Equity Index Options Exercises

Lindsey Matthews

30 years: Risk management & derivatives trading

In this video, Lindsey uses the knowledge of equity index options to complete a few exercises.

In this video, Lindsey uses the knowledge of equity index options to complete a few exercises.

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

Equity Index Options Exercises

3 mins 59 secs

Key learning objectives:

Apply your knowledge of equity index options to complete 5 exercises

Overview:

Equity index options exist as both options on futures (which settle into a position in the futures if exercised) and options on the underlying index (which cash settle). The FTSE index options cash settle, using the same settlement price, the exchange delivery settlement price, as the futures cash settle against.

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

Using the options grid, what would it cost to buy the 5,900 call and sell the 5,950 put?

Buy 5,900 call: -160.5

Sell 5,950 call: +127.5

-160.5 + 127.5 = -33

Cost is 33 index points.

If you buy the 5,900 call and sell the 5,950 call, what does the break-even graph for this position look like?

Individually, the two payoffs can be displayed as follows:

The combined payoff is known as a long call spread and can be displayed as follows:

Once the costs have been included:

Using the option pricing grid above, what would it cost to buy the 5,950 put and sell the 5,900 put?

Buy 5,950 put: -158.5

Sell 5,900 put: +129.5

Paying out 29 index points

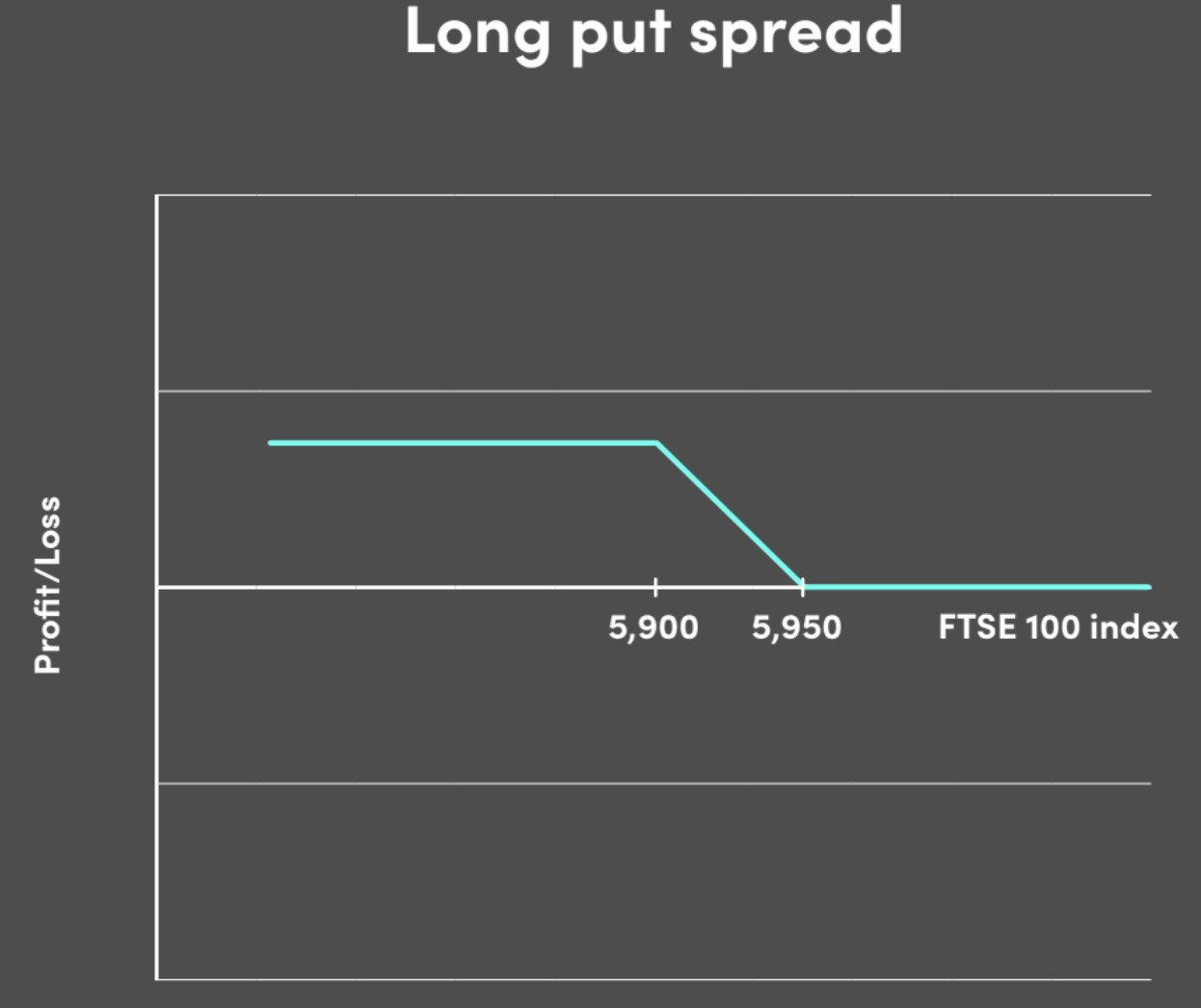

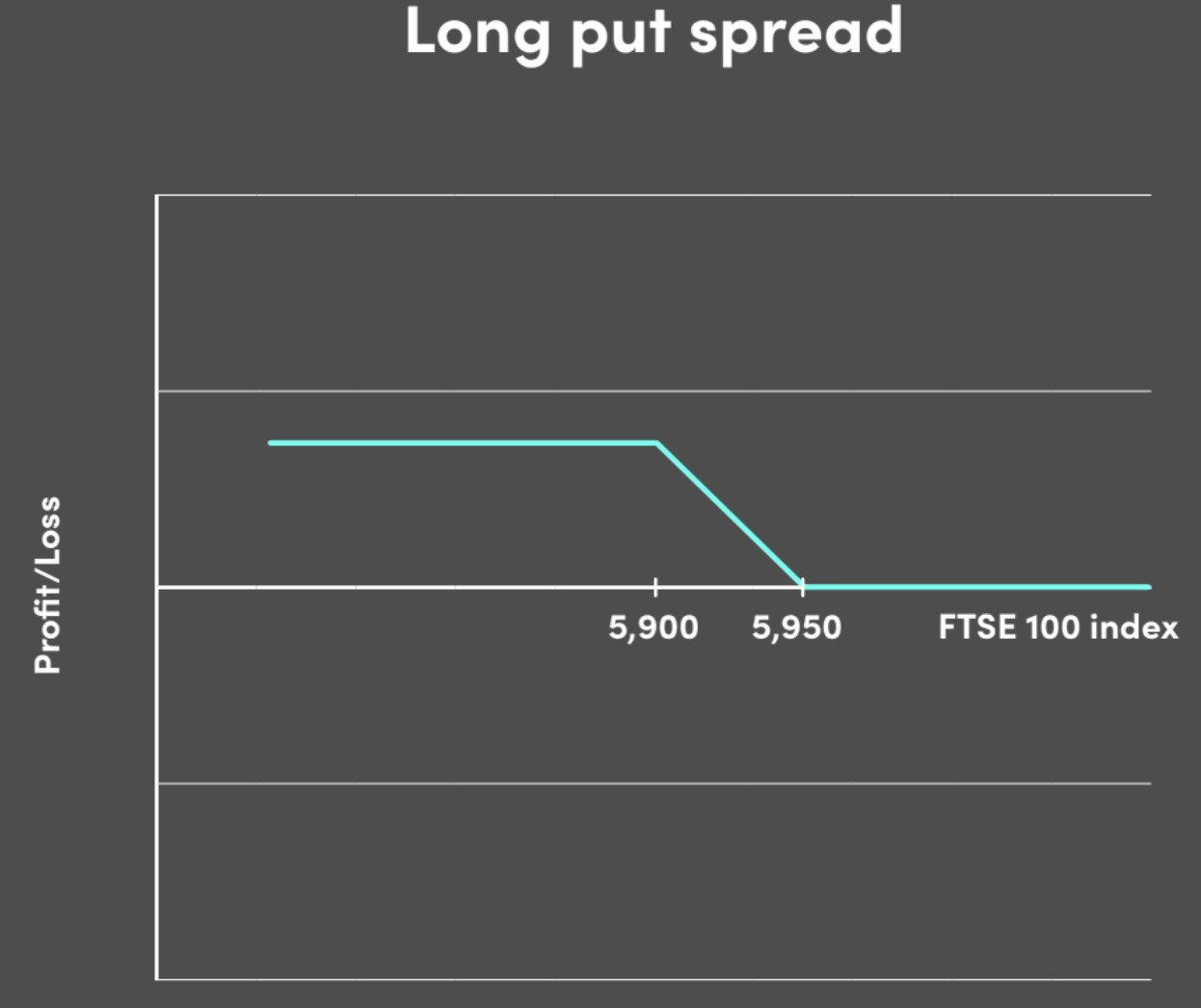

If you buy the 5,950 put and sell the 5,900 put, what does the break-even graph for this payoff look like?

