What are the Limitations of Beta?

Abdulla Javeri

30 years: Financial markets trader

When numbers are used to estimate what is likely to happen in the future, there are always limitations. In this video, Abdulla discusses the limitations of beta including evaluating its consistency, the data set used and the nature of the regression line.

When numbers are used to estimate what is likely to happen in the future, there are always limitations. In this video, Abdulla discusses the limitations of beta including evaluating its consistency, the data set used and the nature of the regression line.

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

What are the Limitations of Beta?

4 mins 13 secs

Key learning objectives:

Explain the limitations of beta

Overview:

Beta has its own shortcomings including change over time, heavy dependence on the data set and the reliance on a linear regression model.

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

What are the limitations of beta?

Beta is not constant over time:

For example, a company might exhibit high growth rates in its early years, in other words it has a high beta. As it matures, those growth rates will be increasingly difficult to sustain. That will be reflected in a lower beta further down the line. News flows such as profits warnings or better than expected results are likely to have an immediate impact on the beta as markets absorb the implications of the news. Beta is unlikely to remain constant over time.

Beta is specific to the data set used:

If we use a different data set, the number will most likely be different. If we use different time frames within a data set, we’ll get different numbers. If you visit a financial website, it might give the beta for a stock. If you visit two others you will probably get two other betas for the same stock. Not knowing how the numbers have been arrived at, it’s impossible to say which one, if any of them is accurate, resulting in uncertainty relating to which beta number to use.

