A SPAC Case Study

Rupert Walford

25 years: Capital markets

In the last video of this three part video series, Rupert takes us through a case study of a SPAC called Churchill Capital IV who acquired a private electric automobile company called Lucid.

In the last video of this three part video series, Rupert takes us through a case study of a SPAC called Churchill Capital IV who acquired a private electric automobile company called Lucid.

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

A SPAC Case Study

6 mins 47 secs

Key learning objectives:

Identify the SPAC in this scenario

Explain why a SPAC merger was beneficial to both parties

Be able to understand SPACs using a real world example

Overview:

In order to fully understand how SPACs work, Rupert goes through a case study of a recent real-world example. Specifically the transaction between Churchill Capital Corp IV (CCIV) and Lucid Motors, a privately owned electric car producer.

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

Who is the SPAC in this scenario?

The SPAC or “blank cheque” company, Churchill IV has agreed to a merger with Lucid Motors, at an implied valuation for the combined business of 24 Billion dollars.

What is the background of this specific SPAC?

Churchill IV is the 4th company in a line of SPACs set up by M.Klein and Company, a strategic advisory firm founded in 2012 by ex-Citigroup investment banker Michael Klein. Klein’s team have already successfully de-SPACed their first venture via a merger between Churchill Capital Corp I and Clarivate Analytics Plc in a 4.2 Billion dollar transaction in 2019 and their 3rd SPAC, Churchill Capital Corp III announced a merger with Multiplan Inc. in July 2020.

Who is the sponsor in this situation?

M.Klein and Company act as the sponsor of the SPAC, covering the initial capital required by it, including underwriting, listing and advisory fees and running costs. They will receive warrants as well as shares in the combined business representing around 25% of the amount raised in the SPAC’s IPO - the previously mentioned “sponsor promote”.

Who was the bookrunner, and what was their role?

Citigroup were hired as joint bookrunner - or underwriter - and global co-ordinator on the deal with Goldman Sachs and JP Morgan hired as the other joint bookrunners. Citigroup’s role was to co-ordinate the marketing and the bookbuild for the public offering of the SPAC’s shares as well the production of the prospectus and oversight of the regulatory processes.

When was the IPO first issued?

