Distinct Areas of Investment Banking

Bill Gallagher

30 years: Credit & banking

In the second part of Bill's video on investment banks, he explains some of the functions the bank performs, including capital raising, sales and trading, and financial advisory.

In the second part of Bill's video on investment banks, he explains some of the functions the bank performs, including capital raising, sales and trading, and financial advisory.

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

Distinct Areas of Investment Banking

12 mins 3 secs

Key learning objectives:

Define capital raising

Outline the benefits of trading for investment banks

Identify the financial advisory services offered by investment banks.

Identify the risks that investment banks are exposed to

Overview:

Investment banks generally cover several distinct areas: capital raising, through debt and equity instruments; financial advisory services, including M&A advice; and sales and trading services, through trading desks. However, this leaves them liable to legal, credit, market and other forms of risk.

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

What is capital raising?

Capital raising means helping a company, financial institution, government or other organisation raise money. This can also mean helping institutional clients execute large sales of debt or equity positions.What are the traditional forms of capital raising?

- Loan from a single commercial bank - In a traditional lending relationship, a commercial bank will lend funds backed by its balance sheet and retain that loan through maturity.

- Syndicated loan market - if a single bank is unable or unwilling to extend large debt facilities, it will club together with other banks to ‘syndicate’ the facility.

What are the alternative forms of raising capital?

- Equity, i.e. issuing shares (or helping existing shareholders sell all or part of their stake)

- Debt, i.e. issuing bonds

What do investment banks advise on?

- Target groups of investors i.e. large institutions or individual retail investors

- The form of instrument that would allow the issuing entity to best realise its goals

What are some examples of institutional investors?

Most of the distribution function of investment banks is geared to more sophisticated institutional investors such as:- Asset management companies

- Insurance companies

- Pension funds

- Hedge funds

- Sovereign wealth funds

- High net worth individuals

- Family offices

What does the sales and trading service consist of?

The investors with whom investment banks place these instruments may wish to sell eventually. To facilitate that need, investment banks will engage in equity and debt trading through “trading desks”. Trading desks will “make markets” in certain instruments, they will quote tight two-way prices as well as indications of the size those prices are good for to attract two-way investor flow.What are the benefits of trading for investment banks?

- Profit from price differences in buying and selling these instruments

- Gain knowledge about investor appetites and sentiment that becomes useful when an investment bank wishes to assist their issuer clients

Why has the profitability of sales and trading for investment banks decreased over the last decade?

- Increased price transparency from the information exposure as well as new regulation

