Why Are Securities Borrowed and Loaned?

Richard Comotto

30 years: Money markets

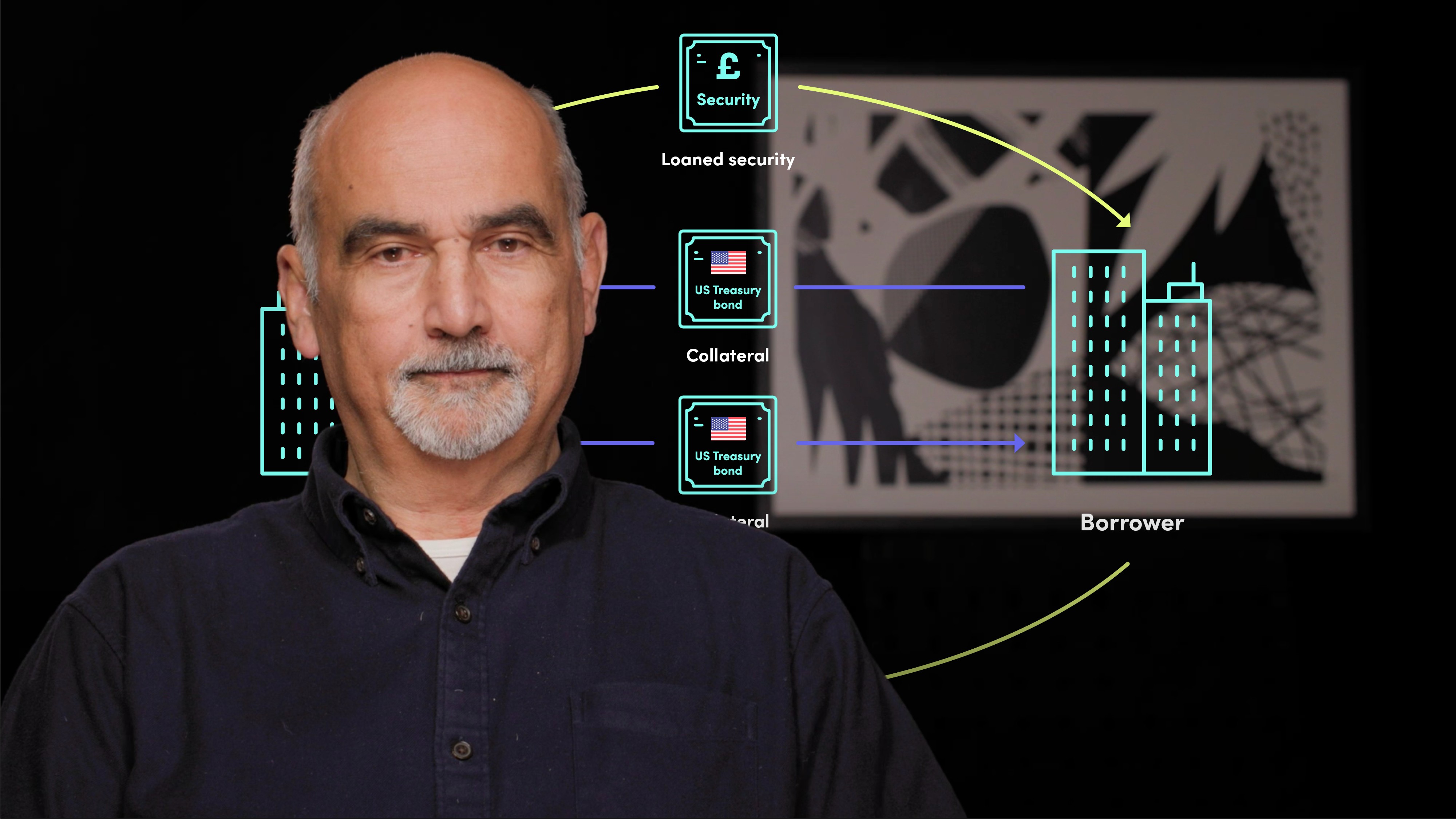

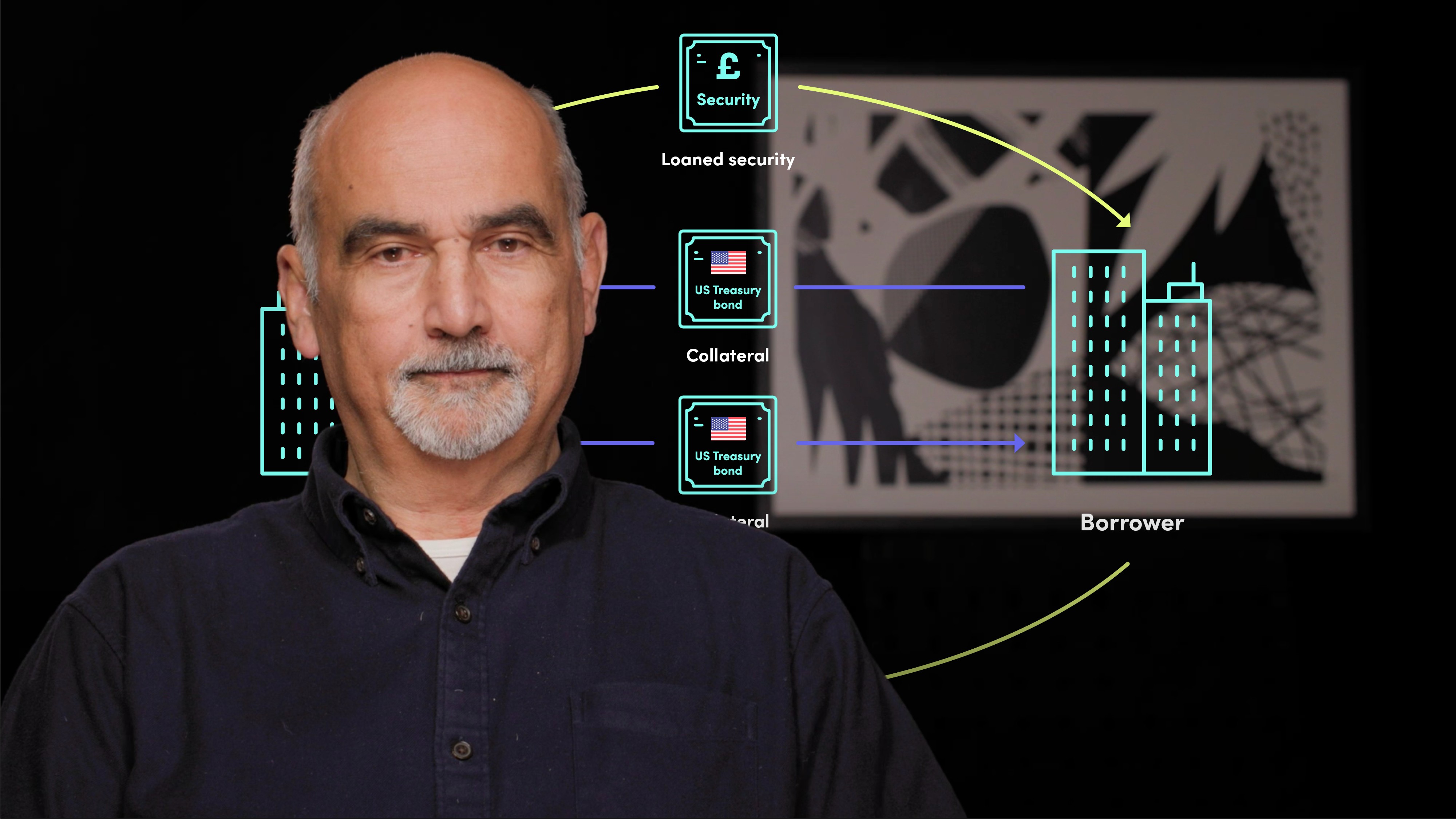

In securities lending, parties borrow securities for different reasons, including to sell them short, to cover unintentional short positions, to meet regulatory liquidity requirements, to exercise a corporate action, and to take advantage of tax inconsistencies. Approximately 50% of the securities loaned globally each year are equity, while the rest are fixed-income securities. Loanable securities can be divided into "specials" or "hot stocks" and "general Collateral" or GC. Specials or hot stocks have intrinsic value, while GC securities lack intrinsic value but can be used as a proxy for a larger group. Securities lending against cash collateral can also be used as a means of raising funding.

