Key Benchmark Curves in Capital Markets

Nigel Owen

20 years: Debt capital markets

In his first video on benchmark curves, Nigel begins by explaining the benchmark curves which are used in global debt markets. Each benchmark curve is the foundation for bond pricing in its relevant market. This video will shed light on the ‘US treasury benchmark curve’, ‘Euro benchmark swap rate curve’ and the ‘Sterling benchmark gilt curve’.

In his first video on benchmark curves, Nigel begins by explaining the benchmark curves which are used in global debt markets. Each benchmark curve is the foundation for bond pricing in its relevant market. This video will shed light on the ‘US treasury benchmark curve’, ‘Euro benchmark swap rate curve’ and the ‘Sterling benchmark gilt curve’.

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

Key Benchmark Curves in Capital Markets

10 mins 36 secs

Key learning objectives:

Identify and explain each of the key benchmark curves

Describe the yield curve

Outline how can we identify the credit benchmark to reference in pricing a new Sterling bond

Overview:

Billions of dollars of new bonds are issued into the global debt markets and traded in the secondary markets every single day, once those bonds have been issued. In this video, Nigel explains the benchmark curves which are used in global debt markets. Each benchmark curve is the foundation for bond pricing in its relevant market. In particular the ‘US treasury benchmark curve’, ‘Euro benchmark swap rate curve’ and the ‘Sterling benchmark gilt curve’.

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

What does the yield curve tell us?

A yield curve is a series of points plotting the yield of a set of securities against the length of time to maturity of those securities. That is the basis for any of the benchmark curves. The benchmark element comes with the agreed set of rules that define which securities will be used to define the relevant benchmark curve.

What is important to note about the US Treasury Curve?

- The largest bond market in the world is the US bond market, with over $30tn of outstanding debt as of mid 2020, and so it follows that the benchmark curve used for that market is the most liquid of global benchmark curves, existing since 1912

- The US Treasury Benchmark Curve has just seven plot points. However, this does mean that the Treasuries that make up the benchmark curve frequently change

- The US benchmark bond curve uses three-month, six-month, two-year, three-year, five-year, 10-year and 30-year maturities.

- New three-month and six-month securities are sold every week by the Federal Reserve and are known as Treasury Bills

- The two-year, three-year, five-year and 10-year securities are known as Treasury Notes. New Notes in all but the 10-year maturity are sold every month. However, the 10-year Notes are only newly issued in each February, May, August, and November. Those same months also see new issuance of 30-year securities, known as Treasury Bonds

What is important to note about the Euro Benchmark Swap Rate Curve?

- The euro bond market predominantly uses the Euro swap rate curve as its benchmark curve for pricing bonds. This is due to the establishment of the Euro currency in 1999

- This means it has many more points for the curve, which potentially makes it easier for investors to value a wider range of maturities, hence you do see a greater variety of maturities in euro bonds than in US bonds

- Take the swap rate for the maturity of the bond you want to price. Swap rates are the annual fixed-rate cash flows matched to six-month Euribor cash flows and given the availability of swap pricing models and the liquidity of the euro swap market, we could provide a plot point for every day!

- For the purposes of plotting a benchmark curve, convention is to just use full years. And while in recent years, longer dates have started to appear on some curves, for now convention is to use 1 to 20 years

- Arguably this makes tracking, understanding and interpreting the euro benchmark curve easier than the US curve

- If you want to price a new 9 year euro bond, you simply take the 9 year euro swap rate, add the suitable credit spread and you have the yield of your new bond. The same procedure for 4 year, 12 year or whatever maturity you choose

What is important to note about the Sterling Benchmark Gilt Curve?

- It uses a model similar to that of the US, but with many fewer government bonds, or Gilts, in circulation, it requires many more definitions

- Technically the first Gilts were issued in the 17th century, but the benchmark Gilt curve came into its own in the 1980s, following the ending of exchange controls in 1979 and then Big Bang in 1985

