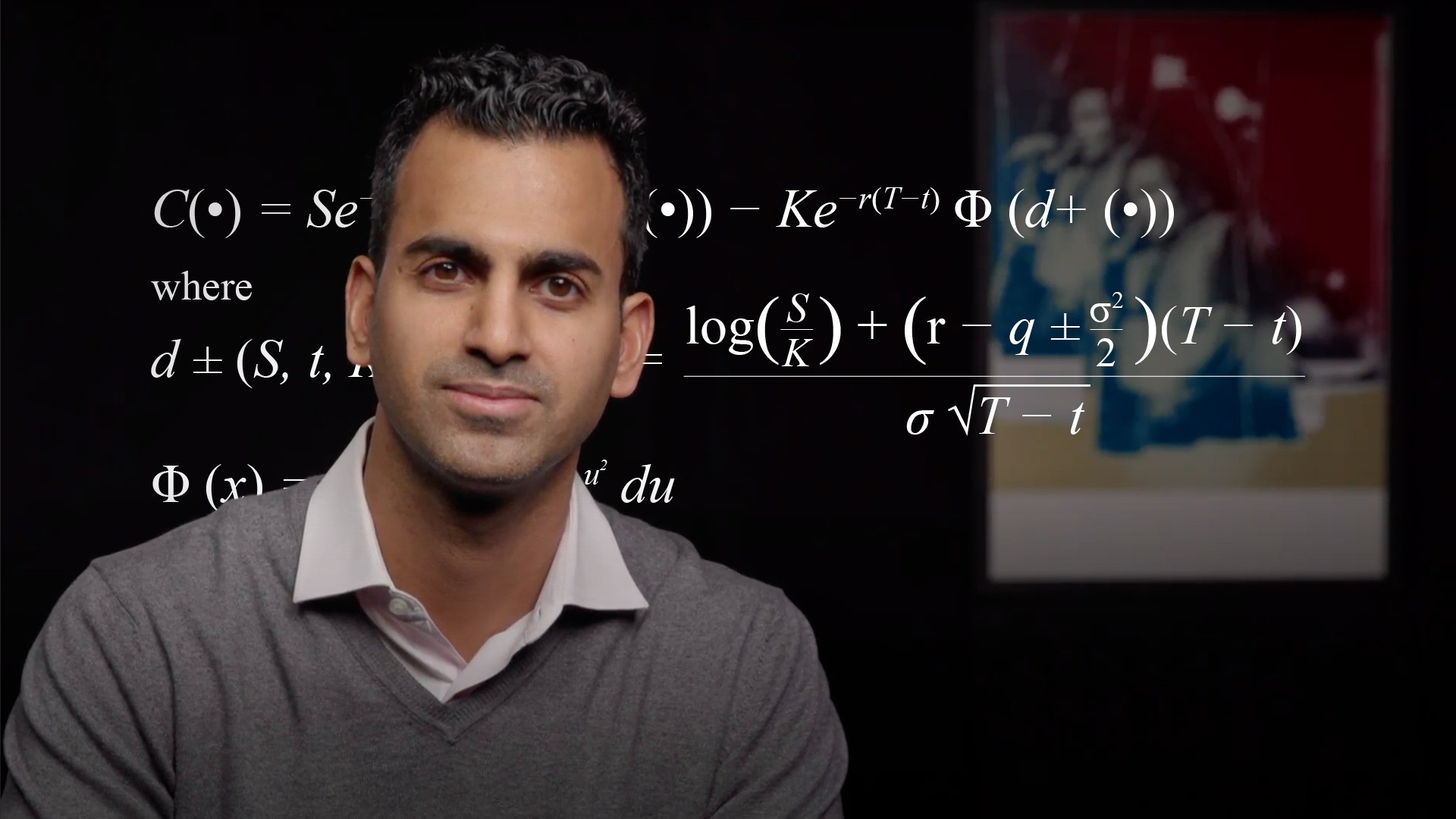

Implied Volatility

Volatility in options markets statistically measures the standard deviation of potential annualised returns of a security or asset. Options markets use historic and implied volatility. Historic volatility tells traders how volatile a security has been in the past, whereas implied volatility is the degree of annualised forward-looking volatility implied by the option’s current price. The higher the implied volatility, the higher the options price.