Equity Options Trading Strategies

Imran Lakha

20 years: Equity derivatives trading

There are three types of trading strategies that use combinations of options. These are volatility strategies, spreads and ratios, and hedging structures. Join Imran as he dives deeper into each strategy and their various applications.

There are three types of trading strategies that use combinations of options. These are volatility strategies, spreads and ratios, and hedging structures. Join Imran as he dives deeper into each strategy and their various applications.

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

Equity Options Trading Strategies

7 mins 7 secs

Key learning objectives:

Explain Volatility Strategies and its types

Define Spreads and Ratios

Define Hedging Structures

Overview:

There are three types of strategies that use a combination of options. They are volatility strategies, spreads and ratios and lastly hedging structures.

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

What is long position and short position?

- A long position is when you BUY.

- A short position is where you SELL, without having bought first.

What are the types of Volatility Strategies?

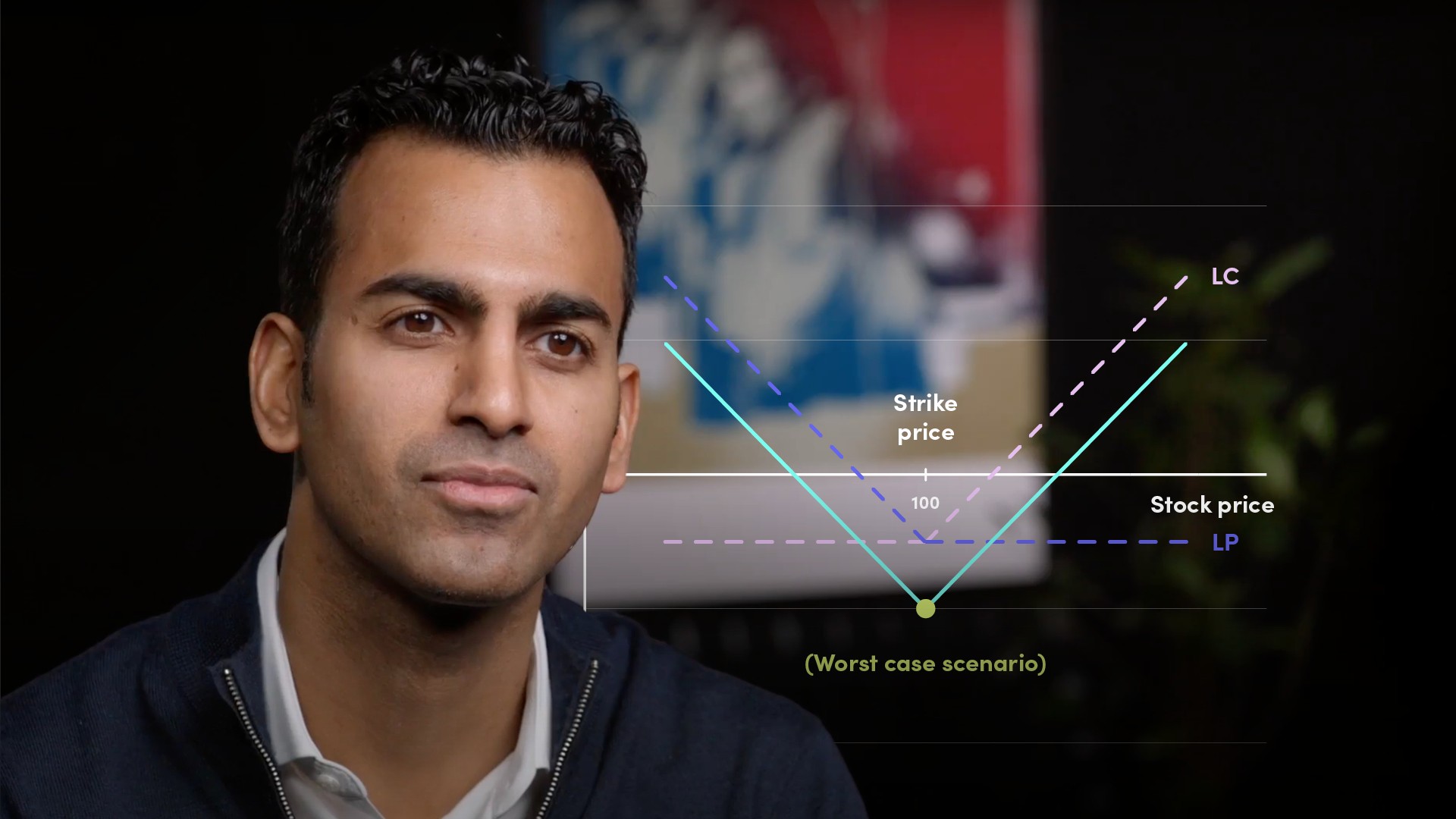

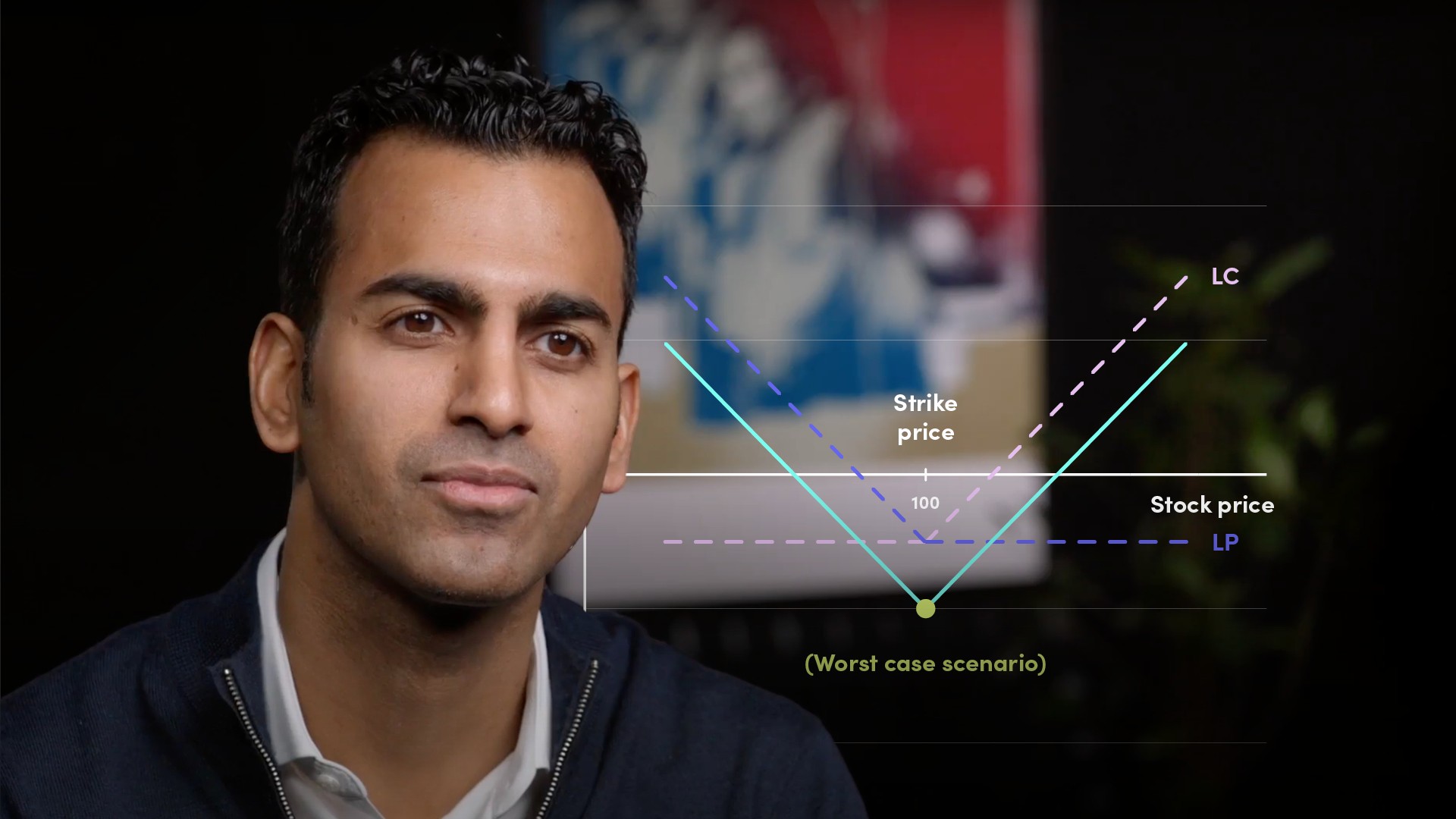

- Straddles: A long straddle is a combined long call and long put, both with the same strike price and same maturity.

- Strangles: A strategy that is made up from buying out of the money options.

What are Spreads and Ratios?

- Call spread is an option spread strategy that is generated when an equal number of call options are purchased and sold simultaneously.

- Call Ratio is used by investors with very particular situations in mind and higher risk tolerance. It helps you to maximise your leverage (your maximum upside vs your premium spent) because your premium outlay is greatly reduced, but it also forces you to take on a much higher risk.

What are Hedging Structures?

RISK REVERSAL or COLLAR is one of the most widely traded structures in the options market. It is constructed by taking a position in the OTM PUT and then taking the opposite position in the OTM CALL.

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

Imran Lakha

There are no available Videos from "Imran Lakha"