- Vastly lower trading costs

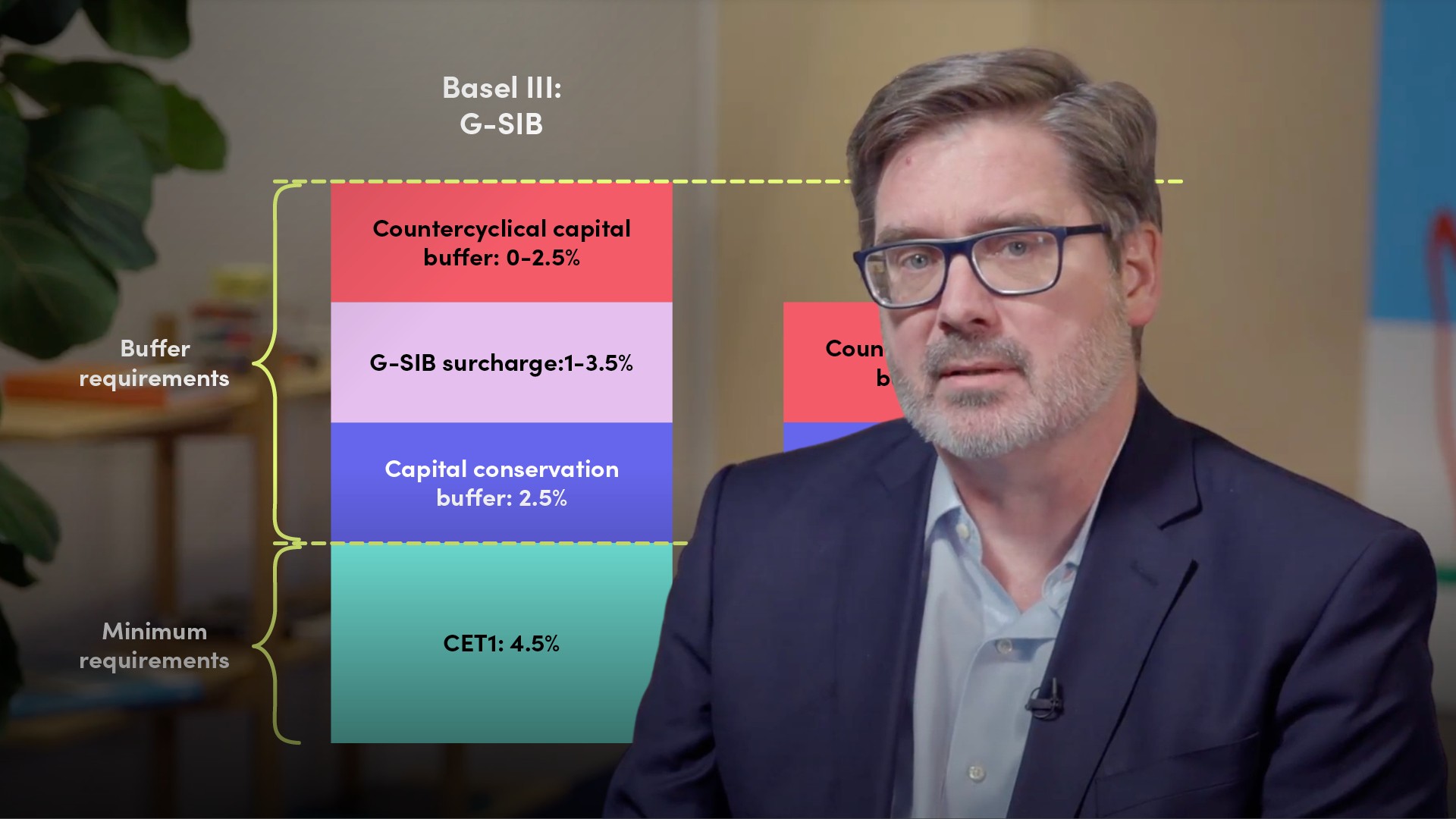

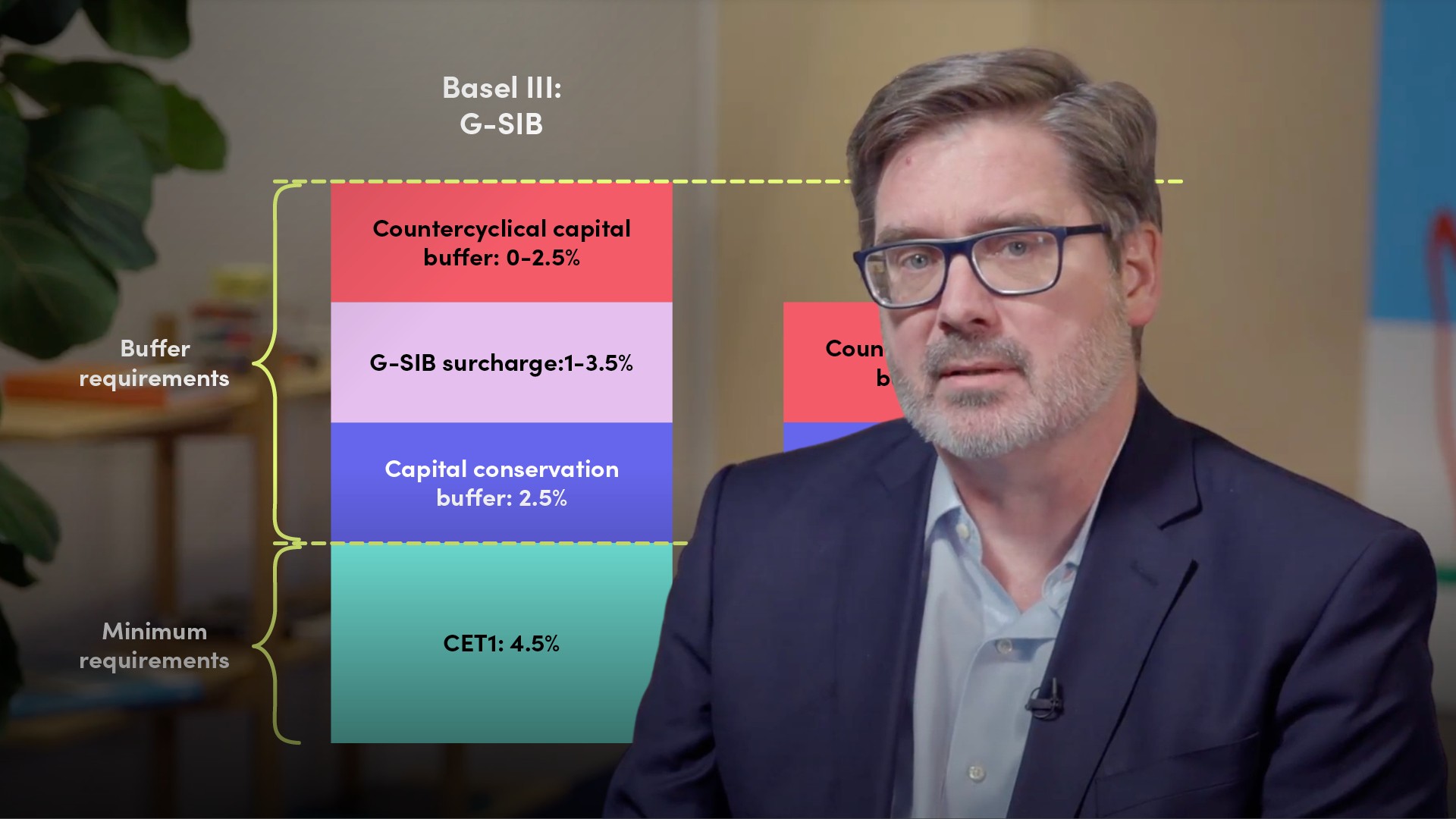

- Increased bank capital requirements

- Strict limits on certain types of investments with a bank’s own capital. The most notable restriction being the “Volcker Rule” which bans banks from using their own capital to trade on their own account (proprietary trading), or investing in and sponsoring hedge funds and private equity funds

What financial advisory services do investment banks provide?

- Financial advisory services are broad-ranging and can be related to mergers and acquisitions and divestments

- How should a company finance itself?

- How should a business deal with financial distress - i.e. does it file for protection from creditors?

- Providing advice to members of a company’s board of directors as to whether a major transaction is “fair”

What are the requirements of an M&A investment banker?

- Have a deep knowledge of a business sector

- Perform an investigation into the strengths and weaknesses of the business being bought or sold (due diligence)

- Provide a document that describes the business that is being sold

- Forecast future financial performance based upon informed assumptions

- Arrive at a valuation of the business that reflects similar transactions and businesses

- Must have expertise in running competitive sales processes to obtain the best sales price for clients

- Must have expertise in laws and tactics relating to buying and selling companies whose shares are traded on stock exchanges

What risks are investment banks exposed to?

- Credit Risk

- The risk that an entity that borrows money doesn’t pay it back in a timely manner. Investment banks will seek to minimise their exposure by selling as much of a debt instrument as they can as quickly as they can

- Market Risk

- The risk that appetite for the instrument or market conditions might impact the pricing of the instrument

- Liquidity Risk

- Some instruments that a bank holds might not be sold readily at a price near to their “intrinsic value” because there might be very few investors willing or able to purchase such assets near such value at any given time

- Legal Risk

- When an investment bank seeks to assist an entity in raising money, they will often be obligated by law to provide prospective investors a description of the issuing entity and the instrument that is selling. While the main responsibility for the description will be the issuing entity, the investment bank can also be legally responsible for the description

- Regulatory and Compliance Risk

- How the investment bank engages with both its issuer and investor clients, and the information they provide to the investment bank is also regulated

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

Bill Gallagher

There are no available Videos from "Bill Gallagher"