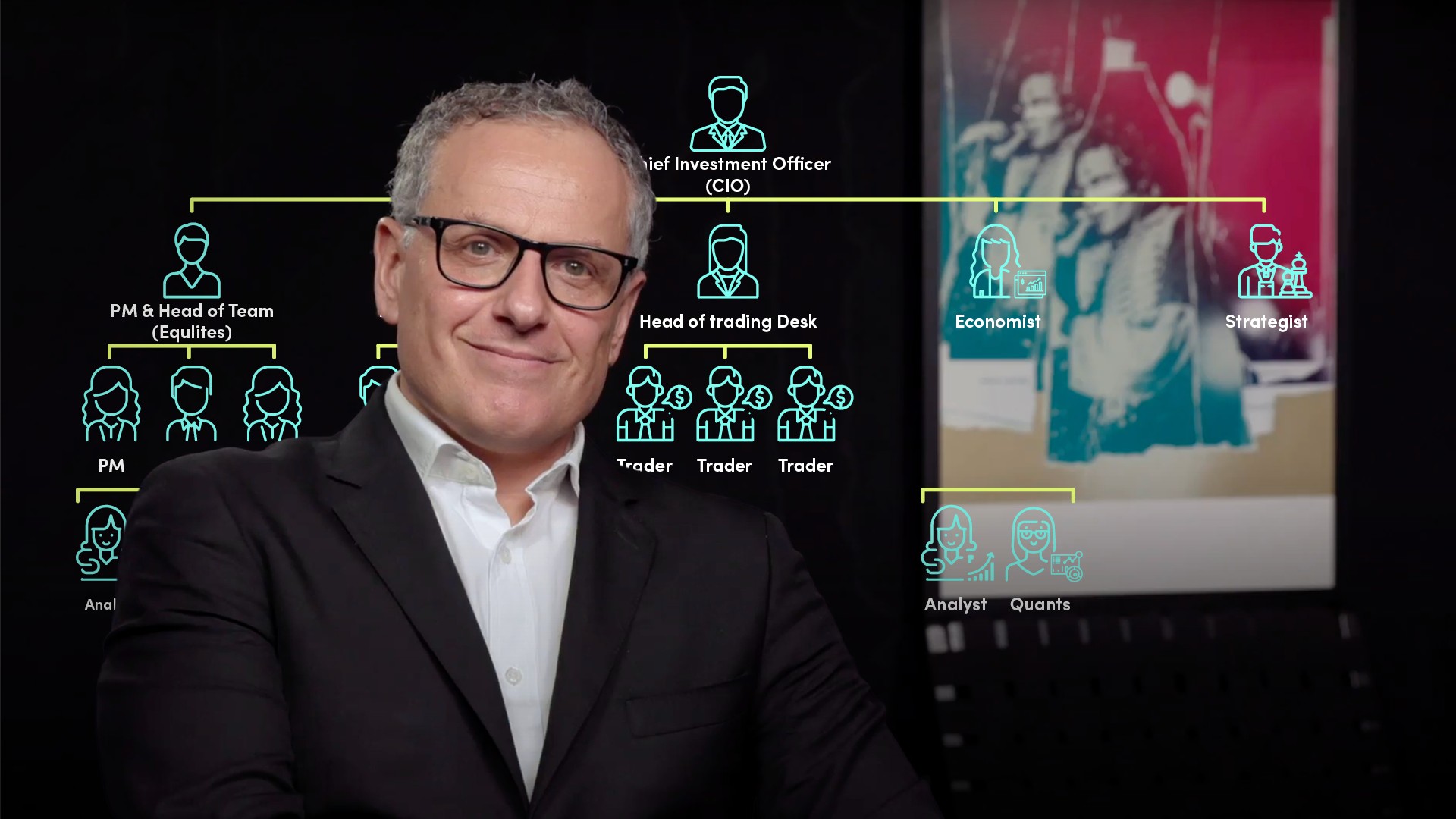

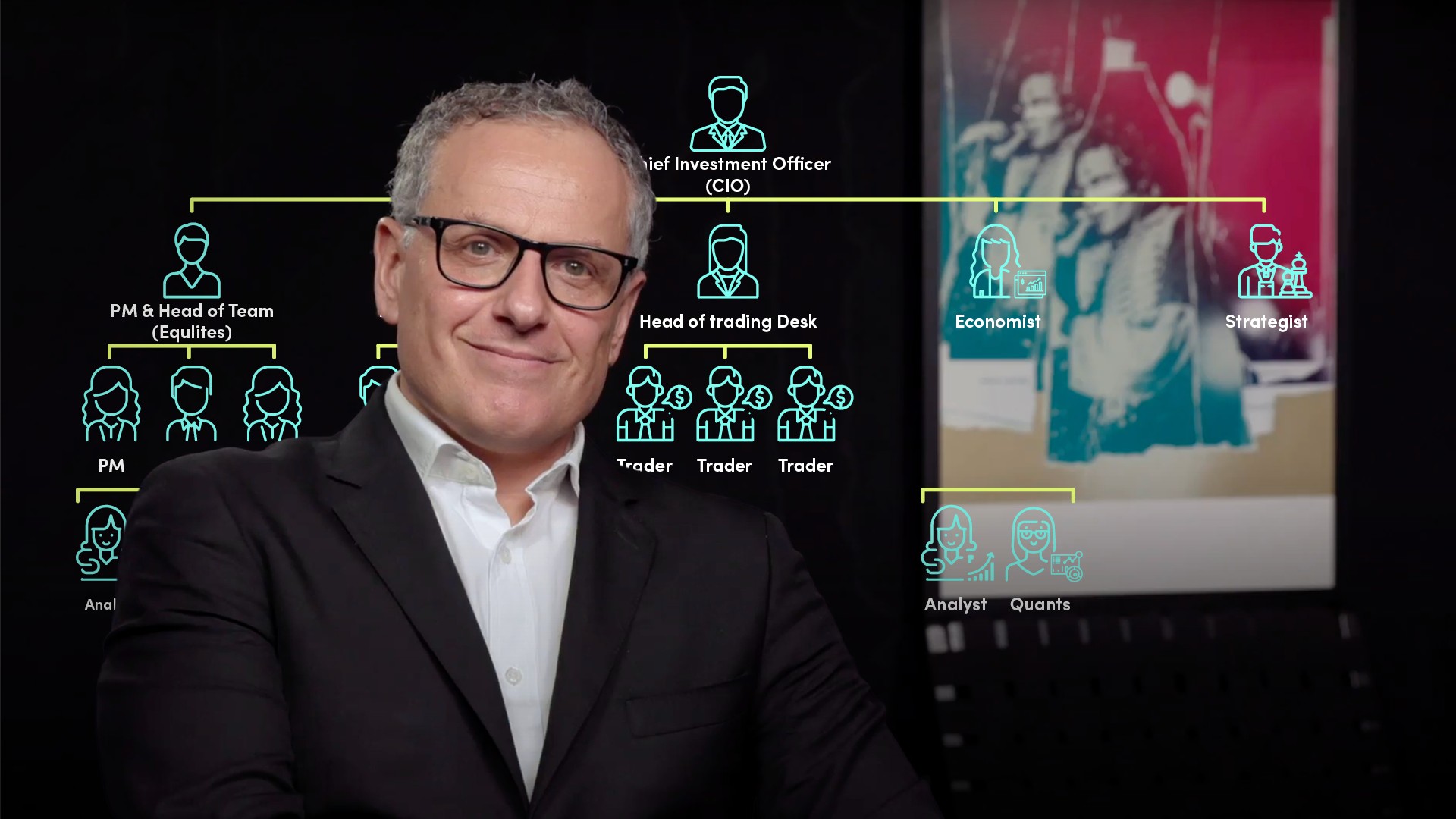

Front Office Decision Makers in Asset Management

Thanos Papasavvas, CFA

30 years: Asset management

This series of videos on “Asset Management Functions” helps demystify the various front office roles within asset management firms and also helps distinguish the various roles, including how an Economist differs from a Strategist, a PM, a trader and so on. In the first video of this series Thanos explains the roles of "Portfolio Manager", "Analyst", "Quant", "ESG Specialist" and "Traders" and how they are directly involved in the decision making process.

