Now You See Me

Robert Ellison

20 years: Capital markets & banking

Central Banks could issue Digital Currencies with a time limit. Let’s call them Time Limited Central Bank Digital Currencies (“TL-CBDCs”). Just like those banknotes falling from the helicopter, TL-CBDCs would be backed by the national central bank, and accepted as payment everywhere.

“Now You See Me” is a highly entertaining comedy-thriller released in 2013. It’s a story about magicians planning the heist of the century, and the central premise rests on their ability to make money appear and disappear in surprising ways. The movie is a must-see for central bankers the world over. I say this because they are in desperate need of fresh inspiration, central banks are running out of firepower and relevance.

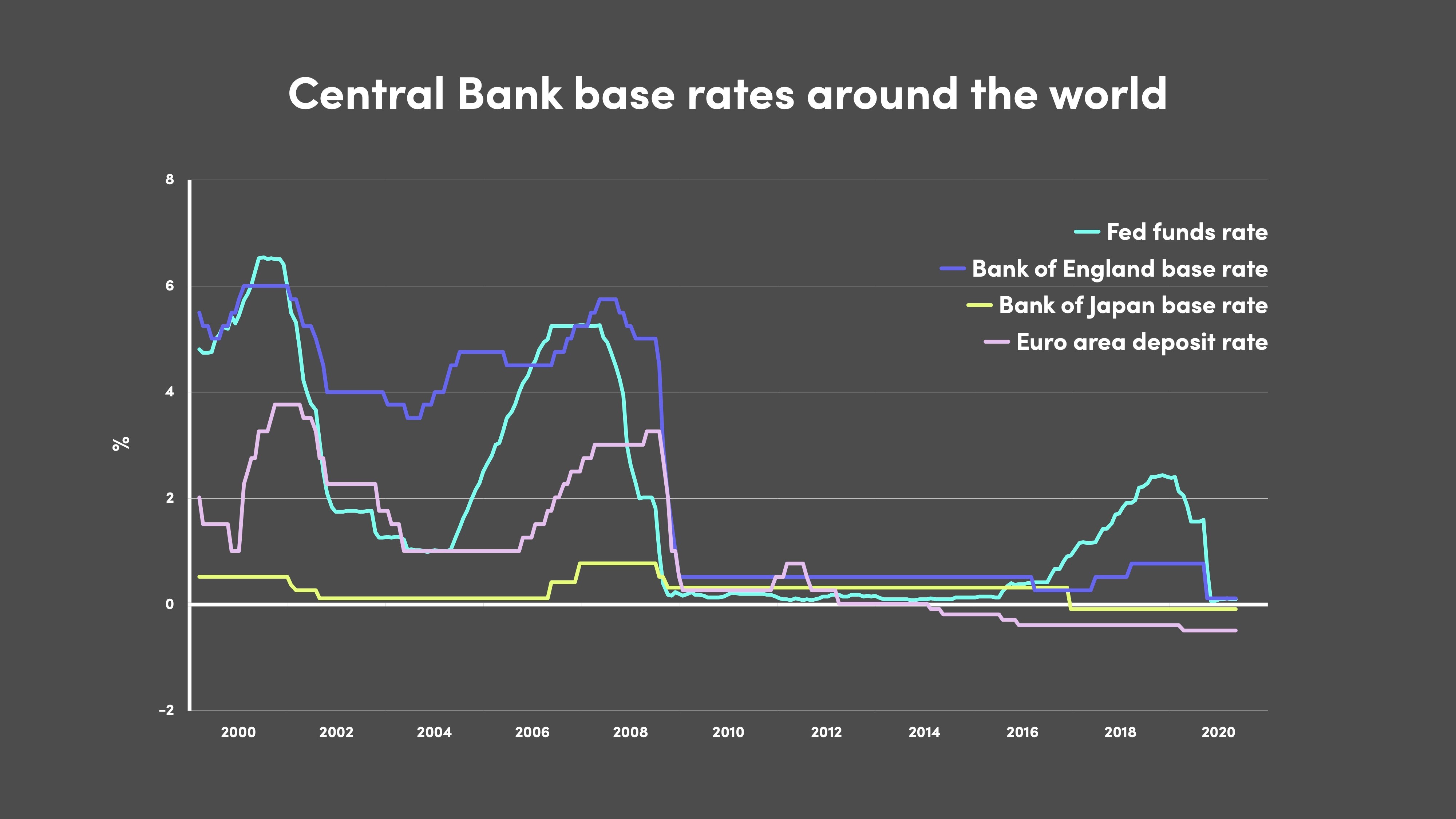

Policy rates have run their road

First, let’s consider the central policy tool historically available to central bankers: interest rates. Rates have been held artificially low for years and today we have a zero interest rate policy (ZIRP). If central banks try to push rates lower from here, savers will have the option to simply withdraw their balances and store currency as cash - a format which by definition cannot be subject to deeply negative rates. Central bankers know this limitation: they call it the Effective Lower Bound (“ELB”). We are at this lower bound, and have been for years. In the meantime, everyone has had to live with the market distortions that flow from ZIRP: otherwise-bankrupt enterprises are propped up via interest-free debt, and society has swapped capitalism’s creative destruction for financial repression.

