Futures and Forwards Overview

Abdulla Javeri

30 years: Financial markets trader

Futures and forwards are both derivatives, and a derivative is a financial product, instrument or contract whose value or price is derived from the price of something else. In the first video, Abdulla provides an overview of both contracts, their main characteristics and differences.

Futures and forwards are both derivatives, and a derivative is a financial product, instrument or contract whose value or price is derived from the price of something else. In the first video, Abdulla provides an overview of both contracts, their main characteristics and differences.

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

Futures and Forwards Overview

5 mins 38 secs

Key learning objectives:

Identify the principal difference between a forward trade and a futures trade

Define a derivative

Understand the forward and futures trade

Overview:

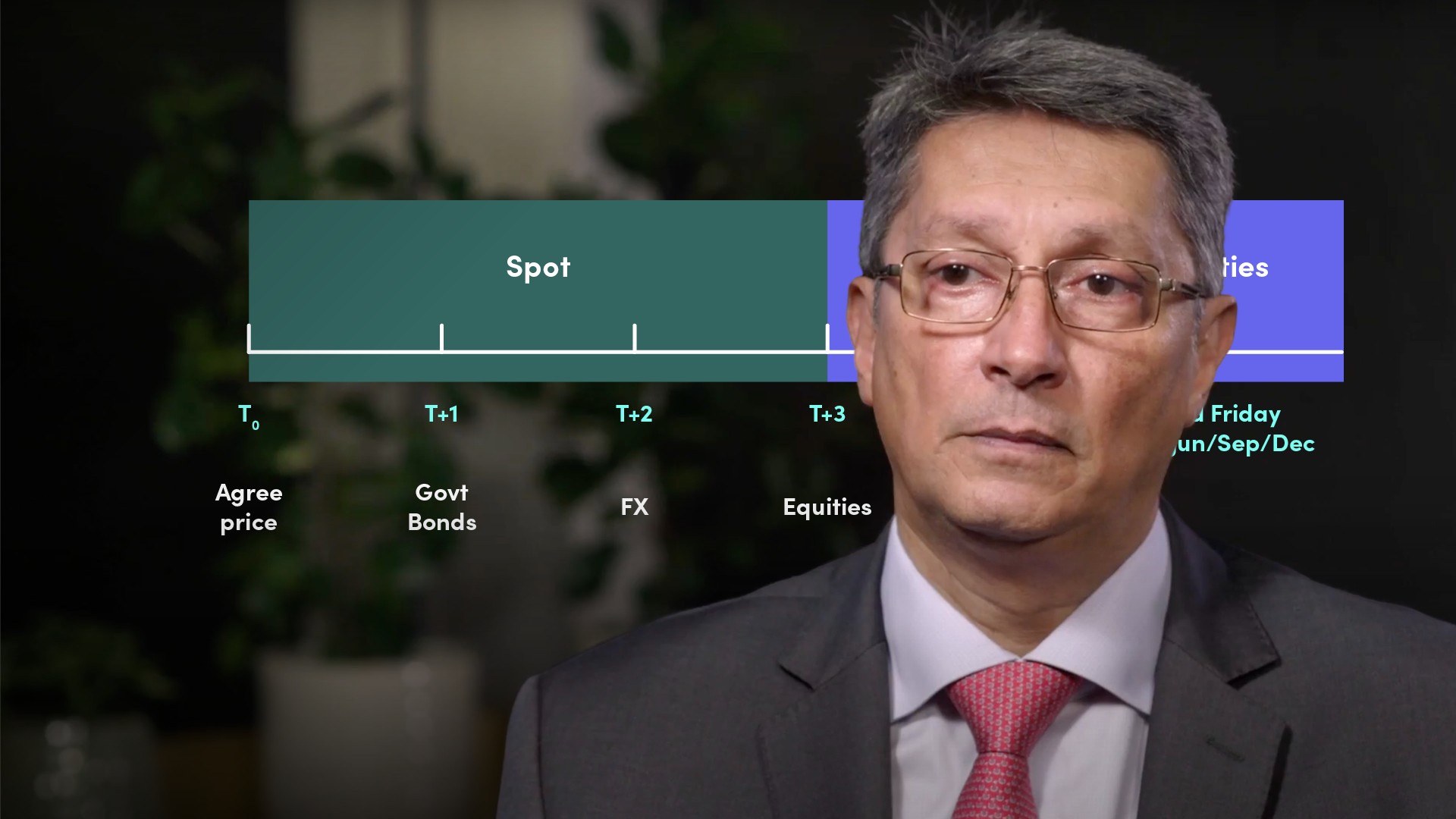

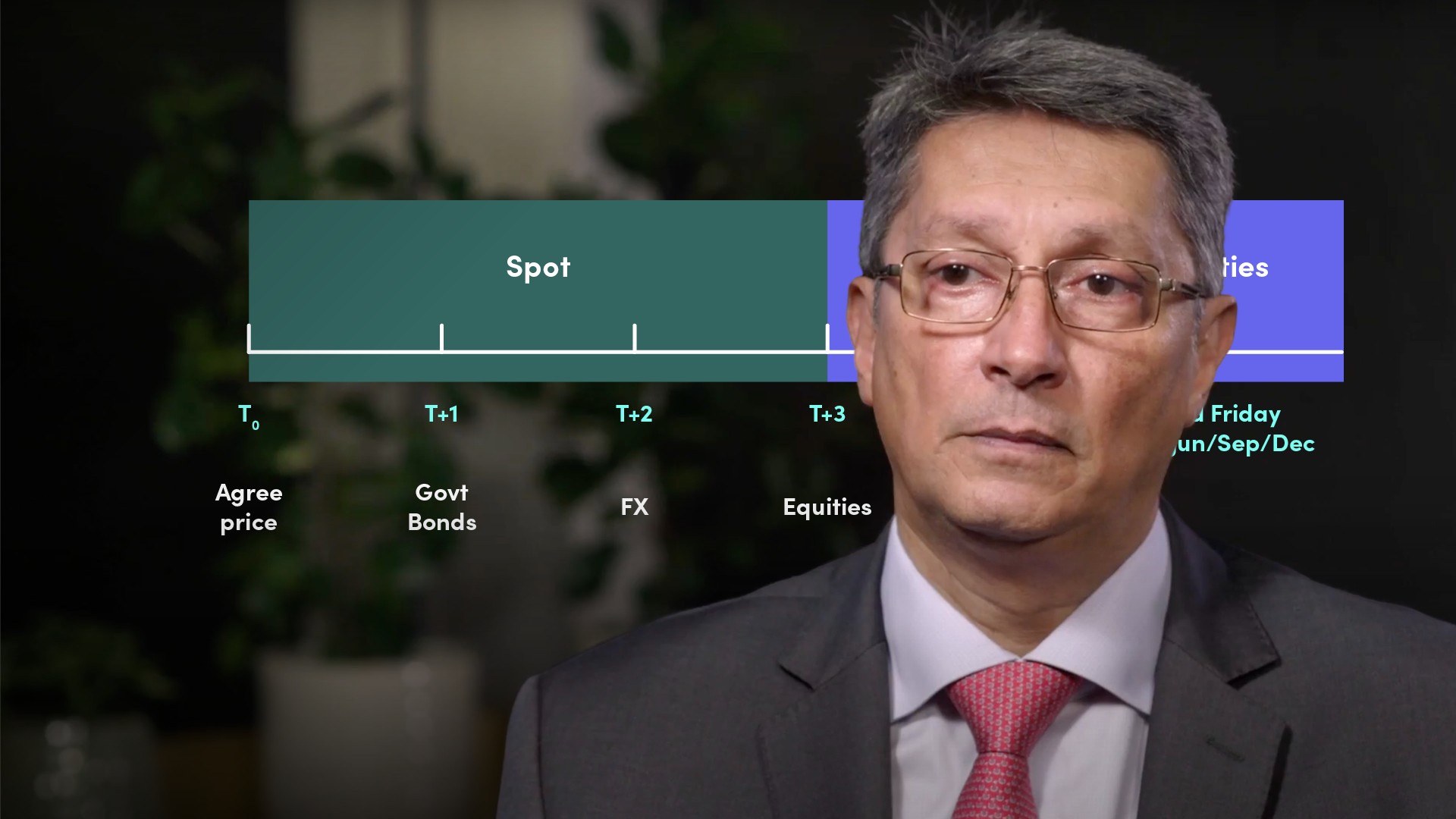

Futures and forwards are both derivative instruments and a derivative. Both contracts are legal undertakings to take delivery (buy) or to deliver (sell) the underlying asset on an agreed date in the future. The contract price is agreed and fixed at the start of the contract. – Agree a price ‘upfront’ for delivery and settlement on the agreed date.

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

What is a derivative, and what are some examples?

A financial product, instrument or contract whose value or price is derived from the price of something else. Derivatives allow someone to buy or sell an underlying asset, at some point in the future at a fixed price. For example:

- Stocks

- Bonds

- Interest rates

- Indices

- Commodities

