Valuing and Investing in Equity

James Eves

30 years: Equity capital markets

In this second part of James's video on "What is Equity?", he continues to demystify equity-related concepts by explaining how the value of a share is determined and who the market participants are.

In this second part of James's video on "What is Equity?", he continues to demystify equity-related concepts by explaining how the value of a share is determined and who the market participants are.

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

Valuing and Investing in Equity

7 mins 37 secs

Key learning objectives:

Understand how shares are valued

Outline the fundamental analysis undertaken by investors

Describe active and passive investing

Overview:

A shares valuation is typically based on the future cash flows and profitability of a firm. Investors are interested because hopefully they can profit from judging companies that are undervalued. They can also sell or ‘short’ shares that they believe are overvalued.

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

What is valuing shares?

Valuing shares is the starting point for calculating the theoretical values of companies. A share’s valuation fundamentally is based on the future cash flows and profitability of a company.What fundamental analysis is undertaken by investors?

- Discounted Cash Flow (DCF) Method

- This method forecasts the future profits that you are expecting from a company and discounts them to derive a net present value. A key input for DCF is the discount rate, which includes risk premiums for holding equity versus other assets like government bonds.

- Price to Earnings (PE) Ratio

- This particularly helpful when considering a company’s relative share value. PE Ratio = Share price / Forecast Earnings per share. The higher the PE ratio, the greater you expect the growth of the future earnings of the company to be.

- Price Earnings to Growth (PEG) Ratio

- PEG ratio = Forecast PE ratio / Expected Earnings growth rate. Hence, a high PE should have a high growth rate. In this way, you can consider it valuation relative to growth.

- Supply and Demand Analysis

- For instance, if a company has recently listed and has some larger founding shareholders, you might expect more supply to come to the market as they monetise or cash in some of their shares.

What are the pros and cons of “being public”?

- Pros - When companies are listed publicly, this brings liquidity and transparency to shares

- Cons - It also brings additional regulations, and sometimes too much of a focus on short-term results, rather than being able to make long term investments. As a result, some notable companies that were listed have gone back to being private i.e. Heinz and Hilton

Who are the different parties involved in an IPO?

- A company would usually look to appoint an investment bank to first help organise the process and offer the shares. The investment bank will help prepare the listing prospectus required by regulators and organise investor meetings, finally taking orders for the new shares and finding a clearing price at which the shares are initially listed.

- It is also common for the sellers to appoint IPO advisors. They bring extensive independent experience to help with maximising investor engagement and demand.

- The majority of shares are held by large institutional investors - such as pension funds, hedge funds or asset management companies

- Once the shares are listed, they are typically traded through stock brokers who buy and sell shares, for institutional or retail investors

- Hundreds of different funds holding shares are managed by fund or portfolio managers

What is active and passive investing?

- Active Investing - Managers and funds looked to generate returns through picking shares that they expected to outperform peers or which they believed were undervalued.

- Passive Investing - The investment strategy is not to try and pick shares, but to match the performance of a particular group or index.

What are the benefits of passive investments?

- Low fees

- Low costs

- Will never beat the market

What are some of the properties of active fund managers?

