What is Securitisation?

Francesco Dissera

25 years: Securitisation

In this video, Francesco provides us with some background on what securitisation is and also introduces us to the problem that securitisation is trying to solve, explaining why issuers and investors might enter into a securitisation arrangement, and finally, how it actually works in practice.

In this video, Francesco provides us with some background on what securitisation is and also introduces us to the problem that securitisation is trying to solve, explaining why issuers and investors might enter into a securitisation arrangement, and finally, how it actually works in practice.

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

What is Securitisation?

16 mins 7 secs

Key learning objectives:

Define securitisation

Understand the basic mechanics of securitisation

Define SPVs and outline how they facilitate operations

Overview:

Securitisation is the process of creating a security, in the form of either a bond or a loan, that gives the owner the right to receive some cash, in a form that is tradeable (in a form that allows someone to sell it or acquire it).

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

What are the different definitions of securitisation?

- A process where assets or receivables are packaged, or pooled, and then divided into slices -- or tranches -- and sold to investors, typically via stand-alone special purpose vehicles, SPVs, also known as SPE or special purpose entities. These vehicles are bankruptcy remote from the originators of the receivables.

- The risk transformation of a pool of credit assets into securities with different risk categories, and ideally more appealing to investors, as a whole.

How does the securitisation definition differ in the European Union?

Securitisation is defined under EU Regulation 2017/2401 and 2402.

- It involves the financing of assets that carry credit risk

- It involves the issuance of tranched debt

- Investor exposure is only to the assets in the underlying pool during the life of the deal

Who are the main participants of the securitisation market?

Today, securitisation is widely used by: Regulated financial institutions, Alternative lenders, Asset managers (CLO managers), Private Equity and hedge funds, Corporates, Government and government agencies.

What assets are typically securitised?

- Financial Assets: This includes mortgages, commercial and personal loans, auto loans and leases, credit cards, SME and corporate loans, speciality financing

- Corporate Assets and Receivables: Including trade receivables, long term contracts and whole loan securitisation

- Government Receivables: Mainly performing and non-performing receivables held by government bad banks, Real assets, and royalties

What are the different dynamics of ABS Issuance in Europe?

Of the non-retained European deals, CLOs dominated the market in 2020, with $22bn equivalent). This was followed by Auto loans ($17.6bn equivalent) and then RMBS. RMBS was further split into prime RMBS, non-conforming RMBS and buy to let, at $10.7bn, $6.5nn and $6.15bn respectively.

What are the basic mechanics of securitisation?

- The starting point is a company or group of individuals who have contractual liabilities on which they need to make regular payments

- That lender might want to receive that money earlier, say today

- For investors, they need a long dated stream of cash flows to match their long-dated commitments to pay pensions or insurance claims in the future

What does the lender do?

- Moves the assets off its balance sheet

- From a technical perspective, this means it earns regulatory capital relief

- From a business perspective, having offloaded a chunk of assets means it can get on with other business

What are SPVs/SPEs?

Special Purpose Vehicles - These are orphan companies that are established exclusively to manage one or more transactions. The company will have directors, and will employ some third-party servicers to service the receivables. Also, SPVs are bankruptcy remote.

