Greeks

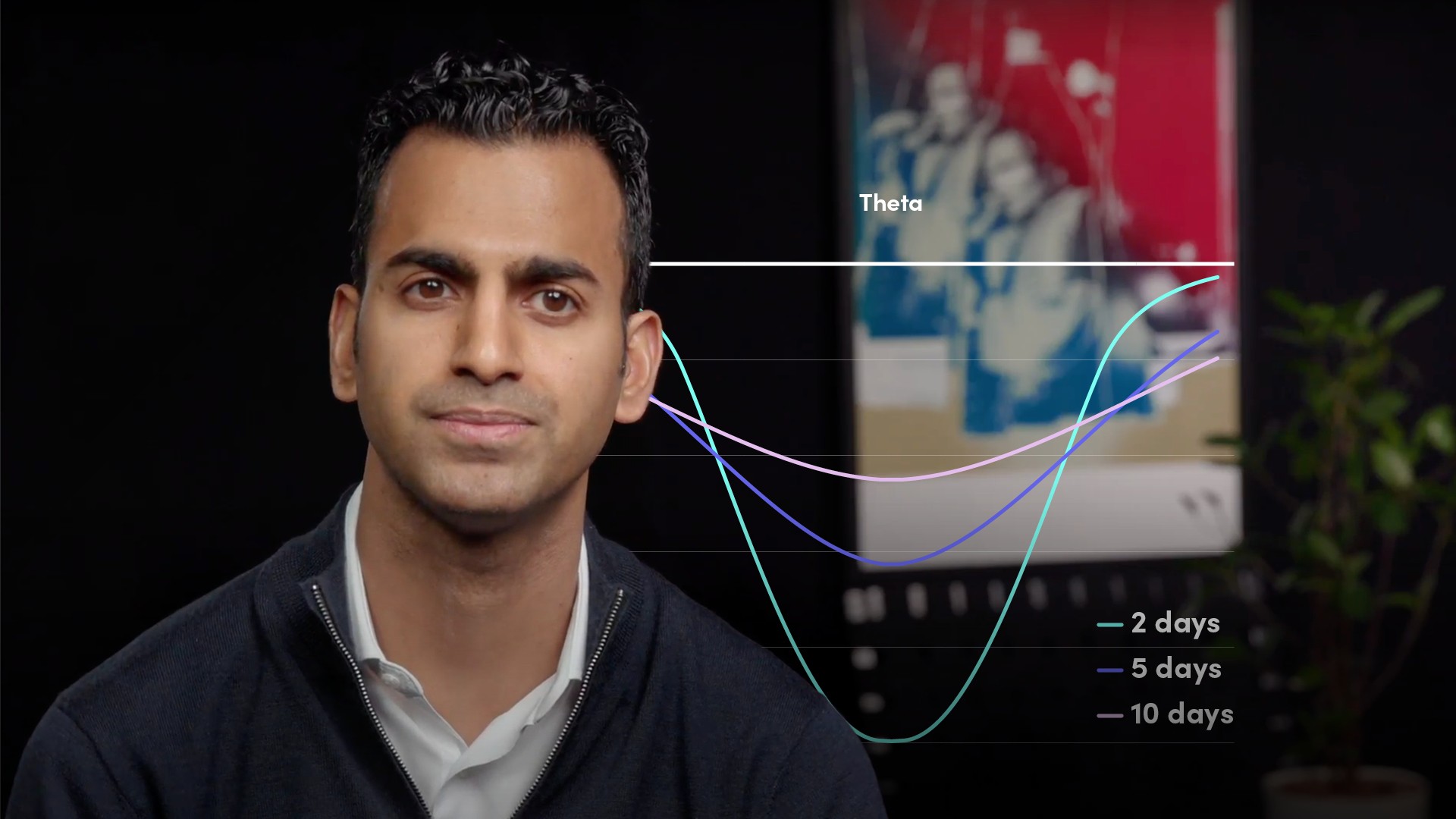

Option Greeks refers to a series of five terms that measure the risk or sensitivity of derivatives with respect to their underlying assets. The Greeks include: Delta (the amount the price of a derivative will change for a change in the price of the underlying); Gamma (the rate of change of delta for a change in the price of the underlying); Theta (the amount an options price will decrease for a one-day change in time to expiry); Vega (the amount an options price will change for a change in implied volatility) and Rho (the amount an option value will change based on a 1% change in the risk free rate). Collectively, the Greeks give derivative traders a consistent way of measure risk exposure.