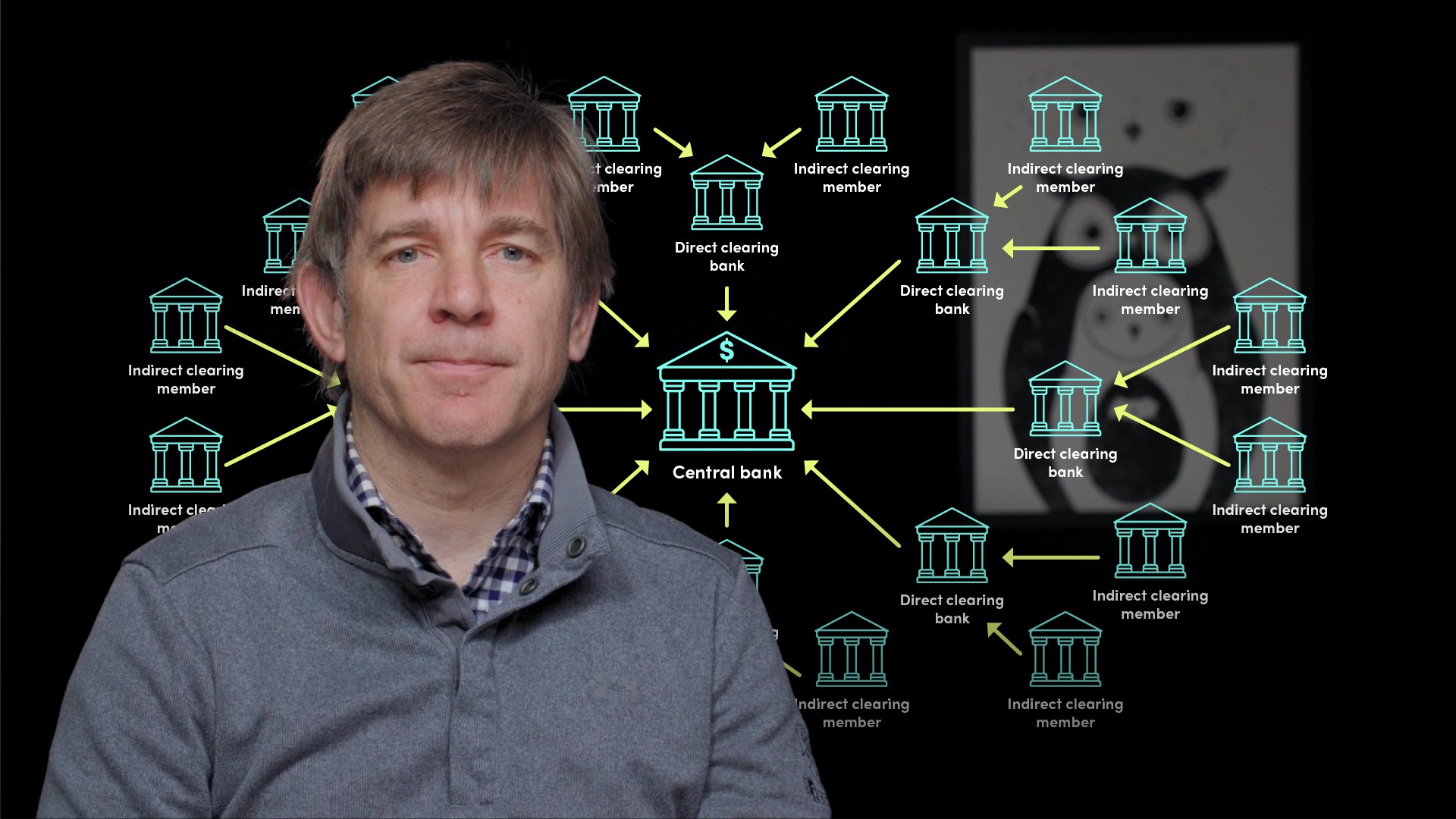

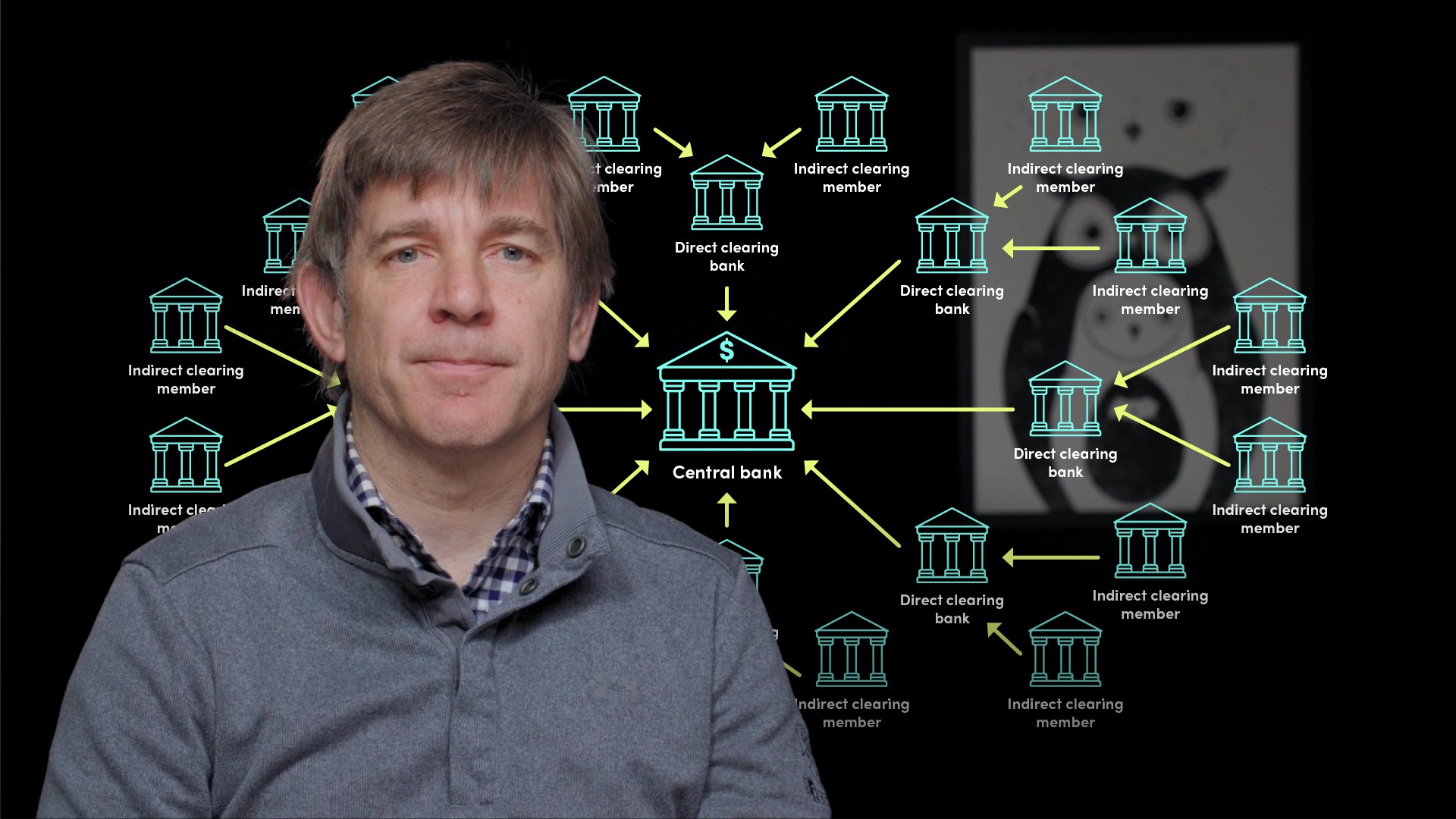

The Prime Functions in a Banking System

Chris Blake

Director

In this video, Chris provides an overview of what a bank is, the prime functions of banks and how they came about, alongside the balance sheet risks that arise from these functions, and how they are mitigated. In addition, he will look at how banks actually create money.

In this video, Chris provides an overview of what a bank is, the prime functions of banks and how they came about, alongside the balance sheet risks that arise from these functions, and how they are mitigated. In addition, he will look at how banks actually create money.

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

The Prime Functions in a Banking System

9 mins 3 secs

Key learning objectives:

Explain and understand the prime functions that are performed by the banking system.

Examine the nature of payments and the link to a bank’s ledger

Understand the linkage from safekeeping to the lending function of a bank

Define and identify the types of maturity transformations banks make

Understand how banks actually “create” money

Overview:

To understand bank asset and liability management (ALM), sometimes called “Treasury” requires a firm grasp of what banks do and what makes them different from corporates and other types of financial institutions, including creating money, running the “so called” ledger and undertaking a number of transformations including size, maturity, credit and interest rate, alongside making payments.

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

Chris Blake

There are no available Videos from "Chris Blake"