What is a Perpetual Bond?

Tim Skeet

35 years: Debt capital markets

Perpetual bonds mean that investors will never receive their principal back and issuers will always pay interest. In this video Tim delves into the details of perpetuals and the potential benefits to investors and issuers.

Perpetual bonds mean that investors will never receive their principal back and issuers will always pay interest. In this video Tim delves into the details of perpetuals and the potential benefits to investors and issuers.

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

What is a Perpetual Bond?

12 mins 36 secs

Key learning objectives:

Define a perpetual bond

Explain the purpose of a perpetual bond

Identify the risk of investing in a perpetual bond

Outline the benefits of a perpetual bond on behalf of the issuer and the investor

Overview:

Perpetual bonds are hybrid debt instruments that possess similarities with bonds and equity. The key feature of a perpetual bond is that there is no maturity date. The benefit of issuing a perpetual bond for a company is that it lowers their debt leverage. For an investor, it often offers a higher yield than other forms of debt on the market.

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

What is a perpetual bond?

Perpetual bonds - referred to in the market as perps, are bonds that exist to perpetuity. In other words, they have no maturity date. Governments, banks and companies that issue them contract to pay interest to investors forever. By the same token, since they never mature, issuers never have to pay investors back their principal.

Why does a perpetual bond exist?

For issuers, perps have significant balance-sheet benefits. For investors, perps offer higher returns relative to standard forms of debt.

How are perpetual bonds like equity?

The best way of thinking about perpetual bonds is as bond-like hybrid instruments that have equity-like characteristics.

| Similarities | Differences | |

| Maturity | Like equities, perpetuals don’t mature. | |

| Interest Payments | Interest payments resemble dividend payments as issuers are technically under no obligation to pay dividends on shares, while coupon payments on bonds are usually mandatory. | Perpetual bonds typically have contractual features that give issuers the right to defer coupon payments under specific circumstances. That feature narrows the conceptual differences between perpetual debt and equity. |

| Accounting | Perpetuals receive equity-like treatment on the balance sheet. |

Why do companies issue perpetual bonds?

Gaining partial equity credit by issuing perpetuals and other kinds of ultra long-dated hybrid debt helps companies lower their debt leverage, which helps companies raise more cost-effective finance in the capital markets and boost their credit ratings.

Other benefits include:

- Companies will often use perpetuals as part of acquisition financing packages because it makes acquirers’ balance sheets look more robust at a critical time

- Companies in the telecommunications, utilities, infrastructure, energy and real estate sectors, issue perpetuals as they have long-term projects to finance

- Perpetuals are classified as debt instruments, and interest payments are tax deductible

Why do people invest in perpetual bonds?

Perpetuals are popular on the buy side with insurance companies and pension fund managers, who need long-dated, fixed-rate assets to match their long-term liabilities. More generally, they are attractive to credit investors, particularly during a period of lower interest rates as they offer higher yields relative to other forms of debt.

What are the risks associated with perpetual bonds?

Perpetuals come with risks, which counterbalance the higher returns. Some of these risks include:

