What is Capital Risk?

David McDonald

20 years: Treasury in Capital Management

In this video, David explains some key concepts relating to capital risk management. He then talks us through an example to illustrate the different types of capital. Finally, he finishes by talking about the three main types of capital risks faced by banks—credit, market, and operational risk.

In this video, David explains some key concepts relating to capital risk management. He then talks us through an example to illustrate the different types of capital. Finally, he finishes by talking about the three main types of capital risks faced by banks—credit, market, and operational risk.

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

What is Capital Risk?

8 mins 59 secs

Key learning objectives:

Understand why a bank needs capital

Outline the different types of bank capital

Understand the key risks to bank capital and how it is managed

Overview:

A bank needs capital to absorb losses so as to protect more senior creditors from losses. Put simply, capital risk is the risk that a bank doesn’t have enough capital. There are several types of capital, each with different risk characteristics such as CET1, Additional Tier 1, and Tier 2 capital. Risks that might deplete a bank's capital include credit risk, market risk and operational risk.

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

Why does a bank need capital and what are the main types?

Capital is the cushion a bank uses to absorb unexpected losses and protect more senior creditors, such as depositors, whilst also protecting the stability of the financial system should a bank enter resolution.

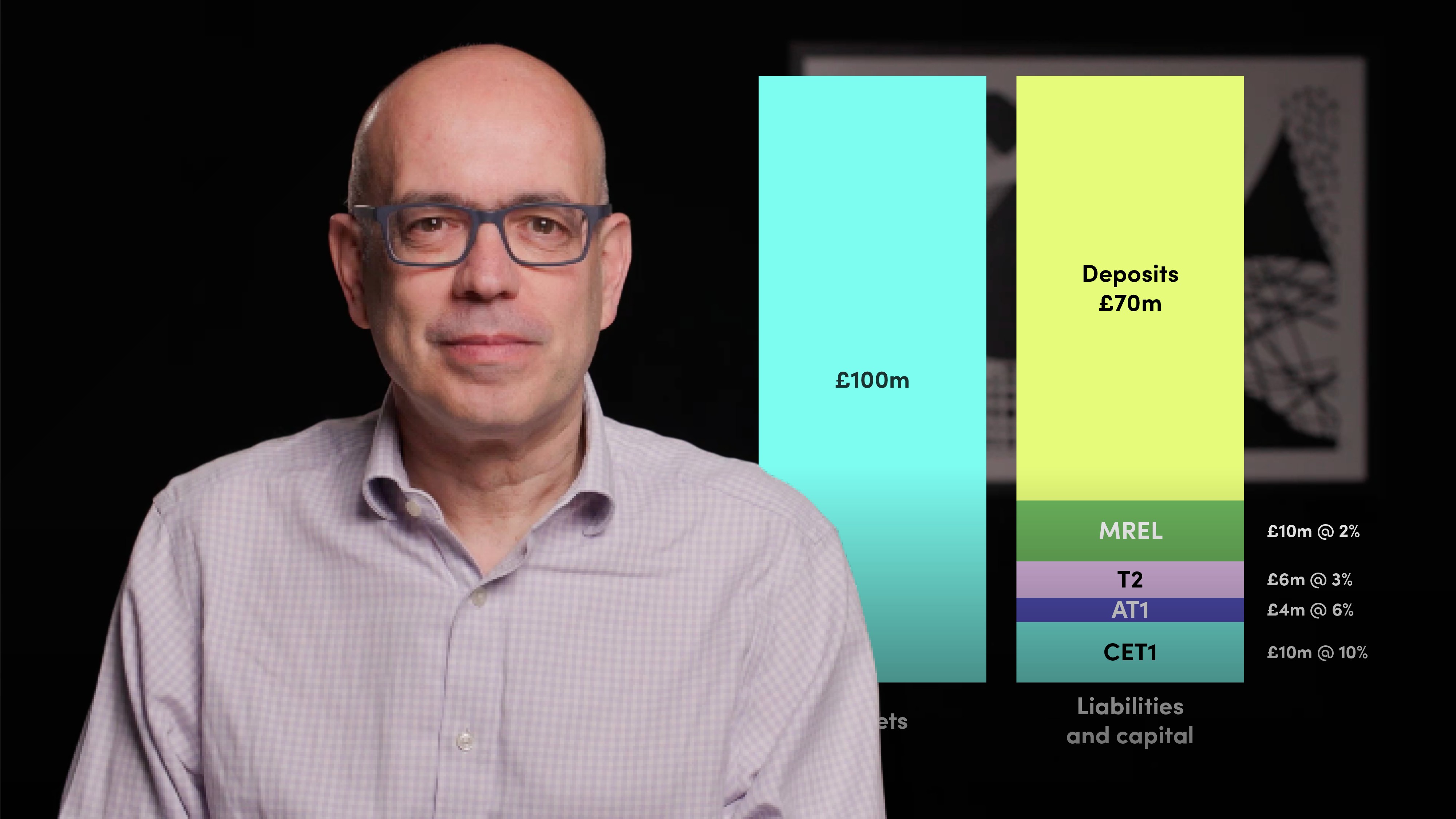

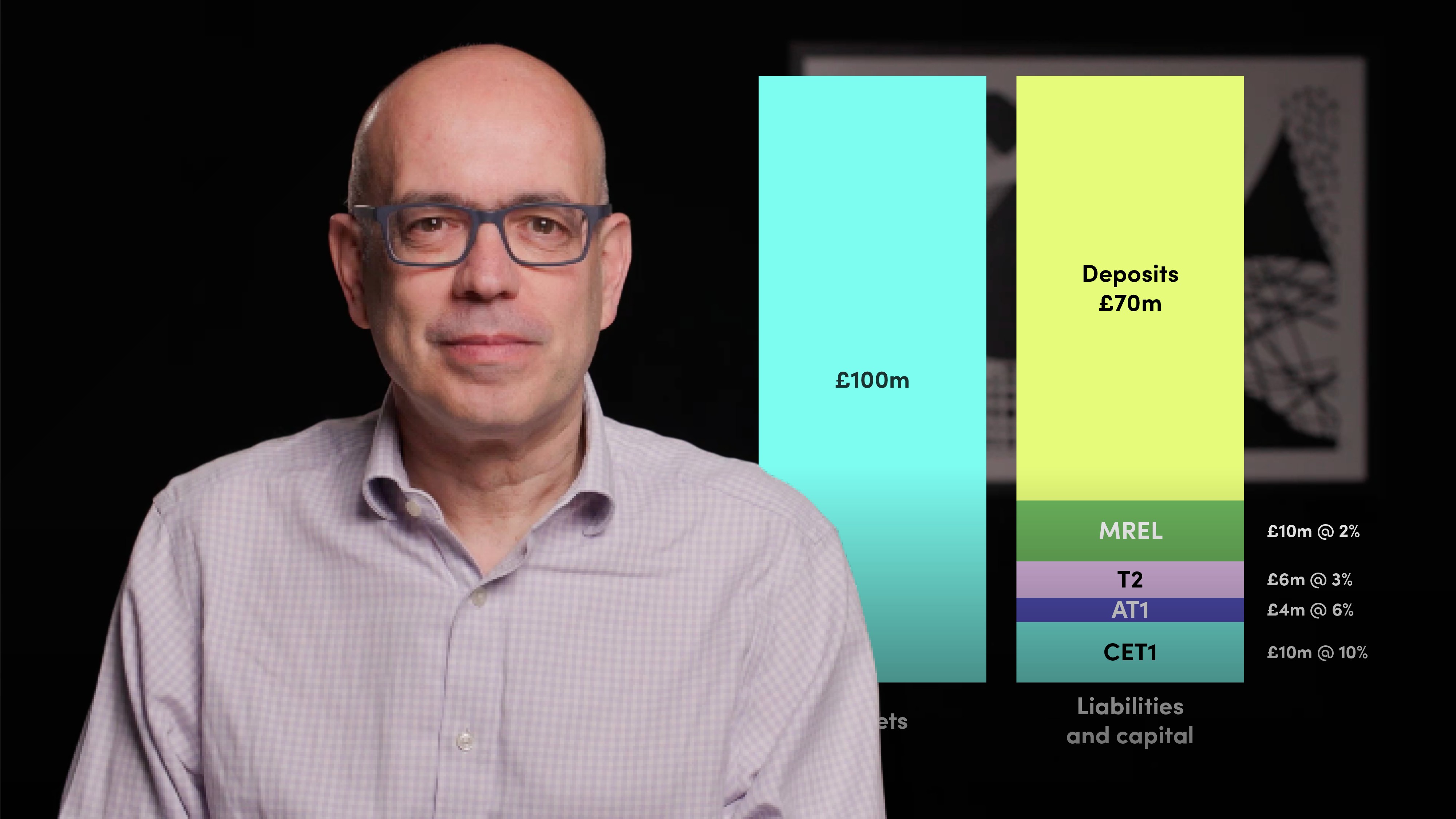

The types of capital are structured through a creditor hierarchy and will absorb losses at different stages.

