The Importance of Household Energy Efficiency

Luca Bertalot

Secretary General: The European Mortgage Federation

This first video of a four-part video series will look at what private finance can do to tackle climate change and what can be done to reduce rising energy costs around the world. Join Luca as he explains why there is a need for energy efficient mortgages (EEMs) and how they can help consumers and the environment, as well as some of the regulatory changes that have already been made in order to move things in the right direction.

This first video of a four-part video series will look at what private finance can do to tackle climate change and what can be done to reduce rising energy costs around the world. Join Luca as he explains why there is a need for energy efficient mortgages (EEMs) and how they can help consumers and the environment, as well as some of the regulatory changes that have already been made in order to move things in the right direction.

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

The Importance of Household Energy Efficiency

5 mins 44 secs

Key learning objectives:

Identify how residential properties are contributing to climate change

Comprehend why there is a need for energy-efficient mortgages (EEMs)

Overview:

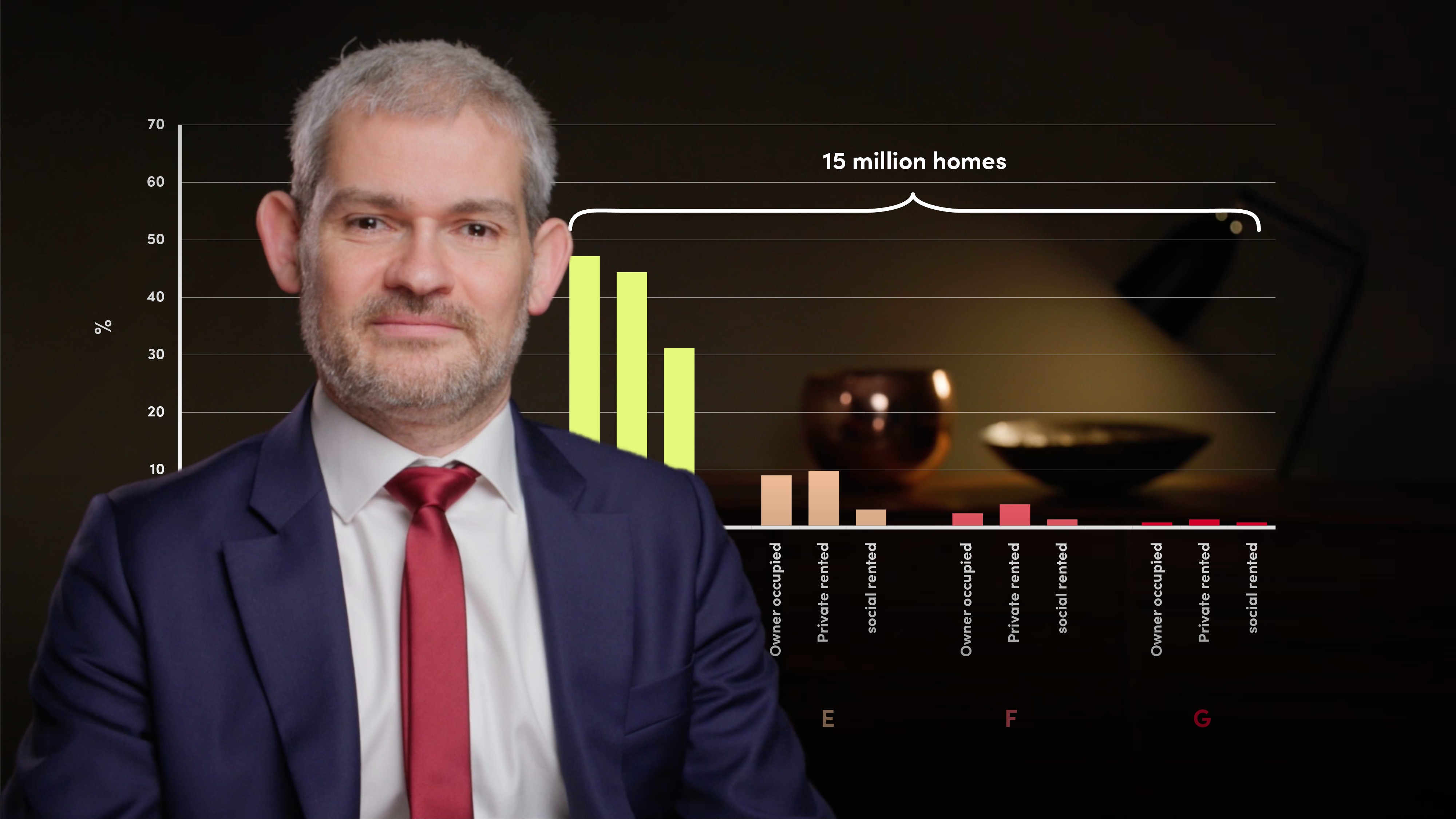

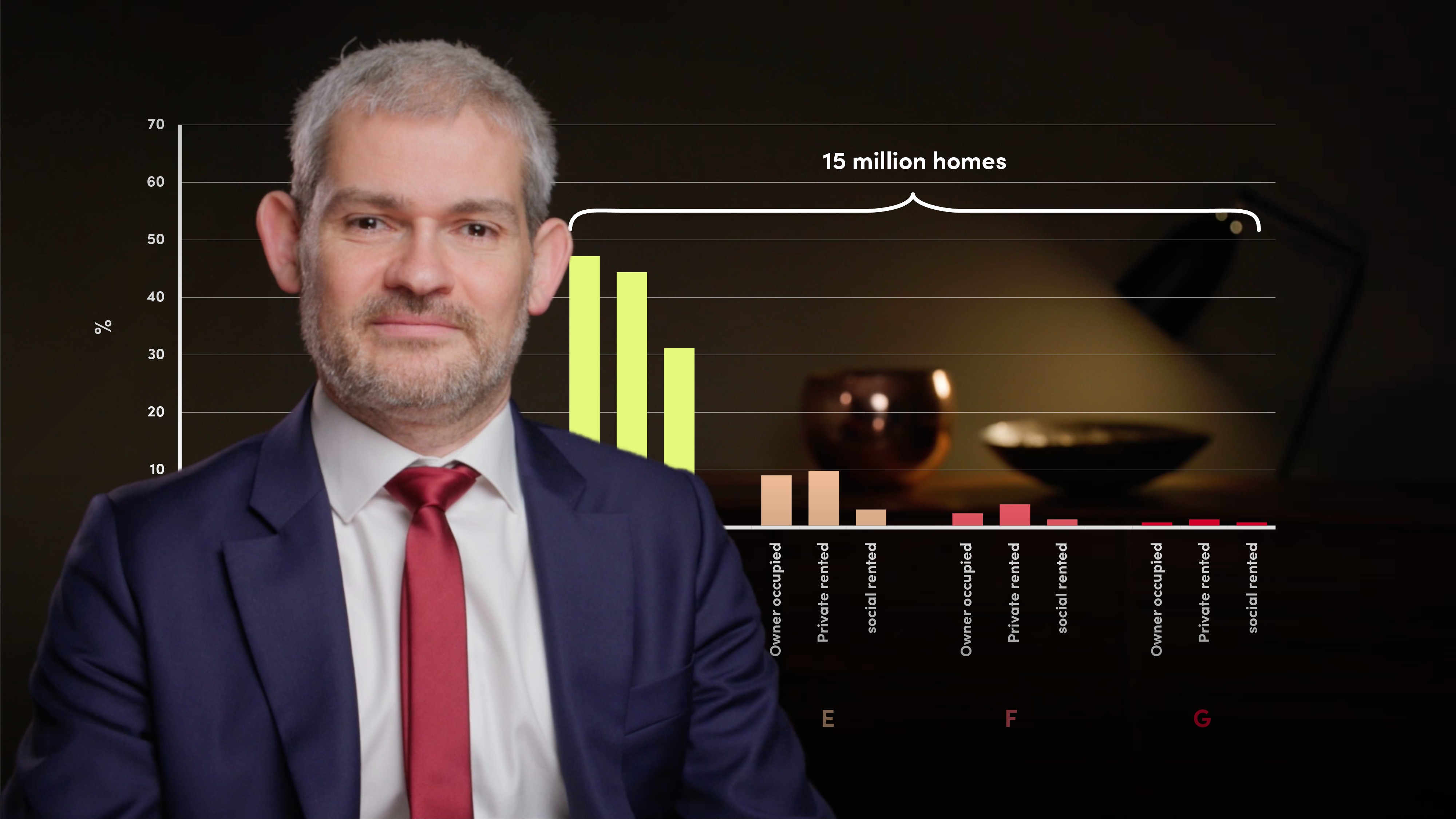

Climate change is one of the most important issues facing our world today and represents one of the biggest challenges that we’ve ever had to face. One of the largest emitters of pollution is residential properties, making up almost 40% of Europe's emissions. Solving this issue is obviously a major step in the fight against climate change. However, retrofitting old energy inefficient housing is expensive. Public finance will not be enough, private finance is desperately needed.

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

How do residential properties contribute to climate change?

Residential properties make up almost a quarter (17-21%) of energy-related carbon emissions globally. In Europe housing makes up almost 40% of carbon emissions. A material part of the carbon footprint is related to residential housing. Heating residential properties consumes 63.6% of final energy consumption alone.

The issue is the older stock of housing across Europe that has poor insulation and old windows that results in loss of heat. However, to green these homes, a substantial amount of financing is needed. This is where energy-efficient mortgages come in.

How would energy-efficient mortgages benefit consumers?

We are living in the midst of an energy crisis. There are many people worrying about the so-called ‘heat or eat’ dilemma. Any rise in the cost of living puts pressure on millions of European households. Today, energy is a major driver of inflation. It is putting pressure on price stability and housing costs. It makes sense to try and reduce energy costs and consumption as much as possible. An effective energy retrofit, using borrowed money from an energy-efficient mortgage, could bring major savings for households, by reducing energy bills up to 70 and 80% in some cases. This is an opportunity to enhance the return on investment on the most important investment of our life, our homes. At the same time, it would offer a better quality of living and opportunities for the next generation.

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

Luca Bertalot

There are no available Videos from "Luca Bertalot"