What is behavioural vulnerability, and how does it differ from other risks?

Behavioural vulnerability refers to the emotional susceptibility that leads to poor decisions under pressure, distinct from financial or capability risk. It may stem from traits like low composure or high impulsivity, or from situational factors such as job loss, overwhelming interfaces, or decision fatigue. Even when a product is affordable and comprehensible, vulnerability asks whether the client is likely to make the wrong decision because of how they feel in the moment.

How can firms detect and measure vulnerability?

The most effective approach combines stable personality traits with dynamic behavioural signals.

Oxford Risk’s model, for example, uses six traits: composure, confidence, financial comfort, impulsivity, desire for guidance, and familiarity preference, alongside situational modifiers such as unusual hesitation, rising logins, or abandoned forms.

Together, these create a vulnerability score that reflects both who the client is and what they’re experiencing now, enabling more precise detection of decision risk.

What should firms do once vulnerability is identified?

Detection is only the start. Clients can be stratified by vulnerability, with higher scores triggering a more protective design. This might mean adding pause points, simplified pathways, or nudges to seek advice, while low-vulnerability clients retain autonomy.

This approach, known as asymmetric paternalism, protects those at risk without constraining others. The principle is simple: same action, different journey, better fit.

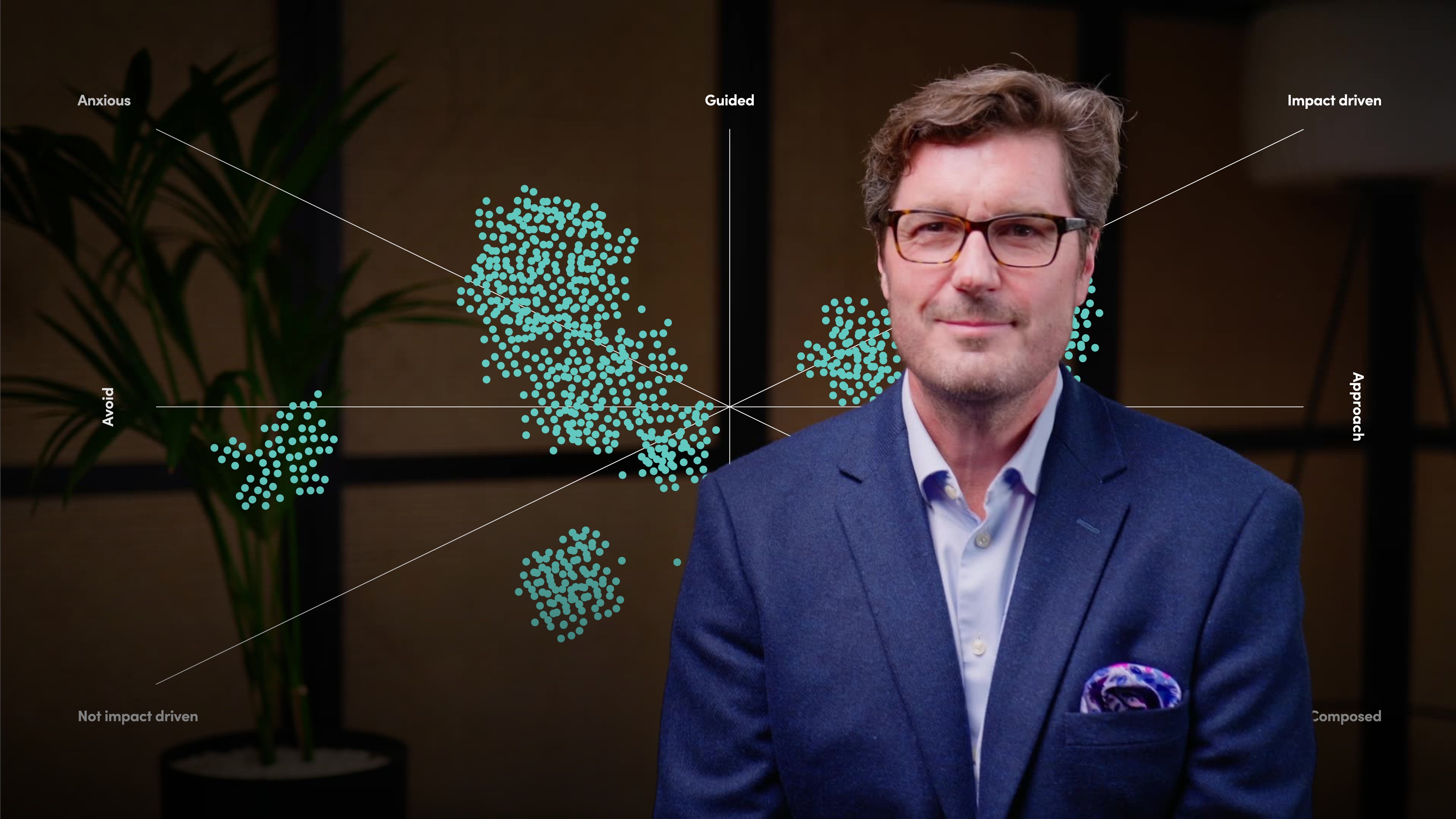

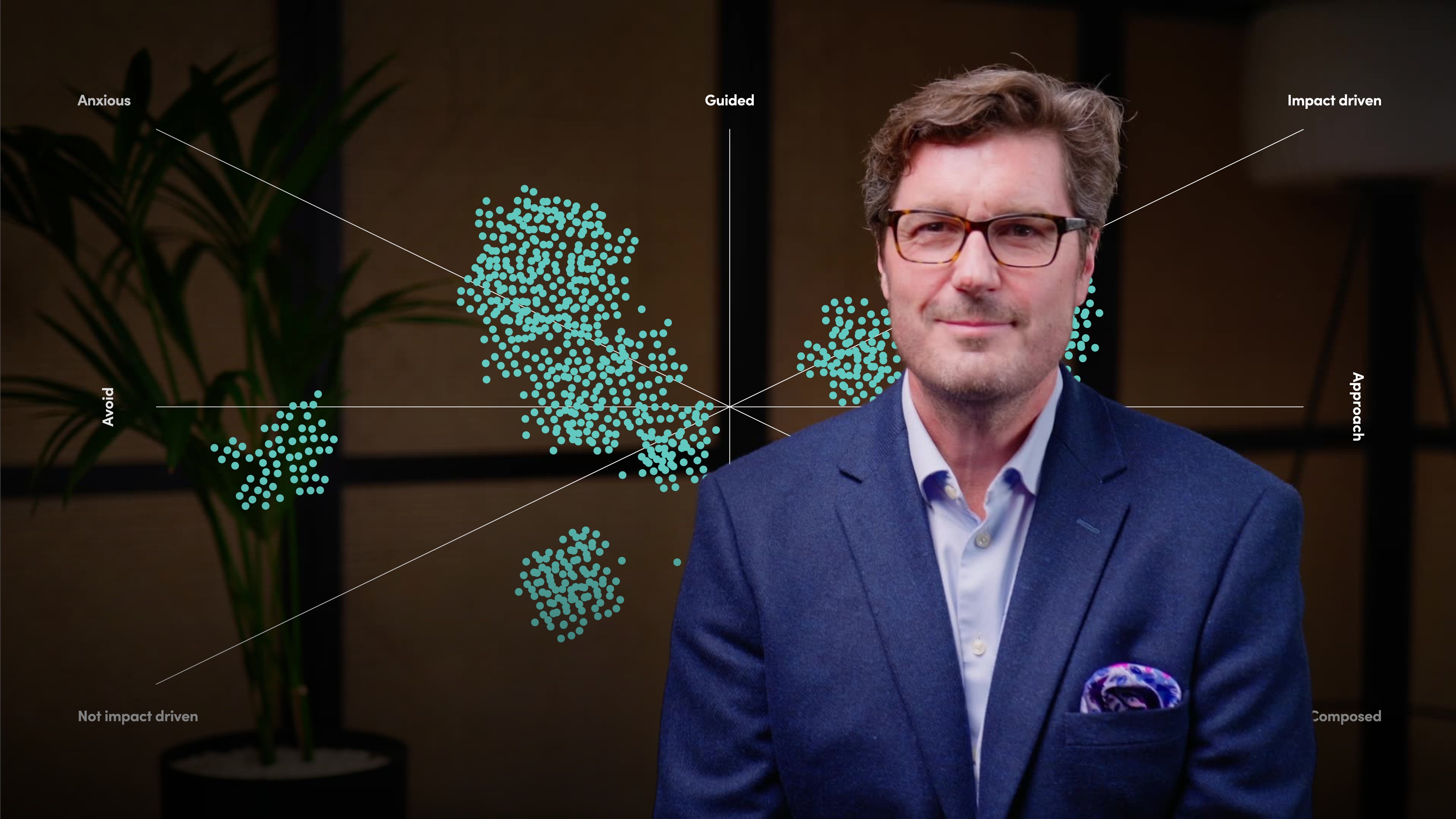

How can behavioural personas support scalability?

Individual profiling may not always be practical, especially at scale. Behavioural personas, clusters of personality traits validated through psychometrics, offer a middle ground. They enable firms to design communications, products, and journeys that resonate with groups of clients sharing similar behavioural tendencies. Unlike demographics, personas reflect real drivers of behaviour, avoiding stereotypes while supporting more personalised engagement.

Why is supporting behavioural vulnerability a regulatory and ethical imperative?

Under the FCA’s Consumer Duty, firms must prevent foreseeable harm, including emotional harm caused by poor decision-making under stress. Behavioural vulnerability frameworks help identify when interventions are needed, fulfilling regulatory requirements and protecting long-term client outcomes. This isn’t about policing behaviour but designing systems that account for human limits, supporting clients before decisions turn into regret.