Sustainable funding with contingent returns to investors

Keith Mullin

35 years: Capital markets editorial

The World Bank’s plastic waste-reduction bond is not quite what it appears to be

The World Bank (a.k.a. the International Bank for Reconstruction and Development or IBRD) priced its fourth Outcome Bond on January 24th: USD 100m in seven-year principal-protected Plastic Waste Reduction-Linked Notes. The bonds are listed in Luxembourg and were offered to investors by sole underwriter Citigroup.

But let’s be very clear from the get-go: the World Bank is categorically not financing plastic waste reduction to the tune of USD 100m. In fact, the World Bank is allocating no cash whatsoever to plastic waste reduction. The bond’s nomenclature is highly misleading.

Proceeds from the sale of the bonds (USD 100m less fees) will finance the World Bank’s standard sustainable development projects and are in no way related to the two designated projects that will receive funding from the bonds. The projects that are getting funded are not World Bank projects. They were selected by project developer Plastic Collective UK, with which the World Bank has no relationship.

The funding for plastic waste reduction amounts to just USD 14m and is coming not from the World Bank but from the investors who bought the bonds. These included Danish pension provider Velliv, Swedish financial services company Skandia, Canadian asset manager Mackenzie Investments, and US-based asset managers T. Rowe Price and Muzinich & Co.

While investors in the bond will get all of their principal back at maturity, they have agreed to accept a below-market fixed annual coupon of 1.75% throughout the bond’s life. The USD 14m in project funding is in effect an investor donation derived from the present value of the coupon differential relative to standard IBRD bonds. The cash is being paid out up-front in two instalments via a hedge transaction between the IBRD and Citigroup.

The projects will use the cash payments to ramp up capacity at existing facilities, add collection and recycling sites, and install food-grade recycling equipment.

One project is the ASASE Project in Accra, Ghana. Run by the ASASE Foundation, the project starts up small recycling plants as social enterprises in communities where plastic pollution is most severe. The plants use networks of waste pickers, who collect plastic waste from households, businesses, schools, markets and landfill sites. The project seeks to empower women entrepreneurs to build their own plastic waste collection businesses as a sustainable source of income and employment.

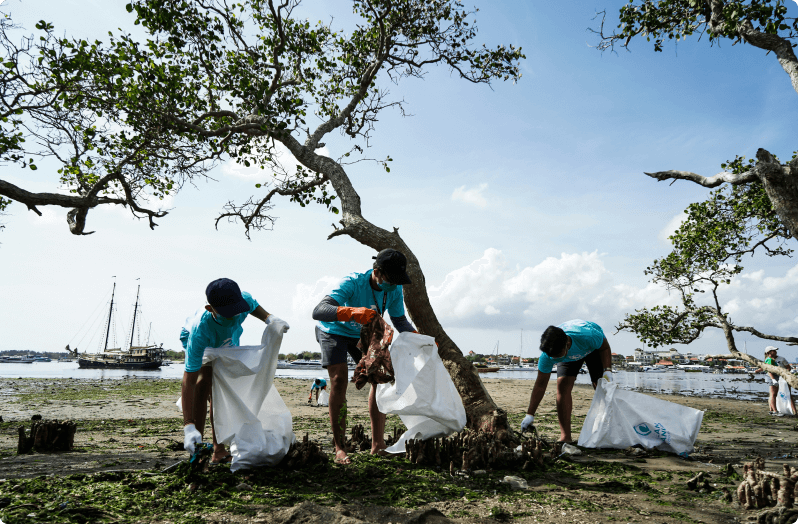

The other is Greencore Resources’ SEArcular Project in Surabaya, Indonesia. The project provides training, employment and price premiums to coastal communities for the ocean-bound plastic they collect. The project receives household and commercial plastic waste from pickers, aggregators and suppliers collected from beaches, waterways, streets, bins and dumpsters in public areas.

As well as aiming to reduce the amount of plastic ending up in nature and the sea, the projects will also bring about important subsidiary benefits (particularly as they ramp up), such as less pollution and better air quality hence fewer associated negative health impacts, as well as job creation in poor communities.

In the next decade, the projects are expected to collect roughly 230,000 tons of plastic waste, 180,000 tons of which will be recycled. They are currently seeking registration in the VERRA Registry. This is the database for projects vetted and approved by VERRA, the non-profit that manages the Verified Carbon Standard (VCS) and other programmes. Plastic Collective UK will manage the plastic and carbon credit programmes of the two projects and will publish an annual plastic waste reduction report on its website as soon as possible after each bond interest payment date up to maturity.