The combined position is known as a long put spread and gives the following payoff before considering costs:

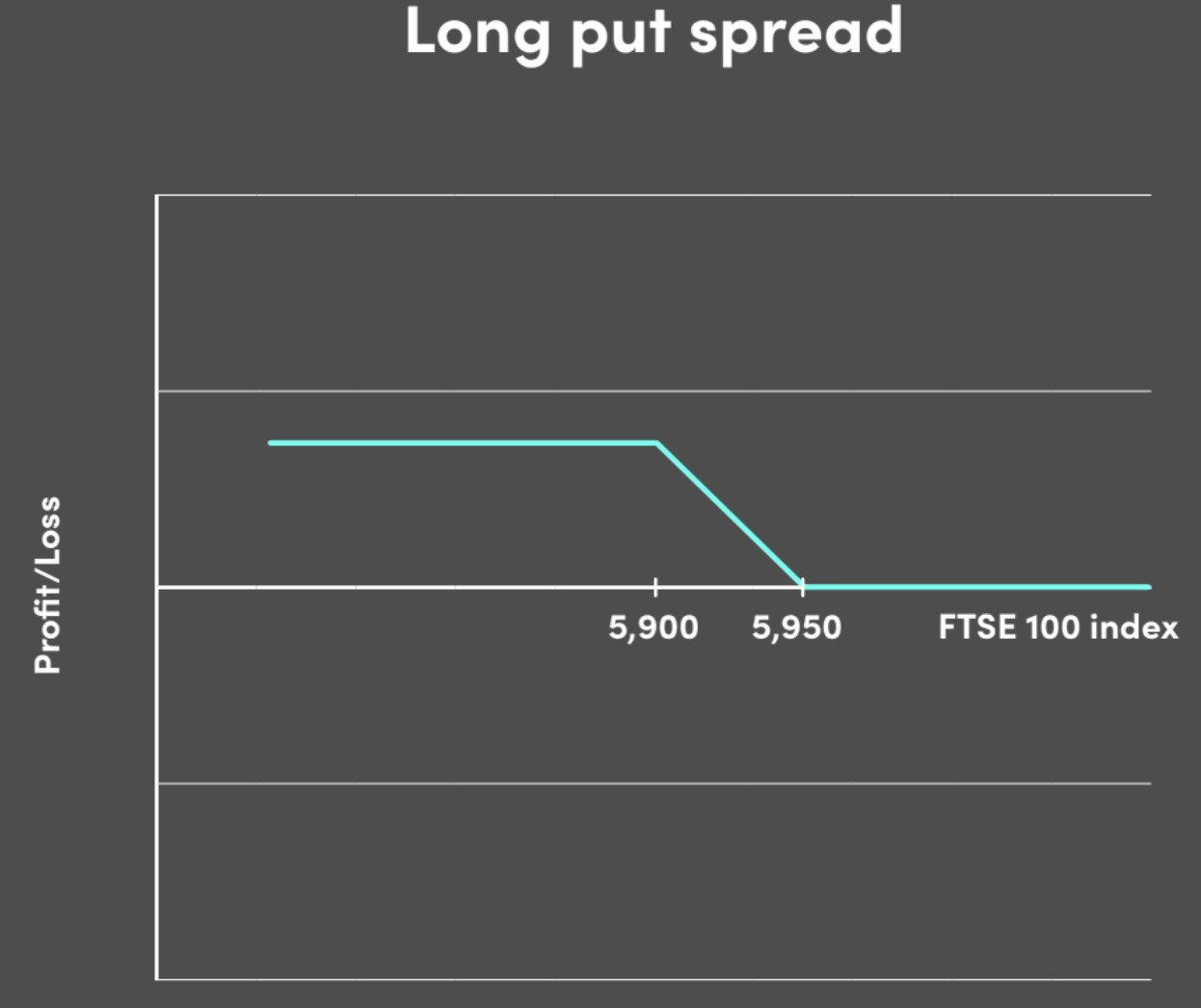

Once costs have been included, the payoff looks like the following:

