Capital Risk Appetite and Measurement Techniques

David McDonald

20 years: Treasury in Capital Management

In this video, David explains how banks ensure they have enough capital by means of their internal models typically set by their risk or finance functions. He also explains how internal risk appetites are set using these models factoring each type of risk. And finishes by talking about the importance and need for bank regulatory capital requirements.

In this video, David explains how banks ensure they have enough capital by means of their internal models typically set by their risk or finance functions. He also explains how internal risk appetites are set using these models factoring each type of risk. And finishes by talking about the importance and need for bank regulatory capital requirements.

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

Capital Risk Appetite and Measurement Techniques

11 mins 2 secs

Key learning objectives:

Understand how a bank determines how much capital it needs today

Outline how regulatory capital requirements influence bank capital levels

Overview:

A bank will determine how much capital it needs in its risk appetite statement. The risk appetite statement needs to ensure that the bank has enough capital for today and enough capital for tomorrow, i.e. future risks. Determinants on the level of capital include how much capital the bank needs to support its business plan, its regulatory requirements, and its targeted external rating.

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

How does a bank ensure enough capital for today?

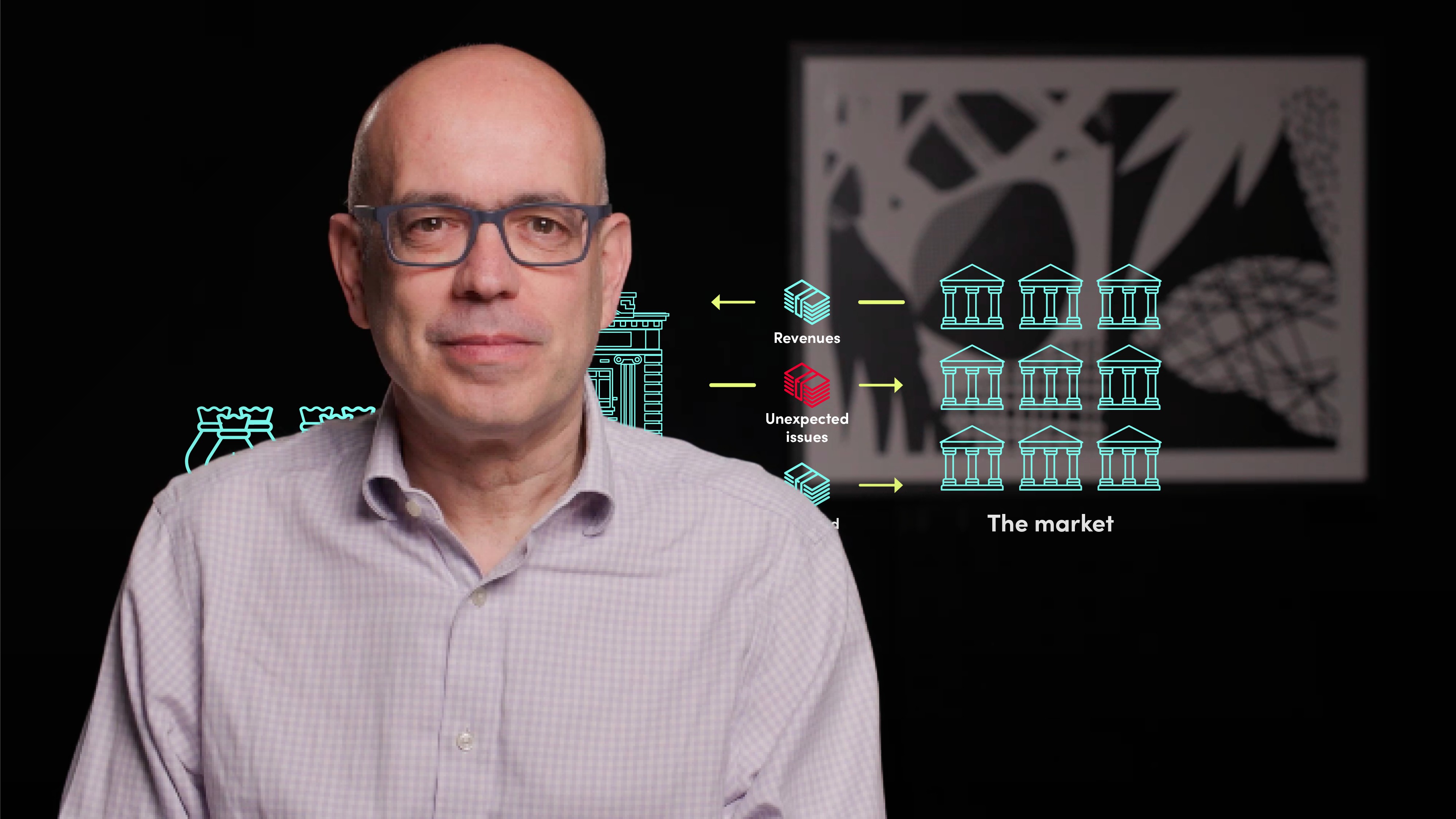

Banks hold capital to absorb unexpected losses because expected losses should be covered by revenue and capital requirements are typically calculated by the risk or finance functions within a bank.

Unexpected losses will occur in the future and by definition the size of these losses cannot be known with any degree of certainty. To predict these losses a bank will rely on historical experience to provide a guide to the future. If banks can access enough good quality, historical data then they can, for any risk type, produce a histogram illustrating frequency and magnitude of loss events.

They can create a histogram showing total operational risk losses, showing the probability (or frequency) with which monthly losses occurred, ordered by the size of loss.

They can also create credit risk distributions with expected losses being covered by a credit margin and unexpected losses being covered by capital up to a confidence interval of 99.95% for example.

Finally, market risk distributions could be developed to make sure that a bank does not have a risk position that could result in losses outside its risk distribution.

Banks can, and do, develop these models for controlling risk within the bank for day to day risk management. They can also use the models, at more extreme confidence intervals, to determine how much capital the bank needs.

How do regulatory capital requirements influence bank capital?

Since the Global Financial Crisis, regulators have typically wanted banks to hold more capital than their internal models tell them to hold. Regulators are thinking about the impact of a bank failure on other banks, depositors and the wider economy, whereas banks are more concerned about shareholder value. Therefore regulatory capital requirements can be thought of as defining regulatory capital risk appetite.

Regulators define the models that can be used to measure capital risk through the Basel Accords. Many banks can use their own models to measure capital risk, however there are rules that must be applied for those models to be acceptable to the regulator.

To assess credit risk, the models are known as Internal Ratings Based (IRB) models. For market risk they are Internal Models Approach (IMA) models and for operational risk they are Advanced Models Approach (AMA) models. Each of these models is run daily or monthly, depending on the institution, and the outcome is a measure of Risk Weighted Assets, which form the denominator for banks’ regulatory capital ratios, the CET1 ratio, the Tier 1 ratio and the Total Capital ratio.

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

David McDonald

There are no available Videos from "David McDonald"