- Pick particular shares or strategies

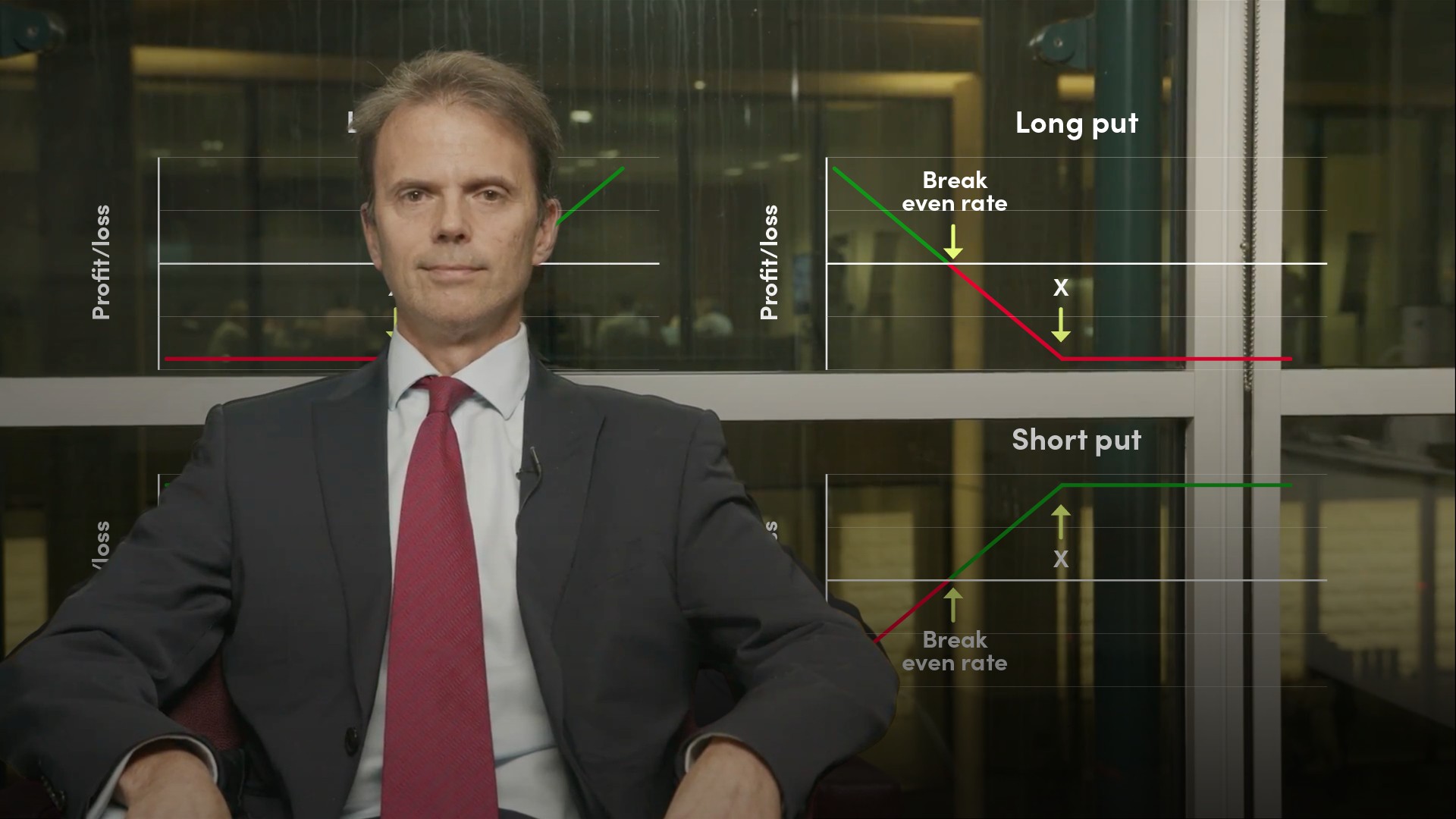

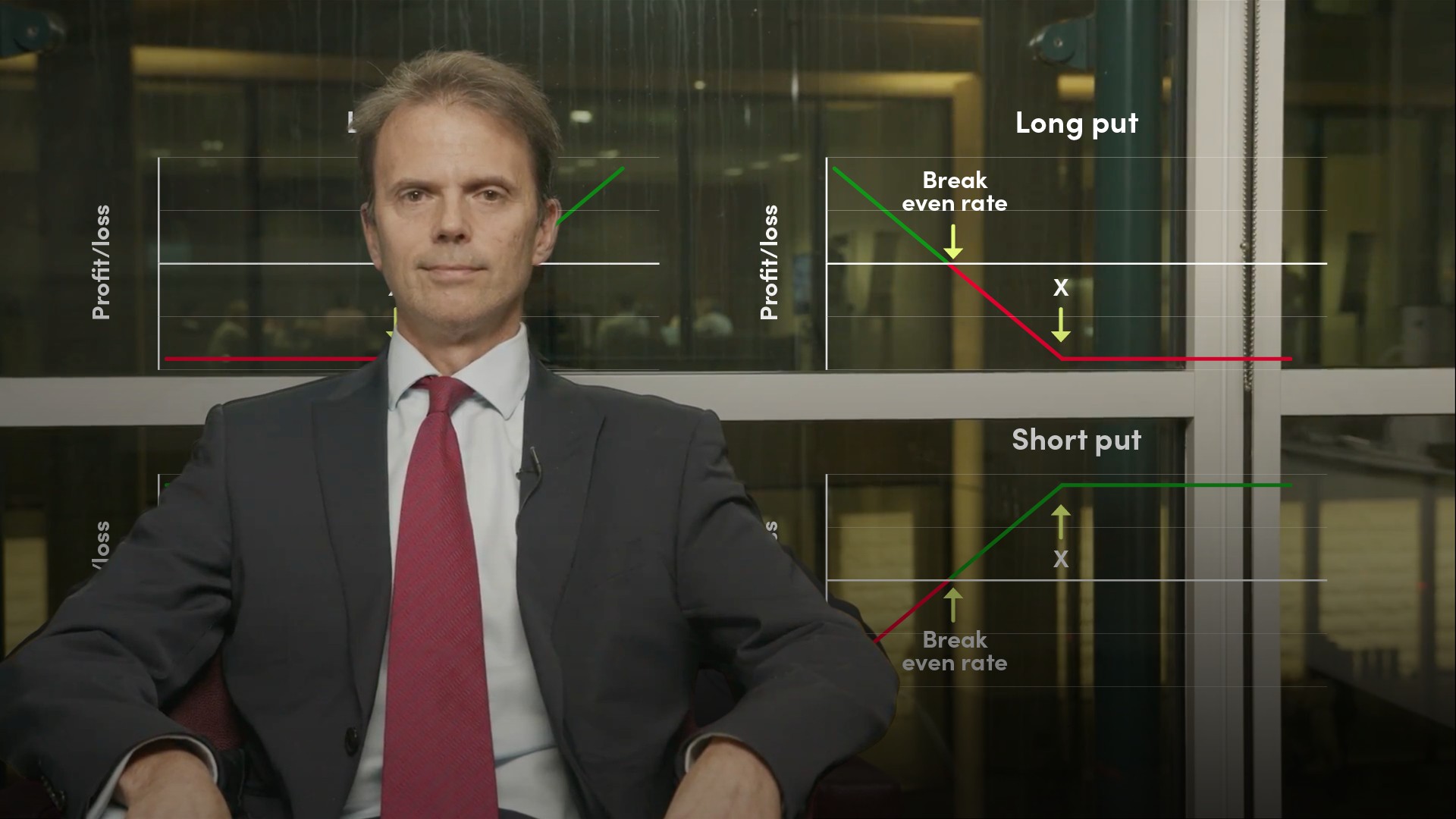

- Go short or buy derivatives like call options or puts to change their investment profiles

- More expensive to run

- Can underperform a market significantly. However, of course good funds or managers can also significantly outperform the market

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

James Eves

There are no available Videos from "James Eves"