renaudiere"