What is Senior Debt?

Tim Skeet

35 years: Debt capital markets

At its simplest, debt is split into senior and subordinated segments. Senior debt will receive priority in getting repaid from any cash left over in the business. In this video, Tim provides an overview of the order of repayment within senior debt.

At its simplest, debt is split into senior and subordinated segments. Senior debt will receive priority in getting repaid from any cash left over in the business. In this video, Tim provides an overview of the order of repayment within senior debt.

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

What is Senior Debt?

3 mins 24 secs

Key learning objectives:

Define senior debt

Identify the different types of senior debt (secured and unsecured formats)

Explain why most debt is issued in senior unsecured debt

Overview:

Senior debt is when the debt of a corporate borrower is repaid first and thus has priority over unsecured debt if the company becomes insolvent. They will be repaid from any cash left over in the business and/or from the sale of assets.

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

When is the risk of default most prevalent?

For borrowers with very high credit ratings, the risk of default and liquidation is very much distant. However, for borrowers in the non-investment grade, the risk of default is greater.

Debt seniority will play a larger role in the default-risk analysis lenders use to assess the investment proposition.

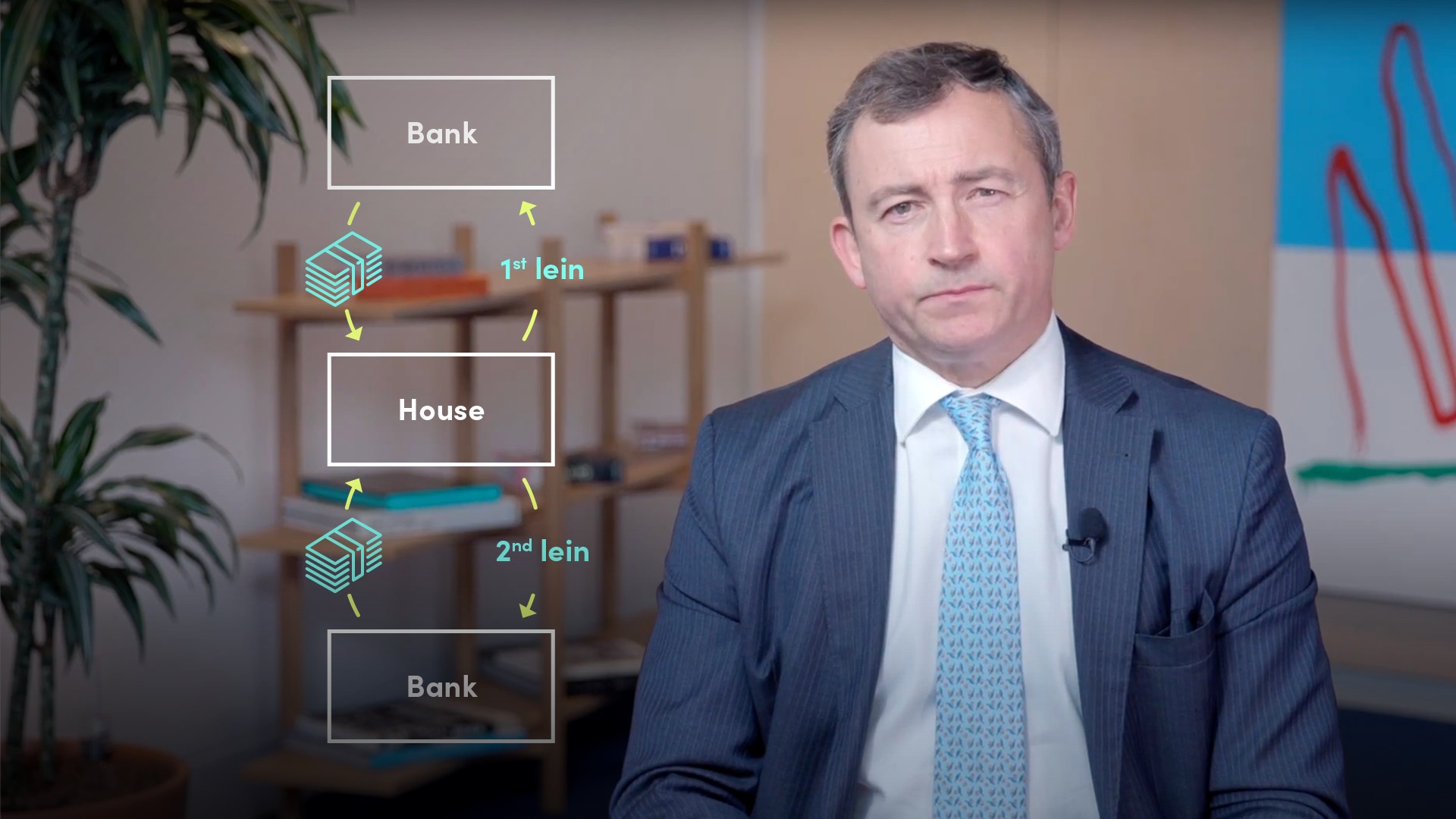

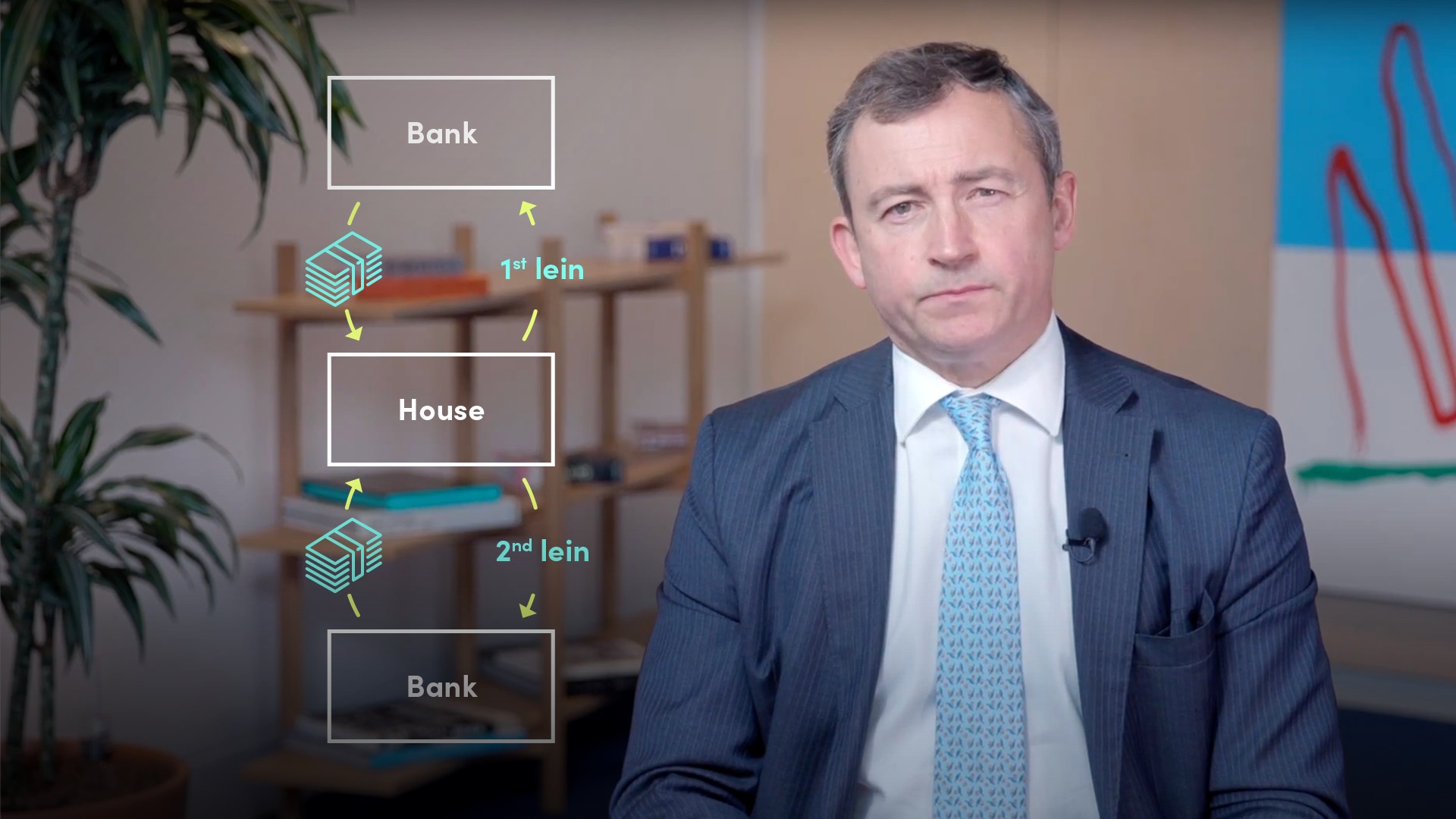

What are the different types of senior debt?

Senior secured formats – The debt of senior secured creditors is secured by collateral contractually pledged by the borrower. This is therefore considered safer and cheaper to use.

Senior unsecured debt – This type of debt is not secured by a specific type of asset.

Why is senior unsecured debt issued the most?

The reason is because banks and companies don’t like to or cannot encumber the assets side of the balance sheet by tying collateral to huge amounts of liabilities.

However, this is of great risk and investors tend to be wary of companies with heavily-encumbered balance sheets.

What is the repayment priority list?

The more senior secured debt is repaid first, and the creditors further down the repayment queue paid after. It is repaid in the following list:

- first-lien

- second-lien

- lower security

Why are second-lien facilities popular?

Second-lien tranches give private equity acquirers the option of adding a layer of more subordinated debt that boosts leverage. Also, they’re considered as an alternative funding option to high-yield bonds or mezzanine debt.

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

Tim Skeet

There are no available Videos from "Tim Skeet"