The Investment Process and Security Selection

Alex Struc

20 years: Asset management

This two-part video series will help us understand the investment process and explore what sources of repeatable performance can arise from its various components.

This two-part video series will help us understand the investment process and explore what sources of repeatable performance can arise from its various components.

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

The Investment Process and Security Selection

8 mins 32 secs

Key learning objectives:

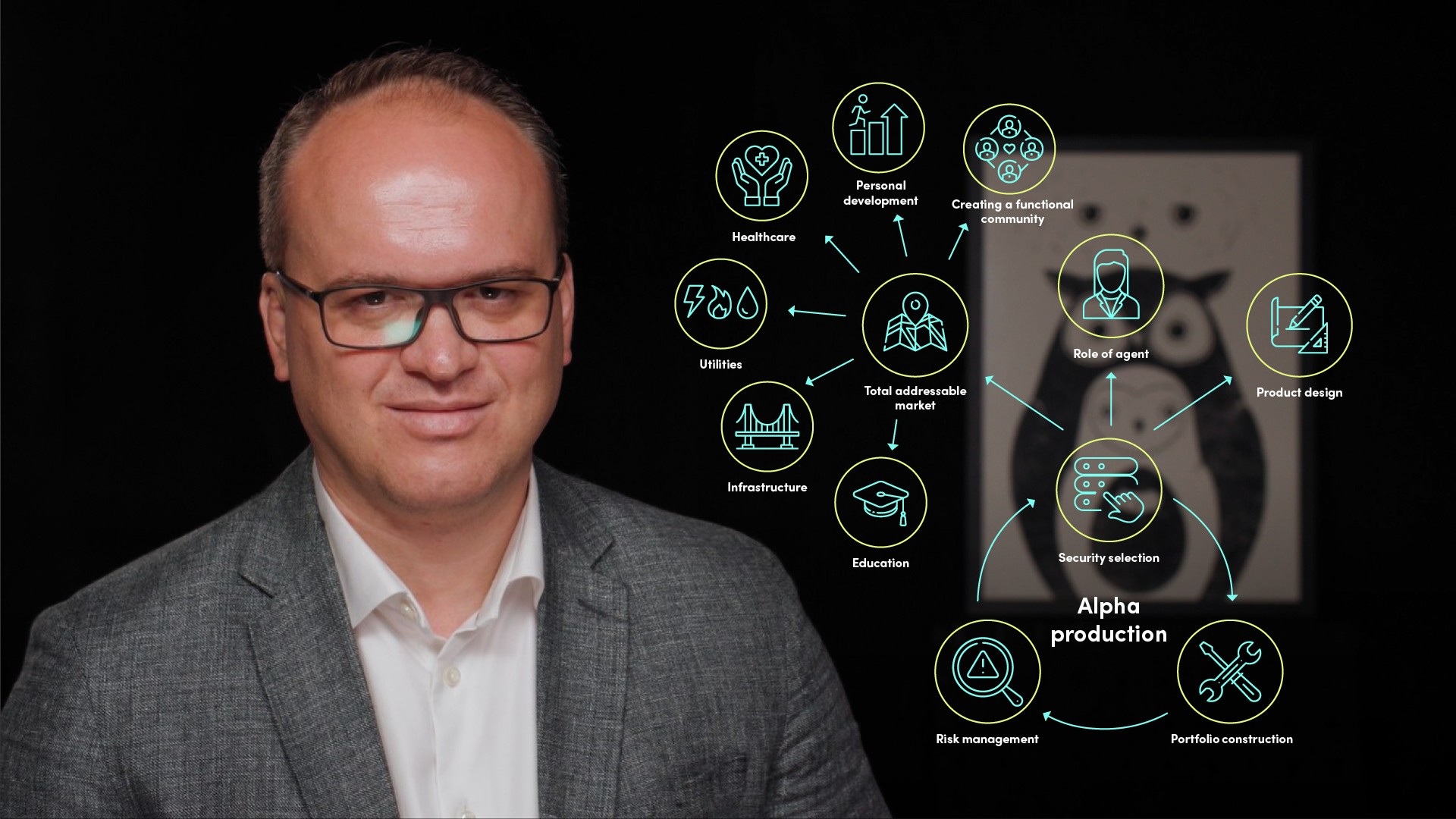

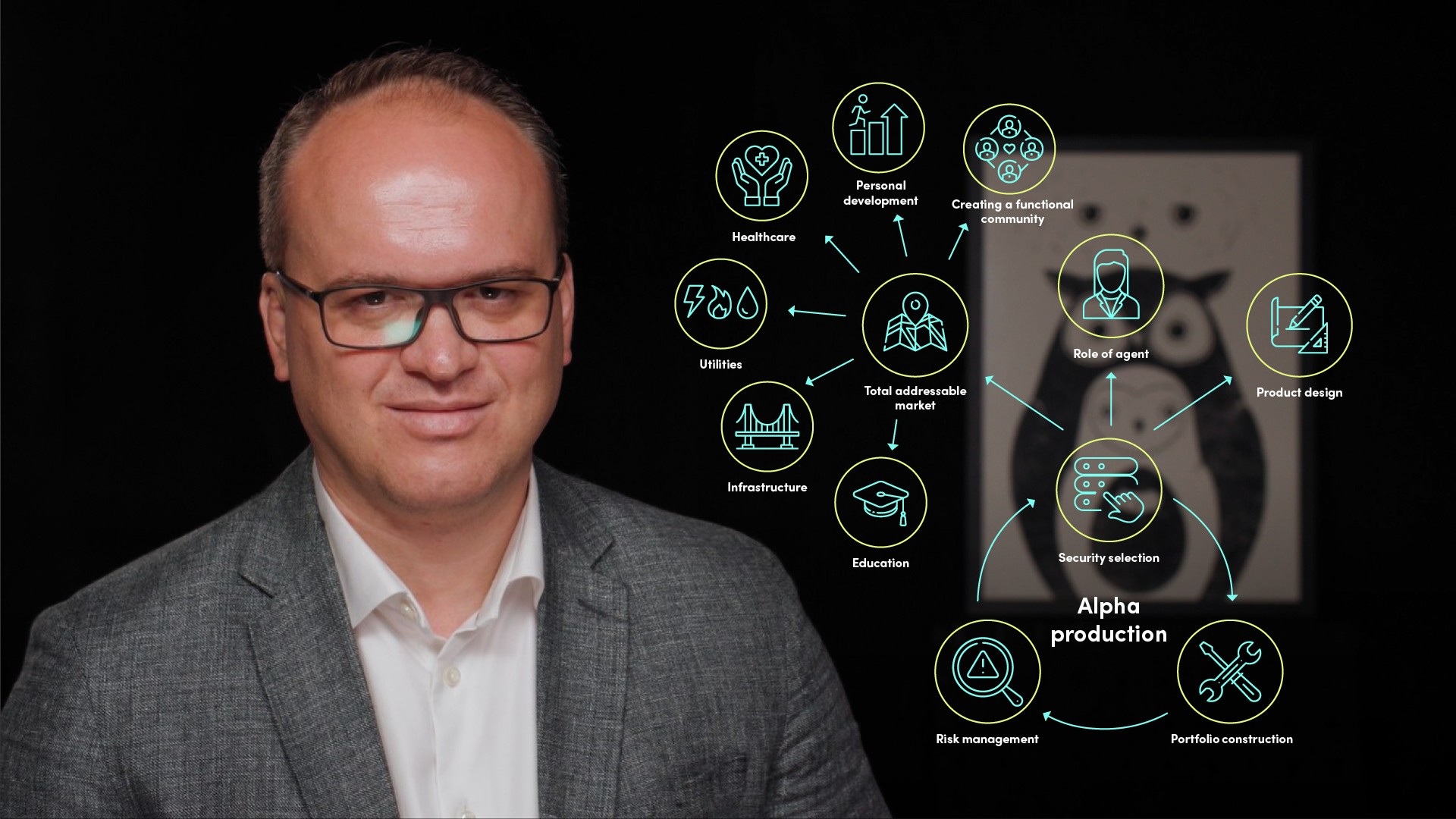

What are the key stages in the investment process?

Recognise how the activities of the investment process fit with one another

Understand what sources of repeatable performance can arise from its various components

Overview:

Security analysis is a discipline of understanding the underlying fundamentals of a business or sector. The key outcome is the point prognosis based on the assessment of the total addressable market.

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

What are the key stages in the investment process?

- Security selection

- Portfolio construction

- Risk management

What are the benefits of focusing on each discipline?

- Help investors stay focused on finding sources of outperformance

- Helps investors learn from mistakes

Harmony in the investment process

- Security analysis is the practice of weighing the risks and opportunities arising from a business activity. The key outcome of all investment analysis is opportunity-based security selection. The cornerstone of all security selection is research, which pivots on applying knowledge of sector-specific fundamentals to make a timely call.

- Portfolio construction is about combining multiple securities into a diversified proposition, which can increase the efficacy of an overall investment strategy by reducing risks. The focus of portfolio construction is sizing - i.e the practice of deciding on and allocating a portion of the portfolio's cash to individual positions. Portfolio managers combine securities with various risk-reward profiles to reduce correlation while still aiming to achieve the highest possible rate of return.

- Risk management is the discipline of scaling portfolio positions to contain mistakes and amplify what works best. The information gleaned from historical performance and linking it to past decisions – otherwise known as attribution – can further inform research, which underpins and improves security selection and portfolio construction.

What is Security selection?

The term security selection applies to many financial instruments and sectors like futures, options, fiat currencies, crypto assets, private lending, real estate, and many others.

What are the key elements of security selection?

- Total addressable market

- The role of the agent

- Product design

What is MOAT?

MOAT, the term popularized by Warren Buffet, is often used to explain a business’s ability to maintain competitive advantages over its competitors to protect its long-term profits and market share.

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

Alex Struc

There are no available Videos from "Alex Struc"