This series of videos on “Asset Management Functions” helps demystify the various front office roles within asset management firms and also helps distinguish the various roles, including how an Economist differs from a Strategist, a PM, a trader and so on. In the first video of this series Thanos explains the roles of "Portfolio Manager", "Analyst", "Quant", "ESG Specialist" and "Traders" and how they are directly involved in the decision making process.

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

Front Office Decision Makers in Asset Management

11 mins 25 secs

Key learning objectives:

Identify the various front office roles within asset management firms

Outline the roles of those who are directly involved in the decision making process in asset management firms

Overview:

The front office is a part of an organisation where the actual investment decisions are made, implemented and managed.

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

Who may be directly involved in the decision making process in asset management firms?

- Portfolio Manager

- Analyst

- Quant (Quantitative Analyst – Data Analyst – Portfolio Analyst)

- ESG Specialist

- Trader

What is a Portfolio Manager and what are their roles?

The portfolio manager is the person ultimately in charge of a pot of money, to target a certain return profile from a particular asset class. The PM is responsible for the management of the portfolio in line with investment policy and guideline constraints, ensuring appropriate risk versus the benchmark. The PM himself has to adhere to very strict guidelines and restrictions to what can be part of the portfolio as well as clear risk and return criteria and is therefore responsible for:

- Ensuring good risk/return performance in line with client expectations

- Ensuring nothing goes into the portfolio which should not be there

Who are Analysts and what are their roles?

Analysts are responsible for understanding in depth and analysing in minute detail stocks, bonds and commodities which could form part of the portfolio. Analysts do not tend to take on risk and buy/sell positions in a portfolio; instead they make recommendations as to whether they believe a particular stock or bond is cheap, expensive or fairly valued with targets in mind.

- They read through company reports and accounts

- They attend company meetings

- They meet with the CEOs and executive team to understand the vision of the company as well as its peers and competitors

What is the role of Quantitative Analysts?

- Simple data gathering and analysis

- Monitoring risk within the investment portfolio

- Designing quantitative models which help asset allocation and investment decisions

- Nowcasting

Some quants, also known as Portfolio Analysts, typically focus on investment risk in the portfolio, determining how and where the expected risk that the PM’s have taken may manifest itself. They help guide the PM to ensure that there are no unexpected risks. Separate from compliance and investment guideline risk, they also specialise in ex and post-ante risk analysis.

Who are ESG Specialists and what are their roles?

This is a new role that has emerged in the asset management front office as asset managers, asset owners, and the wider community and society have become more aware of climate change and broader ESG issues. ESG specialists provide support to the various investment teams such as equity, fixed or multi-asset. Sometimes their role is advisory whilst other times they may have a veto. Whilst some ESG specialists would only invest in companies with strong ESG criteria, others would only invest in companies with the poorest ESG criteria.

Who are Traders and what are their roles?

A trader within an asset management firm is an execution trader rather than a proprietary trader, they have some flexibility in terms of the timing of when to execute the order or how to execute it and with which counterparties, but they cannot decide what to buy or sell, or how much. A good trader, however, does not just execute orders, but feeds information back into the decision making process by providing colour and sentiment on the market. Trades can take less than a second to execute, right through to several days!

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

Thanos Papasavvas, CFA

There are no available Videos from "Thanos Papasavvas, CFA"