Three Ways to Calculate VaR

Gurdip Dhami

25 years: Treasury & ratings

Learn how market rate analysis shapes VaR accuracy. Explore volatility, correlation and distributions, then compare Historical Simulation, Monte Carlo and Parametric VaR to see how each method measures potential market losses.

Learn how market rate analysis shapes VaR accuracy. Explore volatility, correlation and distributions, then compare Historical Simulation, Monte Carlo and Parametric VaR to see how each method measures potential market losses.

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

Three Ways to Calculate VaR

11 mins 13 secs

Key learning objectives:

Understand why market rate analysis is essential for VaR

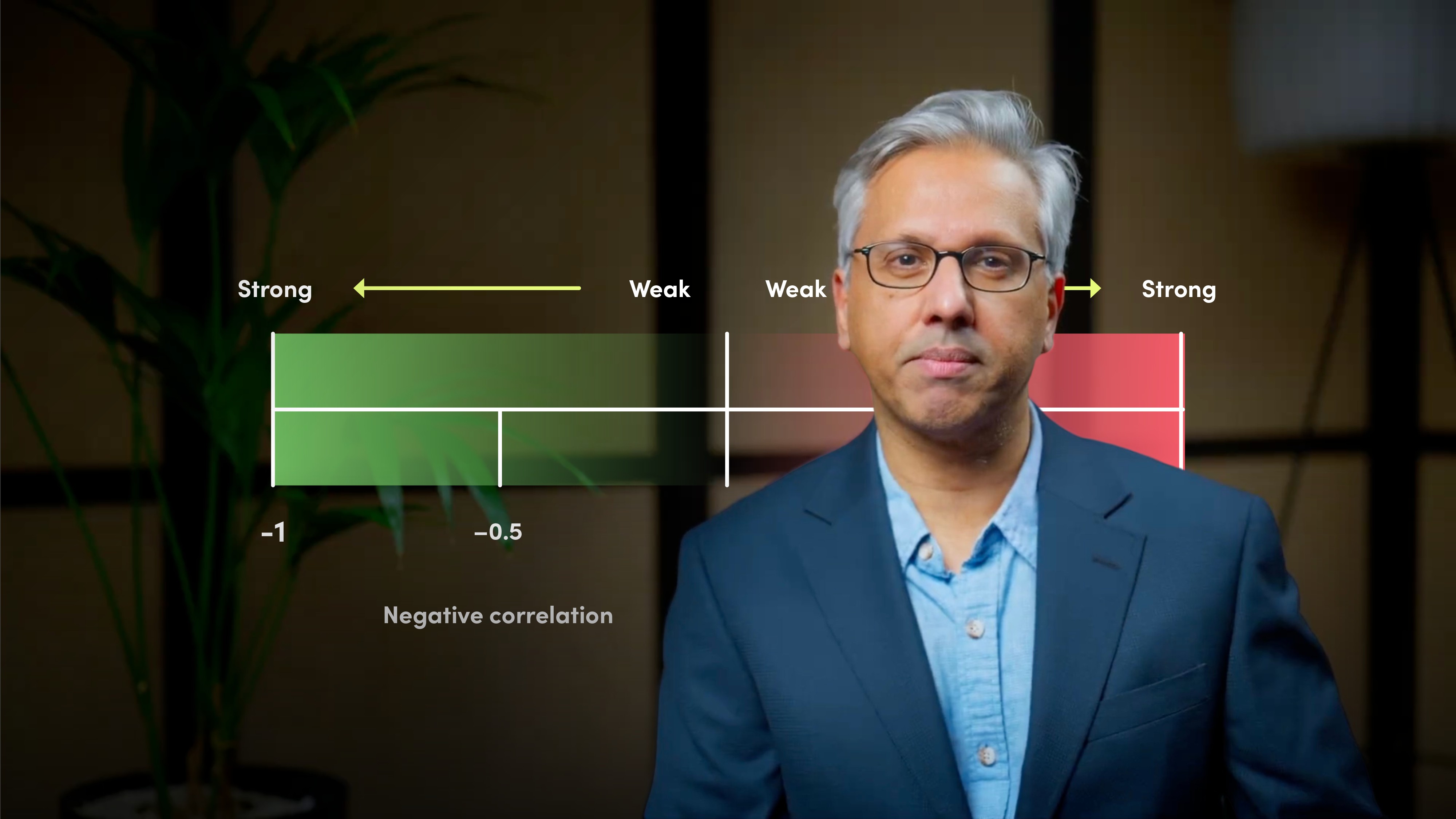

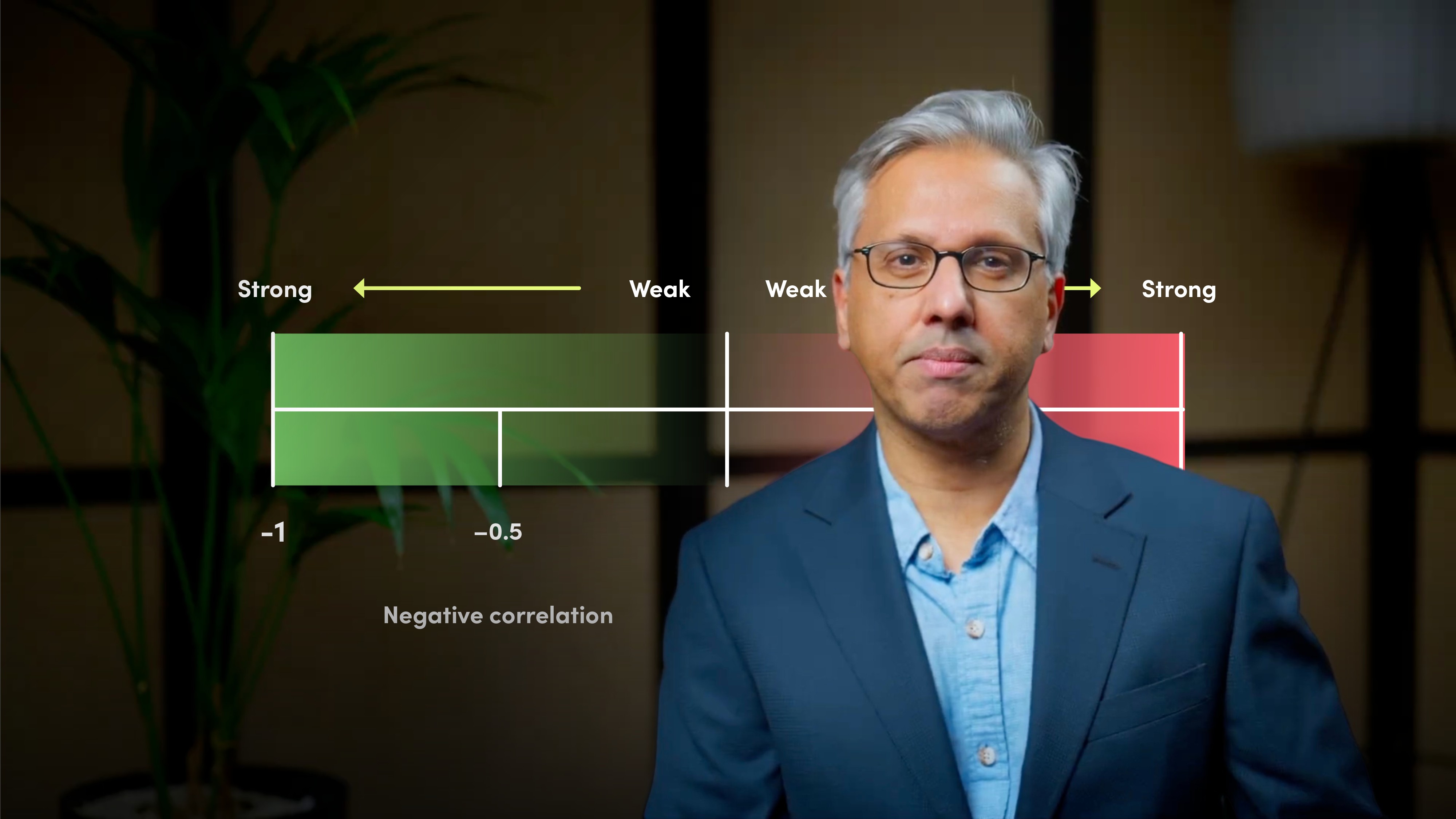

Interpret volatility, correlation, and distribution characteristics

Outline the three common VaR calculation methods

Identify the key pre-calculation steps common to all VaR methods

Overview:

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

- Historical Simulation uses actual past returns, so it captures real-world behaviours including extreme events, but assumes the past is a good guide to the future.

- Monte Carlo Simulation produces thousands of hypothetical return scenarios using volatility and correlation assumptions, allowing flexibility to reflect current market conditions.

- Parametric VaR uses a mathematical formula and an assumed probability distribution, making it fast and simple, but more sensitive to modelling assumptions.

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

Gurdip Dhami

There are no available Videos from "Gurdip Dhami"