IBOR Transition and Fallback Provisions (Aug 2022)

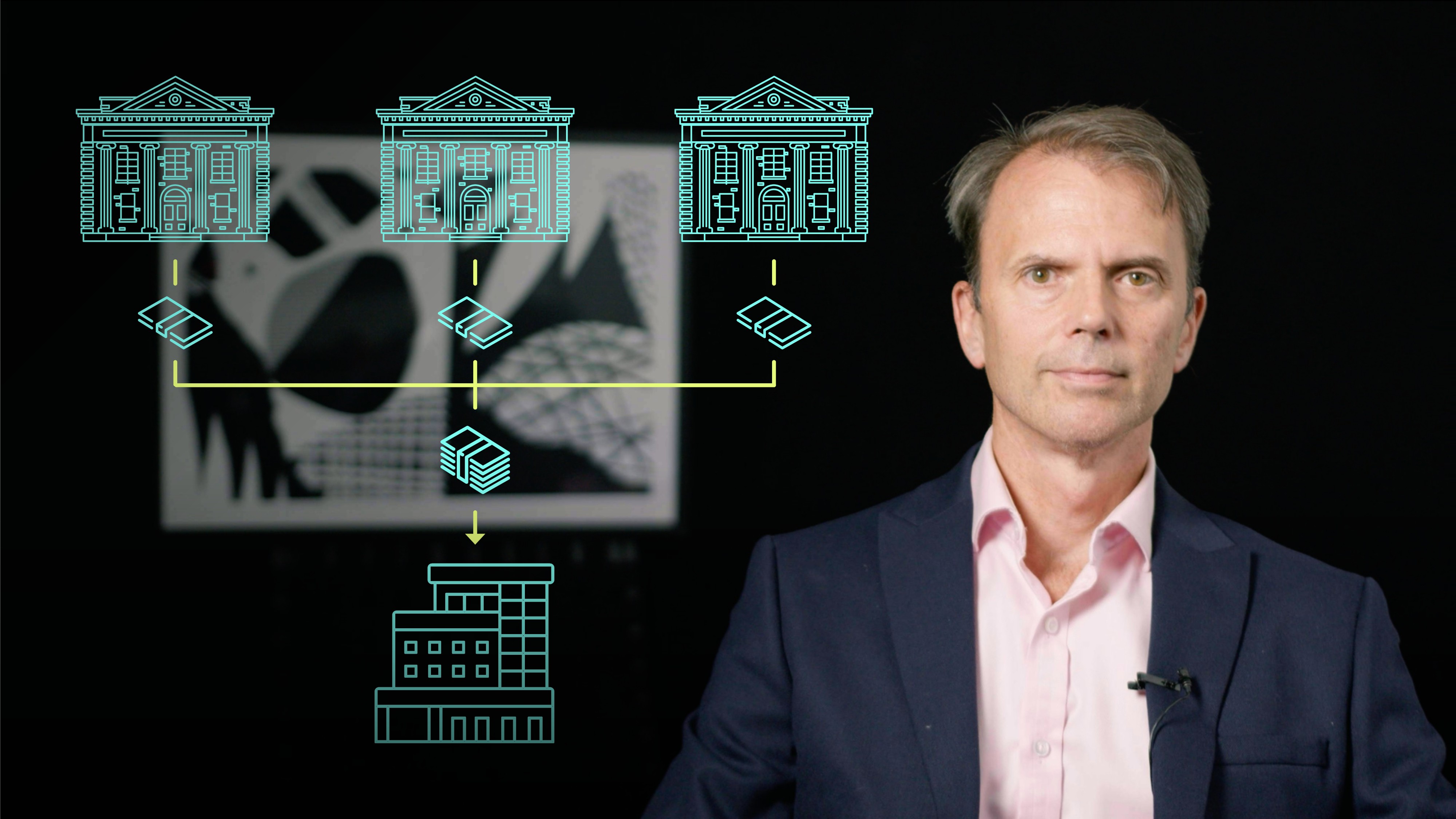

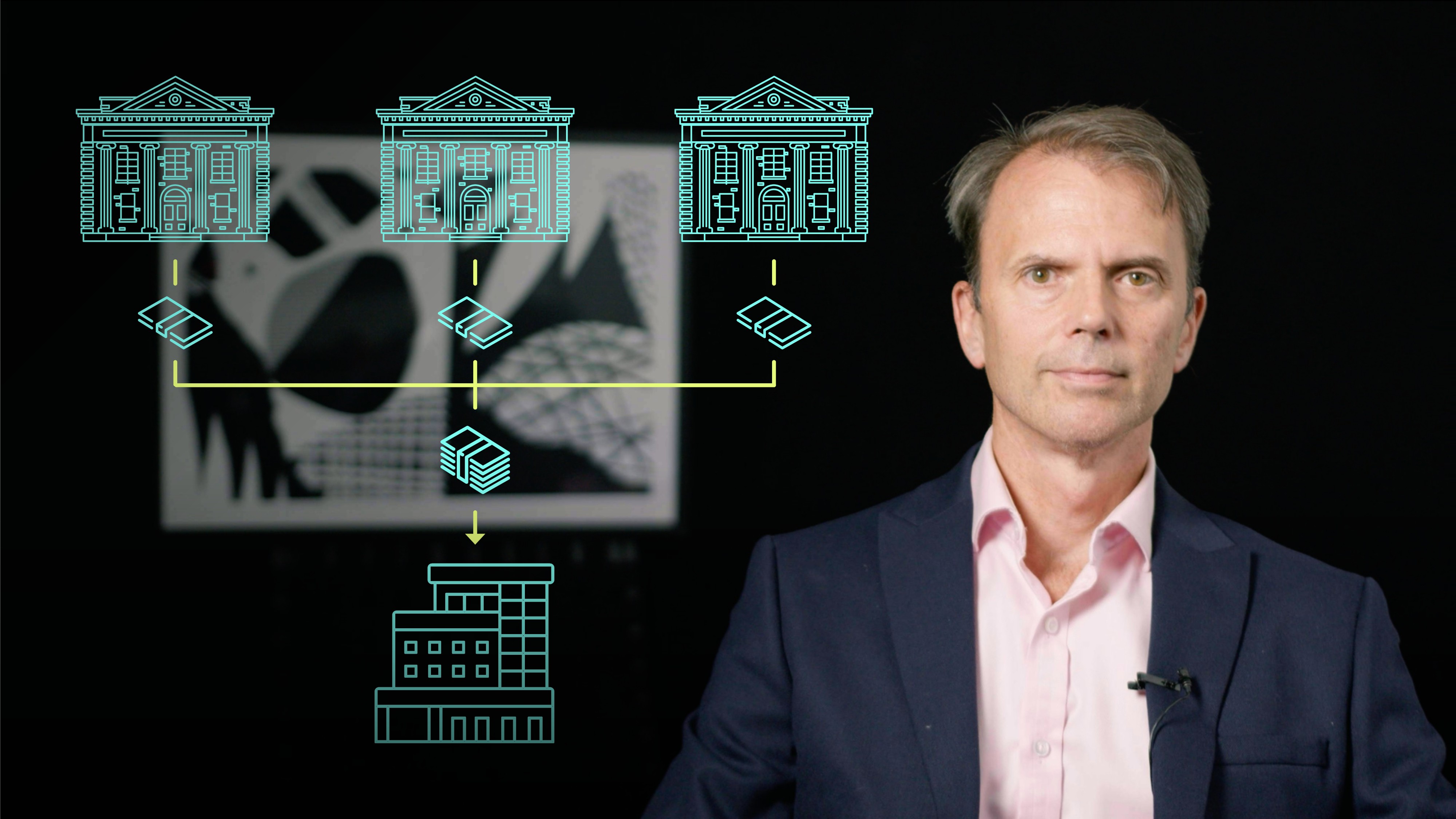

James Eves

30 years: Equity capital markets

In the next video of this pathway on LIBOR, James Eves explains that the transition has progressed significantly since 2021 and has been largely completed in some jurisdictions. James also discusses the different legislative approaches taken by different countries in addressing the transition and the remaining issues that need to be addressed. Finally, James also provides an overview of the impact of the transition on different types of financial instruments.