What are the differences between a forward and futures trade?

- Forward trades are privately negotiated contracts between two counterparties where all the terms are agreed on entering the contract

- The ability to tailor the terms makes them particularly suitable for companies seeking to offset (hedge) risks in their business e.g. Interest rate, foreign exchange and commodity price risks.

- Forward trades are ‘Over the Counter’ (OTC contracts) and are not tradeable

- They carry credit risk in that the counterparty might not fulfil their obligations under the contract

- Futures are standardised Exchange based contracts

What does the contract specification stipulate?

- The contract specification stipulates all the characteristics of the contract, including the expiry dates – usually the calendar quarters, March (H), June (M), September (U) and December (Z)

- Being standardised exchange based contracts, they are tradeable in much the same way as stocks on a stock exchange

- The use of a central counterparty system for futures (and options) contracts substantially reduces counterparty credit risk for market participants

What are futures and forward contracts?

- Futures contracts are standardised tradeable Exchange-based contracts, therefore popular with investors. The Exchange defines the terms of trading through contract specifications.

- A forward contract is an over-the-counter bilateral transaction. As the contracts are bespoke, they’re not tradeable. However, the ability to tailor the contract according to individual requirements makes them more flexible than futures and therefore, arguably, more suitable for commercial purposes.

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

Abdulla Javeri

There are no available Videos from "Abdulla Javeri"