The first layer of capital that would be used to absorb losses is Common Equity Tier 1 (CET1). It is the book value of shareholders’ equity less regulatory deductions. The shareholders own the bank and their equity is their stake in the bank. They’ll receive a return on their equity through capital growth or dividends, but they accept the risk that their equity will absorb losses if and when they occur.

The next two layers are Additional Tier 1 and Tier 2 capital. AT1 instruments convert into equity at a certain point of non-viability, typically if the CET1 level gets too low. Once it has been converted into equity it can be used to absorb losses.

Tier 2 debt can be used to absorb losses, but once the bank has reached this point, it will have entered into resolution and/or become insolvent.

CET1 and AT1 capital are called going concern instruments as the bank can still be brought back to health, whilst T2 capital is known as gone concern as it will be used once the bank has entered resolution.

What are the main risks to bank capital and how is it managed?

Firstly, credit risk, the risk that a customer, client or counterparty fails to meet their obligations.

Secondly, market risk, the risk that movements in financial markets create a loss.

Finally, operational risk, the risk that the bank loses money because of operational events.

Each of these risk types will typically have their own risk appetite which will be managed independently.

The capital risk appetite will be set by the board and they will determine:

- How much capital they believe the bank needs to support its business plan

- How much capital the bank needs to meet its regulatory requirements

- How much capital the bank needs to meet its desired target external ratings

Today, a bank’s internal approach to capital risk measurement is called ‘Economic Capital’.

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

David McDonald

There are no available Videos from "David McDonald"