Introduction to XVA

Steven Marshall

25 years: Derivatives trading

In the introductory video to this XVA series, Steven defines a wide range of acronyms. Some of which include: XVA, CVA, and DVA.

In the introductory video to this XVA series, Steven defines a wide range of acronyms. Some of which include: XVA, CVA, and DVA.

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

Introduction to XVA

11 mins 25 secs

Key learning objectives:

Understand why we need to apply valuation adjustments when pricing derivatives

Define CVA, DVA, FVA and KVA

Understand how changes to financing, collateral agreements and capital rules led to the development of valuation adjustment

Overview:

Valuation Adjustments (or VAs) are adjustments taken when firms account for and price derivative transactions. In this video, Steven aims to demystify acronyms such as CVA, DVA and FVA, and what sort of things can impact the price of a derivative beyond the underlying mid-market valuation.

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

What is XVA?

“XVA” isa term referring to how we adjust pricing on derivatives to take into account things such as credit exposure and financing costs. XVA is the colloquial name for a whole collection of other acronyms - CVA, DVA, FVA, KVA just to name a few!

What is Credit Valuation Adjustment (CVA)?

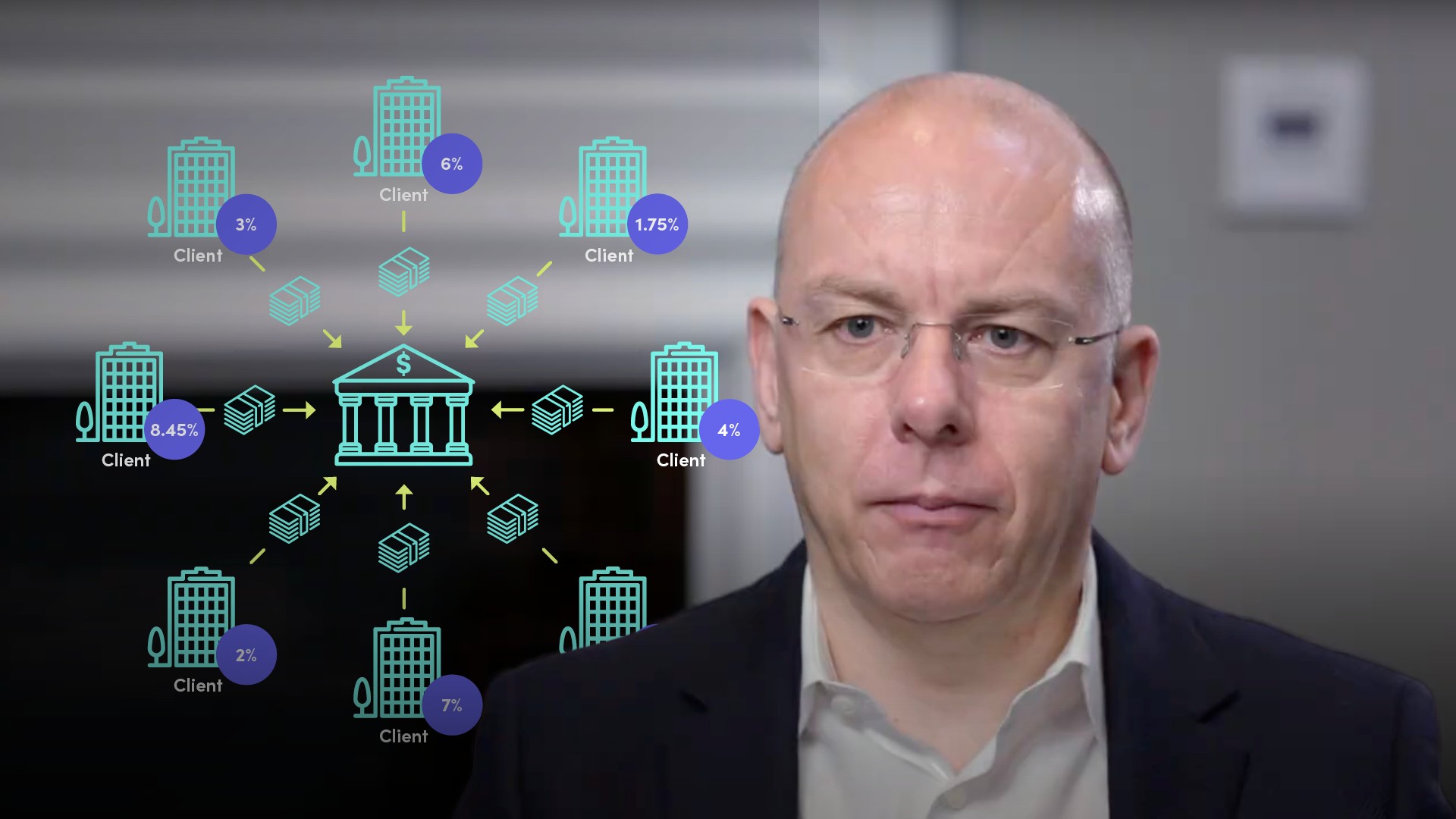

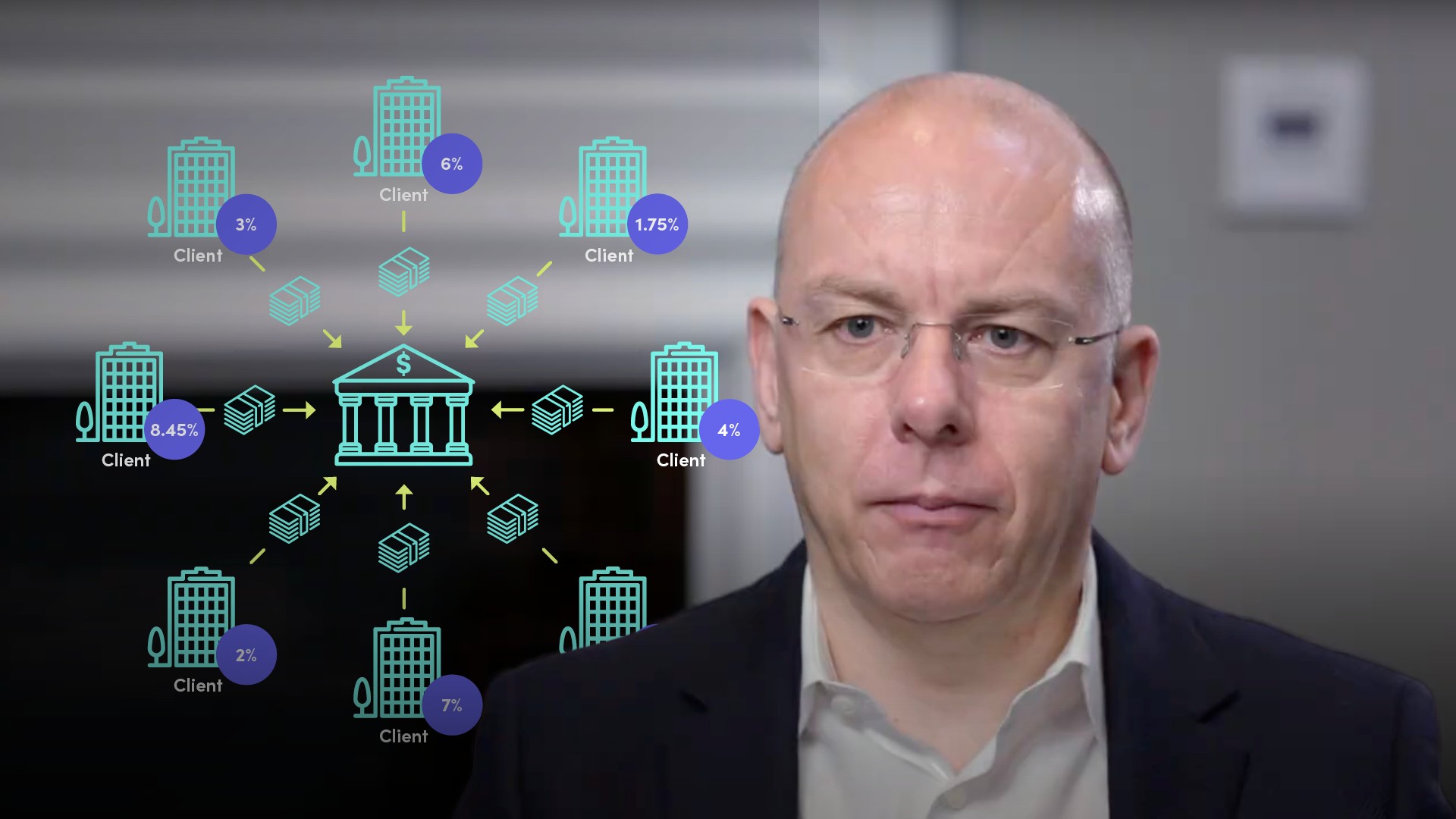

Assume we are an institutional bank who provides derivative hedging solutions to their corporate clients; the credit quality of the corporate counterparty and the risk they may default will impact whether we receive all the payments on a derivative. If the counterparty has a high risk of failing and we are due to receive payments under a derivative contract, then we need to provision against this in a similar way we might for a loan to a risky counterpart. This is known as Credit Valuation Adjustment – or CVA.

What is Debit Valuation Adjustment (DVA)?

DVA is the reverse of CVA and considers the bank itself may fail in its obligations to the corporate counterparty. The bank’s DVA is the corporate counterparty’s CVA and the corporate counterparty’s DVA is the bank’s CVA. In the example previously mentioned - the bank received fixed from the corporate client and rates moved lower - the DVA in this example would reduce as the spot and forward exposure the bank has to the corporate has reduced, making the corporate’s CVA, lower.

What is Funding Valuation Adjustment (FVA)?

The cost of financing derivative transactions due to different collateral requirements is called Funding Valuation Adjustment – or FVA. It may arise because one contract requires daily variation margin posting - say with another bank - whereas an offsetting contract has no collateral – say with a corporate for instance.

What is Capital Valuation Adjustment (KVA)?

Firms need to ensure that they generate a reasonable return on equity for these new transactions and will consider how much additional capital they will have to hold on a new transaction over its life. Taking these two things into consideration will enable them to estimate an appropriate mark-up to put on the trade to generate an adequate return. This is referred to as KVA – Capital Valuation Adjustment.

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

Steven Marshall

There are no available Videos from "Steven Marshall"