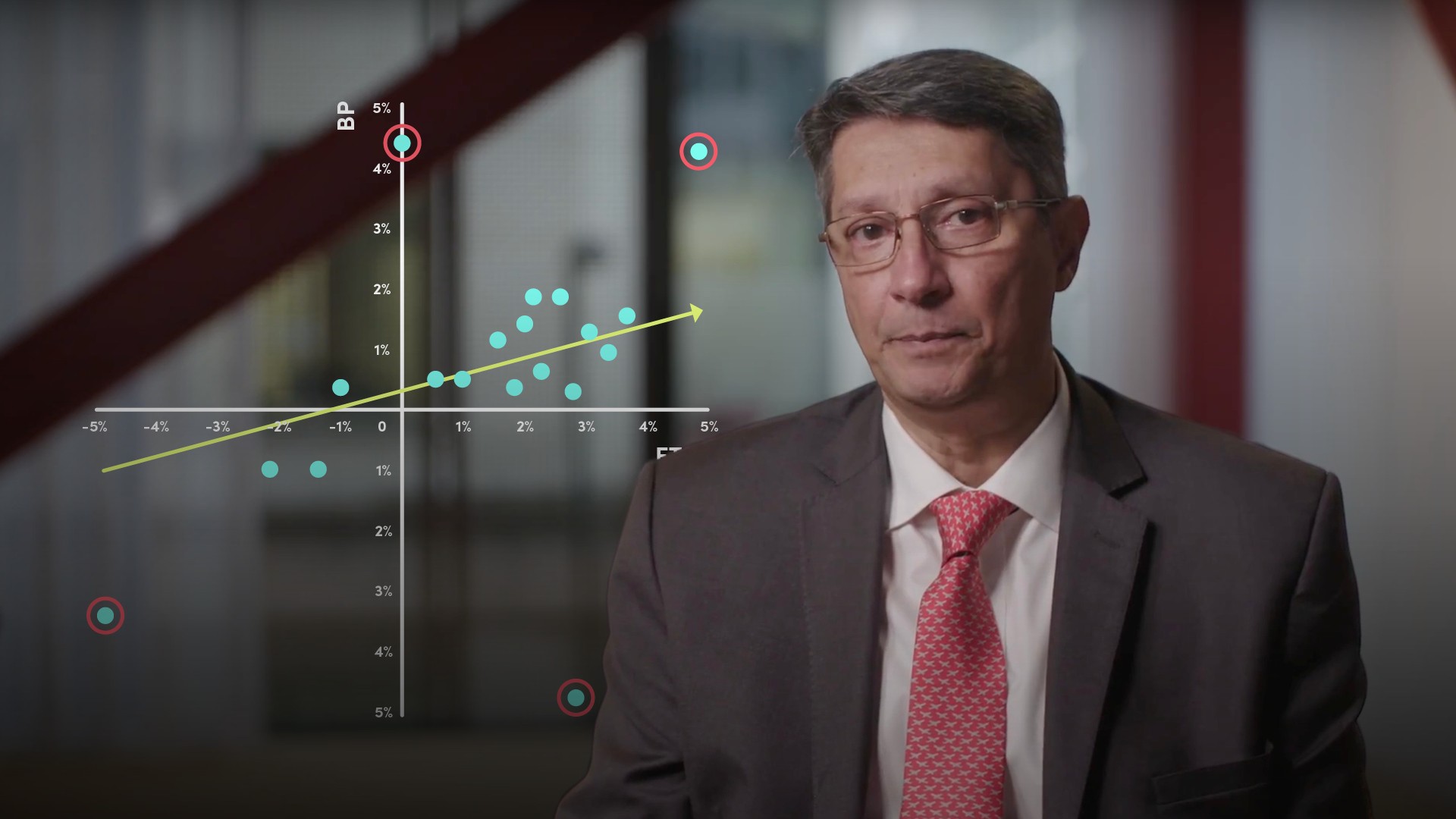

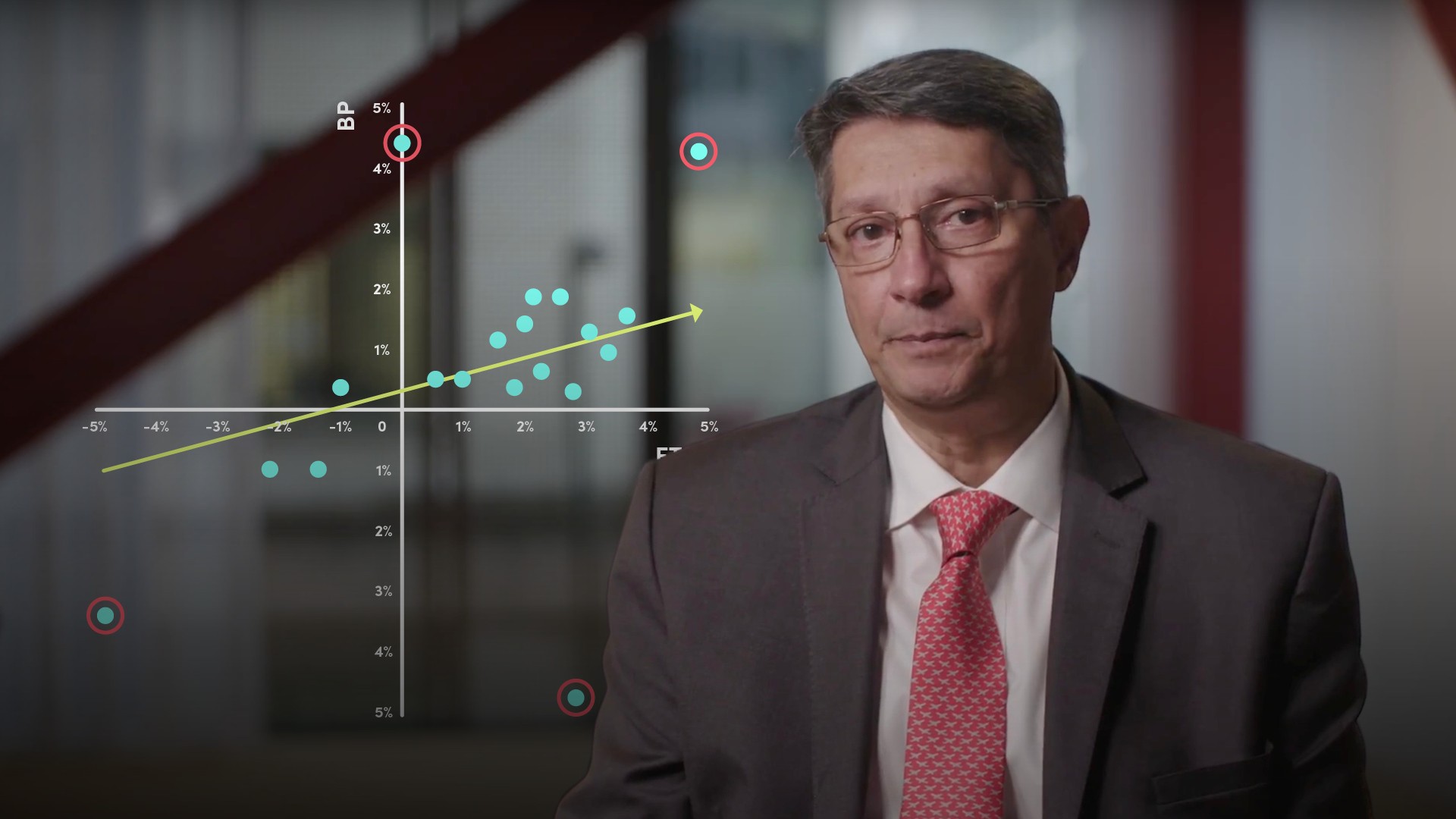

The regression line assumes a linear relationship which might not be the case:

It is the line of best fit that minimises the residuals or squared errors. It’s not a perfect fit, it’s a best guess using a specific data set. As the errors are ever present, most of the time, the asset will not move in line with our regression estimate. This can be seen in the graph which also highlights some of the outlying moves. This is a particular risk for popular hedge fund strategies such as long short and equity market neutral positions.

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

Abdulla Javeri

There are no available Videos from "Abdulla Javeri"