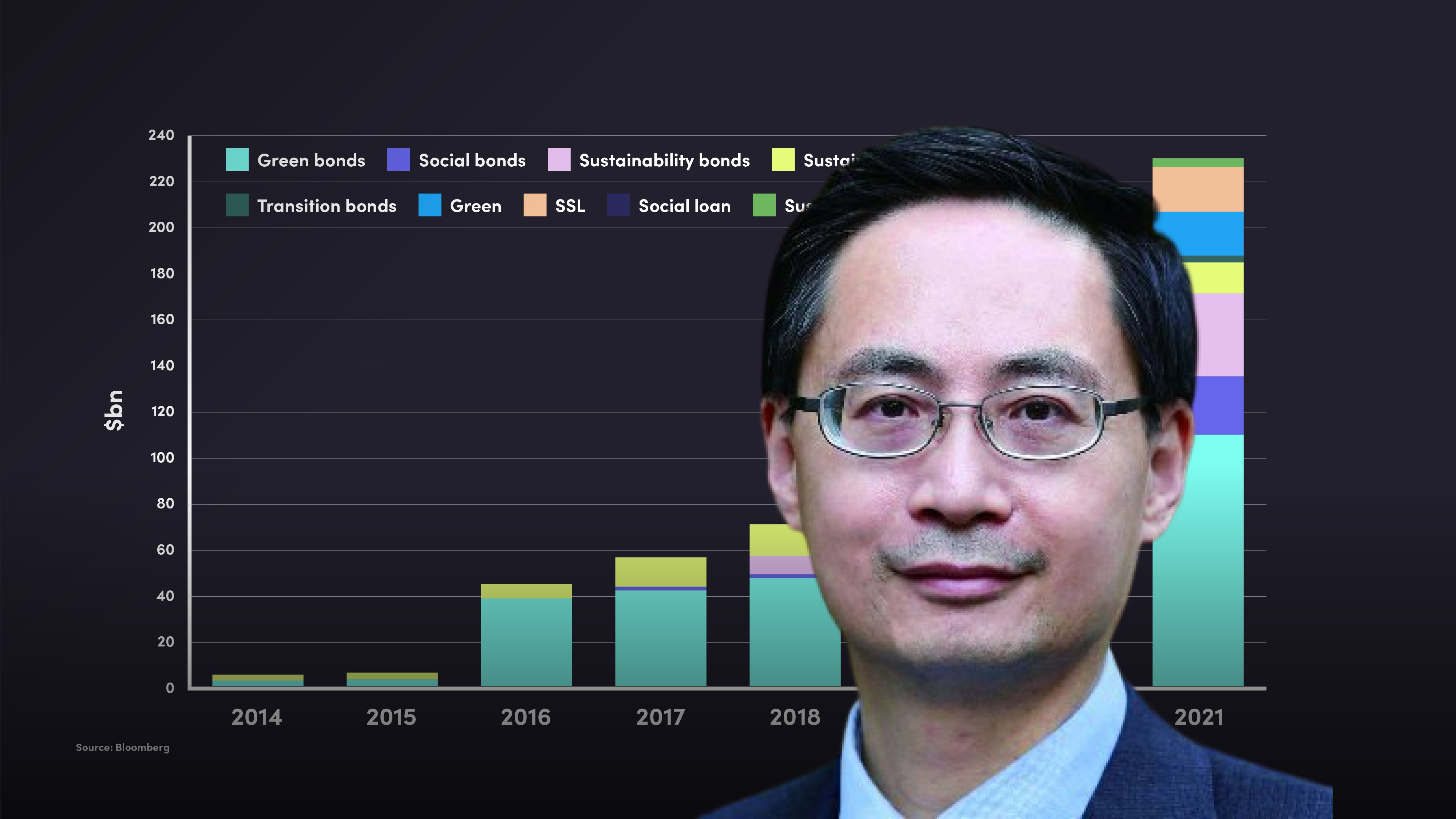

Global Sustainable Finance Developments Dec 2021

Ma Jun

Founder and President: Institute of Finance and Sustainability

In the second of two videos, Dr Ma Jun outlines some of the key international initiatives driving sustainable finance. He outlines the work being undertaken by the G20, the NGFS as well as the IPSF, who are working on establishing a common ground taxonomy.

In the second of two videos, Dr Ma Jun outlines some of the key international initiatives driving sustainable finance. He outlines the work being undertaken by the G20, the NGFS as well as the IPSF, who are working on establishing a common ground taxonomy.

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

Global Sustainable Finance Developments Dec 2021

10 mins 7 secs

Key learning objectives:

Understand what work is being done by the G20 in relation to sustainable finance

Identify the work undertaken by the NGFS

Comprehend the importance of the common ground taxonomy being developed by the IPSF

Overview:

There are many international initiatives driving sustainable finance, including the work of the G20, the Network for Greening the Financial System (NGFS) and the International Platform on Sustainable Finance (IPSF).

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

How is the G20 supporting sustainable finance?

When China held the presidency of the G20 in 2016 the G20 Sustainable Finance Study Group was established. During the period of 2016-2018 the study group successfully facilitated a global consensus on the need to scale up green finance. The group was shut down in 2019, but then was relaunched in 2021 and upgraded to the G20 Sustainable Finance Working Group. They are working to produce a sustainable finance roadmap. To produce the roadmap, the group will look at a few major aspects, including alignment approach, sustainability reporting standards, consistency towards climate risk measurement and the application of digital technology.

There are two subjects becoming consensus under the G20, one is the importance of looking at transition finance and the other is that we need to expand our coverage of green and sustainable finance (incentives to include nature and biodiversity).

The G20 is also supporting the idea of harmonising taxonomies around the world. They have three suggestions when it comes to developing taxonomies.

- Encourage jurisdictions to use the same language when developing taxonomies (industrial classification).

- Encourage jurisdictions to adopt some of the existing references or common standards.

- Regions with multiple smaller markets will be encouraged to develop a single taxonomy.

What has the NGFS been doing in the drive towards sustainable finance?

The Network for Greening the Financial System was launched in 2017 by 8 central banks and has now expanded to more than 90 central banks and financial supervisors.

The NGFS has developed climate risk analyses, methodologies, and scenarios.

They have also launched a study group with is working on the relationship between biodiversity and financial stability. The group has found that the loss of biodiversity will be detrimental to the economy and will result in financial risks. In order to protect the financial system, the financial sector itself, including regulators and financial firms, will have to care about protecting biodiversity.

What is the importance of the common ground taxonomy being developed by the IPSF?

Around the world, there are over 200 sustainable finance taxonomies, which causes problems in itself. If every jurisdiction has its own taxonomy, it will lead to a lack of transparency, market segmentation and increased transaction costs.

The International Platform on Sustainable Finance is working to produce a common ground taxonomy based on the Chinese Green Bond taxonomy and the European Sustainable Finance Taxonomy. This common ground taxonomy will allow issuers around the world to issue in multiple markets around the world without having to be verified against two individual taxonomies. This harmonisation of taxonomies will help develop the global sustainable finance market.

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

Ma Jun

There are no available Videos from "Ma Jun"