Tranche

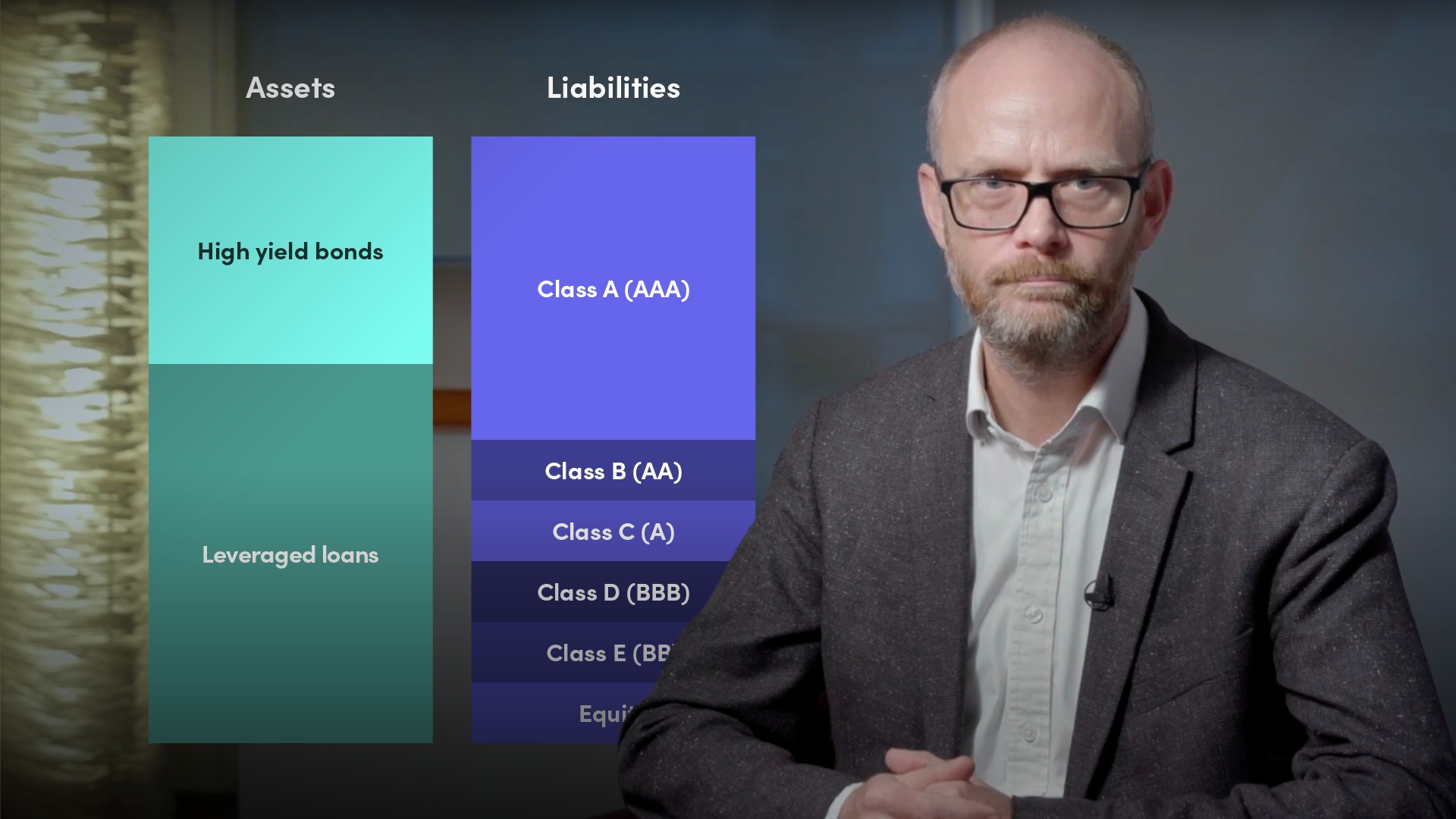

A tranche, the French word for ‘slice’, is used in capital markets to describe the different lines of a bond or securitisation. For example, a borrower might approach the capital markets with a three-tranche bond. All of the tranches that the borrower agrees to sell are executed simultaneously but each tranche has different characteristics. For example, they might have different maturities, they might be in different currencies, they might have fixed or floating interest payment conventions. In securitisation, tranching refers to the priority of payment. In other words, the senior tranche receives preferential rights to cash flows ahead of mezzanine and junior tranches, which are subordinated to it.