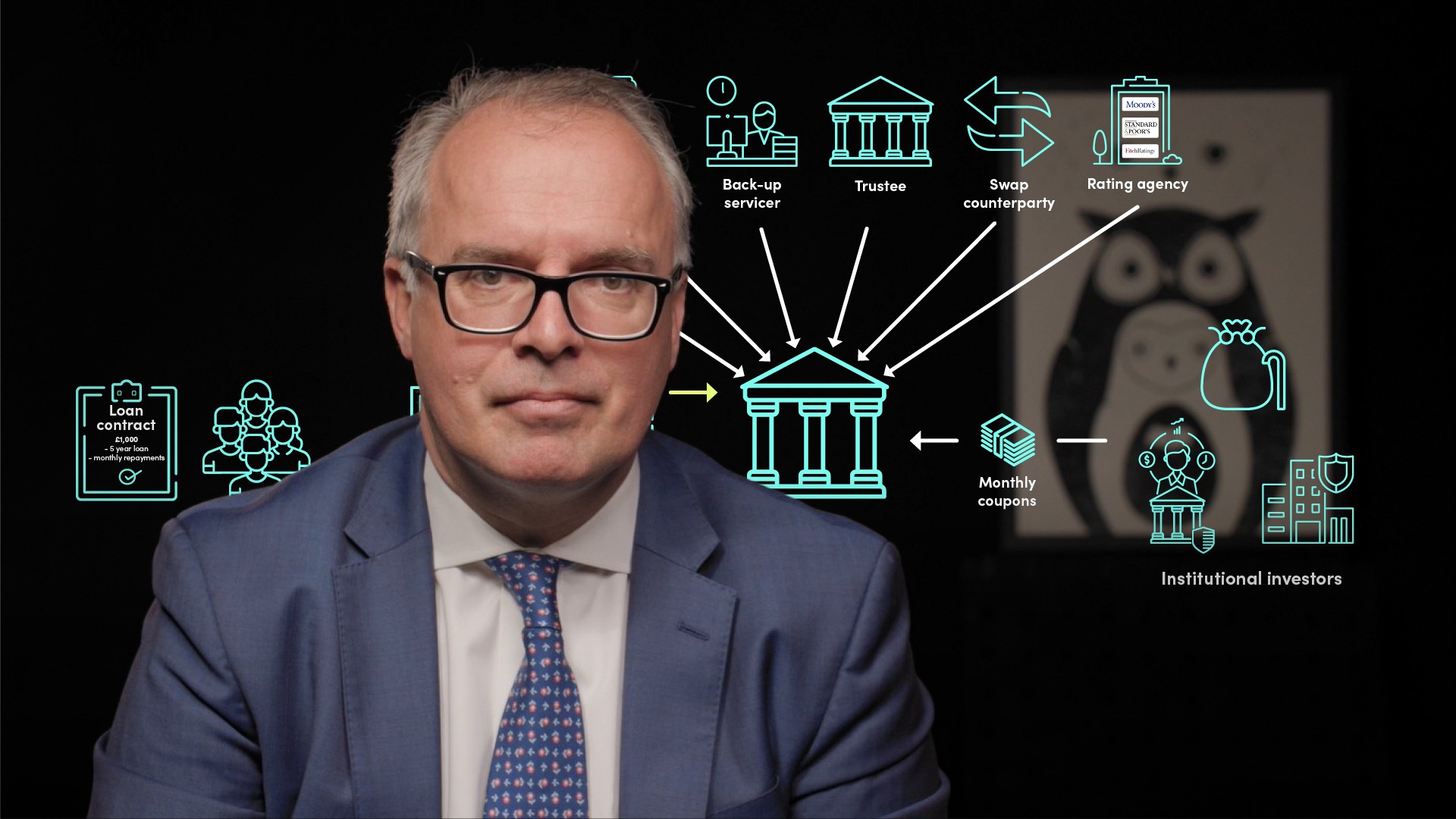

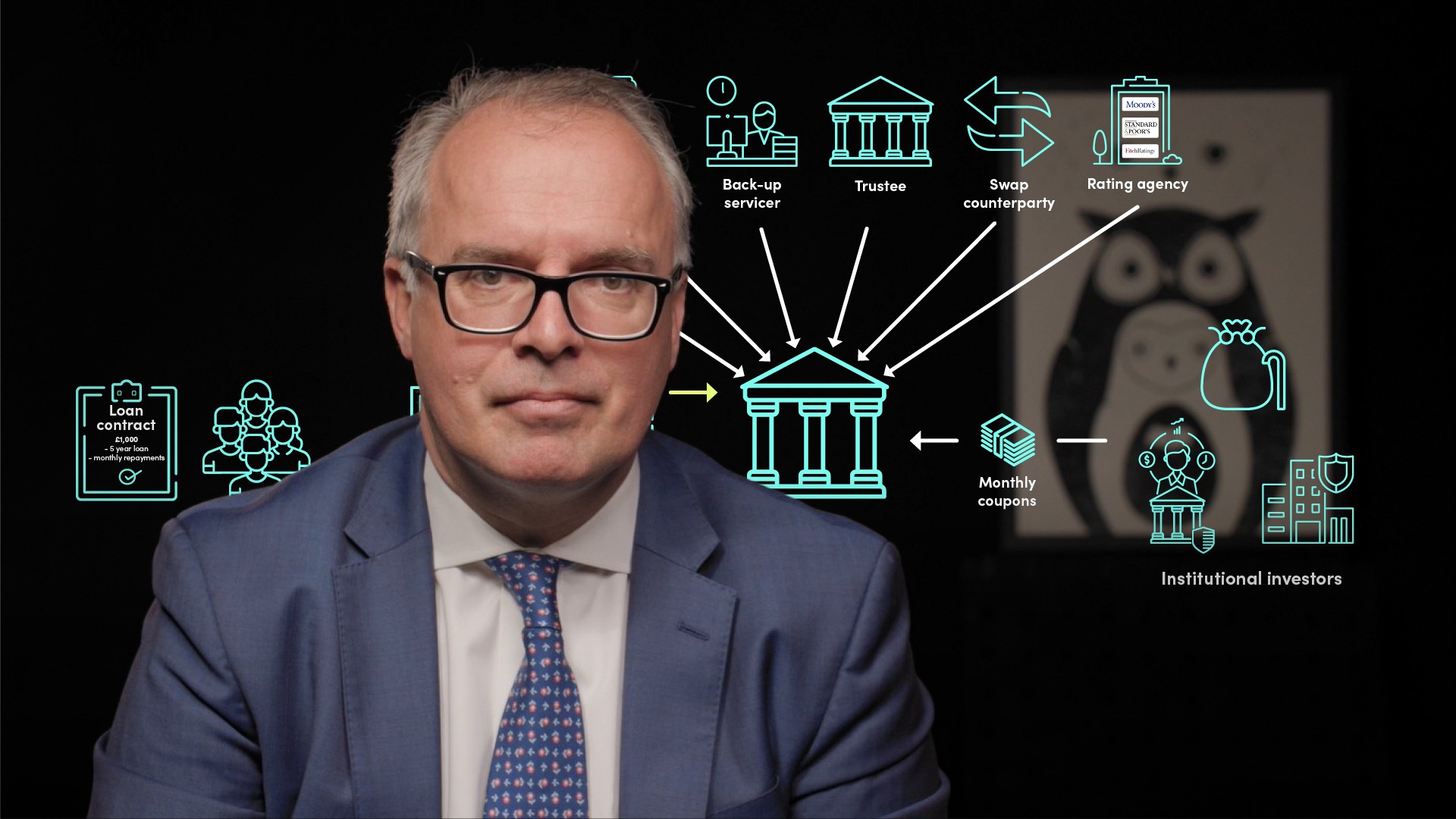

How do the SPVs facilitate operations?

On day one, this SPV buys the rights to receive the contractual payments on the underlying pool of assets. The SPV then collects the payments as they come in, typically via a third-party so-called servicer. They accumulate the cash flows and on a monthly or quarterly basis, they distribute cash flows to the investors, or noteholders according to the interest and repayment profile of the bonds.

Additional counterparties involved are the SPV’s banks, which will open bank accounts and manage payments. There are often other 3rd parties such as calculation agents or cash managers, who do the calculations, or a backup servicer. The structure also envisages the appointment of a trustee (or agent bank) that will represent the rights of noteholders.

What role do rating agencies play?

- The risk related to the securitised portfolio and

- The soundness of the transaction structure:

- They assign credit ratings to some of the tranches of notes sold. Ratings can be as high as Triple A for the most senior tranches.

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

Francesco Dissera

There are no available Videos from "Francesco Dissera"