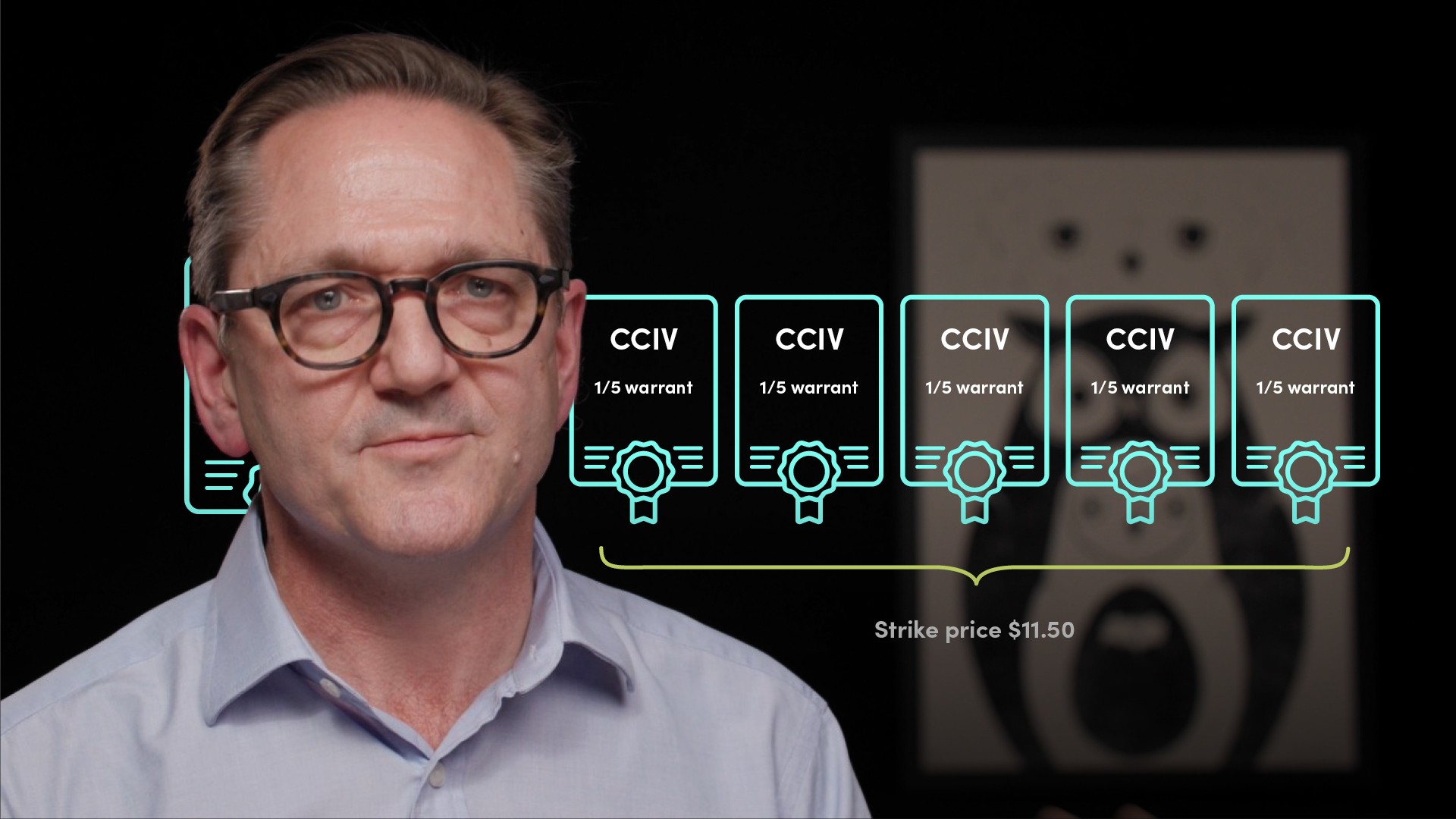

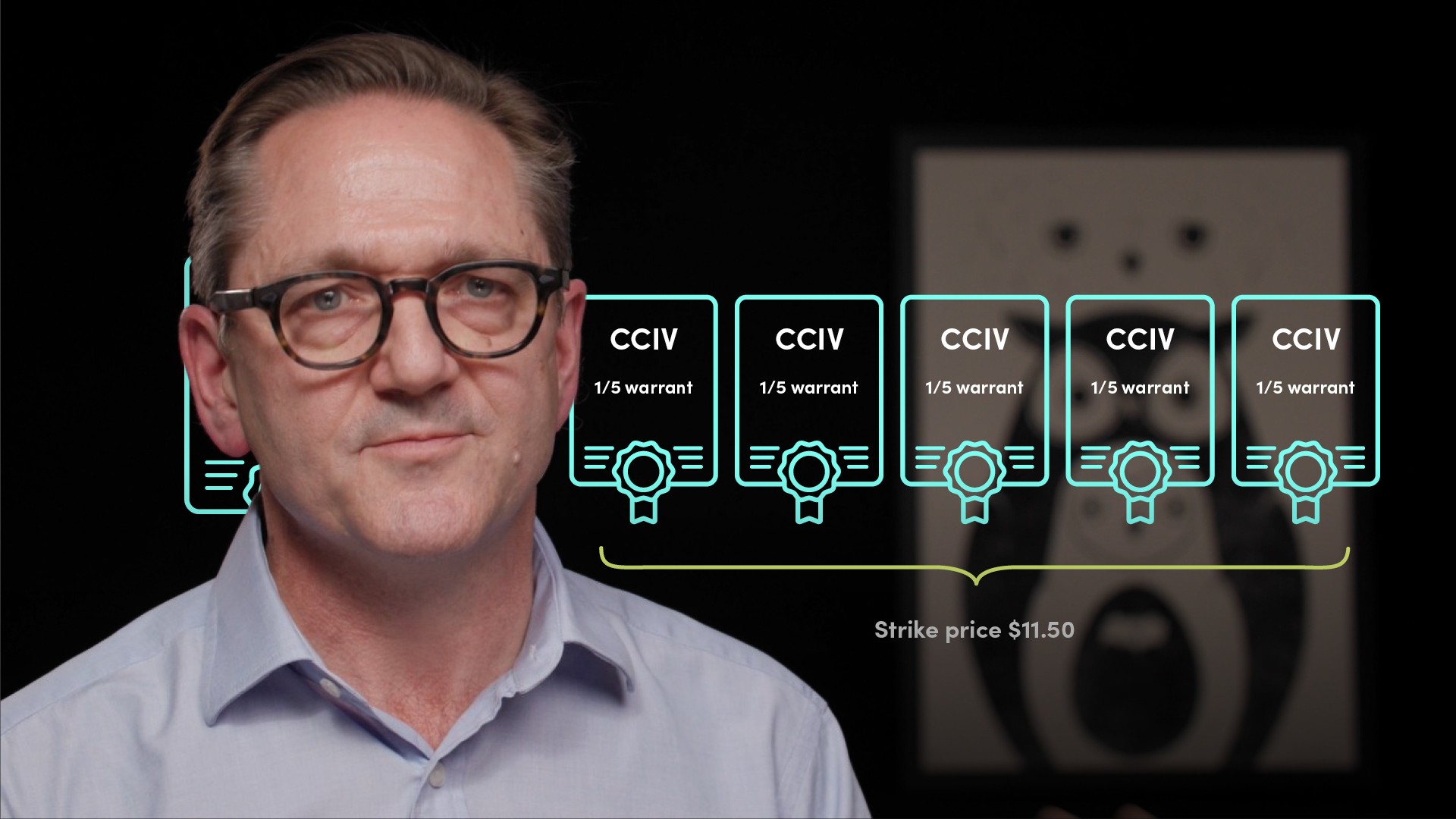

On 30th July 2020, Churchill Capital Corp IV was listed on the New York Stock Exchange via a large IPO of 1.8 Billion dollars. Investors in the IPO received units comprising one share of 10 dollars and 1/5th of a warrant - or one warrant for every 5 shares subscribed. Each warrant gives the holder the right to purchase a share at a strike price of 11 dollars 50.

What was the market reaction and thus the stock price impact of the merger?

Trading of the shares and warrants commenced in September 2020. The stock price was largely stable and static in the first few months of trading, fluctuating around 10 dollars. However, speculation of a potential merger with Lucid Motors resulted in a buying frenzy and Churchill IV’s share price rapidly increased by over 500% to an all-time high of just shy of 65 dollars in a matter of weeks. This was followed by an equally quick descent to around 22 dollars after the merger was officially announced on 22nd February, 2021.

Why was the SPAC merger more beneficial to Lucid Motors than a traditional IPO route?

- Whilst Lucid Motors does have the technical expertise and competence to establish itself, it is not currently profitable and is not projected to generate meaningful revenues until 2022 Because of this, a traditional IPO route would arguably be more challenging for Lucid, than merging with a SPAC

- The SPAC merger has enabled them to raise a large amount of capital quickly and without the market risk associated with - and potentially earlier than they would have been able to via a traditional IPO

What did the deal consist of?

- On the 22nd of February 2021, after private negotiations the merger was announced, with Lucid’s implied value of just over 24 billion dollars, which would make it the 18th largest car manufacturer in the world by market capitalisation

- Churchill IV will contribute 2.1 billion dollars to Lucid and a further 2.5 billion dollars has been raised in the form of a private investment in public equity, or PIPE, from well known investors including BlackRock, Fidelity and Franklin Templeton

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

Rupert Walford

There are no available Videos from "Rupert Walford"