What is Cross-default?

Tim Skeet

35 years: Debt capital markets

Cross-default is a common clause in borrowing documentation that allows creditors to demand repayment if it defaults on one of its obligations. Join Tim in this video where he takes us through this concept in more detail.

Cross-default is a common clause in borrowing documentation that allows creditors to demand repayment if it defaults on one of its obligations. Join Tim in this video where he takes us through this concept in more detail.

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

What is Cross-default?

3 mins 16 secs

Key learning objectives:

Define cross-default

Explain the purpose of a cross-default clause

Explain when a company can be declared to be in technical default

Overview:

A cross-default clause in a borrowing document ensures that all creditors are allowed to demand repayment if the borrower formally defaults on one of its borrowings.

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

What is cross-default?

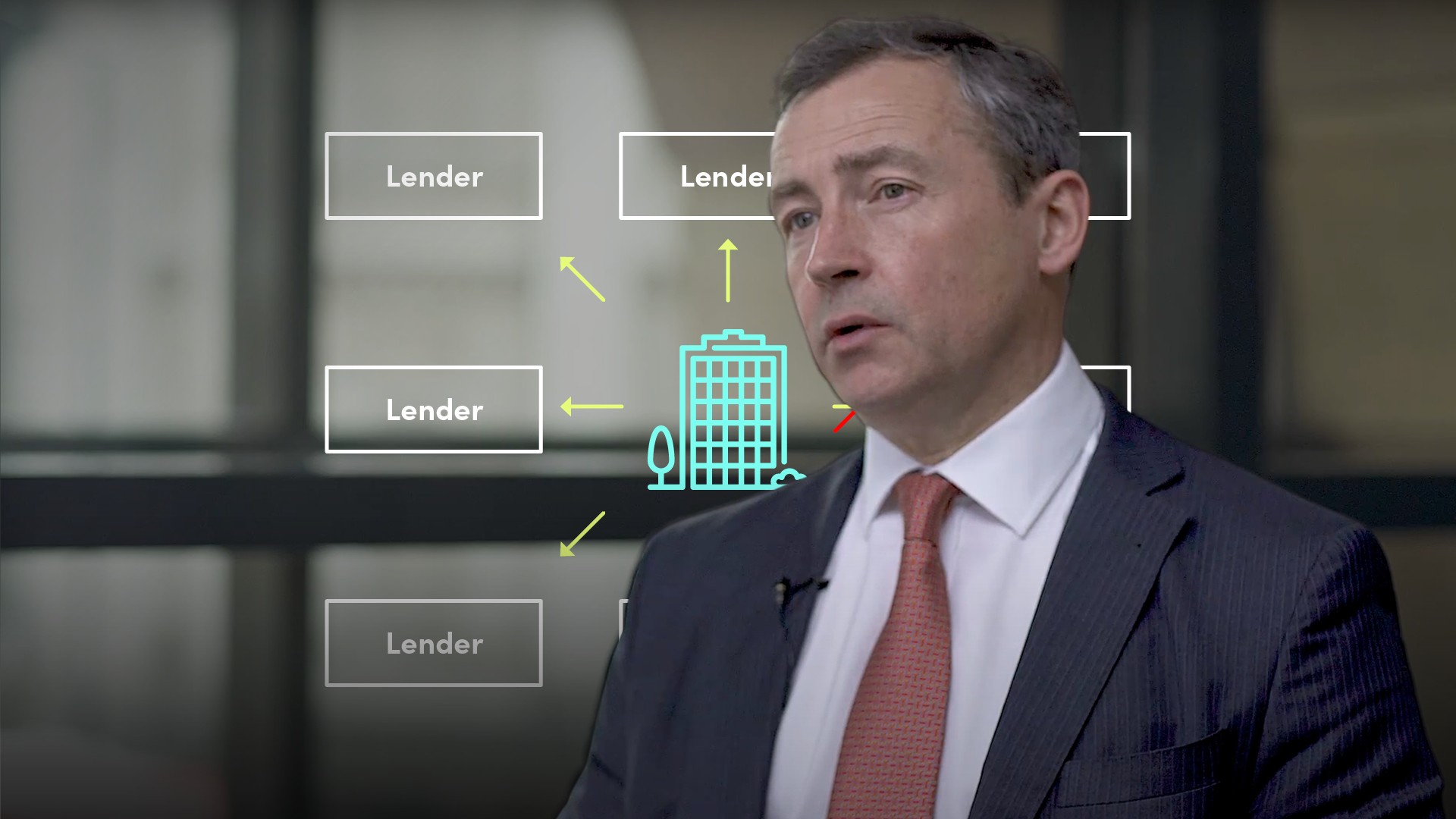

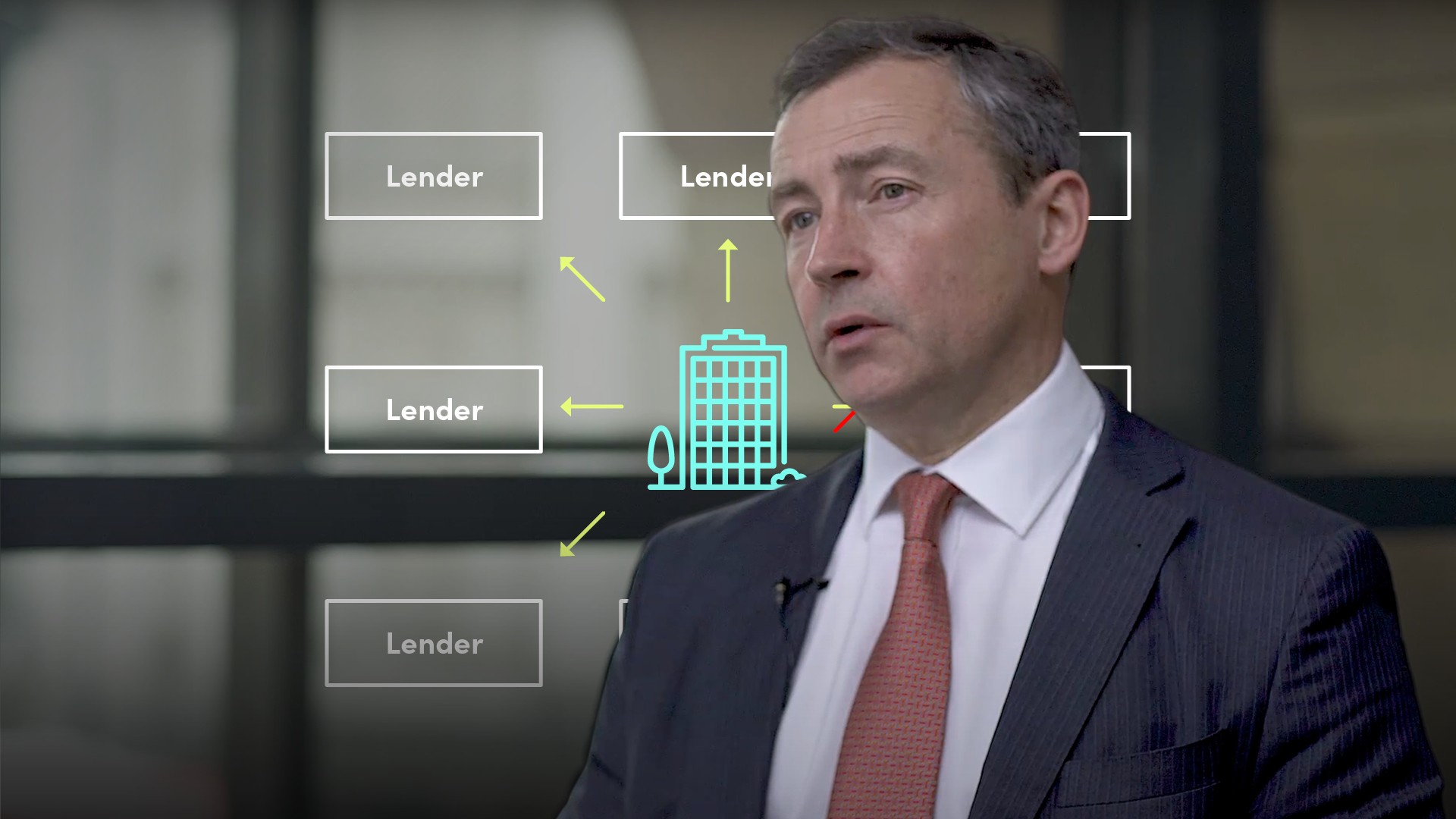

A cross-default clause is a standard clause in borrowing documents. It ensures that if a borrower formally defaults on a specific borrowing, all other borrowings with cross-default language are automatically declared in default as well. Cross-default is ubiquitous in loan documentation; proportionally less so but still very common in bond documentation.

What is the purpose of cross-default?

Cross-default ensures that creditors are not unduly singled out for default when other creditors are excluded from default. It also prevents borrowers from offering priority treatment to specific lenders or investors to the detriment of others.

When is a company declared to be in default?

A company can be declared in technical default if it breaches the terms of any of its negative or positive covenants. Many covenants are expressed in the form of ratios. For example, if a company’s interest bill exceeds a certain multiple of its earnings, it might be in breach of covenants, in which case default may be declared and cross-default invoked.

Default does not just happen in the extreme scenario of a company not having the money to pay its interest or repay its principal. In many cases, failure to pay principal or interest within 30 days of a relevant due date might constitute an event of default and give lenders and bondholders the right to demand immediate repayment.

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

Tim Skeet

There are no available Videos from "Tim Skeet"