Collar

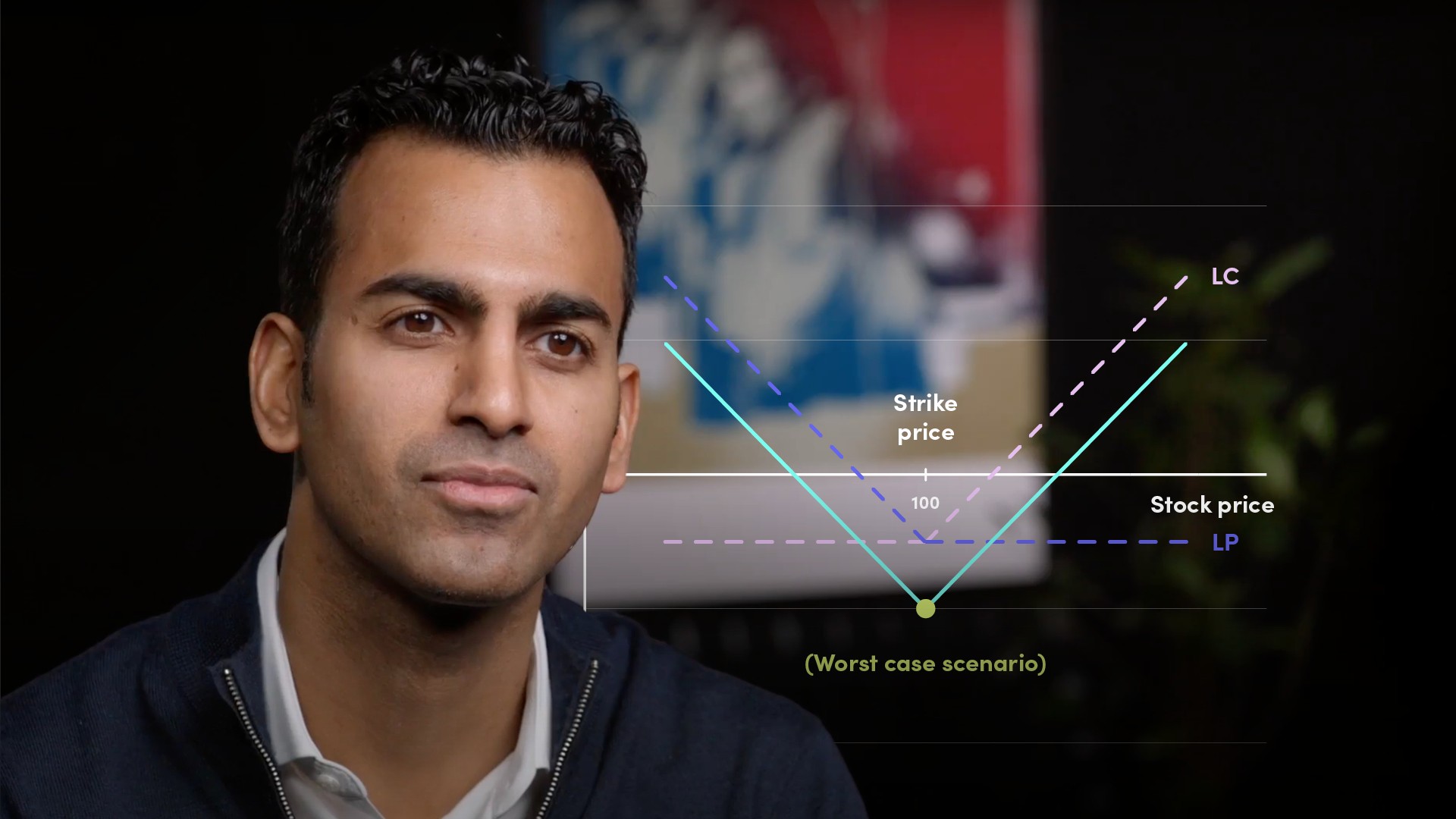

A collar option is a strategy that protects from large losses at the same time as it caps returns. The strategy consists of owning the underlying, buying an out-of-the-money put and selling an out-of-the-money call. If the price of the underlying rises, the position in the underlying increases in value but the profit is capped by exercise of the call against it. If the underlying declines in value, the position in the underlying loses value but the put limits losses. The above is often referred to as buying the collar. Selling the collar involves being short the underling, buying an out-of-the-money put and selling an out-of-the-money call. If the price of the underlying falls, the position in the underlying increases in value but the profit is capped by exercise of the put against it. If the underlying rises, the position in the underlying loses value but the call limits losses.