What is Time Value of Money?

Abdulla Javeri

30 years: Financial markets trader

Time Value of Money is arguably the most important concept in the world of business and finance. In this video, Abdulla explains the concept of Time Value of Money, step by step.

Time Value of Money is arguably the most important concept in the world of business and finance. In this video, Abdulla explains the concept of Time Value of Money, step by step.

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

What is Time Value of Money?

6 mins 8 secs

Key learning objectives:

Define the Time Value of Money

Identify the equation used to calculate TVM

Overview:

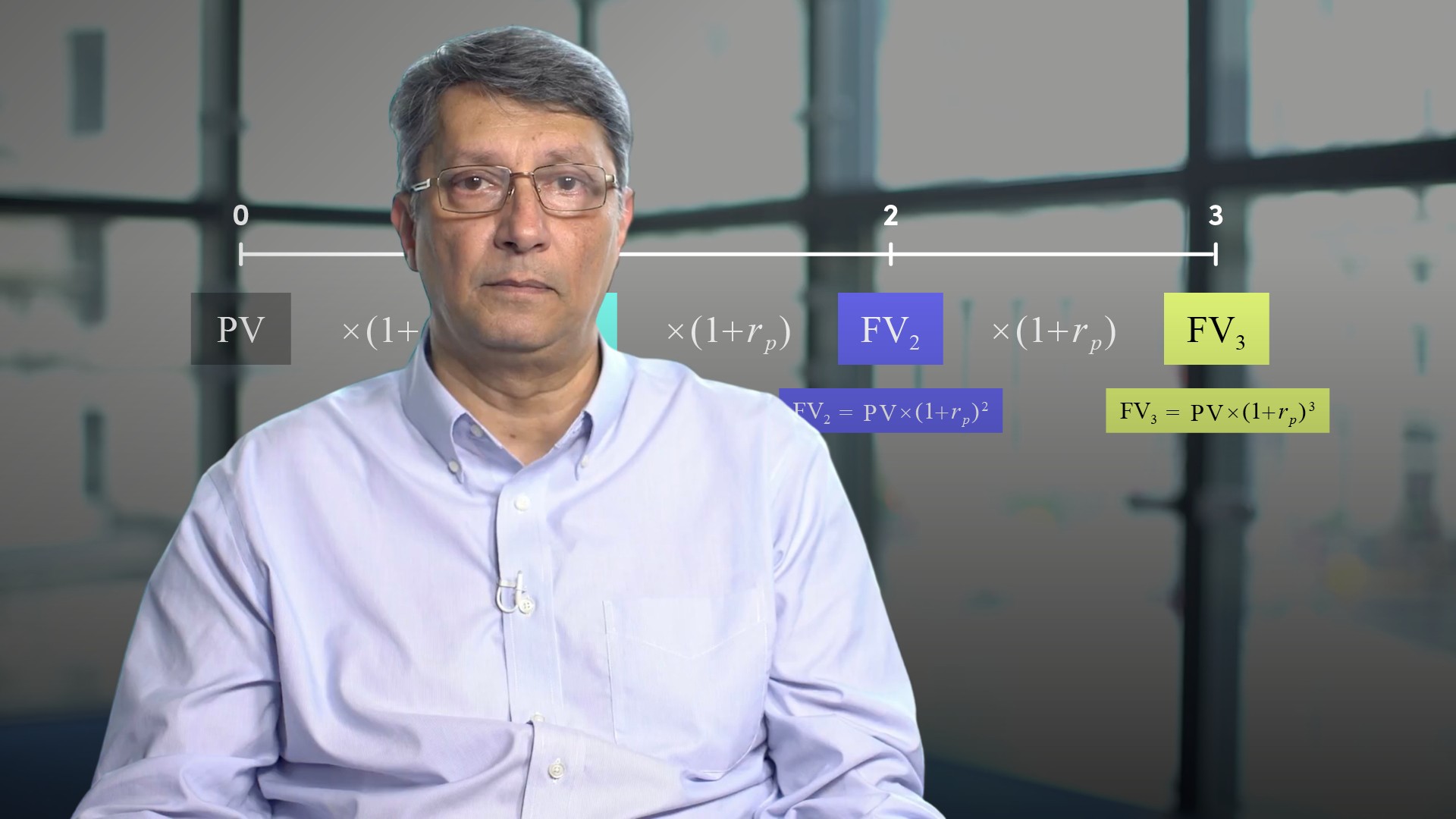

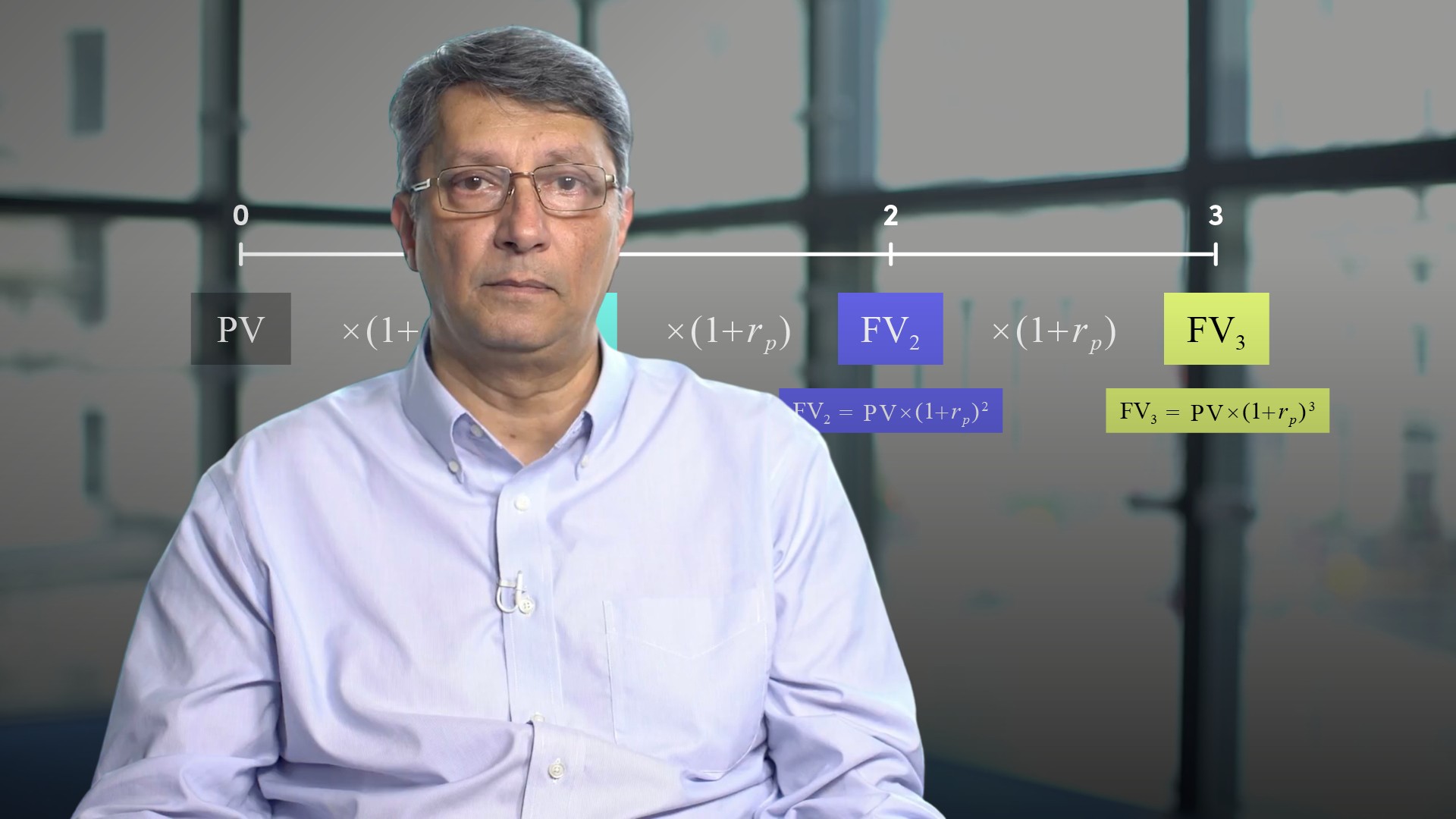

The concept of the Time Value of Money (TVM) is that money has a value today (its Prevent Value or PV) that can be invested at a given interest rate to derive a higher Future Value (FV). For value comparisons, FV can be discounted to a PV equivalent. PV can be compounded to find its FV.

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

What is the Time Value of Money?

The time value of money (TVM) is arguably the most important concept in business and finance and is fundamental to understanding value, the profitability of investments and the value of financial assets. The concept of TVM is that money has a value today (its Prevent Value or PV) that can be invested at a given interest rate (i.e. compounded) to derive a higher Future Value (FV). For comparisons, FV can be discounted to a PV equivalent. PV can be compounded to find FV, using a simple formula.What is the equation used to calculate TVM?

FV = PV x (1+rp)periods(n)Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

Abdulla Javeri

There are no available Videos from "Abdulla Javeri"