Managing Capital Risk and Reporting

David McDonald

20 years: Treasury in Capital Management

A bank must determine if it has enough capital for the future, even if it has enough capital to handle its risks today. Unsurprisingly, regulators are very curious in the same question. Join David as he covers how banks should manage capital risk going forward.

A bank must determine if it has enough capital for the future, even if it has enough capital to handle its risks today. Unsurprisingly, regulators are very curious in the same question. Join David as he covers how banks should manage capital risk going forward.

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

Managing Capital Risk and Reporting

11 mins 6 secs

Key learning objectives:

Outline how banks determine whether they have enough capital for future risks

Understand the importance of stress testing

Overview:

Even if a bank has enough capital to manage its risks today, it needs to know whether it has enough capital to manage future risks. They do this by creating detailed risk assessment plans as well as assessing what could go wrong under certain conditions through stress testing.

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

How does a bank ensure it has enough capital for future risks?

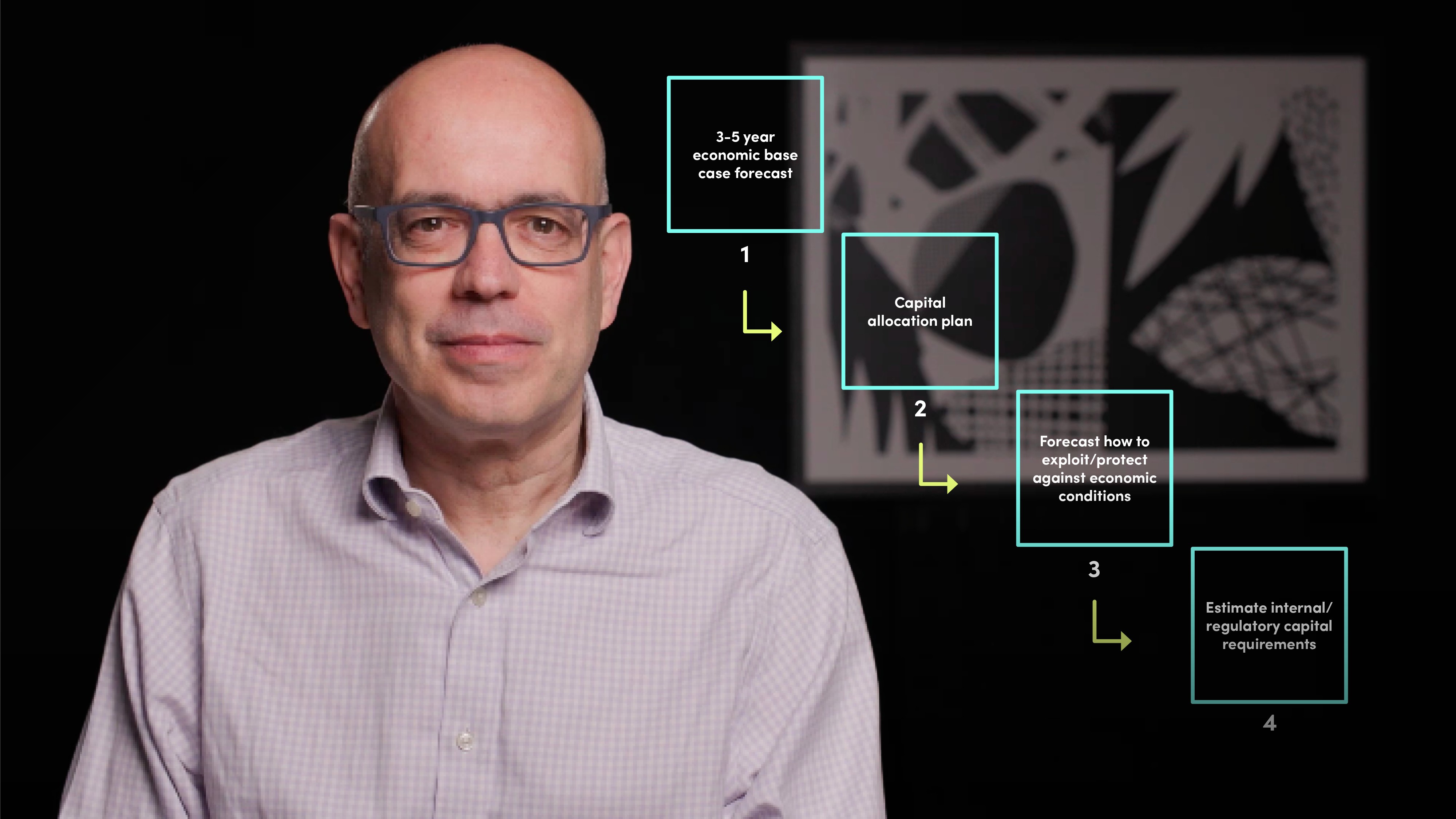

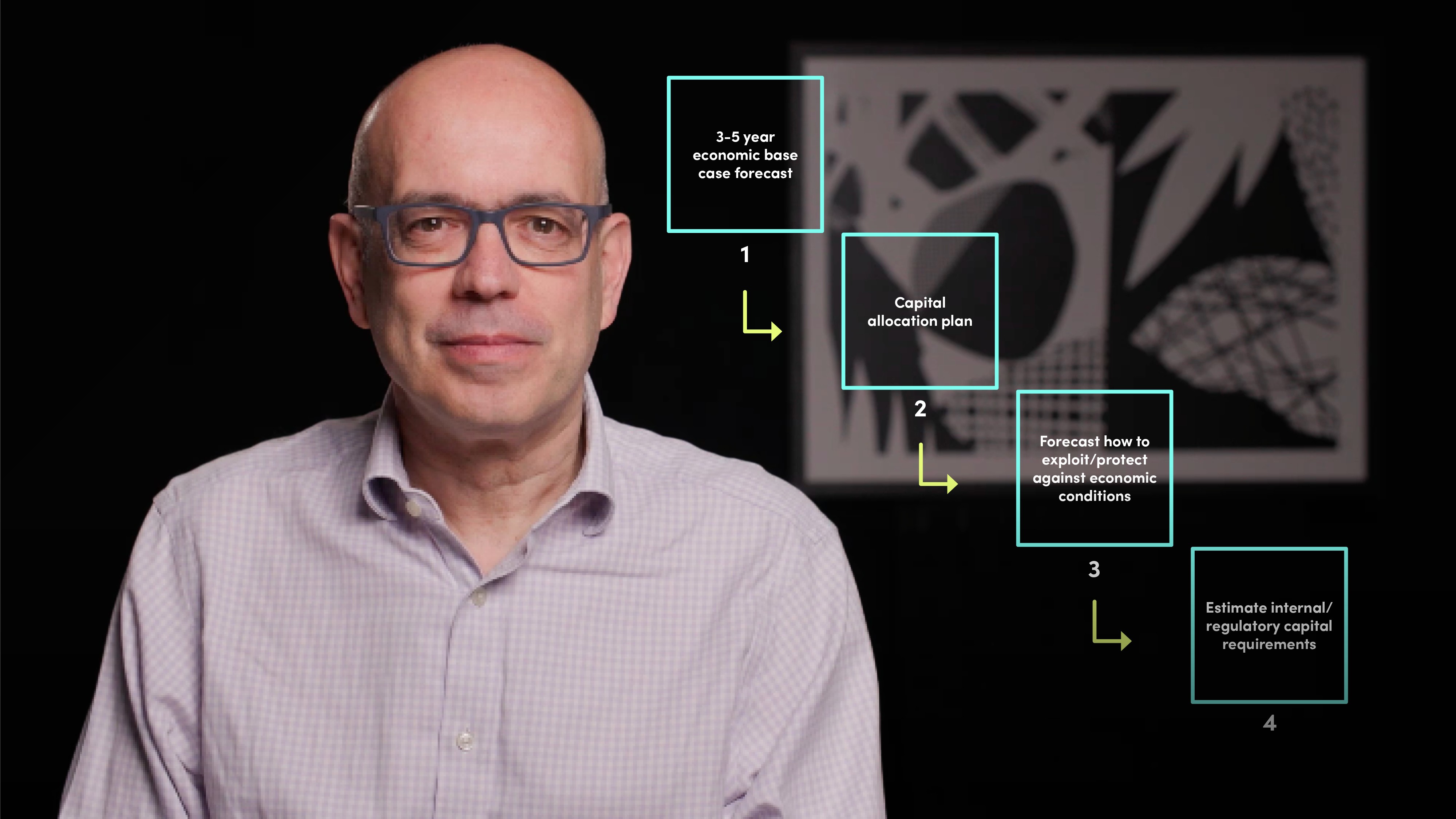

To ensure enough capital for future risks it needs to create a detailed risk assessment. It starts with developing a strategic plan starting with an economic base case forecast for 3-5 years, or a capital allocation plan. Businesses and finance departments then forecast how the bank could best take advantage, or protect against, forecast economic conditions. Risk departments run their models for each point (at year end, for example) in that plan to estimate what internal and regulatory capital requirements could be. However, to ensure the plan is robust enough the bank also needs to undertake stress testing, i.e. determining what happens if it all goes wrong.

Why are stress tests so important?

Following the GFC, Board and regulators’ risk appetites now typically include limits for what could happen to a bank’s capital or liquidity should things not go according to plan, known as stress testing. A Board’s risk appetite statement will include a limit on how much the capital position could be eroded should things go wrong, and they would be advised not to approve a strategic plan if this appetite is breached.

A stress scenario is run in the same way as a base case strategic plan. Businesses forecast what would happen to balance sheet growth and margins; risk departments calculate impairments and capital requirements for each risk type and, additionally, might add on downside impacts for current and forecast operational events. A revised forecast capital plan is constructed for the board to consider formally as part of its strategy deliberations.

Stress tests should be extreme but plausible and should have a clear purpose, most likely with a defined pass/fail threshold.

The severity of the scenario may be determined in-house or be prescribed by the regulator, although regulators do tend to provide indications of the appropriate degree of stress expected in its Internal Capital Adequacy Assessment Process, or ICAAP.

One of the key outcomes of the stress testing process relates to the actions that the bank could take to mitigate the impact of the given stress scenario. The actions it could take would be documented in its recovery plan.

Regulatory stress tests started to evolve in 2009 and are typically run annually in the US and UK and every two years in the EU.

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

David McDonald

There are no available Videos from "David McDonald"