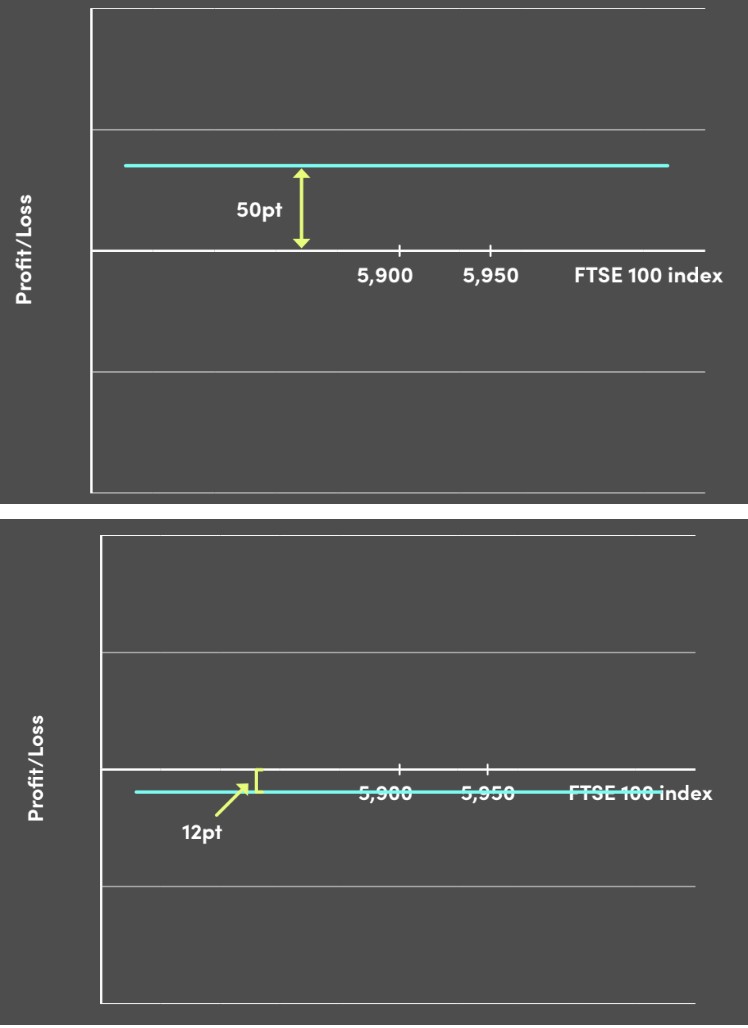

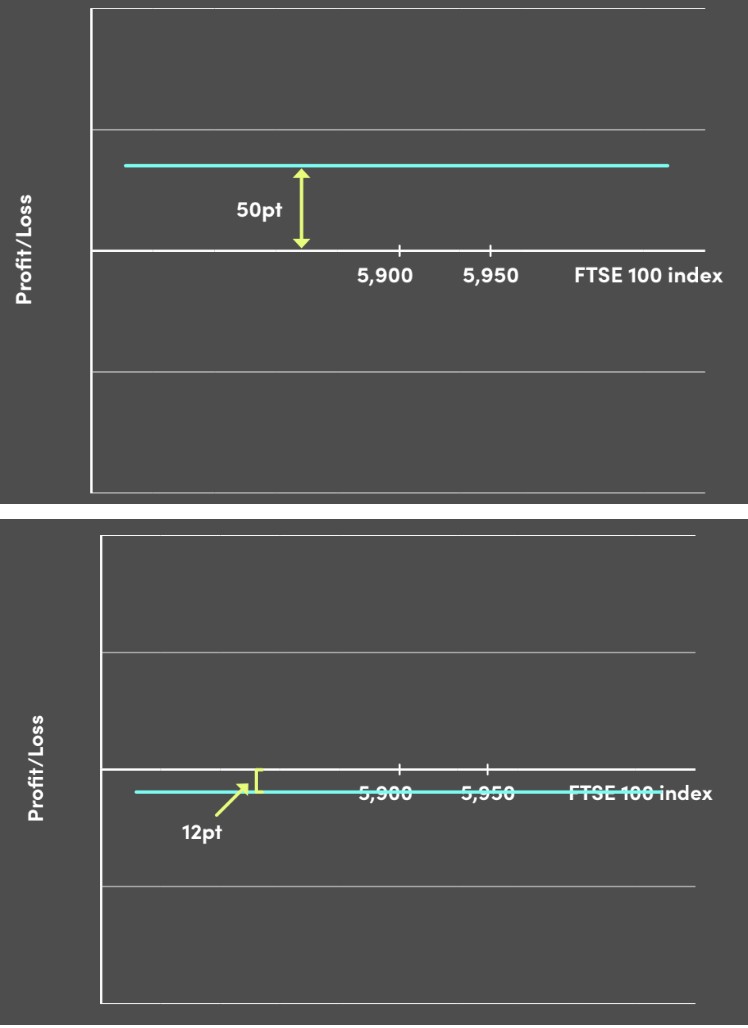

What does the combined position of the long call spread and the long put spread look like?

Combining the two positions gives a flat payoff of 50 points, however, the position has cost 62 points resulting in a payoff of a flat -12 points regardless of the futures price.

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

Lindsey Matthews

There are no available Videos from "Lindsey Matthews"