Cryptocurrency Jargon Buster

Catherine Thomas

Financial technology specialist

Catherine clarifies often misused and misunderstood terms relating to cryptocurrencies.

Catherine clarifies often misused and misunderstood terms relating to cryptocurrencies.

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

Cryptocurrency Jargon Buster

5 mins 16 secs

Key learning objectives:

Define cryptocurrency, security token, stablecoin, utility token, Digital Wallet and crypto-assets

Describe an Initial Coin Offering and explain its regulatory situation

Explain the function of a token

Overview:

A cryptocurrency is a form of payment and store of value, while tokens can be used for a variety of functions including, but not limited to, being used as a currency and a store of value. There are specific types of tokens that provide rights, minimise volatility, and provide access to products and services. Tokens can be created through an Initial Coin Offering.

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

What are Cryptocurrencies?

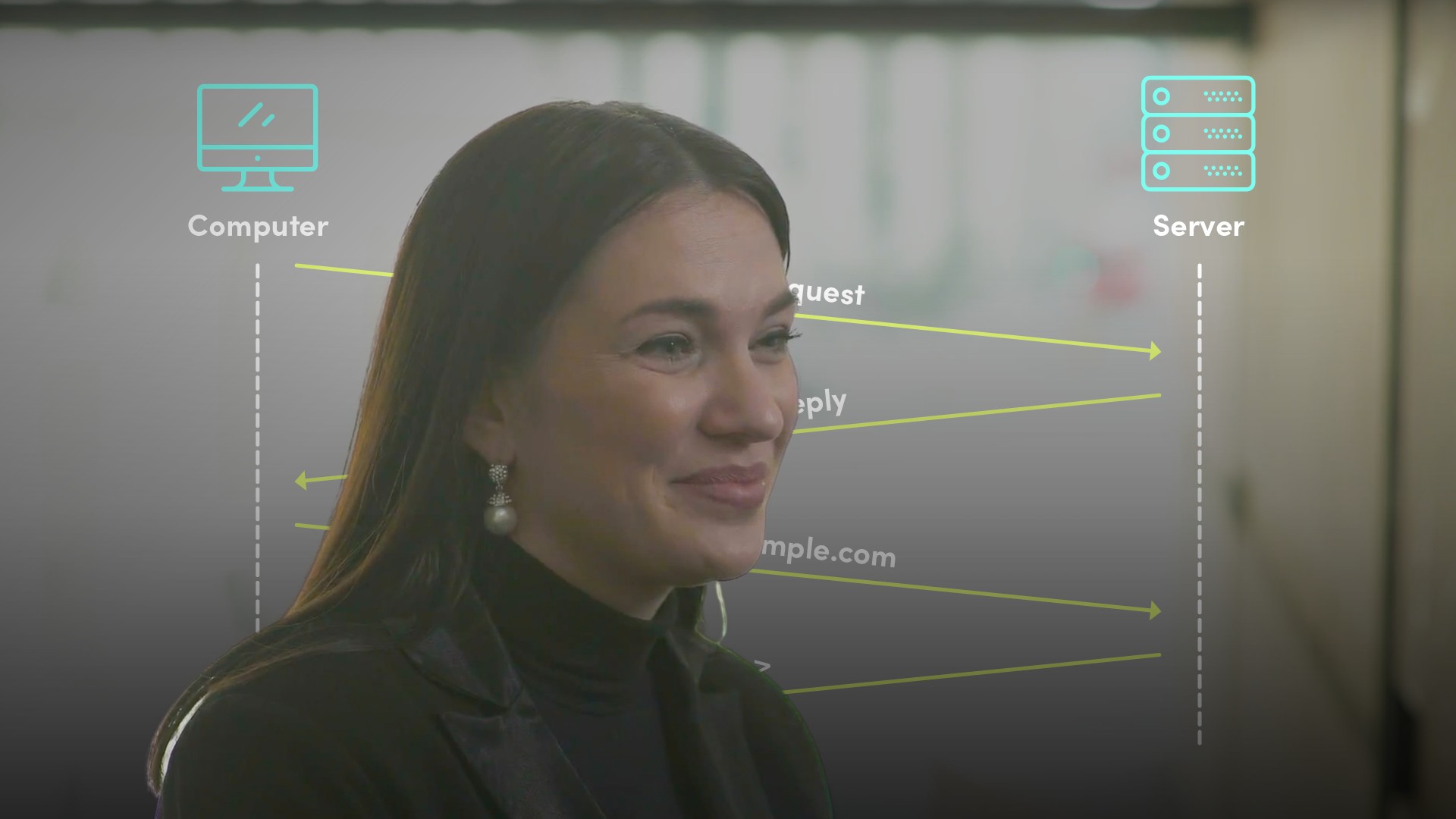

Cryptocurrency is often used as a form of payment and store of value. They are designed to service peer-to-peer monetary systems for individuals to transact amongst themselves, without the intervention of a third party.

What is the function of a Token?

There could be any number of different possible functions for a token, that include functioning as a currency or store of value.

What is a security token?

A security token is a type of cryptographic token that may provide rights such as ownership, repayment of a specific sum of money, or entitlement to a share in future profits.

What is a stablecoin?

A stablecoin is a type of cryptographic token designed to minimise the volatility of the price of the stablecoin, relative to some "stable" asset or basket of assets.

What is a utility token?

A utility token is also known as work tokens. It is a type of cryptographic token which can be redeemed for access to a specific product or service that is typically provided using distributed ledger technology.

What is an Initial Coin Offering?

An Initial Coin Offering or ICO is a token distribution mechanism. In this process a project sells tokens in exchange for bitcoin and ethereum for the purposes of funding.

An ICO can be a source of capital, as an alternative to venture capital, banks and stock exchanges. However, the majority of ICOs fail to acknowledge that creating a token is creating a new digital economy.

How are ICOs regulated?

ICOs may fall outside existing regulations, depending on the nature of the project, or be banned altogether in some jurisdictions, such as China and South Korea.

What is a Digital Wallet?

A Digital Wallet refers to a file that houses private keys. It usually contains software which allows access to view and create transactions on a specific blockchain.

What does it mean when a Digital Wallet is described as “hot” or “cold”?

Wallets are sometimes known as “hot” if they are connected to the Internet and “cold” if they are not.

What are crypto-assets?

Crypto-assets refers to a digital token, like keys or in software terms an “API key”, used to access a service, product or marketplace in an open network that is distributed and not owned or operated by one central party. These networks use tokens to incentivise individuals or organisations to contribute value to the system. The most famous example is Ethereum.

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

Catherine Thomas

There are no available Videos from "Catherine Thomas"