What is Subordinated Debt?

Tim Skeet

35 years: Debt capital markets

As the name suggests, junior or subordinated debt holders contractually stand below all forms of senior debt. In this short video, Tim explains the risks associated with investing in subordinated debt and the reasons why borrowers issue this type of debt.

As the name suggests, junior or subordinated debt holders contractually stand below all forms of senior debt. In this short video, Tim explains the risks associated with investing in subordinated debt and the reasons why borrowers issue this type of debt.

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

What is Subordinated Debt?

1 min 49 secs

Key learning objectives:

Define subordinated debt

Learn the risk factor of subordinated debt for investors

Understand why investors buy subordinated debt

Explain senior subordinated debt

Identify the benefits of issuing subordinated debt over equity

Overview:

Subordinated debt, sometimes called junior debt, is a layer of debt that is contractually subordinated to all forms of senior debt.

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

What is subordinated debt?

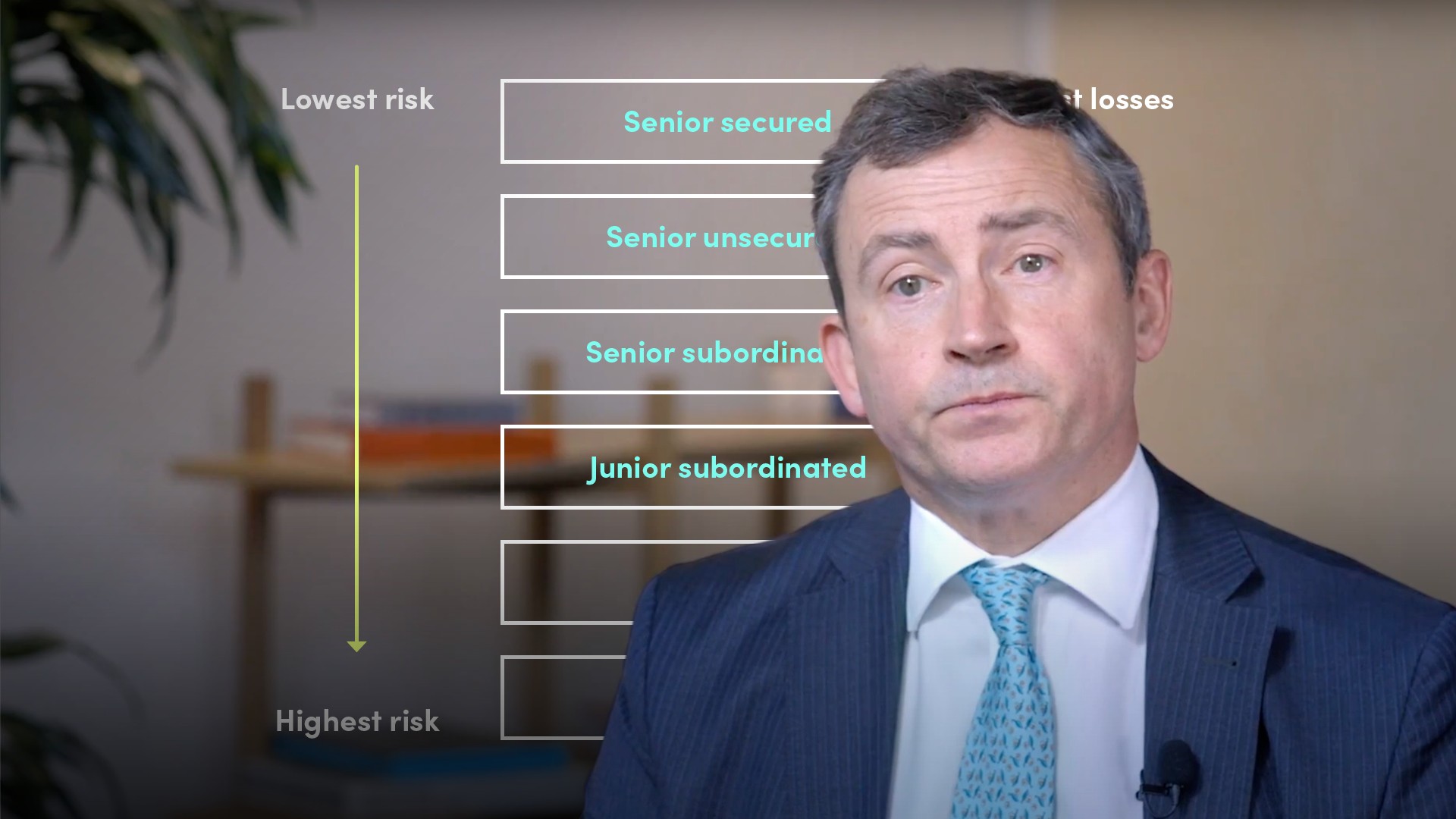

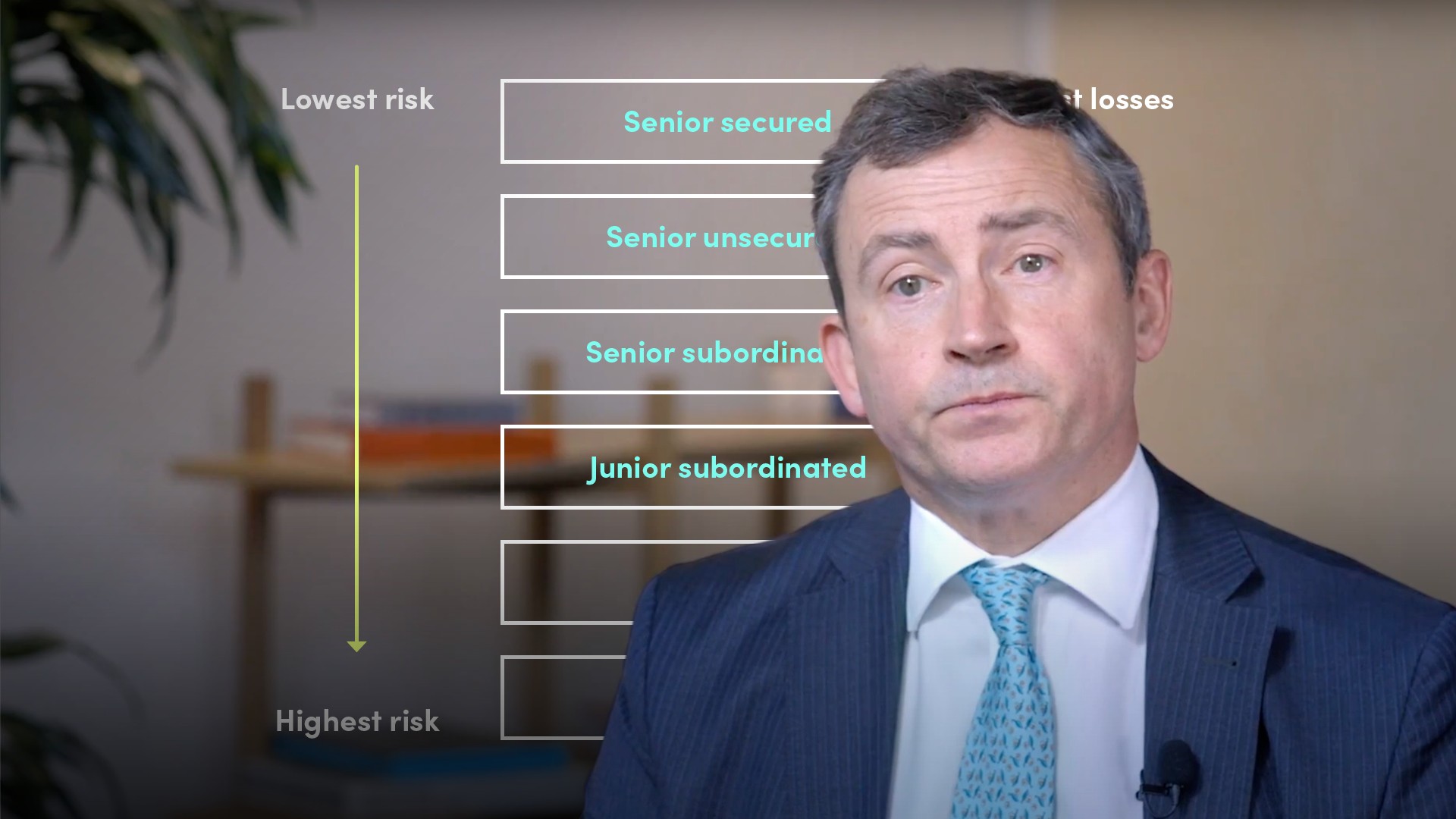

Subordinated debt, sometimes called junior debt, is a layer of debt that is contractually subordinated to all forms of senior debt.Why is subordinated debt risky for investors?

Junior or subordinated debt holders contractually stand below all forms of senior debt - but above shareholders - in the repayment queue. Subordinated creditors may not receive anything back in liquidation, so stand to be wiped out or receive just a fraction of their money back.Why do investors buy subordinated debt?

Returns to investors for holding subordinated debt are higher than returns they receive on senior debt, as borrowers compensate investors for the additional risk they have taken on relative to senior debt.What is senior subordinated debt?

Some companies’ subordinated credit lines contain specific contractual clauses (carve-outs) that rank them above the normal subordinated credit outstanding. This is referred to as senior subordinated debt. It is still subordinated as it ranks below senior unsecured debt.What are the benefits of issuing subordinated debt over equity?

Junior debt can be relatively expensive for borrowers to issue, but debt is cheaper to issue than equity. Companies benefit from issuing debt since interest payments are tax-deductible whereas dividend payments to shareholders are not.Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

Tim Skeet

There are no available Videos from "Tim Skeet"