In securities lending, parties borrow securities for different reasons, including to sell them short, to cover unintentional short positions, to meet regulatory liquidity requirements, to exercise a corporate action, and to take advantage of tax inconsistencies. Approximately 50% of the securities loaned globally each year are equity, while the rest are fixed-income securities. Loanable securities can be divided into "specials" or "hot stocks" and "general Collateral" or GC. Specials or hot stocks have intrinsic value, while GC securities lack intrinsic value but can be used as a proxy for a larger group. Securities lending against cash collateral can also be used as a means of raising funding.

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

Why Are Securities Borrowed and Loaned?

14 mins 39 secs

Key learning objectives:

Understand why securities are borrowed and loaned

Outline the difference between commonly borrowed securities

Understand the concept of arbitrage within the securities lending market

Overview:

Securities are borrowed and loaned for various reasons, including covering short positions, holding securities for a certain period, and meeting regulatory liquidity requirements. Equities are more likely to be borrowed to cover short positions, while fixed-income securities are more likely to be borrowed to hold. Securities are divided into "specials" or "hot stocks" with intrinsic value and general collateral (GC) without intrinsic value. Specials offer yield enhancement while GC is used as a proxy for larger groups and to raise funding. Securities lending also supports arbitrages, such as convertible arbitrage, where a trader goes long on a convertible bond and short on the equity it is convertible into. This creates a profit by closing out the short equity position at a profit, which is created by borrowing and selling the equity.

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

Why are securities borrowed and loaned?

Securities are borrowed and loaned for various reasons. Securities are borrowed to sell short or to hold for a certain period of time, such as to avoid settlement failure, to cover short positions, to hedge inventory or long positions, or to meet regulatory liquidity requirements. Securities are loaned by lenders to earn extra returns in the form of fees and non-cash collateral, or to help exercise corporate governance rights. Lenders may not lend if they object to the possible use of securities in short-selling or if their holdings are not large enough. The motivation for lending is to earn extra returns and for beneficial owners to provide protection against borrower default.

What types of securities are commonly borrowed and loaned?

Over half of the estimated 2-3 trillion euros of securities loaned globally each year are equity, while the rest are fixed-income. Loanable securities can be divided into "specials" or "hot stocks" with intrinsic value and "general collateral" or GC without intrinsic value. Specials are lent for yield enhancement, while GC are in demand as a proxy for larger groups. Securities lending against cash collateral can also be used as a means of raising funding, like repo, and the loaned security doesn't have to have intrinsic value but can still be GC.

What arbitrages are supported by securities lending?

Securities lending is a process that enables various types of arbitrages. Convertible arbitrage involves going long of a convertible bond and short of the equity it is convertible into. Equity long-short involves taking a long position in a share expected to appreciate and shorting a related share expected to depreciate. Pairs trading is a special type of equity long-short that involves trading between two securities issued by competitors in the same sector. Credit arbitrage trades across the capital structure of a firm by going long senior debt and shorting junior debt or going long debt and shorting equity. Fixed-income arbitrage involves different securities issued by the same entity, usually debt securities. M&A arbitrages aim to extract premiums in a merger or acquisition by shorting the target company's overpriced shares and going long the bidder's underpriced shares. Event-driven strategy is a long/short strategy applied to a distressed company based on the principle that the bonds are underpriced. Tax arbitrage involves securities lending to transfer ownership of securities to another party to mitigate tax losses.

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

Richard Comotto

There are no available Videos from "Richard Comotto"