In the next video of this pathway on LIBOR, James Eves explains that the transition has progressed significantly since 2021 and has been largely completed in some jurisdictions. James also discusses the different legislative approaches taken by different countries in addressing the transition and the remaining issues that need to be addressed. Finally, James also provides an overview of the impact of the transition on different types of financial instruments.

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

IBOR Transition and Fallback Provisions (Aug 2022)

15 mins 6 secs

Key learning objectives:

Outline the progress in moving to alternative risk-free rates

Understand LIBOR legislation during the transition

Understand the development of fallback protocols for those products referencing LIBOR

Overview:

This update is designed to clarify the LIBOR transition progress since the start of 2021, as well as look at the key remaining issues. At the heart of the change was the desire to move from LIBOR, which was based on bank estimates of financing levels, to replacement rates that are liquid and tradeable in all market conditions. The use of new RFRs has grown dramatically and in some jurisdictions completely replaced old LIBOR.

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

What progress has been made on transitioning those instruments referencing LIBOR to new risk-free rates?

The transition from LIBOR to Risk-Free Rates (RFRs) has progressed significantly since the start of 2021. The use of RFRs has grown dramatically and in some jurisdictions, old LIBOR has been wholly replaced. The sterling market has moved almost entirely to the daily overnight rate SONIA (Sterling Overnight Index Average) while in the US, SOFR (the Secured Overnight Financing Rate) now accounts for nearly 50% of all new derivatives.

What legislation has been introduced during the transition?

The legislative approach to LIBOR varied by jurisdiction. As the new Risk-Free rates were so different from the existing IBORs, every jurisdiction had to consider how best to operate the transition from a legislative perspective, including enacting new laws to do this.

In the US, the Adjustable Interest Rate (LIBOR) Act was passed to replace LIBOR in contracts without a defined alternative. This legislation aims to replace LIBOR in documents with compounded SOFR plus an agreed spread.

In the UK, the Financial Conduct Authority was given powers to change the benchmark itself, allowing for a temporary period of "synthetic" LIBOR. As the FCA is responsible for the 5 different LIBOR currencies, the UK approach was coordinated with other working groups/regulators.

In Switzerland, it was agreed that Swiss Franc LIBOR would end in December 2021 and there would be no synthetic version, while in Japan synthetic yen LIBOR will finish at the end of 2022.

In the UK, the FCA is currently consulting on ending certain rates in 2023 and ending 3-month sterling LIBOR at some point that year. It is expected that the FCA will offer some period of synthetic US dollar LIBOR as well, but this is not guaranteed.

What development has there been on the fallback protocols?

The fallback provisions for the transition from LIBOR to Risk-Free Rates have three main components: the trigger event, the process to be followed, and the required adjustments.

There is an estimated $300tn of notional derivatives referencing LIBOR outstanding. For derivatives, the International Swaps and Derivatives Association (ISDA) published a protocol in October 2020 that supersedes all older ISDA definitions and which applies to new transactions by default and has been adopted by over 15,000 counterparties. As part of the protocol, ISDA recommended the new rates, methods of compounding them and additional spreads to be added. Clearing houses have also updated their rule books for the new fallbacks and will automatically adjust legacy transactions.

For loans, new fallback language was introduced by the loan market’s trade associations, in consultation with their members, for new loans to follow a "waterfall" selection process, but older loans will need to be renewed or renegotiated. By waterfall, they mean that you have a set order to select the replacement rate so that it is 100% clear for the person responsible for determining the new rates. In the US, it is estimated that $4 trillion of loans still need to transition.

Bonds are the hardest to transition because the issuer doesn’t necessarily know who the holders are. For bonds issued pre-2018 the fallbacks ultimately make you use the last rate until maturity, however, consent solicitations are feasible for non-US law bonds, but the situation is more complicated for US law bonds.

Post-2018 bonds usually have updated fallbacks which hopefully allow for a smoother transition, without the requirement to run a lengthy consent solicitation process. New fallbacks typically require an issue to hire an independent advisor to determine a successor rate as well as an adjustment spread to help compensate for the difference between LIBOR and the new rates.

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

James Eves

There are no available Videos from "James Eves"