What about QE?

Back when QE was innovative, it was sold as a temporary “adrenaline-shot” for the financial economy, stimulating private sector risk appetite and investment. The adrenaline still continues to flow into financial markets (just take a look at the S&P), but QE has bloated to become a crutch for public debt in an accounting sleight-of-hand, the main purpose of which is to facilitate and subsidise western governments’ ballooning debt burden. Collectively, as a society, we are storing up huge liabilities to be repaid (or not) by future generations, while in the meantime QE has inflated financial asset prices to the immediate benefit of today’s top one percent. We call this crony capitalism.

Japan as a case study

Still not convinced? Look no further than Japan for a case study. For decades, the Bank of Japan has been trying to stimulate their economy via ZIRP and QE. The result? Unconventional policy became conventional, and yet they’re still trapped in a deflationary spiral. A “lost generation” is all the Japanese have to show for these efforts. It turns out that when temporary measures become permanent, we are repaid with unintended consequences.

Central banks are innovating

Central bankers figured all this out a while ago, and since then they’ve been working on new ideas to reinvent policy transmission and effectiveness. A popular idea is Central Bank Digital Currencies (“CBDCs”), a digital replacement for cash. Just like banknotes, these digital currencies would benefit from the full-faith backing of the issuing central bank, and circulate in the real economy as a means of exchange. If central-bank issued cash could be replaced with a central-bank issued digital currency (itself subject to policy rates) then the problem of Effective Lower Bound will be solved at a stroke, paving the way for deeply negative rates. More recently, CBDCs’ promoters have flagged the benefit that digital tokenized currency can’t host and transmit a physical virus like banknotes can. Others have lobbied for the benefits of CBDCs in the transmission of emergency fiscal policy as an alternative to the existing, bank-intermediated, infrastructure - a system which has struggled to stand up to the task of distributing government loans and grants to businesses in distress. CBDCs were proposed, but not adopted, in the formulation of the CARES Act in the US. The idea is sure to resurface when helicopter money really comes into play.

Helicopter money

A lot of ink has been spilled discussing whether and how helicopter money should feature in the policy toolkit. It doesn’t really matter where you stand in this debate, helicopter money is already here, and in ways that approximate Milton Friedman’s original analogy. In the UK, the furlough scheme will cost more than £100bn. Can you think of anything more wasteful than gifting £100bn of public money, and then ordering the recipients not to work? We won’t get many attempts at restarting the global economy using such pathetically blunt tools.

Helicopter money’s fatal flaw

There is a persuasive objection to helicopter money, which is this: people don’t actually spend the free money it puts in their hands. A study conducted by the Dutch Central Bank last year estimated that people only actually spend 30 cents in every dollar of helicopter money they receive. The remaining 70 cents is saved, trapped in the financial system and contributing to asset price inflation in exactly the same way QE is doing right now (as if we need more of that). In an attempt to boost consumption and stave off deflation in the short term, we actually risk storing up more inflationary pressure for the future.

TL-CBDC

Here’s a twist on the idea of CBDCs which might address this flaw of consumer restraint. Central Banks could issue Digital Currencies with a time limit. Let’s call them Time Limited Central Bank Digital Currencies (“TL-CBDCs”). Just like those banknotes falling from the helicopter, TL-CBDCs would be backed by the national central bank, and accepted as payment everywhere. Now you see me. But if recipients of TL-CBDCs don't spend it within a period of (say) two months, then it expires with no value - as if it never existed in the first place. Now you don’t. A deployment of TL-CBDCs should spin up consumer demand quickly and efficiently, more than 3 times more efficiently than regular helicopter money if those dutch projections are to be believed. CBDCs might be issued to direct spending only to small businesses, a “levelling up” to counterbalance the fact that QE unfairly favours larger, highly leveraged companies. Or it could be targeted to those sectors most in need of help. Citizens whose jobs have been protected by CBDCs’ deployment will spend more themselves, contributing to broader economic activity. Everyone in the loop has more confidence, spending power and taxpaying ability. Because it's more efficiently deployed, the inflationary pressures that go alongside intervention are minimised. The icing on the cake is that unlike cash, CBDCs can only be deployed in the legitimate economy, therefore maximising tax receipts. And once the rails are established, it can be used again. What if, in the future, there’s a flood, or earthquake in a certain part of the country? Roll out regionally-targeted TL-CBDCs.

Precedents

There’s nothing radical about the idea of a currency that loses its value over time - anyone who has kept a bank balance where interest rates are pegged below inflation can attest to the fact that central bankers have been making your money disappear for years, albeit slowly. Secondly, even a hardcore crypto-sceptic (like me) might be convinced that digital currency might turn out to be one of those discoveries like radio, crude oil, or graphene: well understood for years, and just waiting for its time to eventually come. Fresh ideas are needed. All around the world, authorities are levering technology to contain the virus. Right now, we’d do well to identify opportunities to frame our economic recovery in a similar way.

Robert Ellison

Share "Now You See Me" on

Latest Insights

UBS and Switzerland: Capital hikes are not the right tool for the job

15th October 2025 • Prasad Gollakota

Trade deals & trade wars: The regional impact

23rd May 2025 • Adrian Pabst and Eliza da Silva Gomes