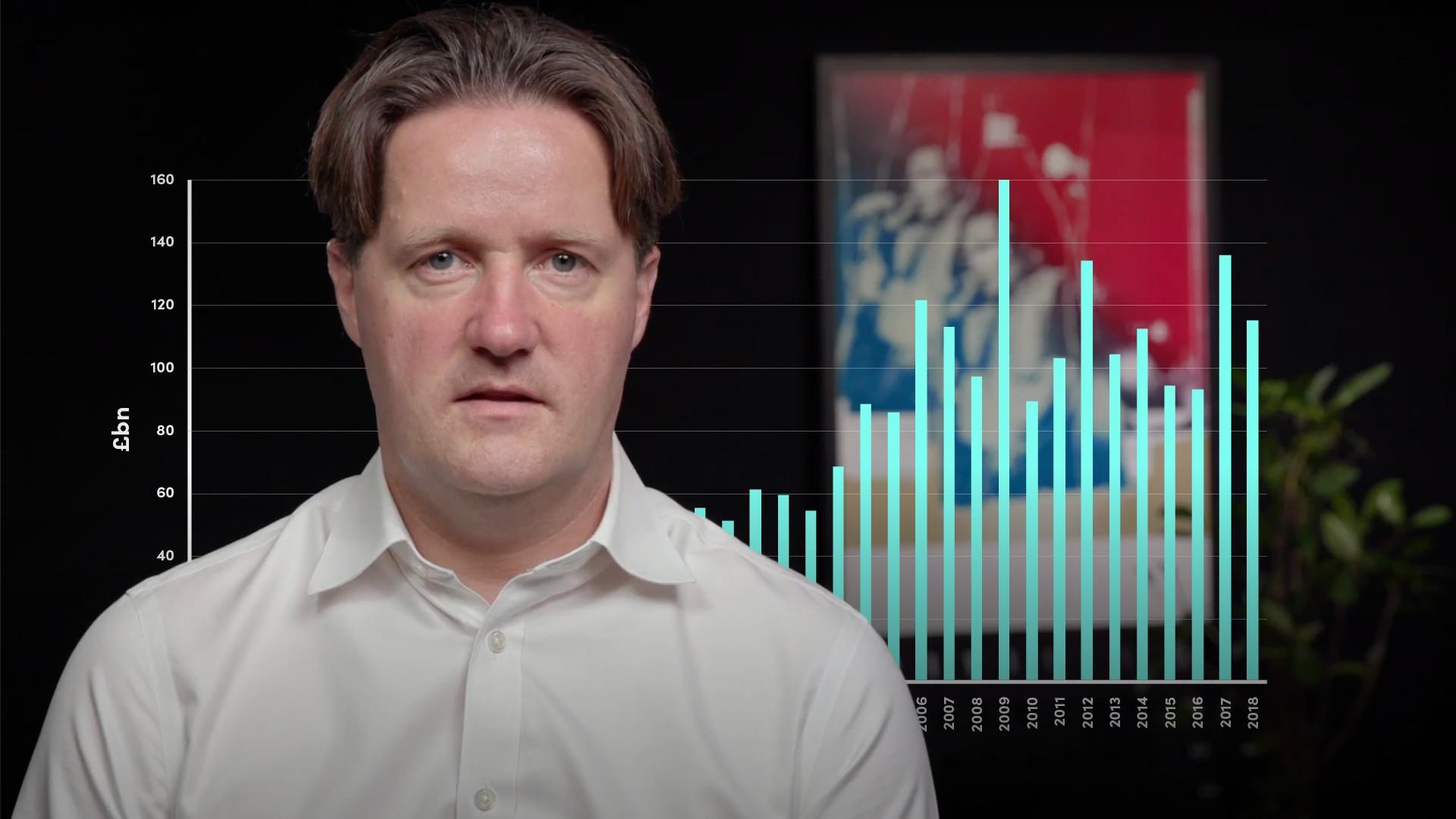

- Between 1980 and 1988, the sterling bond market doubled in size every two years and with the Bank of England acting as the governing body of the market, it determined that Gilts would be used as benchmarks for pricing bonds

- It is a curve where the securities define the plot points, rather than vice versa in the US Treasury or euro swap curves

- A benchmark Gilt is any Gilt with an aggregate nominal amount of at least £10bn

Why might a gilt not be appropriate for the benchmark?

- High coupons

- Lack of liquidity;

- A more suitable alternative Gilt exists closer in maturity.

How can we identify the credit benchmark to reference in pricing a new Sterling bond?

- (a) where there is only one benchmark maturing in the same calendar year as that bond, that benchmark;

- (b) where there is no benchmark maturing in that calendar year, the nearest shorter maturity benchmark;

- (c) where there is more than one benchmark maturing in that calendar year: (i) firstly, the benchmark maturing in the same month as that bond, or failing which; (ii) secondly, the nearest shorter maturity benchmark in that calendar year, or failing which; (iii) the nearest longer maturity benchmark in that calendar year

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

Nigel Owen

There are no available Videos from "Nigel Owen"