Contingent returns

While investors have accepted a below-market fixed annual coupon, they potentially stand to generate returns above conventional IBRD bonds. But any additional payments to investors will come exclusively from the sale by the Plastic Collective UK of any Plastic Credits (Plastic Waste Collection Credits, WCCs; Plastic Waste Recycling Credits, WRCs) and Verified Carbon Units (VCUs) generated by the projects.

Noteholders are exposed to the risk that the quantity of Plastic Credits or VCUs generated and issued into the VERRA Registry is lower than anticipated. Or zero. Which would reduce or eliminate contingent cash flows on the bonds. The World Bank has zero dollar exposures here. Payouts to investors in the bonds follow this formula:

(Fixed Interest Amount + VCU Linked Interest Amount + Plastic Credits Linked Interest Amount + Shortfall Catch Up Amount)

The VCU-linked Interest Amount is equal to the number of VCUs issued from the projects, subject to a cumulative ceiling of USD 532.99 per USD 100,000 bond. Each VCU represents a reduction or removal of one tonne of carbon dioxide equivalent (CO2e).

The Plastic Credits-linked Interest Amount is equal to the number of Plastic Credits issued from the projects, subject to a cumulative ceiling of USD 19,468.25 per USD 100,000 bond. A Plastic Credit represents one tonne of plastic waste that has been collected and properly managed (WRC) or recycled (WCC).

If the registration of credits on VERRA is delayed for any reason, investors will also be entitled to a Shortfall Catch-Up Amount, which is a make-whole payment for amounts to which investors would have been entitled on earlier coupon payment dates. At maturity, bondholders may also receive an Additional Redemption Amount, representing a share of the outperformance by Plastic Collective UK in sales of Plastic Credits. This follows a pre-set formula linked to the average price of Plastic Credits sold.

Citi and the World Bank have entered into a Forward Flow Agreement that hedges any Plastic Credit or VCU exposure from the issuer’s perspective. Under the FFA, the IBRD will only make the contingent payments if it has received equivalent amounts from Citi as FFA counterparty. Investors have no risk exposure to the price of carbon or plastic credits as contingent payouts are a function of the number of credits entered into the VERRA registry and are subject to an offtake agreement between Citigroup and the Plastic Collective.

Way forward?

The question is: is this sort of bond financing the way forward? Well, it certainly is one way forward. After all, the World Bank’s plastic waste-reduction bond follows its Carbon Bond (funding a water purification project in Vietnam), Rhino Bond (a wildlife conservation project in South Africa) and UNICEF Bond (Covid response).

But the amounts going to designated projects through these bonds are significantly smaller than the headline size of the bonds, so USD 14m for the USD 100m plastic waste bond and just USD 8m equivalent (ZAR 152m) for the USD 150m Rhino Bond, contingent on the growth rate of the rhino population in two designated South African parks.

The IBRD’s Outcome Bonds have adopted a Social Impact Bond/Development Impact Bond-type framework, whereby institutional investors are exposed to project risk but are rewarded financially if project targets are met. This creates positive alignment between investors and project outcomes. The problem is these bonds are heavily structured and are very complex. The prospectus for the plastic waste-reduction bond makes for a pretty toe-curling read.

Outcome Bonds, SIBs, DIBs, Pay-for-Success Bonds, Pay-for-Performance Bonds, whatever you want to call them, are not for standard institutional investors. They’re for investors who have allocated to impact outcomes, principally philanthropic organisations and foundations that are not driven by out-and-out profit maximisation.

The key question is whether and to what extent this type of bond technology can be leveraged to an industrial scale such that it makes a significant dent in outcomes. I doubt it can or will be. Two projects in Accra and Surabaya won’t move the needle on a global problem. The plastic waste-reduction bonds are linked to small-scale community projects dressed up in very grandiose institutional clothing. The Outcome Bond structure will remain very bespoke with limited overall global impact.

Structures like sovereign debt-for-nature swaps or debt-for-climate swaps may hold more promise. A few deals have been done in the past two to three years, including for Barbados, Belize, Cape Verde and Ecuador. Others are studying blueprints. These have essentially been debt conversions where outstanding expensive debt is repurchased and new money raised at much cheaper rates supported by multilateral guarantees and in some cases political risk insurance from development finance institutions. Through the process, governments commit to funding conservation projects. But, again, commitments are typically in small amounts over long periods of time. The deals are complex, take a long time to put together and involve a lot of moving parts.

Keith Mullin

Share "Sustainable funding with contingent returns to investors" on

Latest Insights

UBS and Switzerland: Capital hikes are not the right tool for the job

15th October 2025 • Prasad Gollakota

Trade deals & trade wars: The regional impact

23rd May 2025 • Adrian Pabst and Eliza da Silva Gomes

Unpacking the truth behind U.S. Treasury market volatility

17th April 2025 • Prasad Gollakota