Conditional Value at Risk (CVaR)

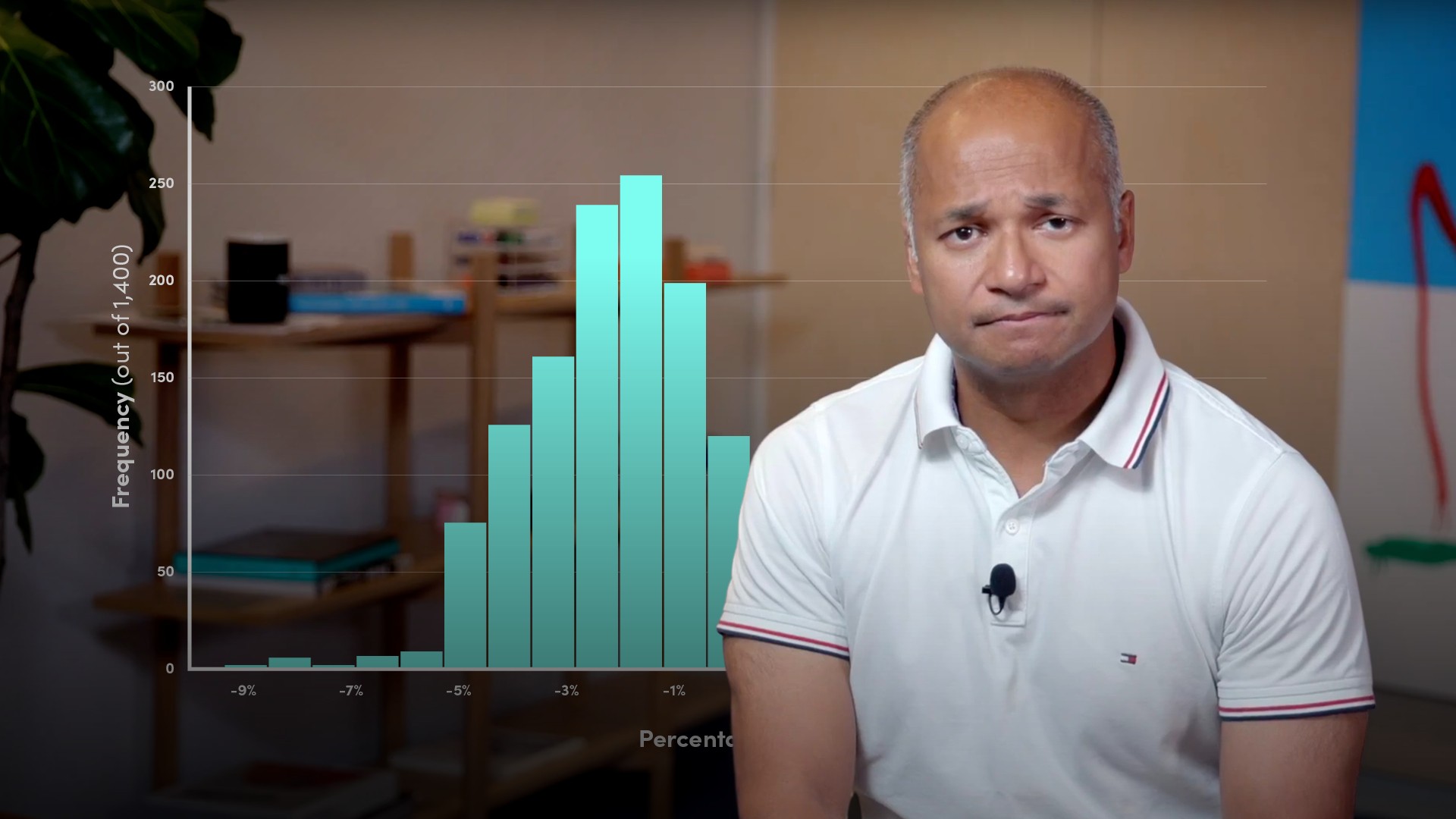

Value at Risk (VaR) and Conditional Value-at-Risk (CVaR) are risk management tools that model portfolio risk. A ten-day USD10m VaR with a 95% confidence interval means there is 95% confidence level that portfolio losses will be capped at USD10m in the next ten days. CVaR addresses what losses could be expected for the remaining 5% beyond the confidence limit. CVaR calculates the probability weighted expected loss beyond VaR thresholds. It measures tail risk.