Preference Shares

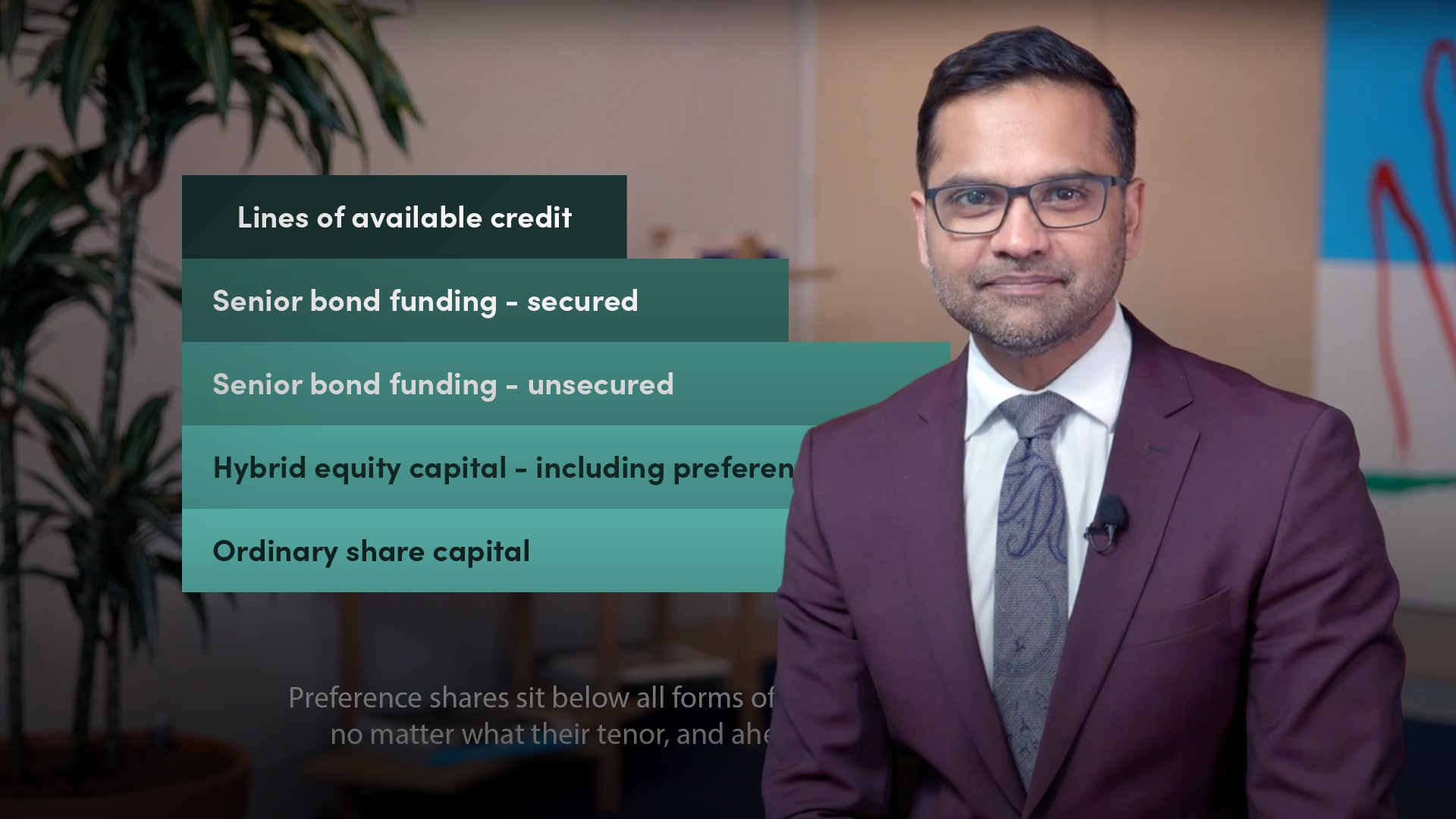

A company’s paid-up ordinary shares are its equity capital and evidence ownership of the company. Ordinary shareholders are the last to be paid out (if at all) in the event of company insolvency but on the plus side, they share in the company profits in the form of dividends if the company opts to pay them and/or in the form of the share capital appreciation as the company grows. Importantly, they are granted voting rights that give them control over the company’s decision-making. Preference shares (a.k.a. preferred stock) are a different animal altogether. They are hybrid instruments that share characteristics of debt and equity. In fact, they are better described as deeply subordinated debt since they pay fixed coupons like bonds, sit above ordinary shareholders in the event of insolvency and confer no standard voting rights on holders. Under circumstances laid out in documentation, a company has the right to suspend preference share dividends; non-payment can be non-cumulative, in which case the holder has lost the payment forever. Preference shares can be issued in convertible format, in which case they are convertible into ordinary shares according to set terms. And they can also be redeemable, another debt-like feature that means they can be repurchased.