Tangible Common Equity

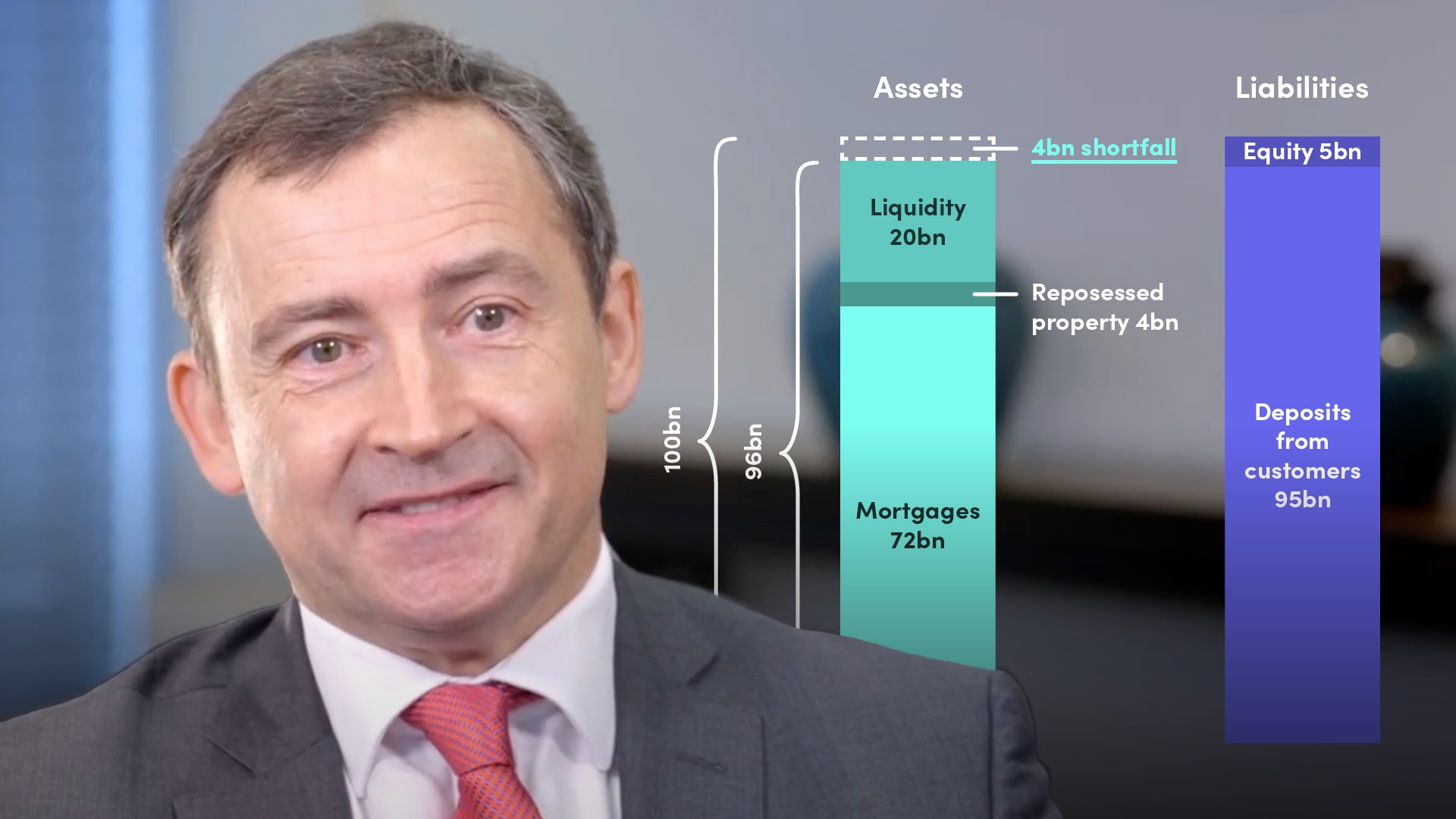

A firm’s tangible common equity is its shareholders’ equity (i.e. assets minus liabilities) minus intangible assets (although some analysts exclude patents from intangibles from this calculation as they may have liquidation value). Banks calculate their tangible common equity against their tangible assets to calculate their tangible common equity ratio, a non-GAAP ratio, to assess their capital adequacy. Banks also calculate a tangible common equity to risk-weighted asset ratio for similar reasons.