- Investors in perps are exposed to the credit risk of the issuer

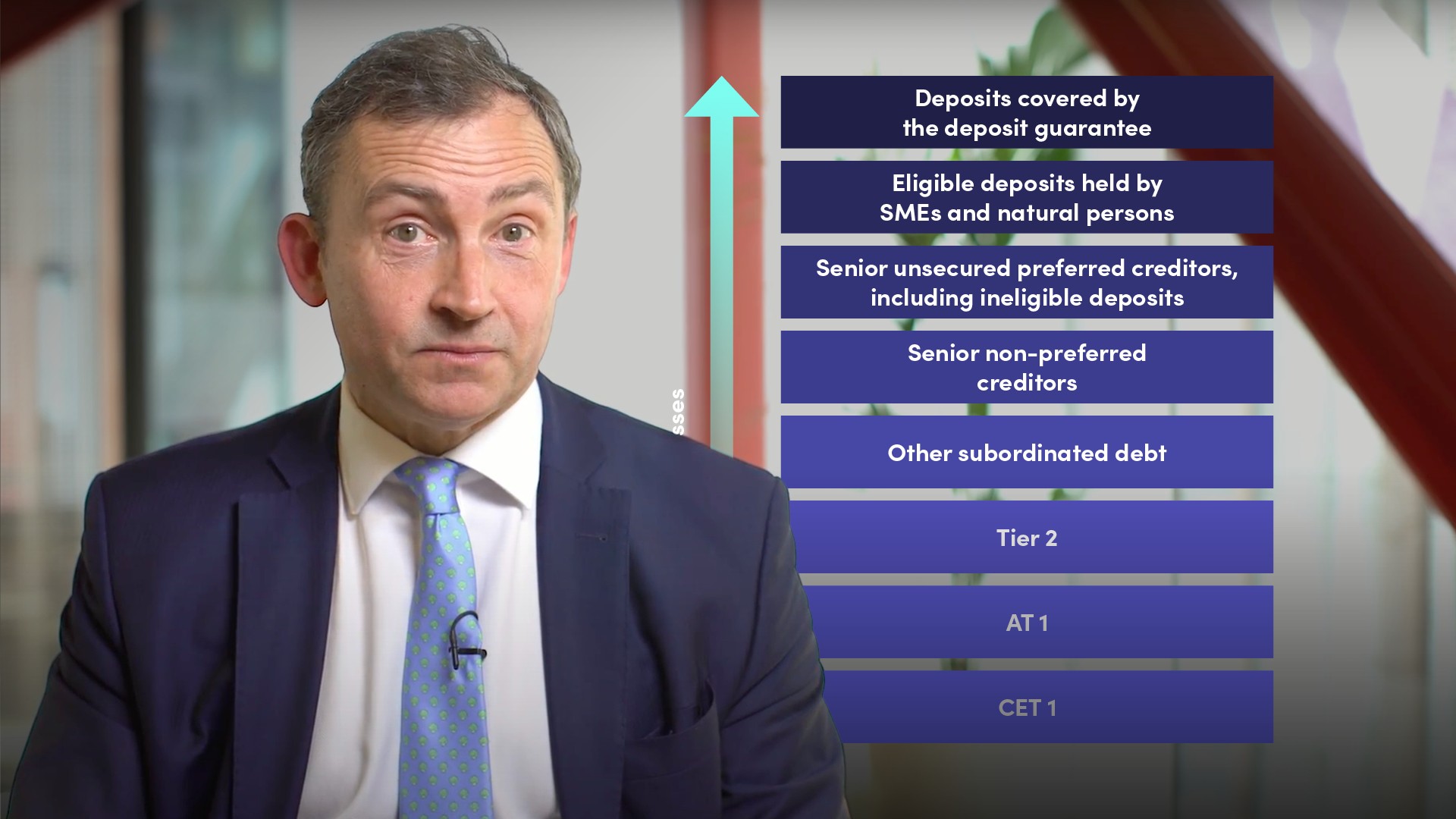

- Perpetual bonds are classified as deeply subordinated instruments

- Liquidity risk due to the limited trading market for these instruments

- Sensitive to changes in interest rates

- Call risk (if the issuer chooses to buy back the bonds, the investor is faced with having to re-invest the money in similar products that may offer lower yields)

What are the unique features associated with bank perpetuals?

Unlike corporate hybrids, bank perpetuals have a unique additional set of features: if a bank’s core capital ratio falls below a set level (usually 5-1/8%), Contingent Convertible (CoCos) or Additional Tier 1 bonds (AT1s) can be converted into common equity, or their value can be permanently written down.

Also, whereas features such as coupon deferral and bond calls in the corporate segment are largely a matter for the company’s executive team, in the bank segment, the regulator can intervene.

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

Tim Skeet

There are no available Videos from "Tim Skeet"