Navigating the murky waters of green claims in the UK

Prasad Gollakota

20 years: Capital markets & banking

What the FCA’s new anti-greenwashing guidance means in practice

The UK Financial Conduct Authority (FCA) issued a stern warning in its recent consultation paper on greenwashing, emphasising the pivotal role of accuracy and substantiation in firms' claims. For financial professionals, ensuring that their institutions adhere to these guidelines is not only a regulatory imperative but also a key component to maintaining trust and credibility in a discerning market.

Why does the FCA have an anti-greenwashing rule?

Tackling greenwashing is a priority for the FCA. As consumers increasingly demand for sustainable products and services, regulators want to ensure that consumers are protected from greenwashing so they can make informed decisions aligned with their sustainability preferences. Moreover, they want to create a level playing field for firms whose products and services genuinely represent a more sustainable choice.

The FCA’s anti-greenwashing rule is one part of a package of measures being introduced by the FCA through its Sustainability Disclosure Requirements (SDR) and investment labels regime PS23/16. The ultimate goal of these measures is to support the UK economy transition to Net Zero by 2050.

What does the guidance require?

What communications does the guidance cover?

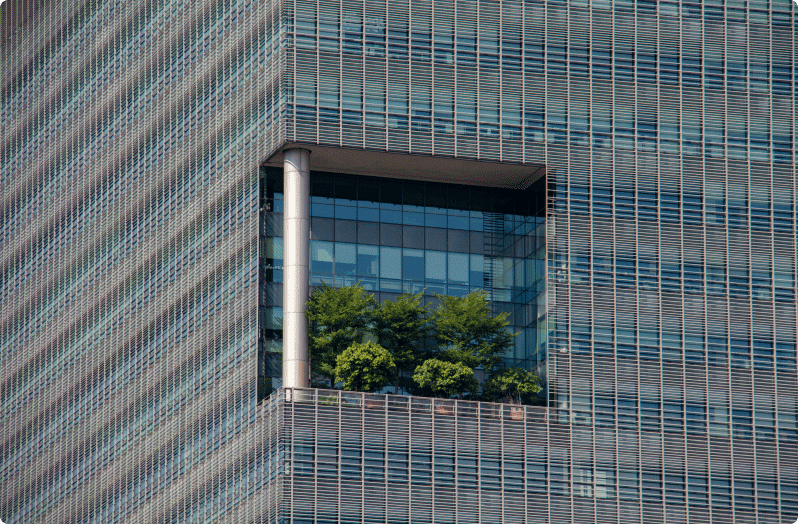

The rule applies to all communications about financial products or services that refer to the environmental and/or social (ie, ‘sustainability’) characteristics of those products or services. Sustainability-related references can be present in, but are not limited to, statements, assertions, strategies, targets, policies, information, and images. Eg. a mortgage or savings account is green.

Who does the guidance apply to?

The guidance applies to all FCA-authorised firms that make sustainability-related claims about their products and services. It also includes firms that approve financial promotions for unauthorised persons, for communication in the UK.

When does the guidance apply?

31 May 2024.

What practical tips should professionals action?

Financial professionals can take a proactive approach to ensure compliance with the FCA's guidelines on accurate and substantiated claims. Here are some practical steps:

1. Thorough Due Diligence

Conduct a comprehensive review of product claims to ensure they align with the reality of the offerings. Scrutinize terms and conditions to identify any discrepancies between promotional statements and actual product characteristics.

2. Evidence Documentation

Establish robust documentation processes to capture evidence supporting sustainability claims. This includes data on investment decisions, due diligence procedures, and any relevant certifications or third-party assessments.

3. Regular Audits

Implement a periodic audit system to review and validate ongoing compliance with greenwashing regulations. This ensures that claims made at the time of promotion remain accurate and substantiated throughout the product's lifecycle.

4. Transparency Initiatives

Consider proactively making evidence supporting sustainability claims publicly accessible. This can be done through dedicated sections on the company website, providing stakeholders with transparent insights into the institution's commitment to sustainable practices.

5. Employee Training

Educate employees on the importance of accurate and substantiated claims. Foster a culture of responsibility and authenticity within the institution, making every employee a steward of the institution's commitment to sustainability.

Also relevant…

The FCA has worked closely with the Competition and Markets Authority (CMA) and Advertising Standards Authority (ASA) to ensure their proposed guidance on the anti-greenwashing rule is consistent with the CMA guidance and the requirements of the ASA’s CAP and BCAP Codes. CAP is the Committee of Advertising Practice and covers all non-broadcast advertising. BCAP is the Broadcast Committee of Advertising Practice for TV and radio.

The FCA has separate regulatory responsibilities to the CMA and ASA, but there are some important overlapping areas. Existing consumer protection frameworks (administered by the CMA & the ASA) do not adequately prevent businesses from making false or misleading environmental or sustainability-related claims about their products and services.

Prasad Gollakota

Share "Navigating the murky waters of green claims in the UK" on

Latest Insights

UBS and Switzerland: Capital hikes are not the right tool for the job

15th October 2025 • Prasad Gollakota

Trade deals & trade wars: The regional impact

23rd May 2025 • Adrian Pabst and Eliza da Silva Gomes

Unpacking the truth behind U.S. Treasury market volatility

17th April 2025 • Prasad Gollakota